If you’re diving into the world of cryptocurrency in 2025, you’ve probably heard the buzz around altcoin season and some ambitious Bitcoin price targets. The crypto market is heating up, and many investors are wondering: Is this the moment to get bullish? This comprehensive guide will walk you through the key trends, price predictions, and fundamental drivers shaping the crypto landscape this year — with a special focus on bitcoin and altcoins like Solana and Ethereum.

Let’s explore why 2025 could be a breakout year for cryptocurrency, how altcoin season might unfold, and how you can position yourself to make the most of these opportunities.

Table of Contents

- Altcoin Season is Approaching: What You Need to Know

- Bitcoin and Solana: The Technical Setup for Explosive Growth

- Bitcoin ETF Inflows and Regulatory Tailwinds

- Market Conditions and Macro Factors Supporting Crypto Growth

- Bitcoin as Digital Gold and Ethereum as the Future of Web3

- Innovations Beyond Bitcoin and Ethereum: TON Blockchain and UAE Residency

- Final Thoughts: Time to Get Bullish on Cryptocurrency

Altcoin Season is Approaching: What You Need to Know

Historically, altcoin season tends to kick off in the summer, often around June or July. For the past five years, the altcoin season index has bottomed primarily in June, followed by a strong second half of the year for altcoins. This cyclical pattern is driven by human psychology and market money flows into smaller-cap cryptocurrencies during bullish phases.

In 2025, we are currently at a pivotal point, with many indicators suggesting that a massive alt season could ignite as early as July 7th. While the timing isn’t guaranteed, the setup is strikingly similar to previous bull markets in 2017 and 2021.

Given that quantitative easing (QE) is expected to ease, and we are in the midst of a bull market, the potential for a significantly bigger move than what we saw in Q4 of 2023 is very real. This means altcoins could see explosive gains in the coming months.

Bitcoin and Solana: The Technical Setup for Explosive Growth

One of the most exciting technical patterns to watch right now is the “cup and handle” breakout forming for Bitcoin and quality altcoins like Solana. This pattern suggests a future price target for Bitcoin around $230,000 and Solana could see gains of nearly 2,800% to 3,000%.

While these price targets are optimistic and don’t have to materialize exactly as projected, the underlying message is clear — both Bitcoin and Solana are due for a major breakout. Expert analysts have even suggested Solana could reach as high as $4,390 if the pattern completes perfectly, though a more conservative expectation still points upwards.

Whether or not these exact numbers are hit, the trajectory is bullish. The charts strongly indicate that the crypto market is gearing up for a significant rally.

Why is Solana So Bullish?

Solana’s fundamentals are just as compelling as its technicals. After soaring from $18 to over $200 during the “meme coin summer” last year, Solana is now benefiting from the next big wave: tokenized stocks. This innovation is gaining rapid traction on the Solana blockchain, with tokenized stock holdings exploding from 4,000 to 33,000 in just 48 hours — a 7.5x surge.

This growth in tokenized assets on Solana’s network is a strong signal of increasing adoption and network activity, which bodes well for its price appreciation.

Bitcoin ETF Inflows and Regulatory Tailwinds

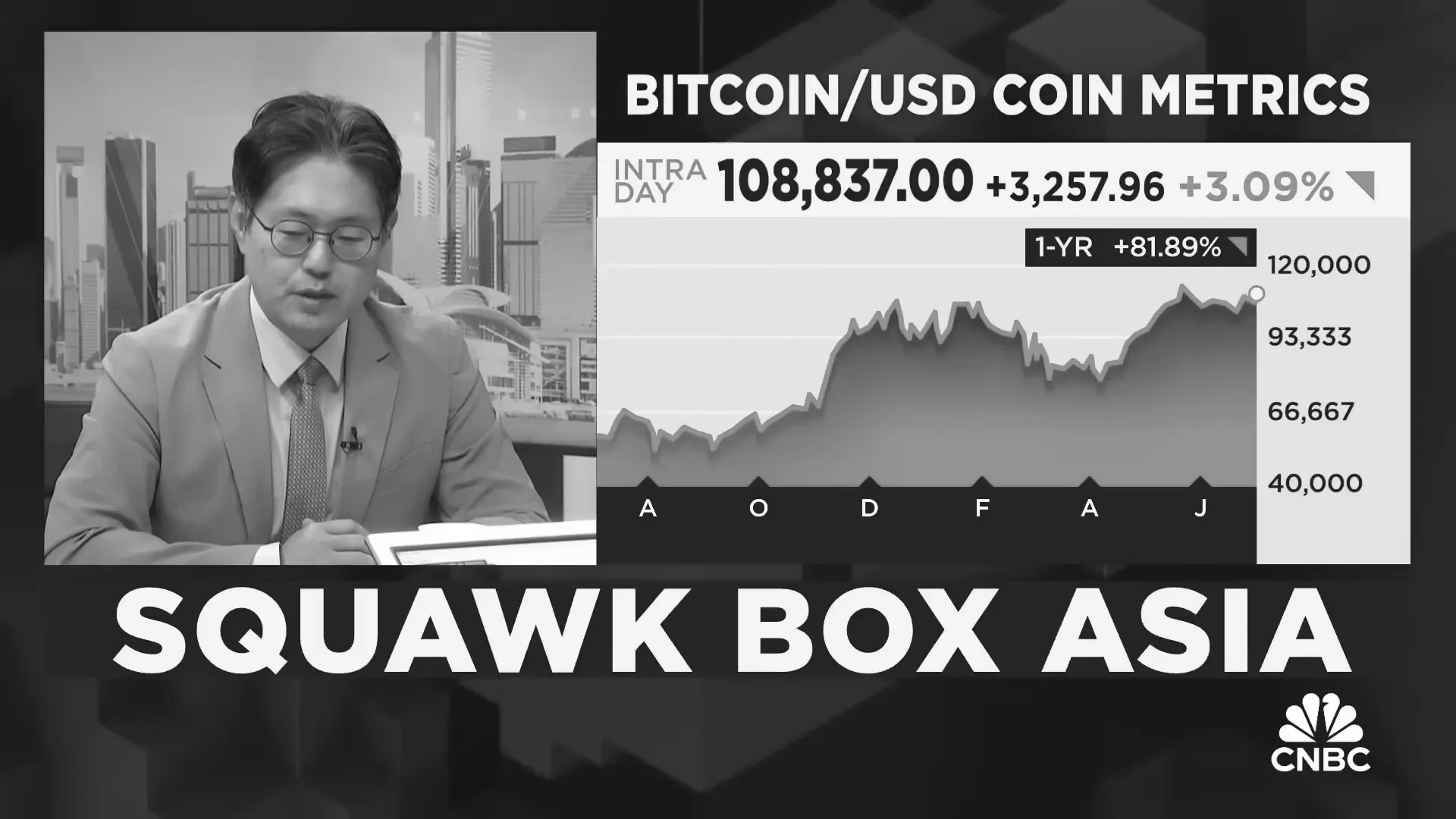

Even if Bitcoin’s cup and handle pattern doesn’t hit the $230,000 technical target, ETF inflows alone could push Bitcoin’s price to around $117,000 in the short term. In 2024, Wall Street’s enthusiasm and ETF hype helped drive Bitcoin to $110,000, and 2025 looks even more promising.

This year, we’re seeing not only ETF volume but also a pro-crypto president, favorable US regulations, and nation-states getting involved. All these factors create a powerful tailwind for Bitcoin’s price.

Peter Chung, head of research at Presto, reaffirmed his bullish prediction of Bitcoin reaching $210,000 by 2025 and is sticking firmly to this target despite market volatility. This consistency among analysts underlines the strong conviction in Bitcoin’s long-term growth.

Market Conditions and Macro Factors Supporting Crypto Growth

Several macroeconomic factors are aligning to support a bullish crypto market:

- Tariff pauses: President Trump extended the tariff pause from July 9th to August 1st, signaling a pro-market stance.

- Federal Reserve rate cuts: Major banks expect the Fed to begin cutting rates as early as July, which historically fuels market rallies.

- Liquidity improvements: Changes in banking regulations could allow banks to hold an additional $5 trillion in treasuries, easing liquidity conditions.

- US dollar weakness: The dollar has been crashing against Bitcoin, highlighting Bitcoin’s strength as a hedge against inflation and currency debasement.

These conditions create an environment ripe for Bitcoin and altcoins to thrive.

Bitcoin as Digital Gold and Ethereum as the Future of Web3

Bitcoin’s value proposition remains simple but powerful: a decentralized store of value, often called “digital gold.” It’s the first mover in the crypto space and continues to outperform many traditional assets.

Ethereum, often described as Bitcoin’s “little sister,” is emerging as a game changer for the financial system and beyond. It represents the next stage of internet evolution — Web3 — which aims to decentralize the web and empower users.

With growing scalability, affordability, and legal clarity in the US, Ethereum’s ecosystem is attracting entrepreneurs, enterprises, and financial institutions. The platform enables building decentralized applications that prioritize community benefits over adversarial relationships, reshaping how systems operate globally.

Why 2025 is the Year to Be Bullish on Ethereum

According to industry voices like Joe Lubin, Ethereum in 2025 will be transformational for crypto and the broader technological landscape. This year marks a turning point where Ethereum’s infrastructure and ecosystem maturity could drive unprecedented innovation and adoption.

Innovations Beyond Bitcoin and Ethereum: TON Blockchain and UAE Residency

Exciting developments are happening across various altcoins and blockchains. For instance, TON blockchain has launched a unique program allowing applicants to secure a 10-year UAE residency by staking 100,000 TON tokens. This is an innovative use of crypto staking tied to real-world benefits, potentially paving the way for similar programs with Bitcoin, Ethereum, or Binance Coin.

Such initiatives highlight the growing integration of blockchain technology into global financial and regulatory systems, further legitimizing crypto assets.

Final Thoughts: Time to Get Bullish on Cryptocurrency

With so many positive signals — from technical patterns and ETF inflows to macroeconomic factors and regulatory progress — it’s hard not to feel bullish about cryptocurrency right now.

Bitcoin remains the cornerstone of crypto portfolios, with Ethereum and select quality altcoins like Solana offering compelling upside potential. Altcoin season is close, and 2025 could be a defining year for crypto innovation and price action.

If you’re a trader or investor, now is the time to position yourself strategically. Platforms like WEEX offer attractive bonuses and trading opportunities with no KYC requirements, allowing you to profit whether the market goes up or down.

Remember, the goal is to accumulate valuable crypto assets, especially Bitcoin and Ethereum, while keeping an eye on promising altcoins that bring innovation to the space.

Stay informed, stay patient, and get ready for what could be an explosive year in cryptocurrency.

The ULTIMATE 2025 Altcoin Season Guide: How to Make Money in Crypto with Bitcoin and Altcoins. There are any The ULTIMATE 2025 Altcoin Season Guide: How to Make Money in Crypto with Bitcoin and Altcoins in here.