Saturday, June 28, 2025, marks a pivotal moment in the financial markets, with optimism sweeping through investors driven by easing geopolitical tensions, dovish signals from the Federal Reserve, and robust technology sector performance. As an avid follower of market trends and a believer in simplifying investing, I’m excited to share a comprehensive breakdown of the current market environment, key trade developments, and the top growth stocks to watch for July. Whether you’re deeply involved in Bitcoin, Crypto, BTC, Blockchain, CryptoNews, or general investing, this article will provide you with valuable insights to navigate the evolving landscape.

Market Momentum: Riding the Wave of Optimism

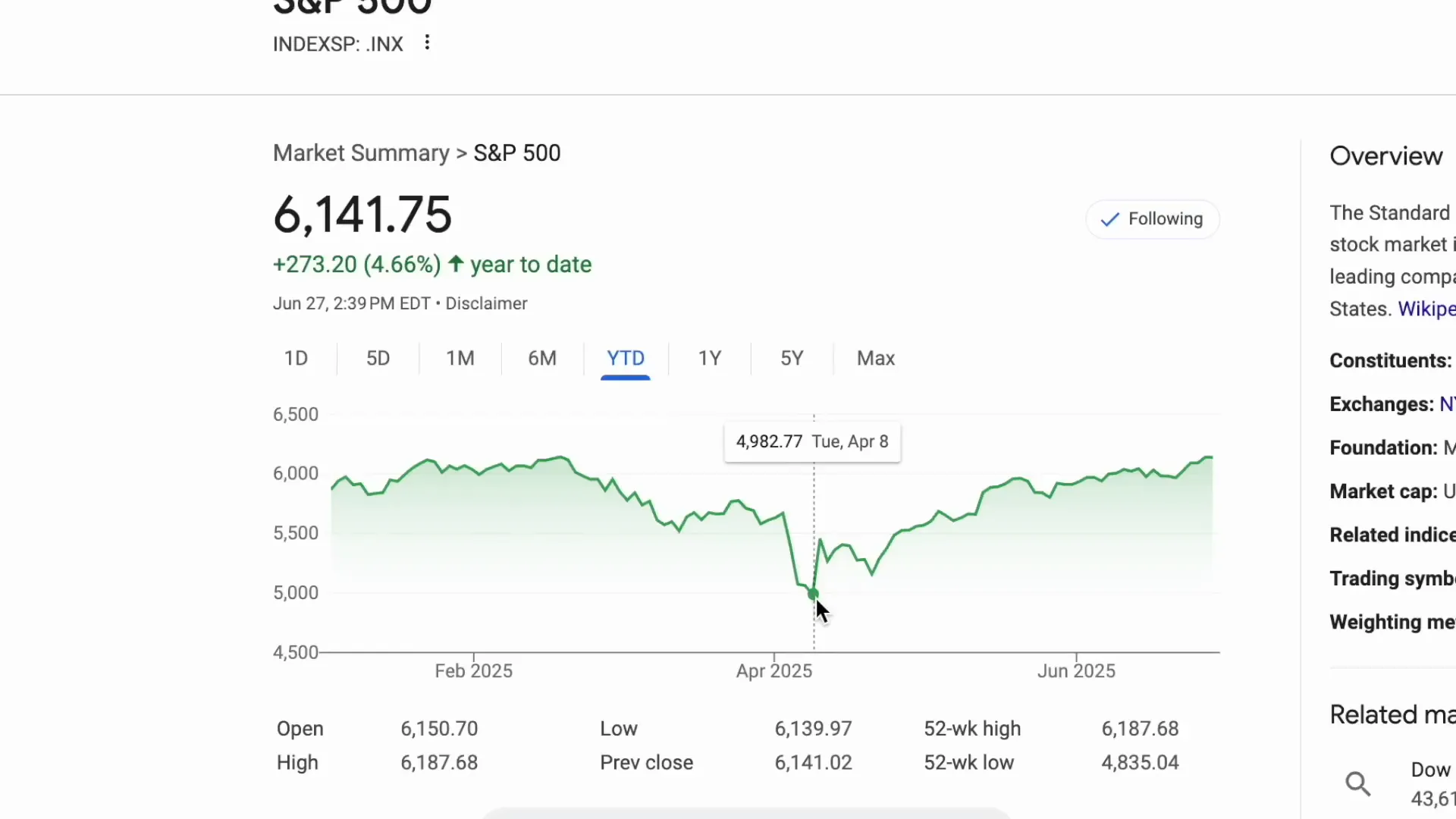

The S&P 500 recently hit a new all-time high on Friday, capping off a remarkable run since the sharp drop on April 8th. The index has surged over 20% since that dip and is now up nearly 5% for the year. This resilience is a testament to the power of steady investing — for those who stayed the course or even seized the opportunity to buy the dip, congratulations are in order. This kind of market behavior underscores the importance of patience and discipline in investing, especially in volatile environments.

But what exactly is fueling this surge? The market’s upbeat mood primarily stems from three catalysts:

- Easing Geopolitical Risks: A tentative ceasefire between Iran and Israel has calmed tensions in a region that often sends ripples through global markets.

- Dovish Signals from the Federal Reserve: Policymakers are signaling a more cautious approach to interest rates, which investors generally welcome.

- Strong Tech Sector Performance: Technology stocks, particularly those tied to artificial intelligence and semiconductors, continue to lead the charge upward.

However, this optimism is not without its caveats. The market’s mood remains highly dependent on upcoming trade and policy events, which could inject volatility if outcomes diverge from expectations.

Geopolitical Developments: A Ceasefire Brings Relief

One of the most significant positive developments last week was the apparent ceasefire between Iran and Israel. Historically, conflicts in the Middle East have been a source of uncertainty and risk for global investors. The easing of hostilities helps reduce the geopolitical premium baked into asset prices, allowing investors to refocus on fundamentals.

Trump and China Sign Rare Earth Trade Deal: A Game Changer?

In a surprising turn, President Trump and China formally signed a trade deal this week, focusing on rare earth materials — a key bone of contention in their ongoing trade war. Rare earths are critical components in technology, defense, and automotive supply chains, making this agreement highly consequential.

Here are the key highlights of the deal:

- Expedited Chinese Exports: The agreement facilitates faster Chinese exports of rare earths and magnets to the U.S., easing supply chain bottlenecks.

- Visa Easing: In return, the U.S. reportedly agreed to relax student visa restrictions for Chinese nationals, signaling a broader diplomatic thaw.

- Tariff Adjustments: Although specifics remain undisclosed, reports suggest reciprocal tariffs may now be structured around a baseline of approximately 55% on Chinese goods and 10% on U.S. exports.

This deal formalizes the earlier 90-day tariff pause that began in May in Geneva, establishing a framework for removing some restrictions and advancing broader trade negotiations. However, practical implementation may face delays as China vets export licenses, with some companies already reporting hurdles.

President Trump also hinted at a significant upcoming trade deal with India, indicating a broader pivot to secure further trade partnerships, which could further shape market dynamics.

Market Sentiment and the Fear & Greed Index

Overall, the market sentiment is trending upward and ended the week on a strong note. The Fear and Greed Index, a popular gauge of investor emotions, currently reads 65 out of 100. This indicates a tilt towards greed, meaning more investors are bullish and actively buying. While this is a positive sign, it also signals that risk levels remain elevated.

Key risks to watch include:

- Geopolitical flashpoints that could reignite conflicts.

- Trade war dynamics, especially around tariffs and export restrictions.

- Potential Federal Reserve interventions that could shift monetary policy unexpectedly.

Volatility remains a lurking threat, and investors should maintain vigilance as the market navigates these uncertainties.

Top 3 Stocks to Watch in July: The AI and Semiconductor Surge

Looking ahead, I’m focusing on three standout stocks for July, each poised to benefit from strong catalysts and analyst interest, especially if trade deals continue to evolve favorably. Semiconductors, in particular, are shaping up to be a dominant theme.

1. NVIDIA: The AI Innovator

NVIDIA remains at the forefront of AI innovation, with recent partnerships in the AI ecosystem accelerating its momentum. Collaborations with CoreWeave, IBM, HP, and European AI model rollouts have kept NVIDIA in the spotlight.

Key updates to watch this July include:

- Earnings guidance and performance.

- Data center sales trends, a critical revenue driver.

- Commentary on export restrictions or developments in AI hardware rollout.

NVIDIA recently hit record highs, and upcoming earnings or geopolitical tensions could amplify volatility. Given its central role in AI infrastructure, this stock remains a bellwether for tech-driven growth.

2. Tesla: Driving into AI-Powered Automation

Benchmark recently raised Tesla’s price target to $475, citing the company’s strategic pivot toward AI-powered automation and robo-taxis. Despite some concerns around vehicle deliveries, Tesla's innovation pipeline remains a significant draw.

For July, keep an eye on:

- Q2 delivery figures, which could sway investor confidence.

- Updates on full self-driving (FSD) technology and robo-taxi deployments.

- Any regulatory or safety developments related to FSD.

A strong robo-taxi update could trigger a breakout, while weak deliveries or negative headlines involving Elon Musk might weigh on the stock.

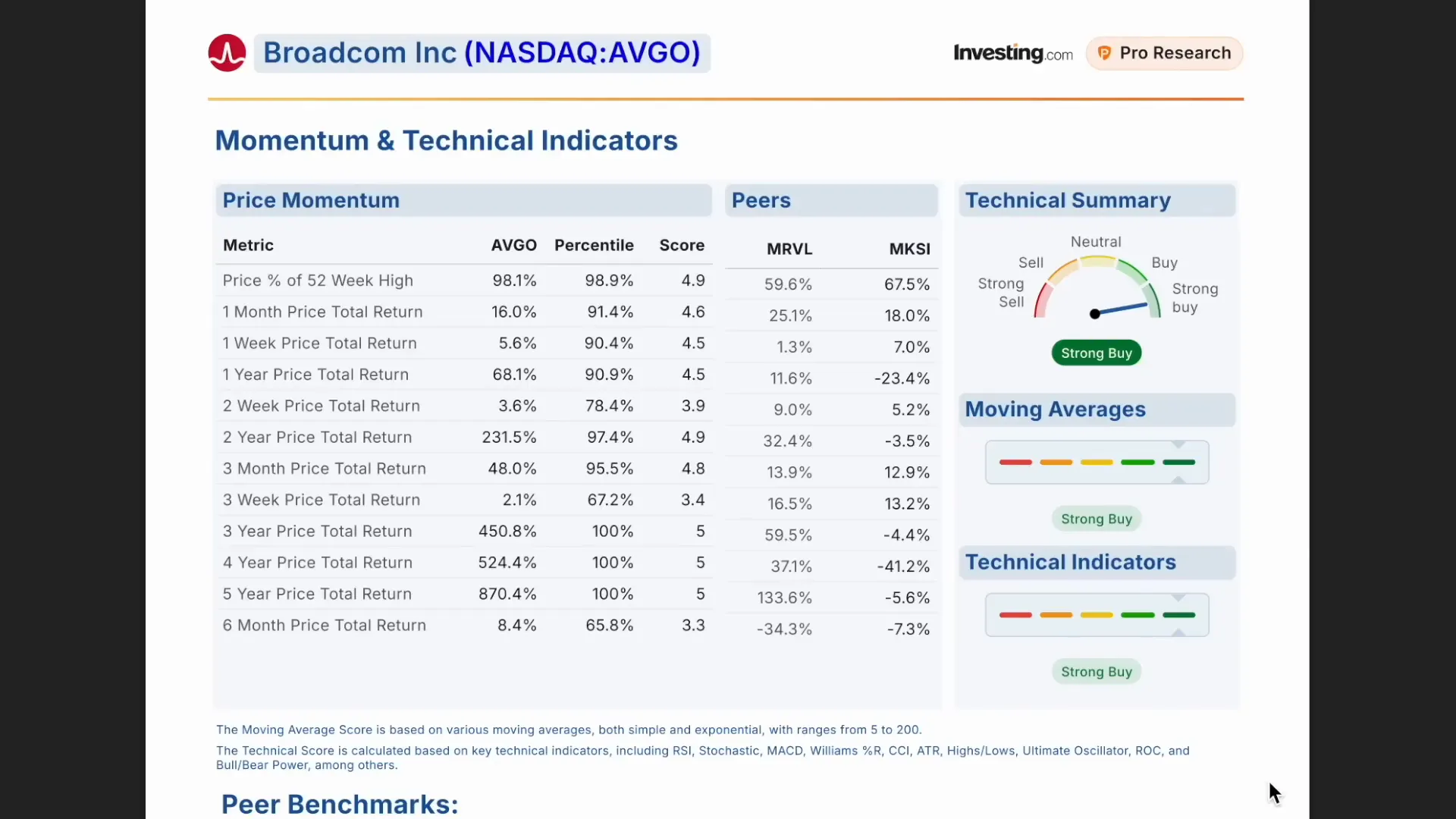

3. Broadcom: The Underrated AI Chip Player

My personal favorite on this list is Broadcom, a mid-tier tech company with significant exposure to AI infrastructure. While NVIDIA garners a lot of attention, Broadcom offers a compelling growth story with potentially larger upside.

Using research tools like the Pro Research tab on Investing.com reveals that Broadcom is a mutual fund favorite, boasting 44% profit growth and 20% sales growth in the last quarter. It is widely regarded as a strong buy by analysts across the board.

Broadcom’s steadier upside and strong fundamentals make it an attractive play for investors seeking exposure to AI chip growth without the higher volatility of mega-cap stocks.

Important Economic and Policy Events to Watch Next Week

The upcoming week and the weeks following are critical as several key economic data releases and policy decisions could move markets significantly.

- Monday, June 30: Core trend inflation indicator and Dallas Fed manufacturing survey, offering early clues on price pressures and regional growth.

- Tuesday, July 11: Durable goods orders, ISM manufacturing, and ADP employment data, shedding light on business investment and labor momentum.

- Thursday, July 3: Initial jobless claims and the June employment report, crucial for understanding wage growth and inflation expectations.

- Friday, July 4: Markets closed for Independence Day.

These data points will be pivotal in shaping investor expectations around inflation, employment, and economic growth — all vital inputs for Federal Reserve policy decisions.

Federal Reserve Policy: The Rate Cut Debate

The debate around a potential rate cut in July is intensifying. Policymakers remain divided, with Chair Jerome Powell taking a data-first approach, while governors Bowman and Waller have expressed support for cuts if inflation remains tame.

Recent inflation data showed a slight uptick compared to the previous month, complicating the narrative. The labor market's strength and upcoming inflation reports will be crucial in tipping the scales.

Tariff and Fiscal Policy Risks: The July 9 Deadline

The 90-day tariff pause with China expires on July 9, creating a significant risk factor. Any renewal, extension, or reimposition of tariffs could trigger renewed market volatility.

Given the recent trade deal with China and potential talks with India, this is by far the most closely watched event. Investors should be prepared for sharp market moves based on developments here.

Additionally, the Senate vote on Trump's tax and spending bill is expected around July 4, raising concerns about the debt ceiling and fiscal deficits that could influence market sentiment.

Upcoming Fed Meeting: July 29-30

The Federal Open Market Committee (FOMC) meeting at the end of July will be a key event. Rate cut expectations will be a primary focus, and market reactions could be significant depending on the Fed's guidance.

Staying Prepared in a High-Risk Market

After a week where the market reached all-time highs, it’s natural to see some profit-taking and slight pullbacks. Investors are also cautious, with many on the fence about the ramifications of the tariff pause expiration and upcoming policy decisions.

As always, staying informed and maintaining a disciplined investing approach is critical. The evolving trade landscape, Fed policy shifts, and geopolitical factors all demand vigilance.

For those committed to strengthening their investing journey, I recommend keeping an eye on major catalysts and continuing to build knowledge around Bitcoin, Crypto, BTC, Blockchain, CryptoNews, and broader investing strategies.

Remember, investing simplified means focusing on the fundamentals, managing risk, and capitalizing on opportunities as they arise.

Extra Resources to Boost Your Investing Journey

For those wanting to dive deeper, consider exploring platforms like Investing.com, which currently offers a 50% off summer sale, plus an extra 15% off with my exclusive link. It’s a great resource for research and analysis to guide your stock picks and market timing.

Joining dedicated investing communities, such as Patreon groups with live Q&A sessions and portfolio reviews, can also provide valuable support and insights from fellow investors.

Keep your eyes on the market, stay curious, and continue learning to make the best decisions for your portfolio. The road to financial freedom is a journey, and with the right tools and mindset, you can navigate the ups and downs with confidence.

Stock Market Soars.. 🚨BEWARE Risk Remains HIGH | Bitcoin, Crypto, BTC, Blockchain, CryptoNews, Investing Insights. There are any Stock Market Soars.. 🚨BEWARE Risk Remains HIGH | Bitcoin, Crypto, BTC, Blockchain, CryptoNews, Investing Insights in here.