In today’s rapidly changing financial landscape, traditional investment strategies are facing unprecedented challenges. The classic 60/40 portfolio—60% stocks and 40% bonds—once a reliable cornerstone for institutional investors, is now under pressure as bonds lose their role as a safe haven. Against this backdrop, a compelling case emerges for integrating bitcoin into portfolios, offering not just higher returns but enhanced risk-adjusted performance.

This article breaks down the insights shared by James Lavish, former hedge fund manager and managing partner of the Bitcoin Opportunity Fund, revealing how a strategic allocation to bitcoin can revolutionize your investment outcomes.

Table of Contents

- The Decline of the Traditional 60/40 Portfolio

- Why Bonds and Cash No Longer Serve as Safe Havens

- The Silent Erosion of Savings: A Systemic Challenge

- Bitcoin: A New Pillar for Institutional Portfolios

- How Bitcoin Enhances Portfolio Performance

- Looking Ahead: Bitcoin’s Institutional Adoption and Market Potential

- Conclusion: The Financial Reordering Is Underway

The Decline of the Traditional 60/40 Portfolio

For decades, the 60/40 portfolio has been the gold standard for balancing growth and stability. Designed to combine capital appreciation from equities with income stability from bonds, it thrived in the post-World War II era, especially during the disinflationary boom from the 1980s through the early 2000s. Falling interest rates, globalization, and fiscal moderation allowed stocks and bonds to perform well together, with bonds acting as a ballast during market volatility.

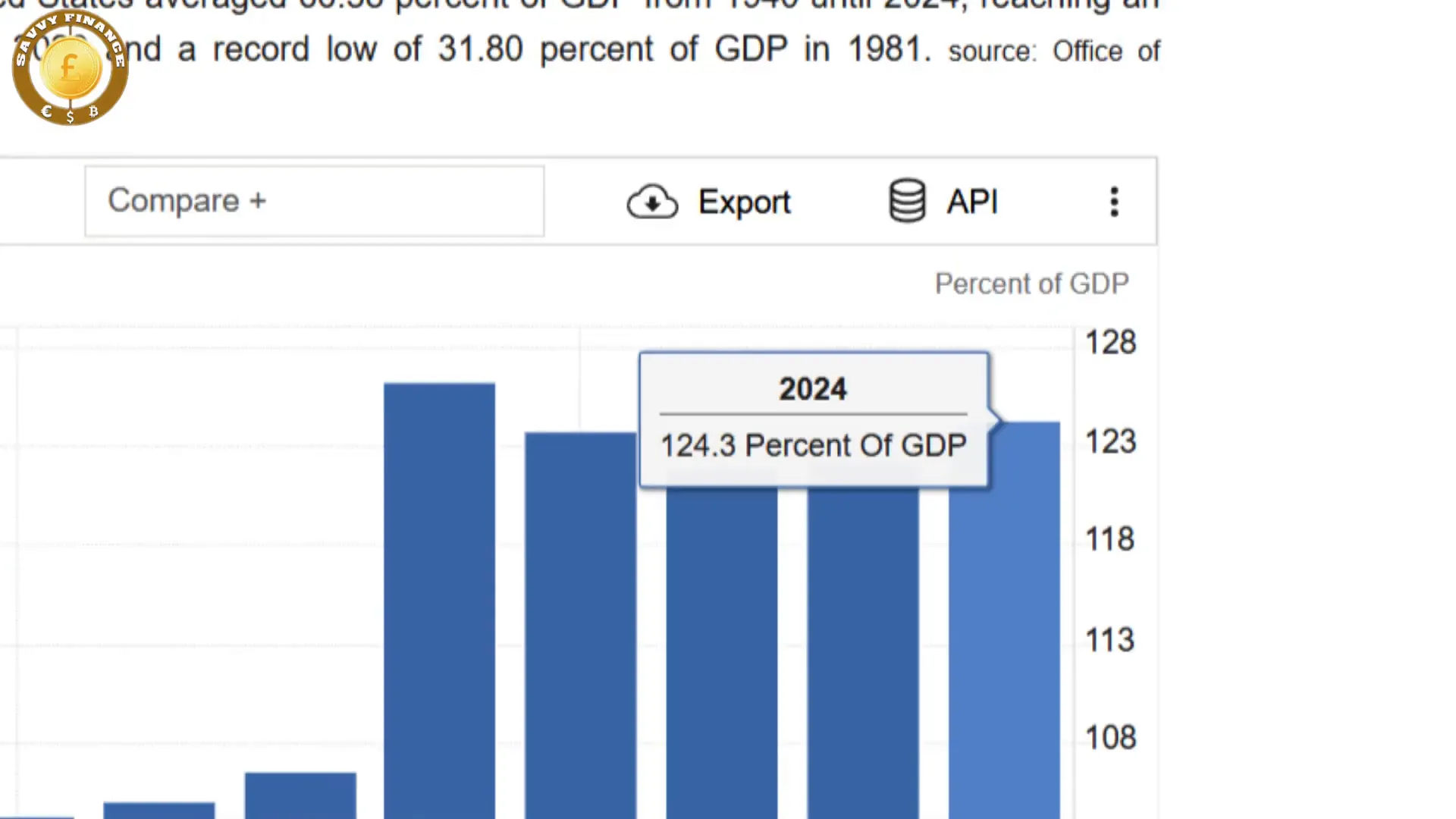

However, this macroeconomic environment has fundamentally shifted. Today, global debt-to-GDP ratios have soared to historic highs. Central banks, particularly in developed markets, face fewer policy options. Real yields are increasingly negative, and bonds—once the portfolio’s risk buffer—have become a drag on returns.

In this new regime marked by higher inflation volatility and fiscal dominance, investors must rethink asset allocation at a structural level.

Why Bonds and Cash No Longer Serve as Safe Havens

Traditionally, the 10-year US Treasury bond was the world’s safest asset. It provided real yields, hedged against drawdowns, and helped investors meet liabilities. Today, the picture is starkly different. Treasury yields correlate more closely with equities during market downturns, offer negative real returns once adjusted for inflation and monetary expansion, and add volatility instead of stability.

This is not a policy mistake but a deliberate government strategy to suppress real yields and manage unsustainable debt. The global economy has become addicted to credit expansion, with debt reaching $324 trillion as of early 2025. In the US alone, annual interest payments on federal debt exceed spending on defense and Medicare.

Central banks respond by increasing liquidity through quantitative easing (QE) and easing collateral requirements. For example, the US Federal Reserve’s decision to remove US Treasuries from banks’ leverage ratio calculations allows banks to buy unlimited Treasuries, effectively financing government obligations.

This phenomenon, known as fiscal dominance, means monetary policy exists primarily to fund government spending. We are in a permanent low-rate, high-liquidity world—not because it’s optimal, but because it’s the only path left.

The Silent Erosion of Savings: A Systemic Challenge

The consequences of this regime are profound. Bonds no longer hedge risk effectively; cash fails to preserve purchasing power. The anchor asset of portfolios has become a liability. This systemic erosion quietly taxes savings, undermining the traditional investment model for all investors—professional and retail alike.

In this environment, the old safe haven playbook is obsolete. Investors need assets that exist outside the “repression loop” of negative real yields and monetary debasement.

The Structural Regime Shift

James Lavish highlights that this is not a temporary market dislocation but a structural shift. Long-duration sovereign bonds have lost their downside protection and now behave more like risk assets. A portfolio entirely denominated in fiat instruments faces silent, compounding losses that are systemic, not cyclical.

Capital preservation today requires more than diversification—it demands opting out of the traditional financial system’s vulnerabilities.

Bitcoin: A New Pillar for Institutional Portfolios

In this context, bitcoin emerges as a uniquely suited asset class. Not just “digital gold,” bitcoin is monetary architecture designed for a world of mistrust, government overreach, and persistent inflation. It has no central issuer, no credit risk, no dilution, and a fixed supply capped at 21 million coins.

Bitcoin trades 24/7 globally, settles in real time, and offers full transparency on a public ledger. It is borderless, programmable, and neutral—a true global reserve asset in a multipolar world where sovereign trust is waning.

Significantly, bitcoin is the only uncorrelated, liquid, hard-capped asset available today, qualities that earn it a critical spot in institutional portfolios.

How Bitcoin Enhances Portfolio Performance

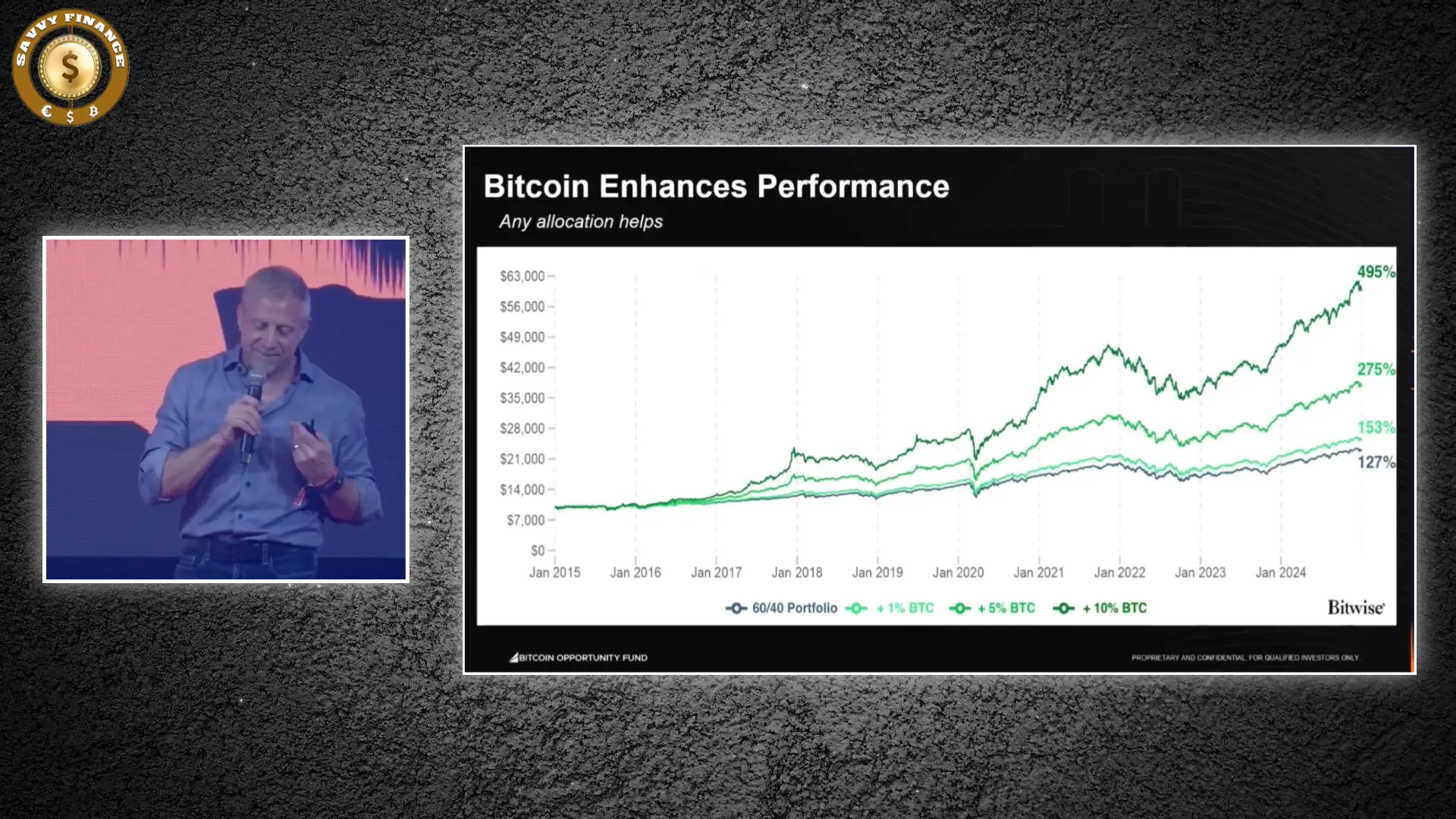

Using the traditional 60/40 portfolio as a baseline, Lavish demonstrates the powerful impact of incrementally adding bitcoin by replacing portions of the bond allocation:

- 60/40 portfolio (no bitcoin): 127% total return over the past decade, annualized at 8.5%

- 1% bitcoin allocation: Return improves to 153%, annualized at 9.7%

- 5% bitcoin allocation: Returns climb to 275%, annualized at 14.1%

- 10% bitcoin allocation: Total return skyrockets to 495%, annualized at 19.5%

This is not just about raw returns. The Sharpe ratio—measuring risk-adjusted returns—also improves with each increase in bitcoin allocation. At 10%, the portfolio surpasses the institutional threshold Sharpe ratio of 1.0, making it easier to defend and manage volatility.

In other words, a modest allocation to bitcoin doubles or even quadruples portfolio returns without leverage or derivatives, delivering a convex payoff in a world where traditional assets offer linear returns and negative real yields.

Looking Ahead: Bitcoin’s Institutional Adoption and Market Potential

Institutional portfolios have been evolving dramatically. From 85% fixed income in 1980 to just 4% in 2022, investors are forced to reach for yield in illiquid assets, derivatives, and leverage—adding complexity and risk to chase a 7% return target that barely keeps pace with money supply growth.

Bitcoin represents a design-fit asset built for today’s challenges. With over $50 billion traded daily and rising institutional custody now accounting for over 30% of circulating supply, bitcoin’s rise is not hype but structural.

Consider the math: if bitcoin captures just 1% of global investable assets—currently over one quadrillion dollars—that implies a $10 trillion valuation, roughly five times today’s market cap, without relying on retail FOMO.

Bitcoin is becoming the default escape valve, a refuge rather than a rebellion, poised to become the pillar asset portfolios are built around—replacing the US Treasury as the anchor in a world of monetary uncertainty.

Conclusion: The Financial Reordering Is Underway

We are witnessing more than a technological evolution; it is a fundamental financial reordering. Institutions that once dismissed bitcoin as speculative are now integrating it into core asset allocation out of necessity. The system’s fragility, suppressed real yields, and growing debt make bitcoin a logical destination for capital seeking preservation and asymmetric upside.

With a 10% allocation historically delivering nearly 500% higher portfolio returns and superior risk-adjusted performance, bitcoin’s role in institutional investing is becoming undeniable. Coupled with regulatory clarity, deeper liquidity, and matured infrastructure, the migration to bitcoin is well underway.

As trust in centralized systems erodes and capital seeks optionality, bitcoin and the broader crypto ecosystem stand to benefit from the same macro forces reshaping global finance.

You don’t need to believe in bitcoin as a technology or ideology—just believe in math.

How are you positioning your portfolio for the next phase of monetary evolution? The choice is clear: adapt or risk being left behind in a world where cryptocurrency, bitcoin, and digital assets redefine wealth preservation.

This Bitcoin Investment Strategy Assures You of 495% Returns. There are any This Bitcoin Investment Strategy Assures You of 495% Returns in here.