Investing doesn’t have to be complicated, especially when it comes to ETFs. Everyone talks about ETFs, but few really explain what an ETF actually is or why it should matter to you as an investor. Whether you’re just starting out or looking to simplify your investment strategy, understanding ETFs can be your gateway to building wealth smartly and efficiently.

In this comprehensive guide, we’ll dive deep into what ETFs are, how they work, and why they might be the easiest and most effective way for you to invest. We’ll also clear up common questions like the difference between ETFs and index funds, and which one is better for your portfolio. By the end, you’ll have the knowledge to confidently make ETF investing part of your financial journey—whether you’re into traditional markets or curious about integrating Bitcoin, Crypto, BTC, Blockchain, and CryptoNews into your investing strategy.

What Exactly is an ETF?

ETF stands for Exchange Traded Fund. At its core, an ETF is a type of investment fund that you can buy and sell on a stock exchange, just like a stock. But unlike buying a single company’s stock, an ETF holds a collection—or basket—of multiple stocks or other assets. This means when you buy one share of an ETF, you’re essentially buying a small piece of many companies or assets all at once.

Think of an ETF as a basket filled with different fruits (stocks). Instead of buying just one apple (a single stock), you’re buying the whole basket with apples, bananas, oranges, and more. This basket gives you diversification, which helps spread out your risk.

For now, you can think of ETFs and index funds as almost synonymous. Both aim to track a specific market index or sector, but ETFs trade like stocks throughout the day, while index funds are bought and sold at the end of the trading day at a set price.

How ETFs Work Compared to Stocks

Let’s say you want to invest in a company, and its stock price is $50. If you buy one share, you own $50 worth of that company. Your entire investment is concentrated in that single company, which can be risky.

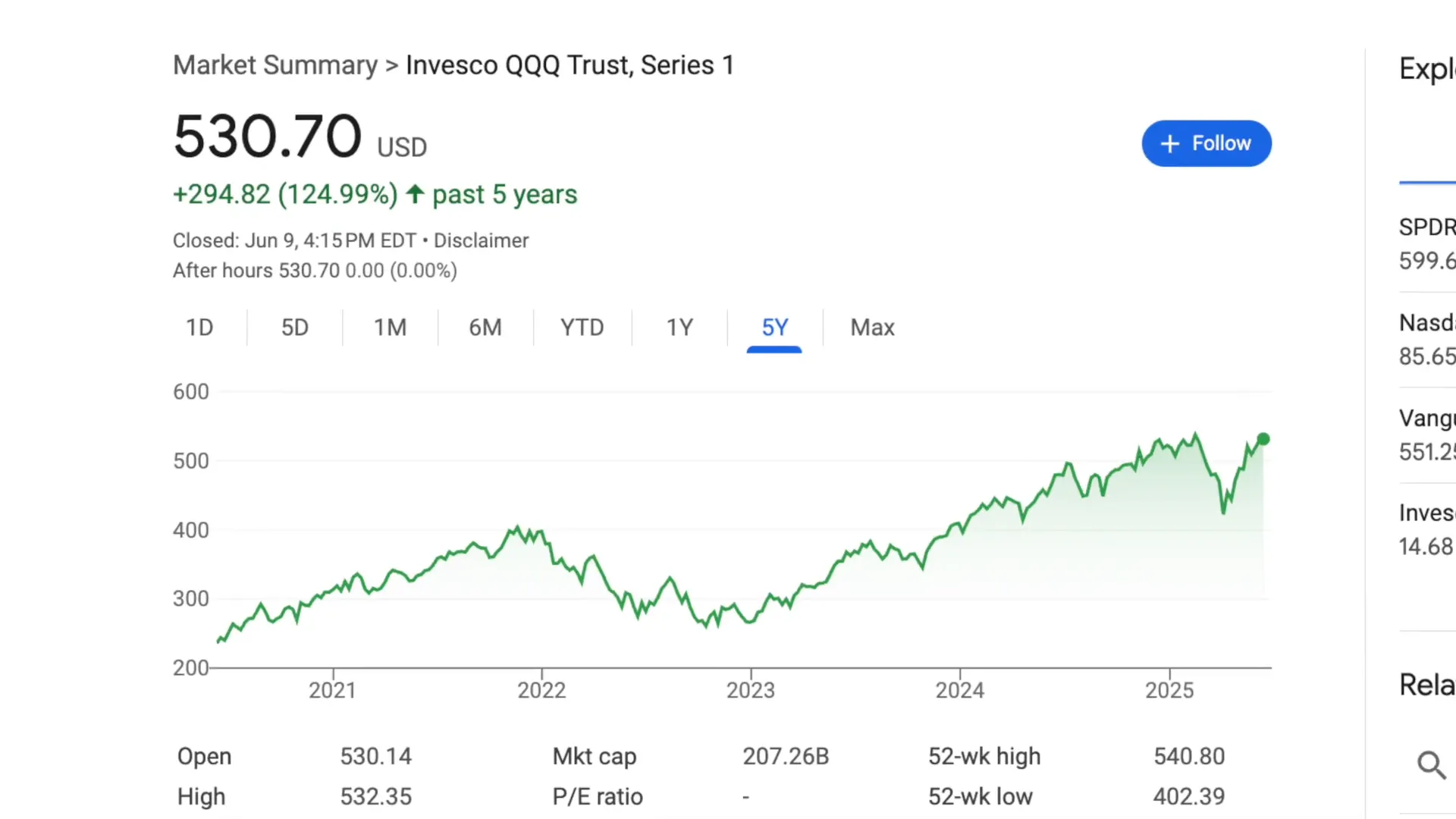

Now, consider an ETF like QQQ, which is one of the most popular growth and technology ETFs out there. As of today, QQQ is priced at about $530.70 per share and contains around 100 companies. When you buy one share of QQQ, you’re buying a small slice of all those companies combined.

Looking at QQQ’s holdings, the top ten companies make up about 50% of the entire fund. These include tech giants like Microsoft (8.65%), Nvidia (8.56%), Apple (7.58%), Amazon (5.6%), Broadcom (4.74%), Meta, Netflix, Costco, Tesla, and Alphabet (Google). This concentration means that while you get broad exposure, the biggest companies have the most influence on the fund’s performance.

Breaking it down further, if you own one share of QQQ at $530.70:

- You effectively own about $45.85 worth of Microsoft (8.65% of $530.70).

- About $45.43 worth of Nvidia (8.56%).

- About $40.28 worth of Apple (7.58%).

This math applies to the rest of the companies in the ETF as well. This way, your investment is spread out, reducing the risk compared to owning just one stock.

Types of ETFs: From Broad Market to Niche Sectors

ETFs come in all shapes and sizes to fit different investing goals and risk tolerances:

- Broad Market ETFs: These track the entire U.S. stock market or international markets, providing exposure to thousands of companies.

- Sector ETFs: Focus on specific industries like technology, healthcare, or energy.

- Growth ETFs: Target companies expected to grow faster than the overall market.

- Dividend ETFs: Invest in companies that pay regular dividends, ideal for income-focused investors.

Everyone’s portfolio will look a little different based on their goals, risk tolerance, and interests. It’s not always best to copy someone else’s portfolio just because it’s working for them. Your money, your goals, your strategy.

ETFs vs. Index Funds: What’s the Difference?

When you start learning about investing, you’ll hear a lot about ETFs and index funds. They’re very similar and often serve the same purpose, but there are a few key differences that might affect your choice:

- Trading Flexibility: ETFs trade on stock exchanges throughout the day, just like stocks. This means you can buy or sell shares anytime during market hours at real-time prices. Index funds, on the other hand, can only be bought or sold at the end of the trading day at a price set after the market closes.

- Minimum Investment: ETFs usually allow you to buy just one share, which can be more affordable. Index funds often have minimum investment requirements that can be higher.

- Tax Efficiency: ETFs tend to be more tax-efficient because of the way trades are handled. When you sell an ETF, you’re typically selling to another investor, so capital gains taxes apply only to you. With index funds, the fund manager may have to sell assets to pay you, which can trigger capital gains taxes passed on to all shareholders, even if you didn’t sell your shares.

For long-term investors, the ability to trade throughout the day usually doesn’t matter much. Whether you buy at 10 AM or noon won’t make a big difference over 10 years. The pennies you might save or lose on timing today pale in comparison to the thousands you can build by staying invested.

When ETFs Might Be Better for You

If you’re interested in intraday trading or want lower minimum investments, ETFs may suit you better. They combine the diversification benefits of an index fund with the flexibility of stock trading. Plus, their tax advantages make them attractive for many investors.

Understanding Capital Gains Tax and Why ETFs Are Tax Efficient

Capital gains tax is the tax you pay on profits from the sale of investments. ETFs have a structural advantage here:

- When you sell your ETF shares, you usually sell them directly to another investor, so the fund itself doesn’t have to sell any underlying assets.

- Because the fund doesn’t sell assets, it rarely realizes capital gains that get passed on to shareholders.

- This means you only pay capital gains tax when you personally sell your ETF shares—no surprise tax bills from the fund manager selling assets behind your back.

In contrast, index funds can trigger capital gains taxes for all investors when the fund manager sells securities to meet redemption requests. Even if you didn’t sell your shares, you might owe taxes. This happens less often with index funds compared to actively managed mutual funds, but it’s something to consider.

How to Think About Your Investment: Shares vs. Total Money Invested

A common misconception is that the number of shares you own or the specific fund you choose matters more than the total amount of money invested. This isn’t true.

For example, the popular S&P 500 index fund currently has a price over $6,000 per share. Buying one share means investing $6,000. However, there’s an ETF called VOO that tracks the same S&P 500 index, but it costs about $551 per share.

Both VOO and the S&P 500 index fund track the same companies and will perform almost identically over time. The difference is that VOO lets you invest in the S&P 500 with a much smaller initial amount. If you buy two shares of VOO, you’re investing around $1,100—still less than a single share of the index fund.

At the end of the day, it’s the total money you have invested that matters, not how many shares or which vehicle you use. This is especially important for beginner investors who might not have thousands of dollars to put into a single share of an index fund.

How to Buy ETFs and Index Funds

Another practical difference is how easily you can buy these investments:

- Many online brokerage platforms allow you to buy ETFs directly, often with no minimum investment beyond the cost of one share.

- Some platforms do not offer certain index funds, especially if they’re proprietary to specific companies or require higher minimums.

- Multiple ETFs can track the same underlying index. For example, VOO and SPY are two ETFs that both track the S&P 500.

This variety gives investors flexibility to choose based on cost, platform availability, and personal preference.

Why ETFs Matter to You as an Investor

ETFs simplify investing. Instead of spending hours analyzing individual stocks or trying to pick winners, ETFs give you instant diversification and professional management at a low cost. They help you focus on what really matters in life—whether that’s family, your career, or even exploring new frontiers like Bitcoin, Crypto, BTC, Blockchain, and CryptoNews investing—without getting bogged down in the details.

By understanding ETFs, you equip yourself with a powerful tool for wealth building that’s accessible to almost everyone. Whether you're investing $50 or $5,000, ETFs help you build a balanced, resilient portfolio that can grow over time.

Integrating Bitcoin, Crypto, BTC, Blockchain, and CryptoNews into Your ETF Strategy

While this guide focuses on traditional ETFs, the world of investing is rapidly evolving with the rise of Bitcoin, Crypto, BTC, Blockchain, and CryptoNews. There are now ETFs that provide exposure to these exciting sectors, allowing investors to gain diversified access to digital assets and blockchain technology without the complexities of buying individual cryptocurrencies.

These crypto-related ETFs can be a great way to dip your toes into the crypto world while still benefiting from the diversification and simplicity ETFs offer. As always, it’s important to research and understand the risks, but ETFs make it easier to include these innovative assets in your portfolio.

Final Thoughts on Starting Your ETF Investment Journey

Investing in ETFs is one of the simplest, most effective ways to build wealth over time. They provide diversification, low fees, and flexibility, whether you’re a beginner or a seasoned investor. Understanding the differences between ETFs and index funds, the tax advantages, and how to think about your total investment amount will help you make smarter choices.

Remember, the goal is to invest consistently, stay diversified, and focus on your long-term goals. ETFs can help you do just that—giving you freedom from the constant stress of stock picking and letting you focus on the parts of life that truly matter.

Ready to start? Look into popular ETFs like QQQ for tech growth, VOO for broad market exposure, or even consider crypto-related ETFs to add some innovation to your portfolio. The key is to get started and stay invested.

Happy investing!

ETF Investing for Beginners: START HERE! (Simple Wealth Building with Bitcoin, Crypto, BTC, Blockchain, CryptoNews, Investing). There are any ETF Investing for Beginners: START HERE! (Simple Wealth Building with Bitcoin, Crypto, BTC, Blockchain, CryptoNews, Investing) in here.