Welcome to a deep dive into the current state of the cryptocurrency market, brought to you with insights inspired by CRYPTO with KLAUS. If you’re keen on Bitcoin, Crypto, BTC, Blockchain, CryptoNews, and Investing, this update is for you. We'll explore whether altcoin season is truly over, what the largest exchange in the world has to say, and how key players like Michael Saylor and crypto CEOs are reacting to the evolving landscape. Plus, we’ll break down XRP’s recent price action and volume changes, and what that means for altcoins in general.

The End of Altcoin Season? Binance’s Bold Declaration

Is altcoin season officially over? According to Binance—the biggest crypto exchange globally—the answer appears to be yes. After a period where altcoins showed promise, Binance’s latest report signals a shift back to Bitcoin (BTC) and Ethereum (ETH) dominance.

In their weekly market commentary, Binance highlights that Bitcoin and Ethereum have rebounded strongly after last week’s geopolitical tensions. Bitcoin showed greater resilience compared to Ethereum, both recovering well as global tensions eased. However, Bitcoin’s dominance, while slightly declining during this recovery, remains solidly elevated at 66%. Binance cautions that this does not signal an imminent altcoin season.

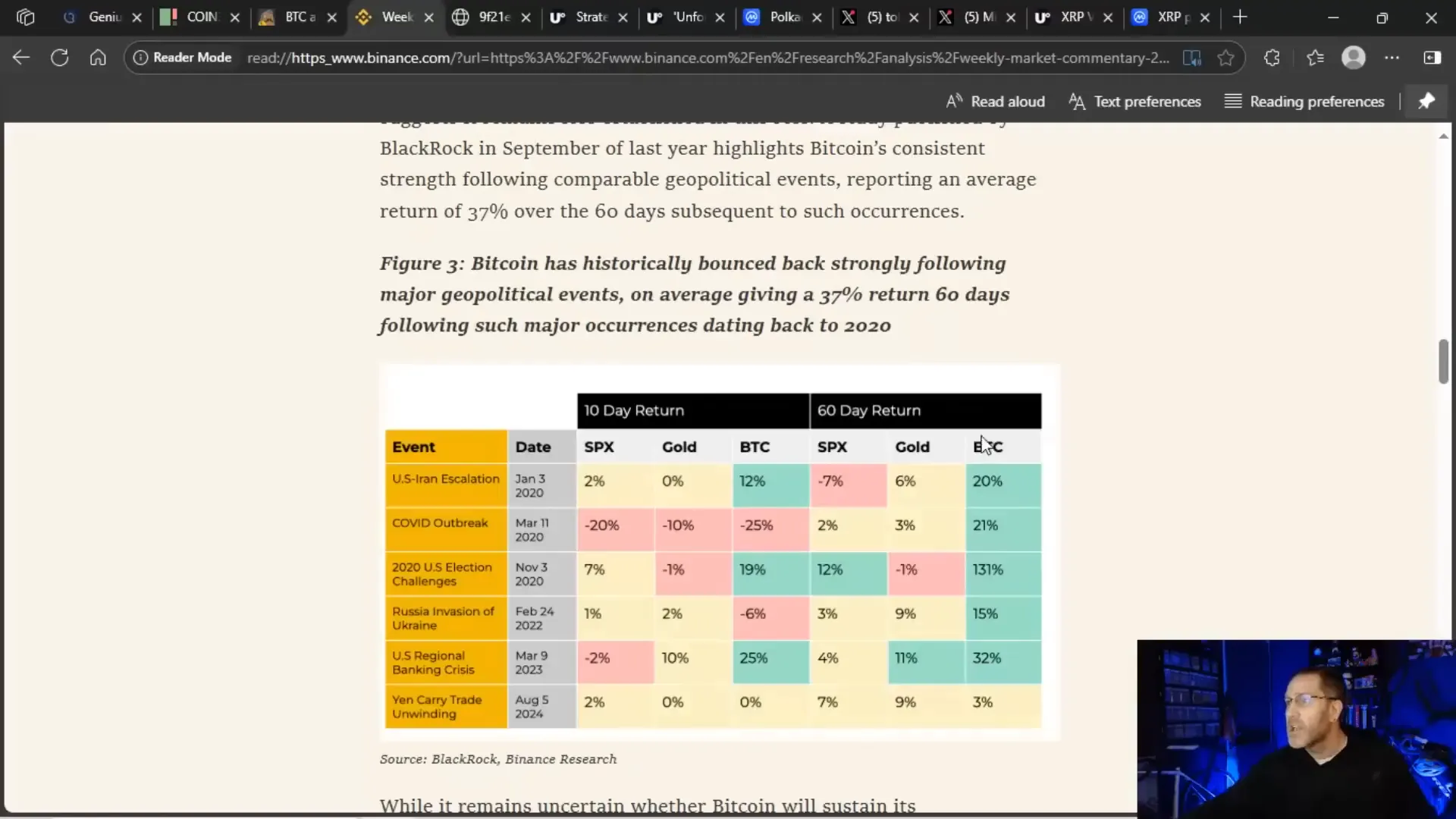

What’s driving this narrative? The data shows that after major global disruptions—like banking crises, COVID outbreaks, or geopolitical escalations—Bitcoin tends to bounce back harder and faster than other assets, including altcoins. The chart below illustrates Bitcoin’s 60-day returns outperforming traditional markets and other cryptocurrencies following such events.

This pattern suggests that investors turn to Bitcoin as a safe haven during uncertain times, reinforcing its dominant position in the crypto market. Altcoins, while promising, have not demonstrated the same resilience or recovery speed, leading Binance to suggest that Bitcoin remains the go-to asset in the near term.

Michael Saylor’s Bitcoin Strategy: Buying at the Tip with a Long-Term Vision

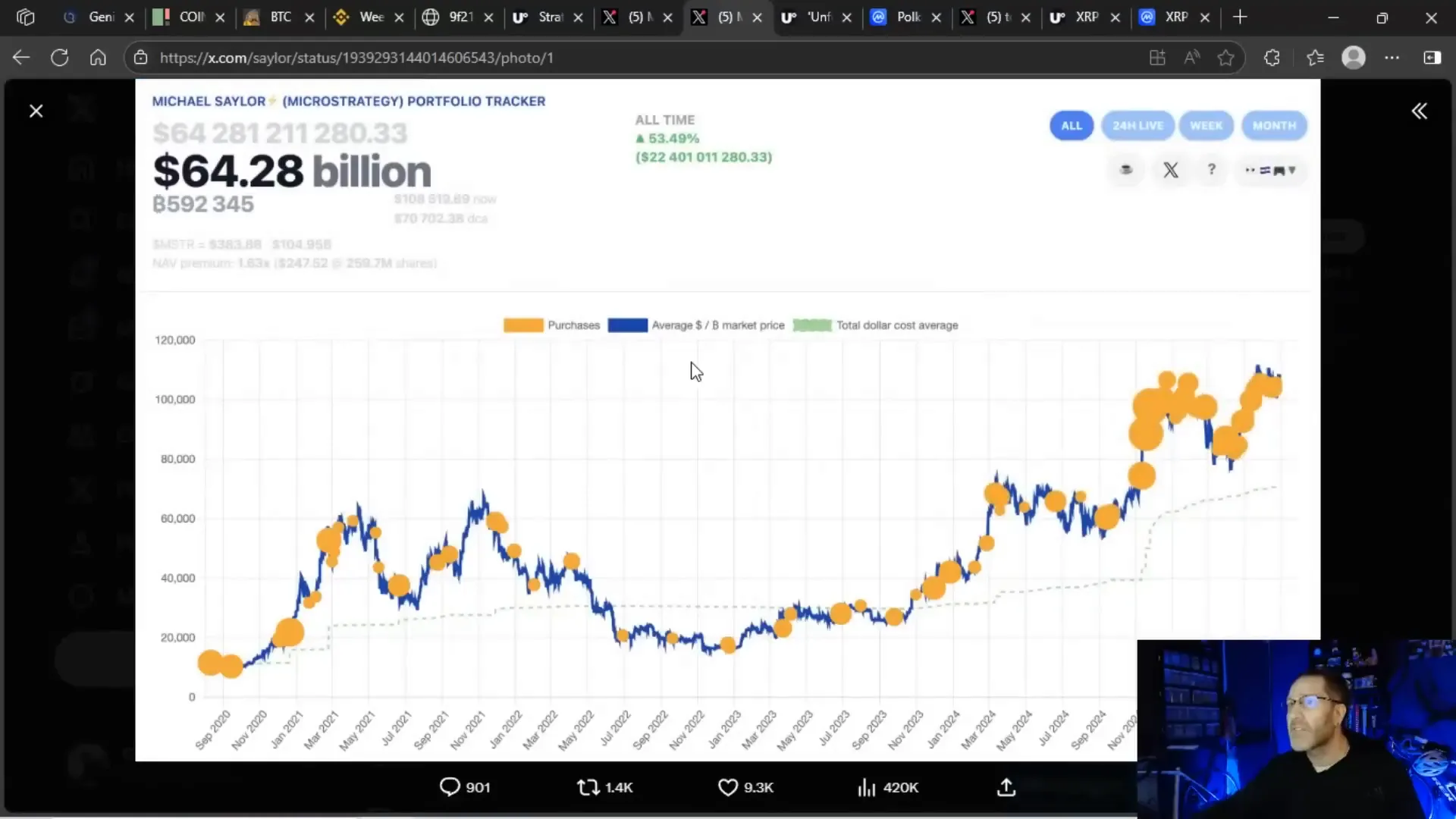

Michael Saylor, a well-known Bitcoin bull, has been in the spotlight for his strategic Bitcoin acquisitions. Recently, his average cost basis for Bitcoin has surged to nearly $71,000, a significant jump from his previous average of around $30,000. This suggests that Saylor has been buying Bitcoin at much higher prices than before.

What does this mean? Saylor’s buys have been relatively small lately, and he’s signaling a long-term perspective rather than short-term trading. His message is clear: “In 21 years, you’ll wish you did buy more.” This is a call to FOMO (fear of missing out) into Bitcoin, encouraging both retail investors and governments to increase their Bitcoin holdings.

However, there’s a catch. By buying at higher prices, Saylor could be seen as buying at the peak, possibly with other people’s money, which raises questions about the sustainability of his buying spree. Will he continue to buy more, or are investors pulling back? Monday’s announcements might provide some answers.

Polkadot’s Collapse and Solana’s Reaction: The Harsh Reality of Crypto Development

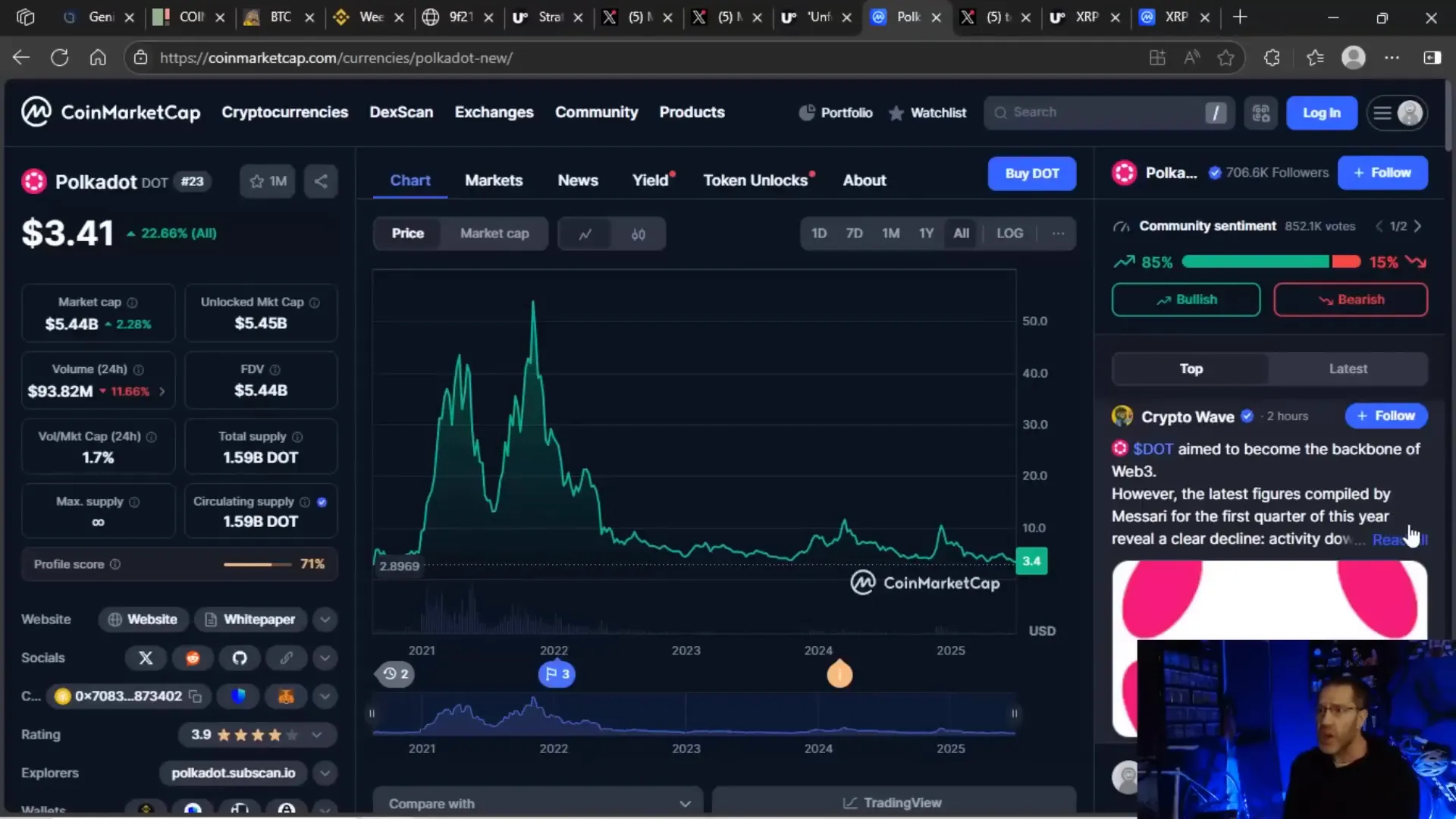

Not all projects in the crypto space are thriving. Polkadot (DOT), once hailed as a leading Ethereum competitor, has faced a dramatic downfall. Despite raising over half a billion dollars in funding, its price and developer activity have plummeted, signaling a collapse that has left many investors disappointed.

Interestingly, Solana’s cofounder Anatoly Yakovenko recently praised Polkadot for its contributions to the ecosystem, especially its work with Rust libraries. But this praise has sparked criticism because, despite the technical achievements, Polkadot’s price has tanked, and usage remains low.

Let’s be real. In crypto, it’s not just about building cool tech; it’s about adoption, usage, and ultimately price action. You can build all you want, but if no one uses your platform and your price is dead in the water, you’re essentially building a bridge to nowhere.

Polkadot’s current price is a stark reminder of the risks in the altcoin space. Once trading above $50, DOT now languishes around $3.41, a devastating fall for investors.

XRP’s Volume Crash and Price Stability: A Beacon Amid Altcoin Turmoil

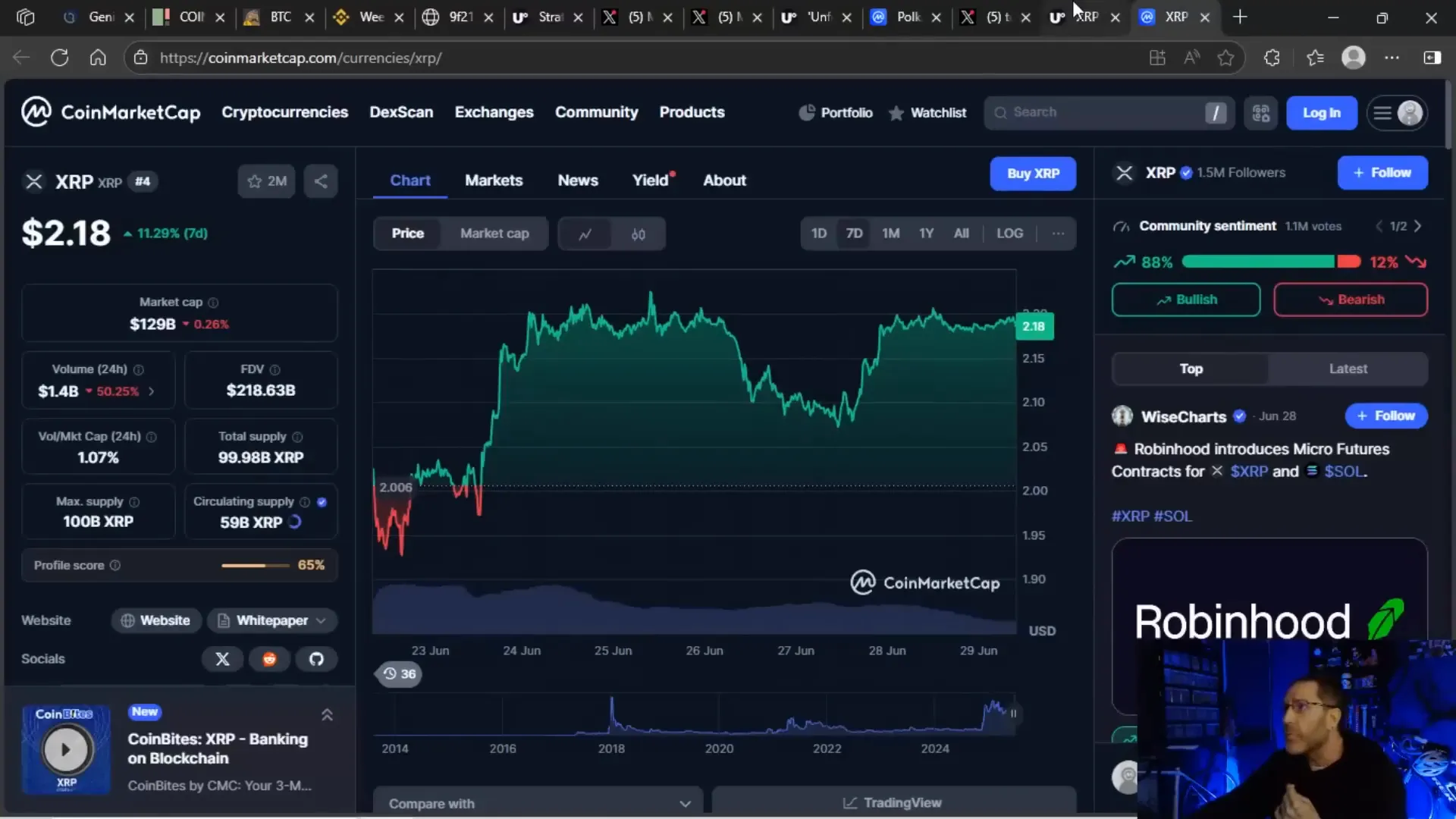

While many altcoins are struggling, XRP is bucking the trend. Over the past weekend, XRP’s trading volume dropped by more than 50%, falling to about $1.4 billion. This is significant but still considerably higher than Polkadot’s $93 million volume, which shrank by 11% over the same period.

This volume decrease came after a big week for XRP, including Ripple’s announcement to drop its cross-appeal in the SEC lawsuit and the implementation of major XRP Ledger upgrades. Despite the volume dip, XRP’s price has remained stable, holding tightly in the $2.18 to $2.20 range over the last 24 hours.

Zooming out, XRP displays strong floor support at the $2 mark, demonstrating resilience amid geopolitical tensions and market fluctuations. This contrasts sharply with altcoins like Polkadot, which show no such support.

XRP holders have reason to feel secure. The consistent price floor, combined with solid institutional and retail support, social media backing, and ongoing development, gives XRP a staying power that many other altcoins lack. This is why more traders are gravitating towards XRP’s volume and price stability, even as other projects falter.

Altcoins in Trouble: The Broader Market Picture

Looking beyond XRP and Polkadot, many popular altcoins are significantly down from their all-time highs:

- Doge: Down 78%

- Cardano (ADA): Down 82%

- Solana (SOL): Down 48%

- Avalanche (AVAX): Price below pre-November pump levels

These charts show a recurring pattern of pump-and-dump behavior, with minimal sustained upward momentum. For example, ADA’s all-time chart reveals brief spikes followed by prolonged declines, erasing much of the gains.

Avalanche’s chart is similarly bleak, showing steady erosion of price gains over the year, with current prices below levels before recent market pumps.

Investors are asking: where can we safely park our money? Many are turning to XRP, given its relative stability and support, while altcoins like Aptos, Avalanche, and Polkadot struggle to maintain investor confidence.

Why Bitcoin and Ethereum Still Reign Supreme

Bitcoin is currently trading just 3% below its all-time highs, a testament to its enduring strength. Ethereum is about 50% below its peak, which, while significant, still places it ahead of many altcoins.

Binance, as an exchange, naturally focuses on the assets that drive the most trading volume and revenue. Bitcoin’s daily trading volume sits around $32 billion, dwarfing XRP’s $1.4 billion. This volume dominance reinforces Bitcoin’s position as the flagship crypto asset and Binance’s top product.

Binance’s report isn’t just market commentary; it reflects where the money flows and where the market’s attention is focused. Bitcoin’s resilience and dominance, especially during times of geopolitical uncertainty, make it the preferred asset among both retail and institutional investors.

Building vs. Delivering: The Real Crypto Test

One of the harsh truths in crypto is that building technology is not enough. The market rewards projects that deliver usable products with real adoption and price appreciation. Overpromising and underdelivering is a recipe for failure.

We’ve seen countless projects tout groundbreaking announcements and development milestones, only to produce “nothing burgers” that fail to move the needle. This leads to a loss of investor confidence, venture capital pullback, and ultimately, project stagnation or collapse.

In contrast, XRP’s steady development on the XRP Ledger, combined with tangible upgrades and strong community support, shows a project with staying power. Its chart doesn’t look like a “dump only” scenario but rather one of resilience and recovery.

Looking Ahead: When Could Altcoin Season Return?

So, if altcoin season is over for now, when could it come back? Market watchers suggest that significant catalysts would include:

- Interest rate cuts by the Federal Reserve, led by Jerome Powell

- Clear regulatory clarity and frameworks for cryptocurrencies

- Renewed retail and institutional interest sparked by technological breakthroughs or adoption

These factors might align toward the end of Q3 or the beginning of Q4 this year, potentially kicking off a new altcoin season. Until then, Bitcoin and Ethereum are likely to remain the market leaders.

Final Thoughts: Navigating the Crypto Landscape with Realism

The crypto market is a rollercoaster of hype, hope, and harsh realities. The data and reports from Binance, the buying patterns of heavyweights like Michael Saylor, and the fate of projects like Polkadot paint a picture of a market in flux.

Bitcoin’s dominance and resilience through geopolitical turmoil reaffirm its status as the digital gold of the crypto world. Altcoins, meanwhile, face the challenge of proving their worth beyond just building and promises—delivering real adoption and price action is key.

XRP stands out as a beacon of stability in this environment, showing strong volume, price floors, and community support where others falter.

For investors, the best approach is clear-eyed realism: understand the market dynamics, watch for meaningful adoption and volume, and don’t get caught up in hype cycles. Keep an eye on Bitcoin and Ethereum as market anchors, and watch XRP closely as a potential altcoin leader during this phase.

Remember, this isn’t about hopium or copium. It’s about making informed decisions in a complex, ever-evolving market.

Bonus: Doggy Time to Brighten Your Day

Because sometimes you need a break from the market’s ups and downs, here’s a little doggy playtime to lighten the mood. Meet Ray, Luke, Vader, and Leia—four furry protectors who bring joy and a sense of calm amidst the crypto chaos. They’re the real MVPs, guarding the home base while the market does its thing.

Whether you’re a seasoned investor or just crypto-curious, remember to take moments to enjoy the simple things. The market will always have its twists and turns, but dogs? Dogs are forever.

Is Altcoin Season Over? Binance, Bitcoin, and the Crypto Market Reality Check. There are any Is Altcoin Season Over? Binance, Bitcoin, and the Crypto Market Reality Check in here.