Bitcoin has been making headlines again, surging past the $107,000 mark this week with over 6% gains, signaling a wave of aggressive buying pressure near the crucial $100,000 milestone. The momentum is building, and many experts now believe we are on the edge of a historic bull run that could redefine not only the future of bitcoin but the entire landscape of cryptocurrency and global finance.

In this article, we'll explore some of the most compelling insights from leading voices in the crypto space, including Chamath Palihapitiya, Tyler Winklevoss, Tim Draper, and institutional leaders like Hunter Horsley of Bitwise. Their analyses and predictions reveal why this cycle might not just be another price spike but a fundamental shift in how bitcoin and cryptocurrency integrate with traditional finance and national economies.

Table of Contents

- Bitcoin’s Historical Price Patterns After Halving Cycles

- ETFs and Institutional Adoption: Crossing the Chasm

- Bitcoin’s Strategic Importance to Governments

- Bitcoin’s Role as a Pillar of National Security and Infrastructure

- Technical Signals Point to a Bull Phase

- Billionaire Predictions: Bitcoin to $1 Million and Beyond

- ETF Inflows Signal Growing Investor Confidence

- Conclusion: Is Bitcoin Becoming a Pillar of Global Finance?

Bitcoin’s Historical Price Patterns After Halving Cycles

To understand the potential magnitude of the current bull run, it's important to look at bitcoin's historical price behavior following its halving events. Halving is a key protocol event that reduces the rate at which new bitcoins are created, effectively tightening supply.

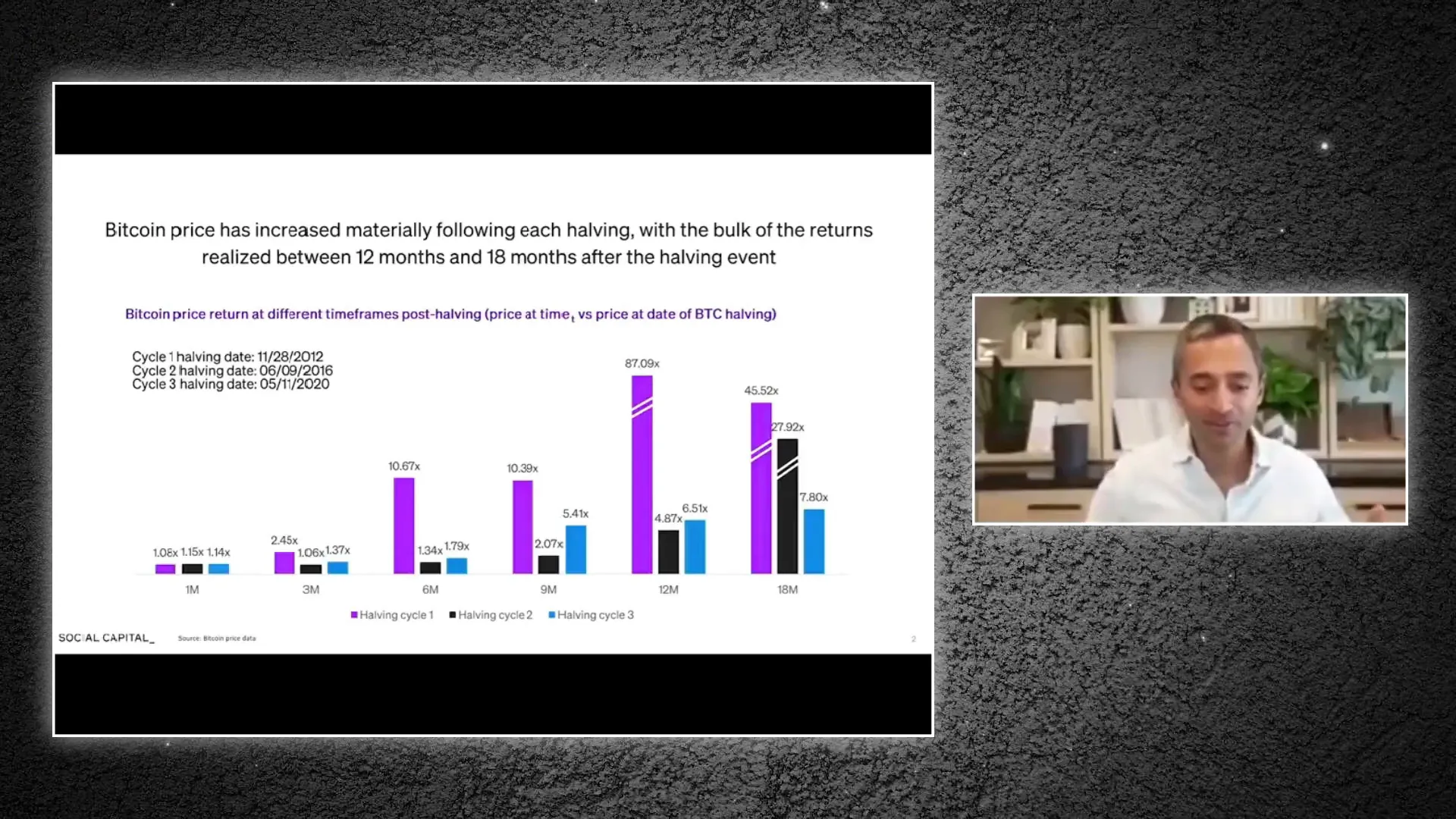

Chamath Palihitiya recently shared a detailed analysis of bitcoin's price performance one month, three months, six months, nine months, twelve months, and eighteen months after each halving. The findings are striking:

- 18 months after the first halving, bitcoin’s price returned 45x.

- Following the second halving, it returned almost 28x.

- The third halving resulted in nearly an 8x return within the same period.

While the returns have varied, the overarching trend is clear: significant price appreciation tends to occur within 6 to 18 months after a halving. This cyclical pattern is a powerful indicator of bitcoin's potential trajectory this cycle as well.

ETFs and Institutional Adoption: Crossing the Chasm

A major catalyst for the next bull run is the increasing commercialization of bitcoin, especially through exchange-traded funds (ETFs). These financial products have made bitcoin accessible to a broader range of investors, including institutions, family offices, and sovereign wealth funds.

As ETFs gain traction, they are expected to help bitcoin cross the "chasm" from a niche asset to a mainstream financial instrument. This development aligns with Chamath’s view that 2024 could be a pivotal year for bitcoin's institutional acceptance.

Bitcoin as a Dual Currency

Another fascinating concept is the idea of countries adopting a dual currency system where both local fiat and bitcoin coexist. For daily transactions, local currencies will remain dominant. However, for preserving wealth and purchasing permanent assets, bitcoin could become the preferred store of value.

This dual currency model is already gaining traction in several nations and, if it continues, could position bitcoin as a global replacement for gold.

Bitcoin’s Strategic Importance to Governments

Institutional perspectives on bitcoin are shifting from skepticism to strategic consideration. Hunter Horsley, CEO of Bitwise, recently stated that the idea of a strategic bitcoin reserve at the national level in the United States is "truly in play." This marks a significant evolution in how bitcoin is viewed by policymakers and institutional investors alike.

This conversation, once confined to crypto enthusiasts, is now entering the halls of power, with discussions ongoing in the Treasury Department and Congress. Senator Lummis is working on legislation to support this initiative, and multiple CEOs from the crypto space are engaging with policymakers to shape the future of bitcoin in government reserves.

Global Sovereign Interest

Beyond the U.S., at least eleven nations have exposure to bitcoin through sovereign wealth funds, including Abu Dhabi, which recently purchased about half a billion dollars worth. This growing interest signals bitcoin’s emergence as a legitimate component of national financial strategy.

Bitcoin’s Role as a Pillar of National Security and Infrastructure

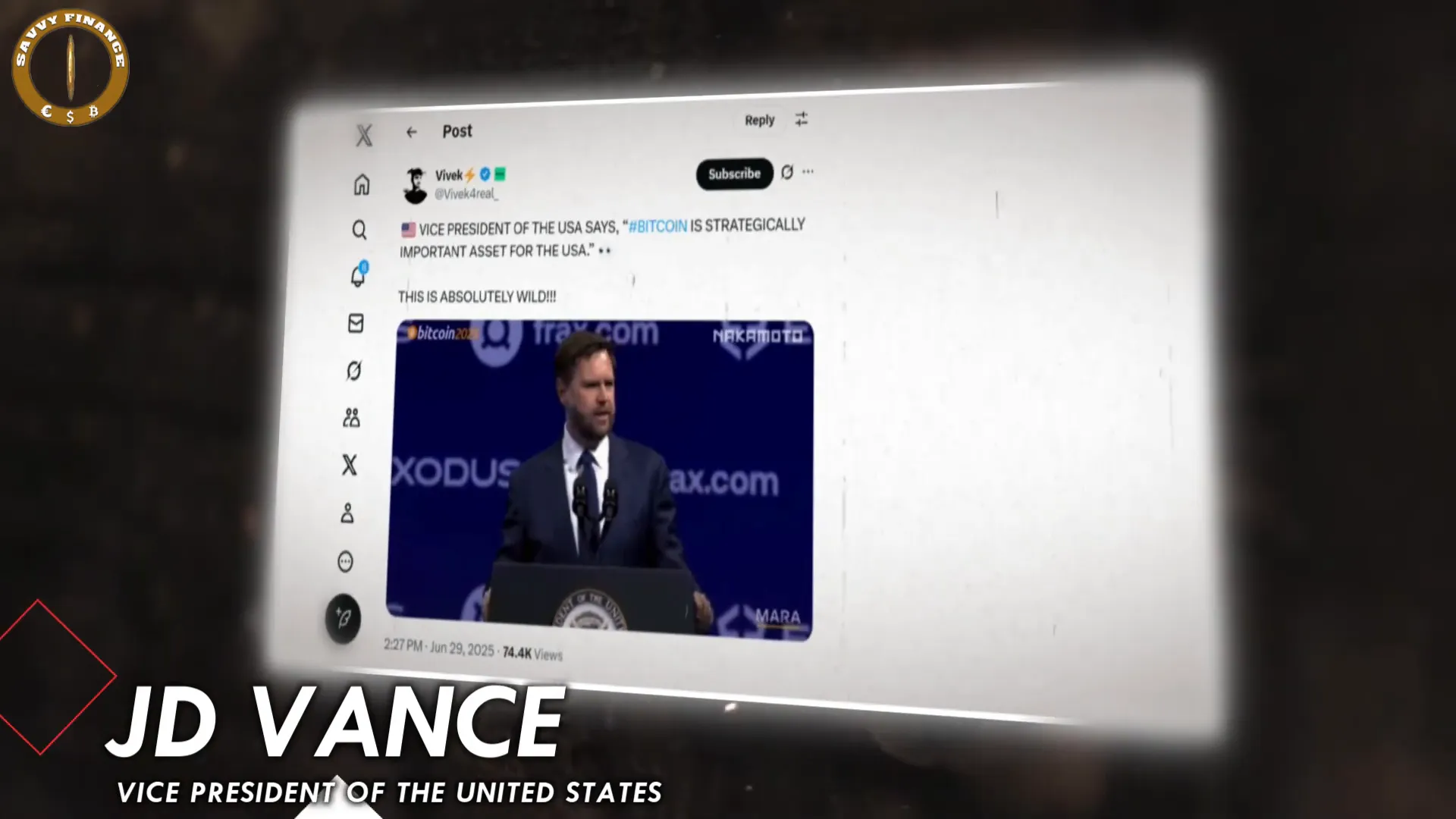

In a recent policy roundtable, the Vice President of the United States described bitcoin as "strategically important" over the next decade. This is a deliberate and powerful shift in tone from previous government rhetoric that often framed bitcoin as disruptive or even dangerous.

Such recognition elevates bitcoin from a mere asset or hedge to a critical piece of infrastructure, one that could be discussed alongside energy, data, and artificial intelligence in terms of national security and economic influence.

Why the U.S. Should Lean Into Bitcoin

The geopolitical landscape also plays a role. The People's Republic of China has taken a hard stance against bitcoin, prompting some to argue that the U.S. ought to lean into bitcoin as a strategic asset. This positioning could have far-reaching implications for global financial dominance and innovation.

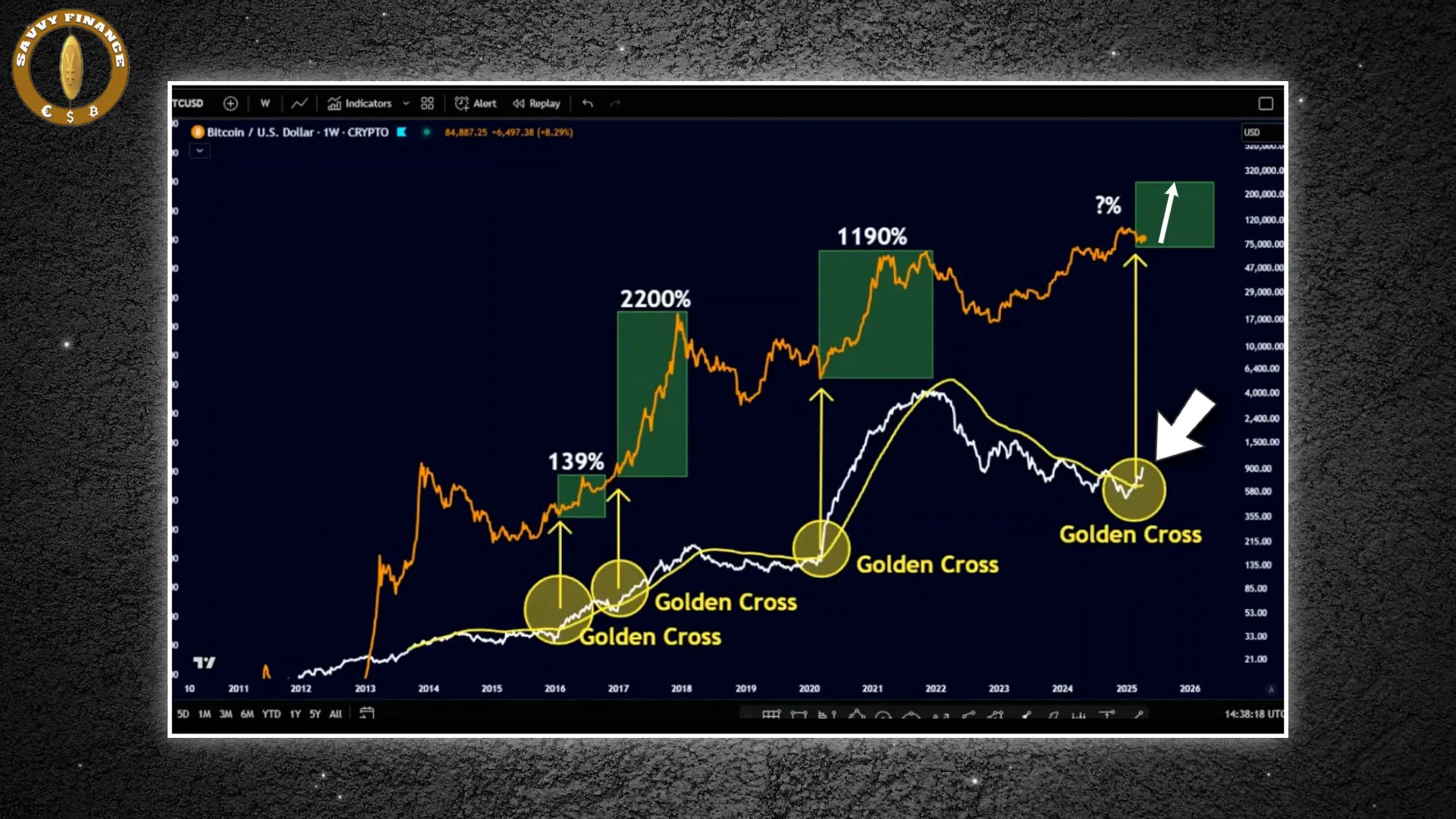

Technical Signals Point to a Bull Phase

Technical analysis also supports the bullish case. Bitcoin is currently flashing a "golden cross," a well-known technical pattern where the 50-day moving average crosses above the 200-day moving average. Historically, this pattern has preceded major bull runs in 2012, 2016, and 2020.

This time, the signal is being closely watched not just by retail traders but by institutions, sovereign wealth funds, and policy analysts — underscoring bitcoin’s increasing relevance in mainstream finance.

Billionaire Predictions: Bitcoin to $1 Million and Beyond

When billionaires with deep crypto roots weigh in, the market listens. Gemini co-founder Tyler Winklevoss recently asserted confidently that bitcoin will "easily cross one million dollars," describing it as "gold 2.0." His rationale is rooted in bitcoin's fixed supply and decentralized nature, making it the ultimate safe haven amid currency debasement worldwide.

Tyler’s baseball metaphor — that we’re still in the "first inning" of bitcoin’s game — suggests this is just the beginning of a much longer run.

Tim Draper’s Vision: Bitcoin to Infinity

Billionaire investor Tim Draper takes the vision even further, predicting bitcoin’s value against the dollar will eventually reach "infinity." His point is that if fiat currencies continue to lose credibility and purchasing power, measuring bitcoin in those terms becomes meaningless.

Draper envisions a world where bitcoin becomes the primary source of wealth ownership — used for everything from buying food and shelter to paying taxes. This systemic shift would mark the end of the dollar's dominance and the rise of bitcoin as the global monetary standard.

ETF Inflows Signal Growing Investor Confidence

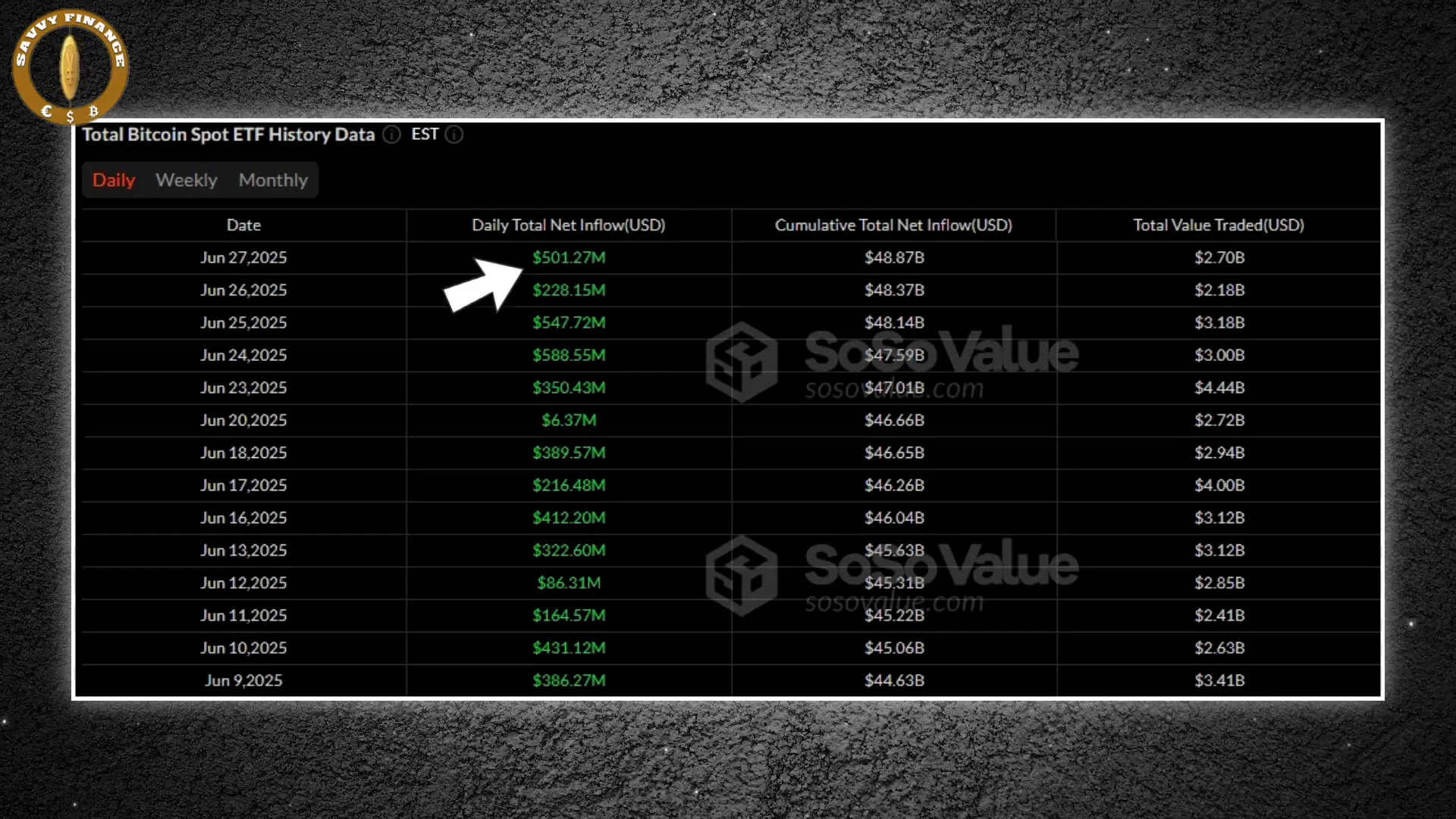

Supporting these bullish forecasts are real-world investor behaviors. U.S. spot bitcoin ETFs have experienced fourteen consecutive days of net inflows, with $501 million flowing in on June 27 alone. Major funds like Fidelity’s FBTC, BlackRock’s iBit, and ARK21 are leading the charge, each bringing in over $150 million.

Ether ETFs are also seeing renewed interest, signaling broader confidence in the cryptocurrency sector. This sustained demand highlights that bitcoin is no longer just a speculative asset but a trusted investment vehicle.

Conclusion: Is Bitcoin Becoming a Pillar of Global Finance?

The convergence of historic price cycles, growing institutional adoption, strategic government interest, and bullish predictions from crypto pioneers all point to an unprecedented phase for bitcoin and cryptocurrency. This isn’t just about price speculation; it’s about a fundamental transformation in how wealth, finance, and national economies operate.

As bitcoin continues to surge past six figures and ETF flows reach record highs, the question remains: Is this the moment bitcoin finally becomes a pillar of global finance? Or are we still underestimating the scale and speed of what’s coming next?

One thing is clear — the next bull run is shaping up to be nothing short of extraordinary.

How the Next Bitcoin Bull Run Could Reshape Cryptocurrency and Finance. There are any How the Next Bitcoin Bull Run Could Reshape Cryptocurrency and Finance in here.