Imagine opening your banking app and seeing a Bitcoin tab right alongside your checking and savings accounts. This is no longer a far-fetched dream—it’s rapidly becoming a reality thanks to groundbreaking regulatory shifts and innovative legislation shaping the future of finance. The stablecoin revolution is poised to fundamentally alter how we think about money, payments, and investing in the world of Bitcoin, crypto, BTC, blockchain, and beyond.

In this comprehensive guide, we’ll dive deep into the seismic changes underway in the United States financial system that are set to integrate stablecoins fully into the economy. We’ll explore the significance of new laws like the Genius Act, the Clarity Act, and the Bitcoin Act, as well as the Federal Reserve’s evolving stance on crypto. Whether you’re a seasoned investor, a crypto enthusiast, or someone curious about the future of money, this article will prepare you for what’s next.

What Are Stablecoins and Why Do They Matter?

Stablecoins are digital dollars—cryptocurrencies designed to maintain a one-to-one peg with the US dollar. Unlike Bitcoin or other cryptocurrencies that can swing wildly in value, stablecoins aim to trade consistently around one dollar, with only minor fluctuations of a few cents. This stability is what makes them so valuable as a medium of exchange and store of value in the crypto ecosystem.

Why does this matter? Because stablecoins enable instant, 24/7, global money transfers without the delays or high fees associated with traditional banking systems. You can pay rent, send money to family overseas, or move funds between exchanges with ease and at a fraction of the cost of wire transfers or bank holidays.

In decentralized finance (DeFi), stablecoins are the gateway for everything from lending and borrowing to complex financial products. They provide the stability and familiarity of the dollar, but with the flexibility of blockchain technology. Until recently, stablecoins were peripheral to the US economy. Thanks to new regulatory clarity, that’s about to change dramatically.

The OCC’s Interpretive Letter 1184: Opening the Doors for Banks to Hold Crypto

Before diving into the legislation, it’s crucial to understand the role of the Office of the Comptroller of the Currency (OCC) and its landmark Interpretive Letter 1184, issued on May 7th, 2025. This letter officially authorized nationally chartered banks to custody and transact cryptocurrencies under existing safe and sound banking regulations.

What does that mean practically? Most major US banks, which hold OCC charters, can now securely store Bitcoin, stablecoins, and other digital assets in cold storage vaults. They can execute buy and sell orders on behalf of customers, much like they do with stocks. They can even stake proof-of-stake tokens to earn interest, provided they have strong risk management and comply with anti-money laundering laws.

This regulatory green light is a game-changer. Major custodians have already applied to offer bank-backed crypto custody services, making it almost certain that bank custody for crypto is imminent. This development sets the stage for integrating digital assets directly with dollars and deposits, bridging traditional finance with blockchain innovation.

The Genius Act: Establishing a Federal Framework for Stablecoins

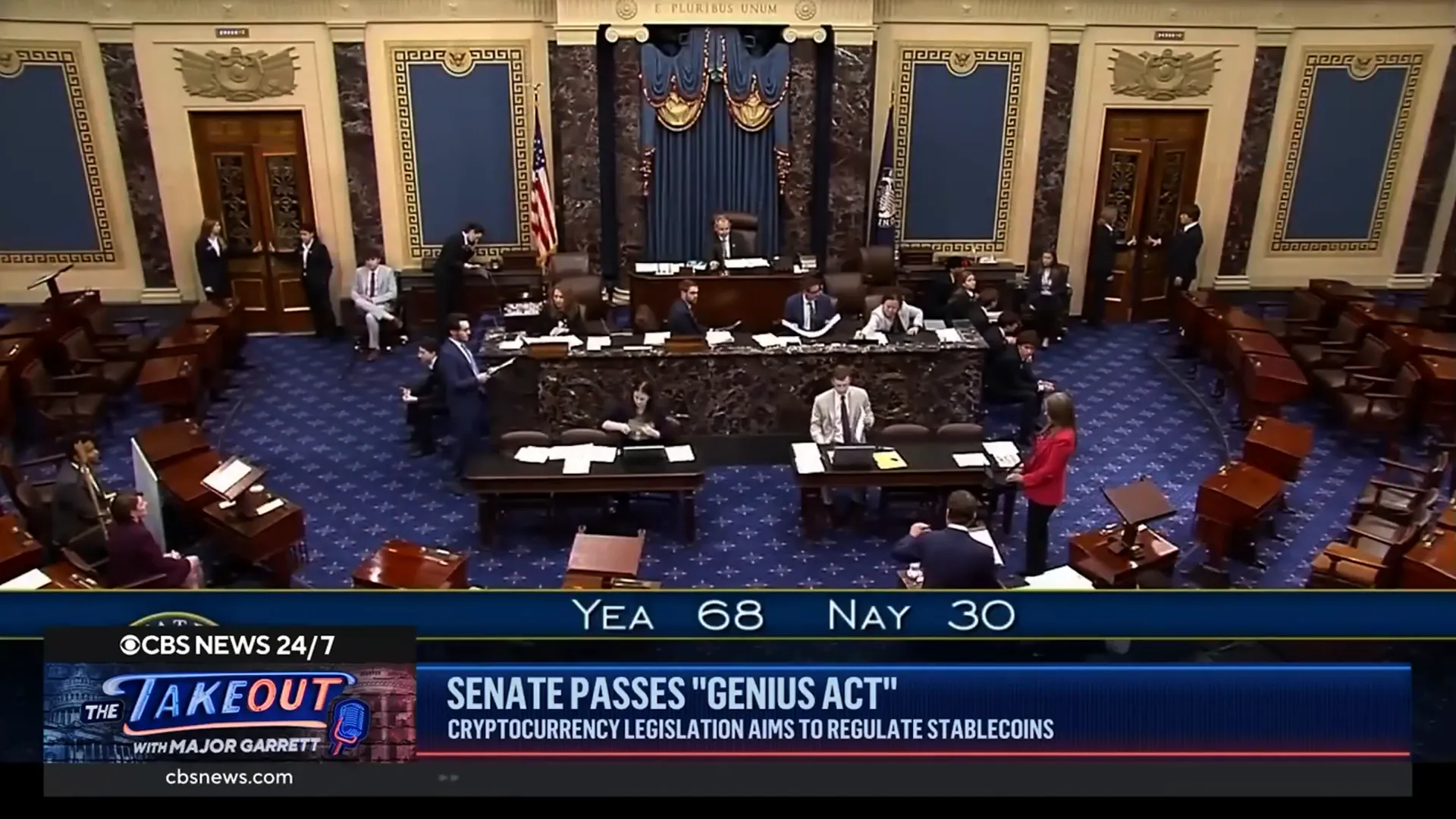

The Genius Act (Guiding and Establishing National Innovation for US Stablecoins) is the first congressional bill to create a clear regulatory framework for stablecoins. Sponsored by Senators Cynthia Lummis and Sherrod Brown, it recently passed the Senate with a strong bipartisan vote of 68-30 and is now slated for a House vote.

Here’s what the Genius Act entails:

- Issuers Must Be Federally Insured Banks or OCC-Approved Firms: Only banks or institutions approved by the OCC can issue payment stablecoins, ensuring trusted entities manage these digital dollars.

- Full Reserve Backing: Unlike fractional reserve banking where banks only keep a fraction of deposits in reserve, stablecoins under this act must be backed 1:1 by high-quality liquid assets such as cash or short-term Treasury bonds. These reserves must be held in segregated accounts at the Federal Reserve or equivalent institutions.

- Monthly Third-Party Audits: Issuers must publish monthly audits by independent firms confirming their tokens are fully collateralized, preventing the risk of “printing money” without backing.

- Compliance with Bank Secrecy Act and Travel Rule: Stablecoin programs must implement Know Your Customer (KYC) and Anti-Money Laundering (AML) protocols, and adhere to the travel rule which requires transparency about the sender and receiver of transactions, much like traditional wire transfers.

Once enacted, stablecoins could become as reliable and consumer-friendly as your checking account, with the added benefits of blockchain speed and efficiency.

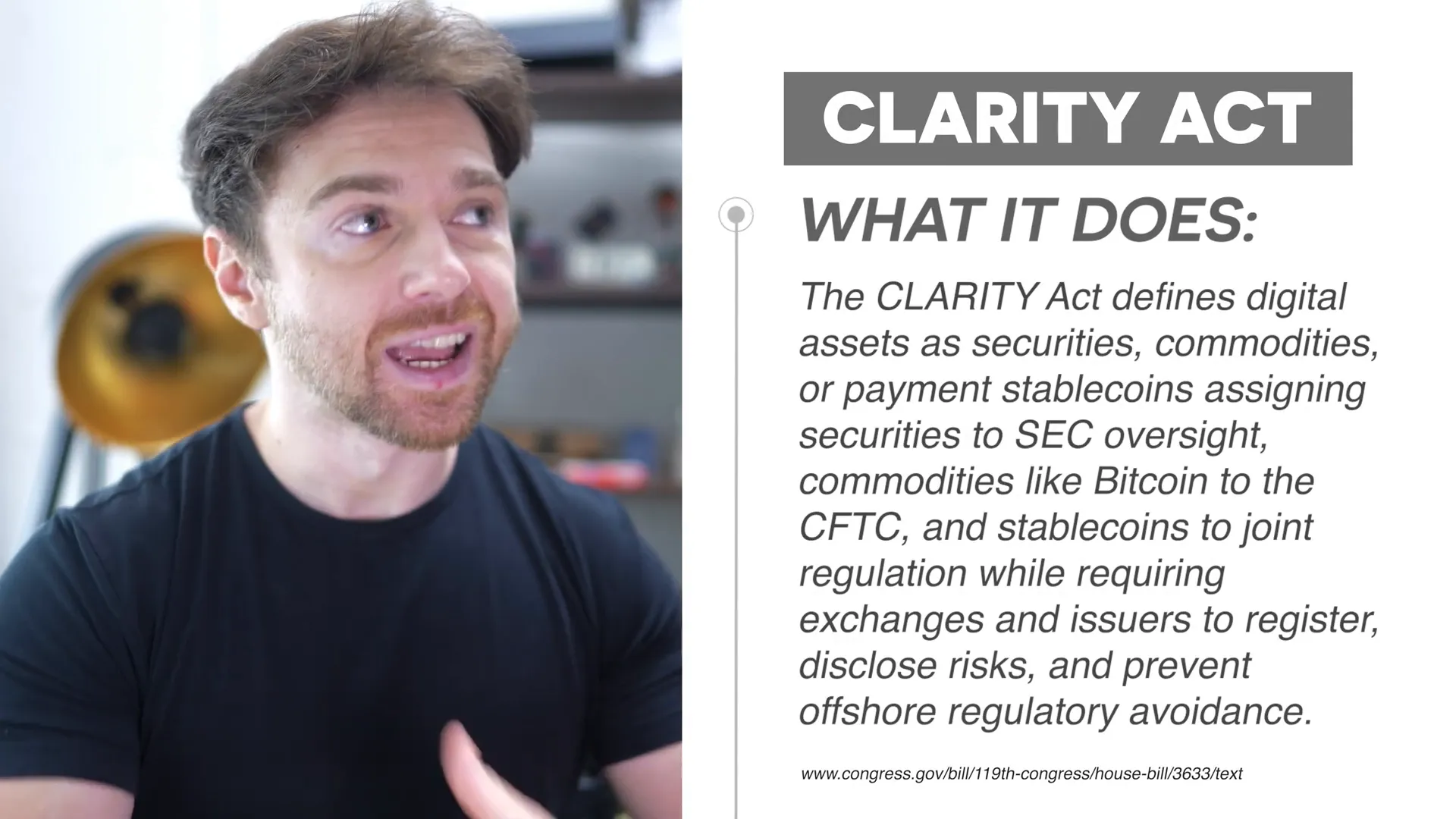

The Clarity Act: Defining Crypto’s Regulatory Landscape

While the Genius Act focuses on stablecoins, the Clarity Act addresses the broader crypto ecosystem by clarifying which regulatory bodies oversee different types of digital assets. This bill, currently moving through the House, categorizes tokens into three distinct buckets:

- Securities: Tokens sold as investment contracts (think ICOs promising future profits) fall under the Securities and Exchange Commission (SEC). Exchanges and brokers dealing with securities must register and comply with disclosure and anti-fraud rules.

- Digital Commodities: Native blockchain assets like Bitcoin and most layer-one tokens fall under the Commodity Futures Trading Commission (CFTC). Platforms trading these assets must register as futures or swaps dealers and follow market regulations.

- Payment Stablecoins: These receive joint oversight from both the SEC and CFTC and must comply with the Genius Act’s framework to ensure full backing and consumer protections.

This clear division of oversight will reduce regulatory uncertainty, making it harder for companies to exploit gray areas or relocate overseas to avoid US laws. The bill also includes bipartisan measures to prevent US projects from incorporating in tax havens like the Cayman Islands, protecting the domestic crypto industry.

With the Clarity Act, exchanges will become safer and more transparent, token launches clearer, and consumers better protected. This is a critical step toward mainstream adoption of crypto and Bitcoin in the US economy.

The Bitcoin Act: Making Bitcoin a US Reserve Asset

One of the most ambitious proposals in the crypto space is the Bitcoin Act, introduced by Senator Cynthia Lummis in March 2025. This bill calls for the US Treasury and Federal Reserve to purchase up to one million Bitcoins—about 5% of Bitcoin’s total supply—and hold it as an official reserve asset alongside gold.

Here’s how it would work:

- No new taxpayer dollars or government debt would be required. Instead, existing Treasury or Federal Reserve liquid assets, such as short-term Treasuries or cash balances, would be converted into Bitcoin.

- The Bitcoin would be stored in a decentralized vault network with federal-grade cold storage, multi-layer security, and strict audit protocols to safeguard the asset.

- Importantly, the bill guarantees that private citizens retain the right to buy, hold, and self-custody Bitcoin without government restrictions, alleviating fears of a potential Bitcoin ban.

Supporters argue this move would strengthen US financial resilience, provide an inflation hedge, and diversify the nation’s $37 trillion debt portfolio. However, the bill’s future remains uncertain. While it has enjoyed strong backing and congressional hearings, full Senate passage isn’t guaranteed, and the White House has yet to express full support.

Even if only some provisions pass—especially those protecting individuals’ rights to self-custody—it would mark a significant milestone for Bitcoin’s legitimacy and integration into US financial policy.

The Federal Reserve’s Quiet Embrace of Crypto

Behind the scenes, the Federal Reserve has been quietly rolling back crypto restrictions that had previously hampered banks from engaging with digital assets. In April 2025, the Fed withdrew its 2022 letter that required banks to obtain pre-approval before handling crypto-related activities.

This change means banks can now move forward with crypto custody, trading, and stablecoin programs without waiting for a Federal Reserve green light. Jerome Powell, Chair of the Federal Reserve, publicly confirmed that banks are free to provide banking services to crypto companies and conduct crypto activities, provided they maintain safety and soundness.

But this newfound freedom comes with responsibility. Banks have spent decades building trust with customers, managing trillions in deposits. Entering the crypto world—known for hacks, scams, and volatility—poses reputational risks. Banks can’t treat crypto custody as just another product; they need to be vigilant and proactive in managing risks.

Despite these challenges, this regulatory evolution is the foundation for the major legislative changes we’ve discussed. It’s what allows stablecoins to become mainstream, crypto custody to be bank-backed, and Bitcoin to gain broader acceptance.

What This Means for Your Wallet and Investment Strategy

All these changes signal the dawn of a new era in banking and finance. Stablecoins backed by federally insured banks and regulated under clear frameworks will become as trustworthy and ubiquitous as traditional dollars. Instant, low-fee payments via stablecoins will soon be as easy as sending a text message, bridging the gap between legacy banking and the $200 billion stablecoin market.

Major players are already moving fast. JPMorgan announced its own stablecoin-like product called JPND. Payment processor Fiserv plans to launch a stablecoin to complement its 90 billion annual transactions. Even retail giants Walmart and Amazon are exploring their own digital tokens.

As banks begin offering Bitcoin custody and buying services, it’s likely that Bitcoin’s price will surge well before these services become mainstream. As Michael Saylor famously said, “By the time your bank is ready to custody Bitcoin and they decide to call you about it, the price will have already gone to the moon.”

For investors, this means it’s wise to stay ahead by dollar cost averaging into Bitcoin and maintaining self-custody. The infrastructure and regulatory clarity are aligning, but mass adoption is still in its early stages.

Earn Bitcoin While You Spend

One practical way to start engaging with crypto today is through rewards programs like the Gemini Bitcoin Credit Card, which offers up to 4% back in Bitcoin on everyday purchases such as gas, groceries, and dining. This lets you accumulate Bitcoin effortlessly as you spend, aligning your financial habits with the future of money.

The Road Ahead: Preparing for the Next Era of Banking

The integration of Bitcoin, crypto, BTC, blockchain, and stablecoins into the US economy is no longer a question of if, but when and how fast. The Genius Act, Clarity Act, Bitcoin Act, and Federal Reserve’s regulatory shifts are converging to create an ecosystem where digital assets coexist seamlessly with traditional finance.

For consumers and investors, this means:

- Greater security and regulatory protections for stablecoins and crypto assets.

- Instant, low-cost payments enabled by stablecoins across networks.

- Access to Bitcoin and other digital assets through trusted banks and financial institutions.

- Clearer rules and oversight for crypto exchanges and token issuers, reducing fraud and uncertainty.

- Potential for Bitcoin to become a US reserve asset, reinforcing its role as “digital gold.”

However, the full realization of these benefits will take time. Banks must carefully navigate reputational risks and develop robust custody solutions. Legislators and regulators will continue refining the rules to balance innovation with consumer protection.

In the meantime, smart investors should consider adopting strategies like dollar-cost averaging into Bitcoin, utilizing crypto rewards cards, and learning how to self-custody their digital assets to prepare for the inevitable mainstream adoption.

As these changes unfold, staying informed and ready will be your greatest advantage. The future of money is digital, and stablecoins are set to replace the US dollar in everyday transactions. Are you ready to embrace this new financial frontier?

Stablecoins Are Replacing the US Dollar: Major Changes Ahead in Bitcoin, Crypto, BTC, Blockchain, and Investing. There are any Stablecoins Are Replacing the US Dollar: Major Changes Ahead in Bitcoin, Crypto, BTC, Blockchain, and Investing in here.