The cryptocurrency market is roaring back to life in 2025, with Bitcoin and Ethereum leading a powerful charge. As the crypto bull market goes completely wild, it's essential to understand the underlying forces driving this surge. This article dives deep into the macroeconomic dynamics shaping today's financial landscape, focusing on the role of liquidity, demographic shifts, and technological innovation, especially in crytocurency and bitcoin. Inspired by insights from macro strategist Raoul Pal, we explore why crypto is not just a speculative asset but a strategic macro allocation in a world of debased fiat currencies and aging populations.

Table of Contents

- The New Economic Reality: Liquidity as the Dominant Market Driver

- Demographic Challenges and Their Impact on Growth

- Technological Innovation: The Path Out of the Productivity Trap

- The Economic Singularity: What Lies Ahead?

- Crypto’s Role in the Current Bull Market

- Conclusion: Positioning for the Next Paradigm

The New Economic Reality: Liquidity as the Dominant Market Driver

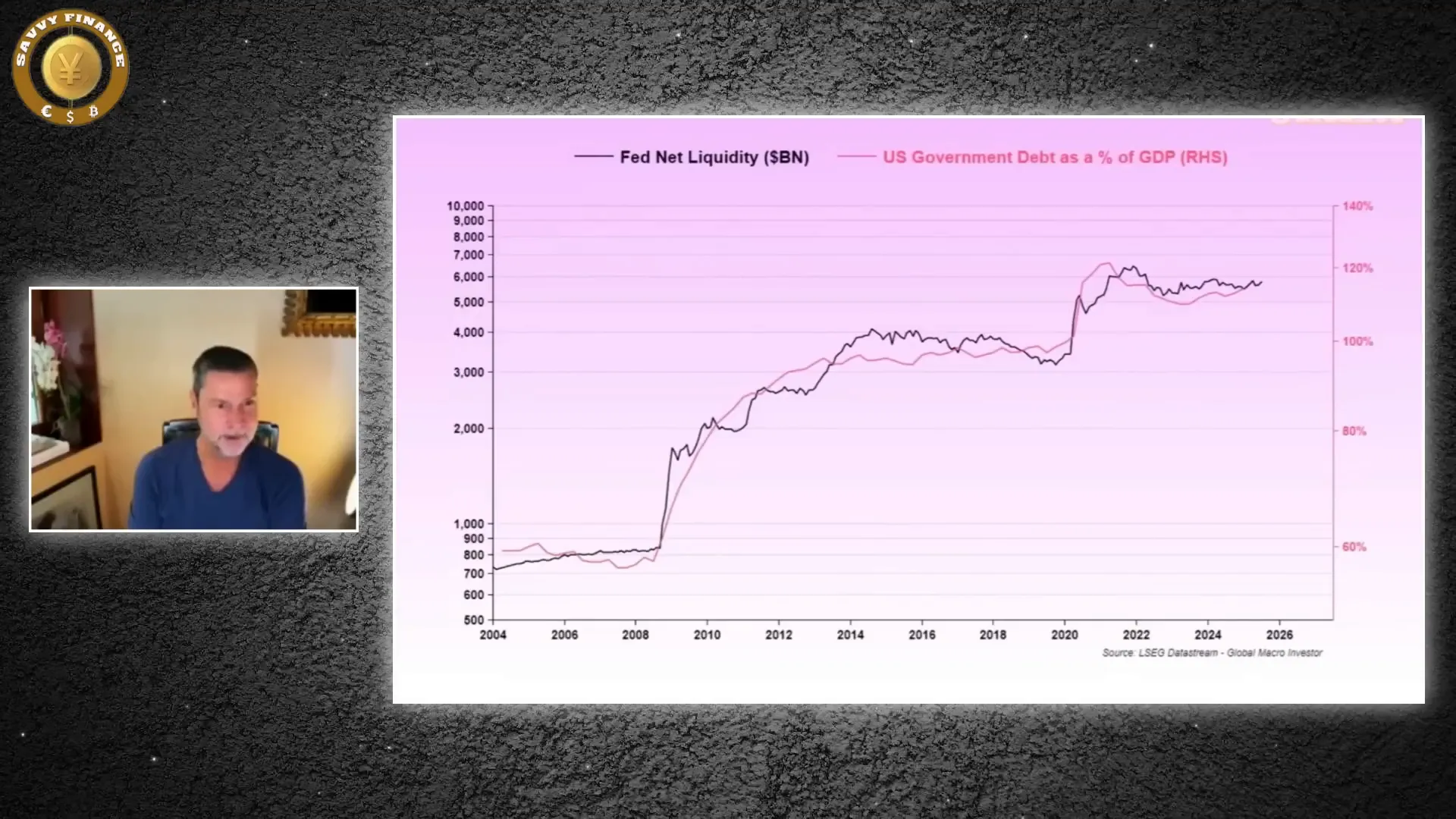

Since the 2008 financial crisis, the global economy has undergone a profound transformation. Central banks worldwide have injected massive liquidity into the system through quantitative easing, fiscal stimulus, and debt refinancing. Raoul Pal argues that liquidity—not earnings, valuations, or traditional monetary policy—is now the single most important driver of asset prices. This phenomenon has created a new economic cycle resembling a four-year metronome, an unprecedented rhythm in modern financial history.

Liquidity injections have expanded global money supply at an approximate rate of 8% per year, silently eroding the value of fiat currencies in a process known as currency debasement. When asset prices are evaluated against this rising liquidity, a surprising pattern emerges: most traditional assets such as equities and real estate merely keep pace with debasement, gold remains flat, and only two asset classes consistently outperform — tech stocks and cryptocurrencies.

Why Tech Stocks and Crypto Outperform

Tech stocks and crypto assets benefit from liquidity expansion for different but complementary reasons. Tech companies are often at the forefront of innovation, leveraging capital to drive growth and productivity. Meanwhile, cryptocurrencies like bitcoin are scarce digital assets designed to resist fiat currency debasement, making them natural beneficiaries of excess liquidity flowing out of traditional markets.

This insight has reshaped how investors allocate capital. Traditional value investing strategies have struggled because they do not account for the dominant macro force of liquidity debasement that inflates asset prices. In contrast, concentrated portfolios focused on tech and crypto have outperformed, suggesting diversification may dilute returns in today's environment.

Demographic Challenges and Their Impact on Growth

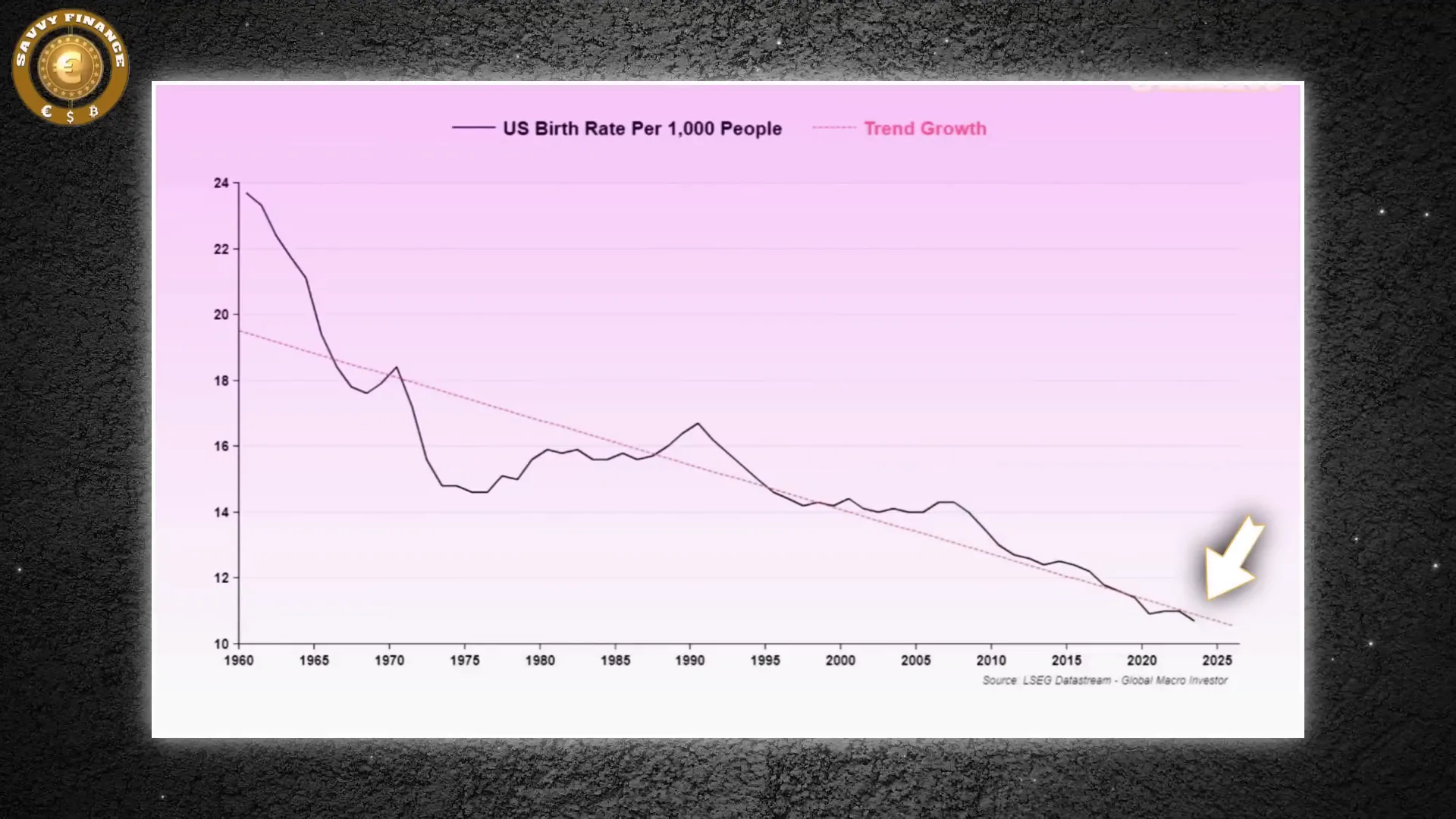

Underlying this liquidity-driven market dynamic is a deeper structural challenge: demographic shifts. Aging populations in developed economies, especially in the West, are driving down labor productivity and shrinking workforce sizes due to declining birth rates.

This demographic decline depresses GDP growth, which traditionally depends on three pillars: debt growth, population growth, and productivity growth. With population growth slowing and debt growth plateauing, overall trend GDP growth is falling. Governments have responded by increasing debt to offset this decline, relying heavily on liquidity injections to service this debt and keep economies afloat.

Debt, Liquidity, and Financial Repression

The interplay between rising government debt and declining labor force participation creates a feedback loop. To manage unproductive debt servicing costs, central banks suppress interest rates and monetize debt, a practice known as financial repression. This keeps real yields low and forces investors to seek yield in riskier, more volatile assets — including cryptocurrencies.

This mechanism is not new; it echoes post-World War II strategies where financial repression helped economies grow out of high debt burdens. However, this time, the demographic tailwinds of the baby boom are absent, replaced by aging populations and a looming productivity trap.

Technological Innovation: The Path Out of the Productivity Trap

Raoul Pal emphasizes that technology, particularly artificial intelligence (AI) and blockchain, offers the only viable escape from the demographic and productivity stagnation. These exponential technologies have the potential to boost productivity significantly, offsetting the drag from aging populations.

Crypto plays a dual role in this transformation. It benefits from the liquidity flowing into innovation and simultaneously acts as a foundational element of the emerging digital infrastructure. This makes cryptocurrencies like bitcoin not just speculative assets but integral components of the future economy.

The Economic Singularity: What Lies Ahead?

Looking forward, Pal warns of an impending “economic singularity” — a point around 2030 when AI and robotics will scale productivity beyond human input, potentially breaking traditional GDP formulas. This singularity could usher in a new economic paradigm marked by abundance, deflation, or volatility. The exact outcome remains uncertain, but the trajectory toward this moment is clear.

Until then, the current macro regime dominated by rising liquidity and fiat currency debasement will persist. Investors should expect traditional asset returns to be muted when adjusted for liquidity expansion, while scarce digital assets like bitcoin continue to absorb excess capital and offer real value preservation.

Crypto’s Role in the Current Bull Market

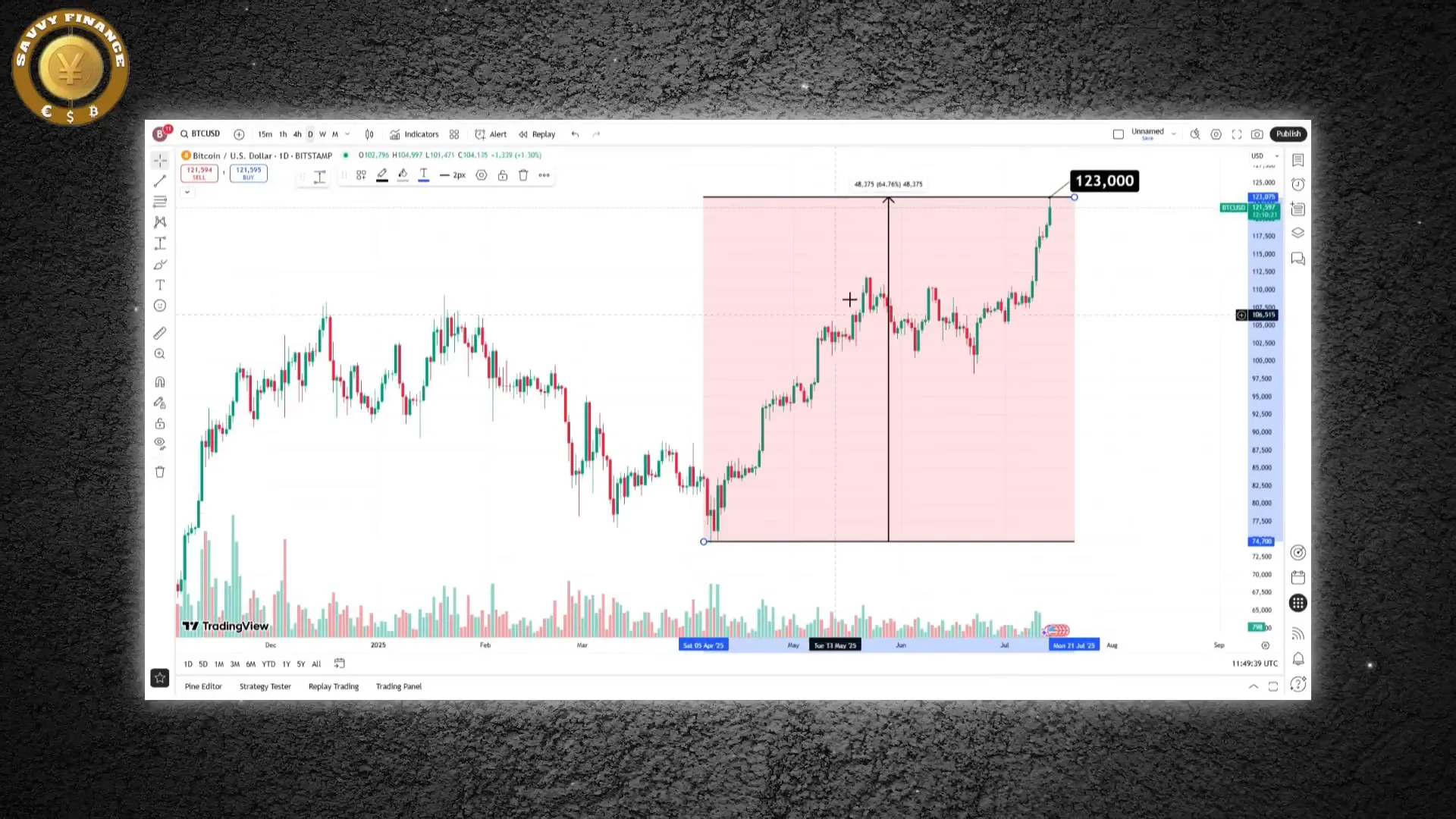

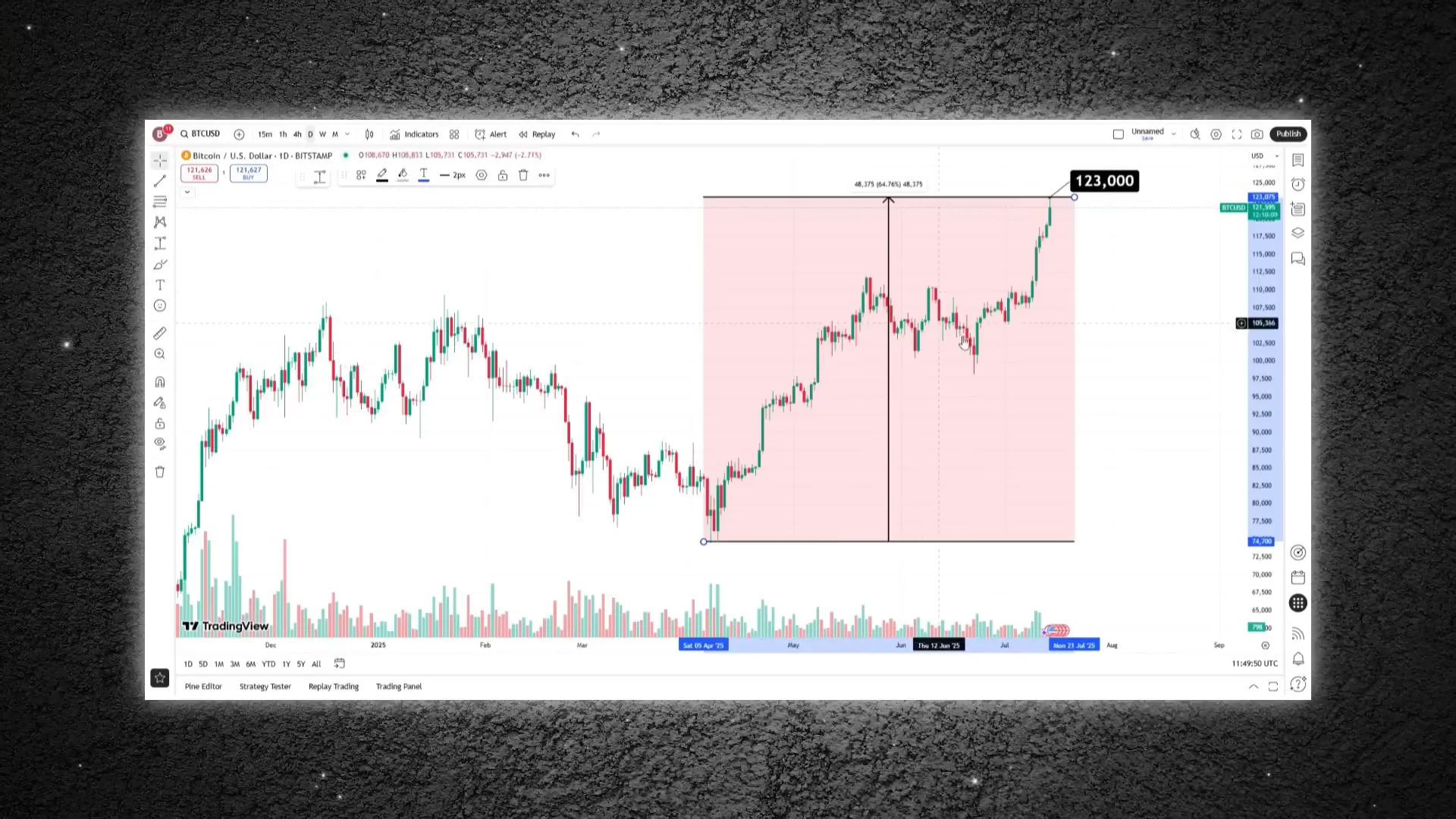

The recent explosive rally in cryptocurrencies exemplifies these macro forces in action. In early 2025, bitcoin surged nearly 50%, outperforming gold and the S&P 500. Ethereum also rallied, buoyed by institutional inflows, favorable policy developments, and a wave of short liquidations totaling over $700 million.

These moves are not merely hype or cyclical phenomena but reflect the growing recognition that traditional assets no longer provide meaningful upside in a world of ongoing liquidity expansion and fiat debasement.

Why Crypto Is Becoming a Systematic Macro Allocation

- Fiat currencies are being debased at roughly 8% annually, eroding purchasing power.

- Crypto assets, especially bitcoin, are scarce and structurally designed to resist this debasement.

- Liquidity injections from central banks and governments funnel capital into crypto more efficiently than other asset classes.

- Technological innovation underpins the growth and adoption of crypto as part of the new digital economy.

Given these factors, crypto is evolving beyond speculation into an essential component of diversified portfolios in the modern macroeconomic landscape.

Conclusion: Positioning for the Next Paradigm

As we witness the crypto bull market’s massive explosion, it’s crucial to see beyond short-term price action and understand the structural forces at play. Raoul Pal’s analysis reveals a world where liquidity dominates markets, demographics challenge growth, and technology offers hope for productivity gains.

In this environment, bitcoin and other cryptocurrencies stand out as the only assets consistently outperforming fiat debasement, making them vital hedges and growth engines for the future.

With an economic singularity potentially on the horizon by 2030, investors have a limited window to adapt their portfolios accordingly. The choice is clear: either watch another rally unfold or position strategically for the next paradigm shift where crytocurency and bitcoin play central roles.

What’s your take? Do you see crypto as a hedge, a tech investment, or both? Share your thoughts and prepare to embrace the future of finance.

Massive Explosion Alert! Understanding the Crypto Bull Market through the Lens of Liquidity and Demographics. There are any Massive Explosion Alert! Understanding the Crypto Bull Market through the Lens of Liquidity and Demographics in here.