Bitcoin’s journey from a niche digital asset to a two trillion dollar market has been nothing short of remarkable. But as the market grows, so too does its complexity and integration with the broader financial system. In this article, we explore the insightful analysis of Lynn Alden, a globally respected macroeconomic analyst, who offers a grounded, data-driven perspective on Bitcoin’s evolving market cycles, liquidity dynamics, and price potential. If you’re seeking a thoughtful, no-hype take on cryptocurrency and bitcoin’s future, this breakdown will guide you through the fundamentals shaping the market today and tomorrow.

Table of Contents

- Rethinking Bitcoin’s Market Cycles: Beyond the Four-Year Halving

- On-Chain Metrics: Market Value to Realized Value and HODL Waves

- Is There a Political Premium on Bitcoin?

- Macro Realities Shaping Bitcoin’s Future

- Technology and Inflation: Will Deflation Offset Fiscal Pressures?

- Price Outlook: Is $150,000 Bitcoin Within Reach?

- Comparing Perspectives: Alden vs. Other Analysts

- Conclusion: Positioning for a New Era in Cryptocurrency

Rethinking Bitcoin’s Market Cycles: Beyond the Four-Year Halving

Lynn Alden challenges the traditional narrative that Bitcoin’s price moves are rigidly tied to the four-year halving cycle. While halvings historically marked notable bull runs, Alden’s research reveals that liquidity cycles — the ebb and flow of global money supply and capital availability — play a far more crucial role in Bitcoin’s price action.

Liquidity cycles typically last around three years, and Bitcoin’s bull markets vary in length accordingly. Some cycles shoot up rapidly from lows to highs, while others unfold more gradually. As Bitcoin matures into a significantly larger and more liquid asset, its price moves are becoming less extreme and more prolonged. This is because larger, liquid markets tend to smooth out wild swings that smaller, illiquid assets often experience.

Bitcoin’s increasing integration with traditional finance — now a $2 trillion asset class — means it responds more to macroeconomic conditions such as global liquidity, credit tightening, and shifting investor sentiment than to the halving timing alone. Alden notes that the four-year halving cycle is “increasingly less relevant” because mining rewards now represent a smaller portion of available coins, and price action is more influenced by when older coins are unlocked and sold.

On-Chain Metrics: Market Value to Realized Value and HODL Waves

To track Bitcoin’s cycle position more accurately, Alden focuses on two key on-chain metrics:

- Market Value to On-Chain Cost Basis (MVRV): This ratio compares Bitcoin’s market capitalization to the aggregate price at which all coins last moved. When MVRV spikes to extreme highs, it signals euphoric sentiment and potential overvaluation, as seen during the 2017 and 2021 cycle peaks.

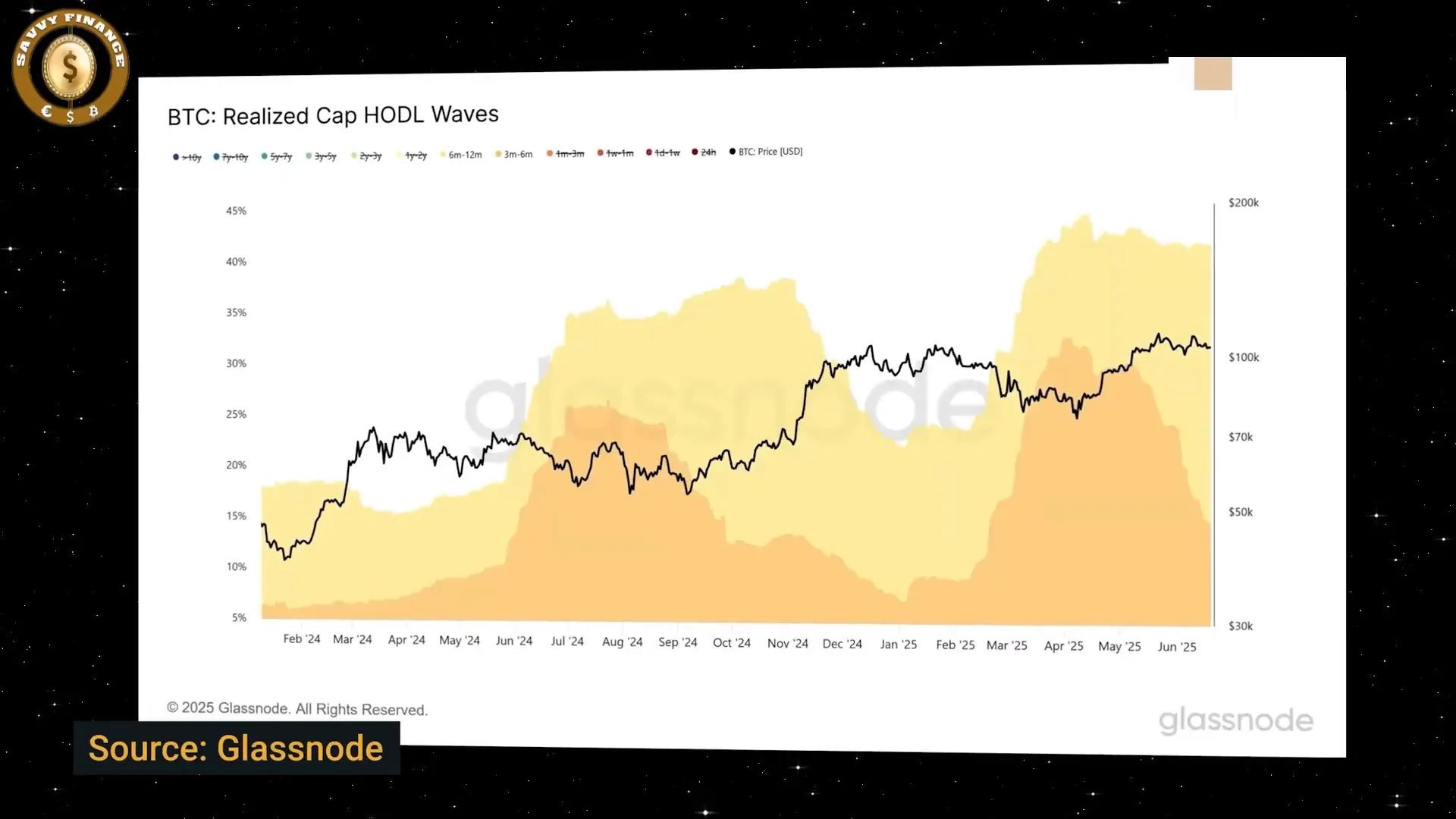

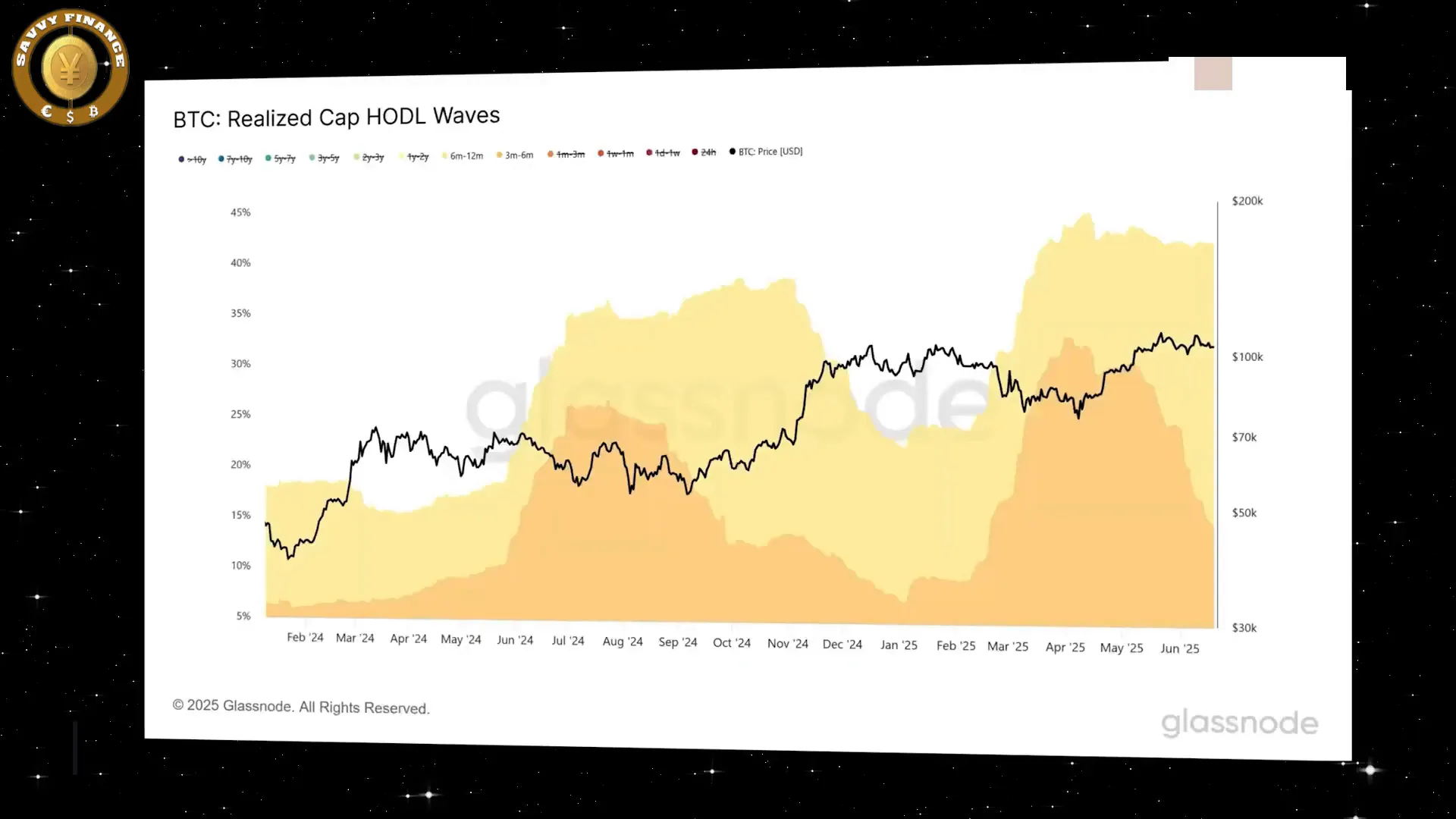

- HODL Waves: These show the age distribution of coins based on how long they’ve remained unmoved. During bull markets, long-term holders start selling some of their coins into strength, causing the percentage of old coins to decline gradually.

Currently, MVRV levels are moderate, far from the frothy excesses of previous cycle tops, and HODL waves indicate a measured, gradual profit-taking by long-term holders rather than panic selling. This suggests that while the market is bullish, the current cycle is still developing and may be longer and less volatile than past ones.

Is There a Political Premium on Bitcoin?

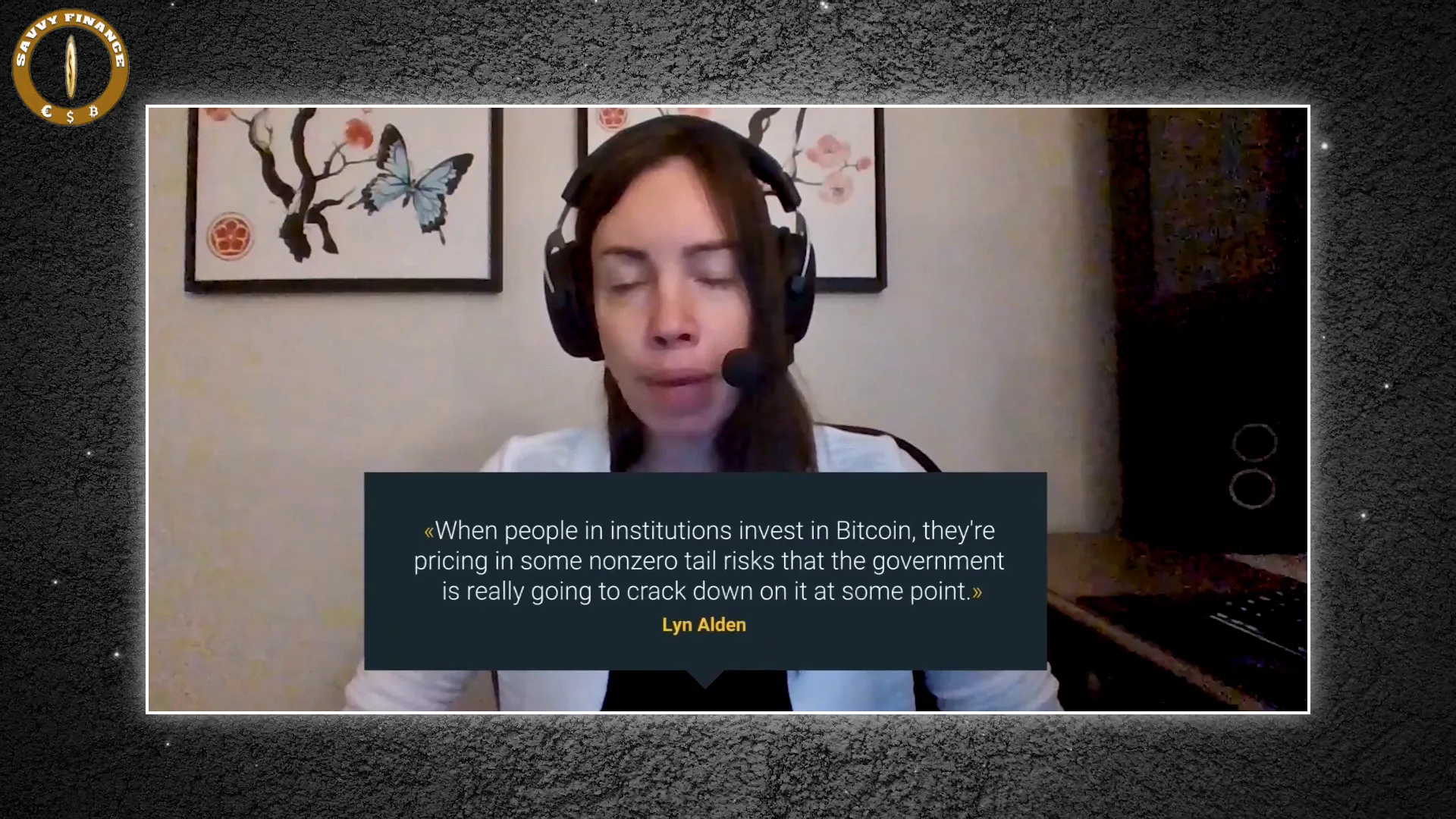

Many wonder if Bitcoin’s recent price strength is due to a “political premium” — the market pricing in reduced regulatory risks under the current U.S. administration. Alden argues the opposite: rather than adding a premium, recent developments have derisked Bitcoin by removing a discount that was priced in due to fears of government crackdowns.

For years, institutional investors priced in the risk that regulatory actions could severely impact Bitcoin. The progress toward spot ETFs and a more permissive environment under the current administration have removed much of that uncertainty, lifting a discount and allowing prices to rise more steadily. However, Alden cautions that political outcomes in the next few years could reverse some of these gains, but the increasing size and liquidity of Bitcoin make it less susceptible to political risk over time.

Macro Realities Shaping Bitcoin’s Future

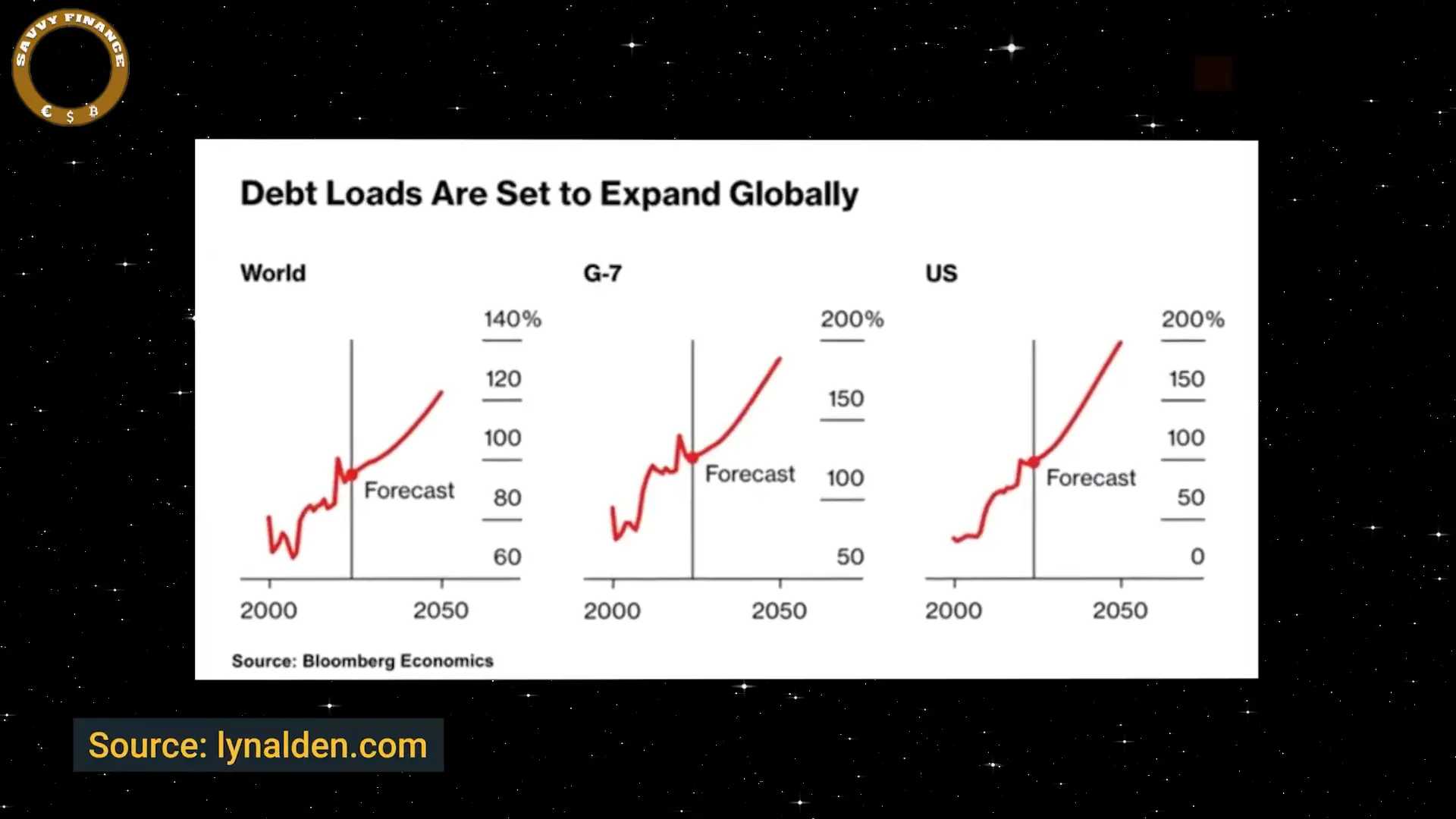

Alden’s analysis remains firmly grounded in macroeconomic fundamentals. She highlights several structural factors in the U.S. economy that will continue to support Bitcoin’s value proposition:

- Persistent Fiscal Deficits: U.S. fiscal deficits are “pretty intractable” due to demographic shifts like aging baby boomers drawing down Social Security and Medicare, creating large deficits even in low unemployment periods.

- Rising Interest Expense: After decades of falling interest rates, the cost of servicing debt is rising as rates fluctuate between roughly 2% and 6%, increasing the fiscal burden.

- Financialization of the Economy: The U.S. tax system heavily depends on stock market performance due to wealth concentration and capital gains taxes, creating a feedback loop where poor market performance can reduce tax revenues and complicate austerity efforts.

These entrenched fiscal challenges, combined with a polarized political system that hinders major spending cuts or tax increases, make a slow-motion fiscal spiral likely over the next 5 to 10 years. In this environment, owning scarce, high-quality assets like Bitcoin and gold becomes increasingly attractive as a hedge against dollar debasement and inflationary pressures.

Technology and Inflation: Will Deflation Offset Fiscal Pressures?

Some argue that technological advances, especially AI-driven productivity gains, could bring deflation and mitigate inflationary pressures. Alden acknowledges technology’s role but emphasizes that it won’t slow down fiscal deficits or their macro impact.

Instead, technology may influence where inflation shows up:

- If energy and production bottlenecks persist, deficits could fuel consumer price inflation.

- If AI and technology suppress wages and increase output efficiently, deficits may show up more as asset price inflation—pushing up prices for scarce assets like Bitcoin, gold, and prime real estate.

Either way, with a growing supply of dollars and credit, owning scarce, high-quality assets remains a prudent strategy, regardless of how technology evolves.

Price Outlook: Is $150,000 Bitcoin Within Reach?

Looking ahead, Alden sets a data-driven price target of at least $150,000 for Bitcoin in this cycle. She stresses that this is a reasonable, step-by-step expectation rather than a speculative moonshot.

Her rationale includes:

- Current on-chain metrics suggest there’s room for a 30% or more price increase before reaching previous cycle extremes.

- The cycle is likely longer and less volatile, with bull and bear phases driven more by liquidity and sentiment pockets than halving events.

- Structural macroeconomic tailwinds from fiscal deficits and a weakening fiat regime support a continued revaluation of Bitcoin as a store of value.

Alden remains cautious, noting she will reassess if prices move beyond that target, but believes the overall trajectory remains bullish.

Comparing Perspectives: Alden vs. Other Analysts

Alden’s macro-driven framework contrasts with analysts like Willie Wu, who blend on-chain flow data with behavioral psychology. Wu sees signs of “smart money accumulation” and anticipates a faster acceleration of Bitcoin’s second leg in this cycle through ETF demand and institutional inflows.

While Wu leans slightly more bullish on timing, both agree Bitcoin remains in a structural bull market fueled by weakening fiat regimes, persistent fiscal deficits, and growing institutional interest in scarce programmable assets.

This alignment strengthens the case for Bitcoin’s continued growth as a mainstream macro asset, no longer a fringe speculation but a recognized part of the global financial system.

Conclusion: Positioning for a New Era in Cryptocurrency

Lynn Alden’s analysis provides a sober, well-grounded perspective on Bitcoin’s evolving market dynamics. As cryptocurrency matures, it increasingly reflects broad macroeconomic realities rather than isolated hype cycles. Understanding liquidity, fiscal policy, and on-chain data metrics offers investors a clearer lens through which to view Bitcoin’s price trajectory and long-term role.

For those navigating the crypto space, Alden’s call to focus on fundamentals, maintain restraint, and watch for data confirmation at each stage of the cycle is a valuable guide. With a target of $150,000 on the horizon, Bitcoin’s future looks promising — but it will be shaped by a complex interplay of liquidity, sentiment, and structural economic shifts.

Are you aligned with Alden’s measured optimism or do you believe a faster, more explosive cycle is coming? Share your thoughts and join the ongoing conversation about Bitcoin’s place in the future of finance.

FOMO Is Dead! The Cold, Hard Truth About Bitcoin's Future in Cryptocurrency. There are any FOMO Is Dead! The Cold, Hard Truth About Bitcoin's Future in Cryptocurrency in here.