Welcome to day three of the high-stakes journey to turn $1,000 into a Porsche GT3, brought to you by Discover Crypto. This challenge isn’t just about the thrill of trading—it’s a deep dive into Bitcoin, Crypto, BTC, Blockchain, and the latest CryptoNews that shape our investing strategies every day. Today’s episode is packed with volatile market moves, political drama, and insider trading tactics that you won’t want to miss.

From Elon Musk’s clash with Donald Trump to Jerome Powell’s cryptic interest rate signals, and a deep dive into trade setups on Ethereum and Solana, this article breaks down everything you need to know to keep your crypto game sharp. Whether you’re a seasoned trader or just curious about the crypto world, follow along as we navigate the madness and make money moves together.

Starting the Day: Market Volatility and Political Drama

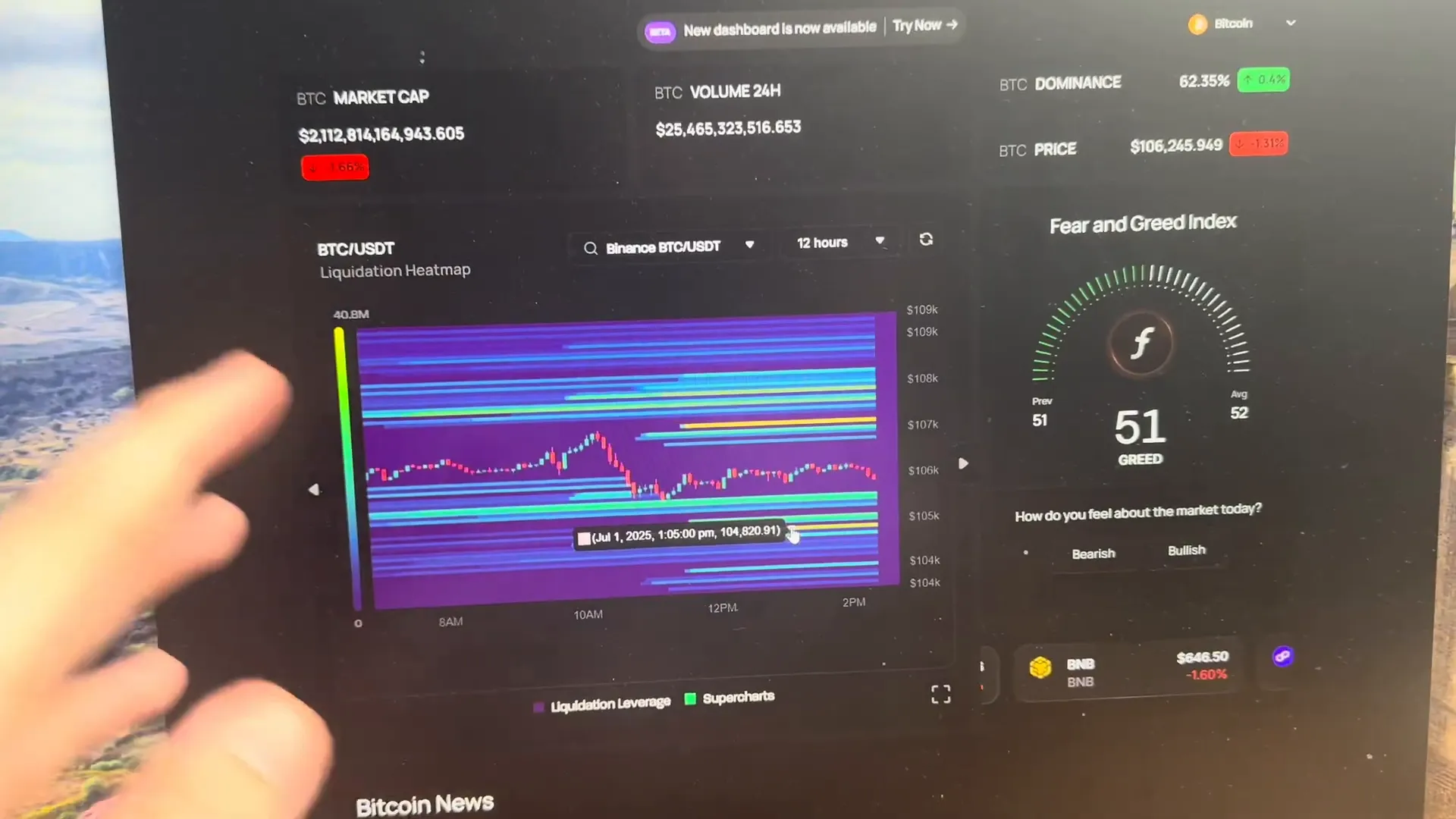

Day three kicked off with a mix of excitement and frustration. The previous week ended with some insane trades, but the start of this week was rough. We got stopped out on two trades—one for a loss of about 3.89% and another closed near breakeven, followed by a modest 2% gain. However, on the morning stream, we caught a long position on Ethereum (ETH) and were up 4% early in the day.

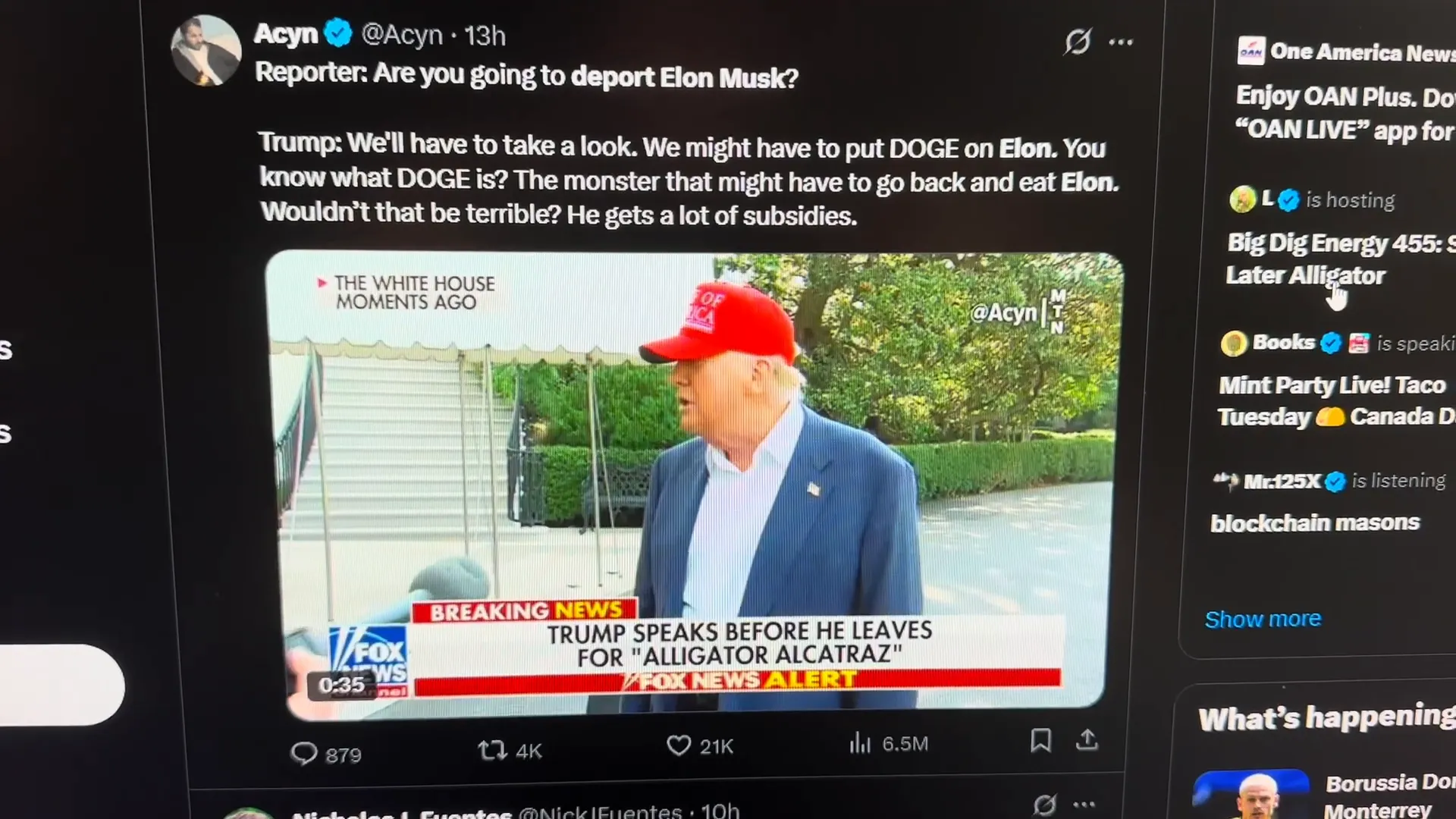

Market volatility was off the charts, largely due to a new political feud brewing between Elon Musk and Donald Trump. Trump publicly called for an investigation into the subsidies Musk receives from the US government and even joked about deporting him. This unexpected drama sent shockwaves through the market, especially impacting Dogecoin (DOGE), which has a close association with Musk.

“Donald Trump said that he's going to deport Elon Musk today... we might have to put Doge on Elon. You know, Doge is the monster that might have to go back and eat Elon. Wouldn't that be terrible?”

This kind of headline-driven volatility is a goldmine for traders who know how to navigate it. As we watched how the trades played out amid the chaos, it was clear that staying calm and sticking to a disciplined strategy was key.

The Powell Puzzle: Interest Rate Signals and Market Reactions

After grabbing some southern comfort food (mac and cheese and tacos, naturally), it was time to analyze the bigger macroeconomic picture. Jerome Powell, the Chair of the Federal Reserve, made a statement that left many traders scratching their heads.

Powell indicated that a majority of Federal Open Market Committee (FOMC) participants expect it might become appropriate to start reducing interest rates later this year. This was a notable pivot because Powell has long maintained that the Fed reacts to data rather than preemptively acting on market expectations.

“A solid majority of FOMC participants do expect that it will become appropriate, later this year, to begin to reduce rates again.”

Why is this so important? Interest rates are a major lever for economic growth and inflation control. The Fed’s decisions impact everything from mortgage rates to stock and crypto markets. Traders are particularly sensitive to these signals because rate cuts can inject liquidity and boost risk assets like BTC and altcoins.

However, the Trump administration expressed frustration over the Fed’s hesitation to cut rates, arguing that many countries are paying lower interest rates than the US despite having weaker economies.

“We are all paying lower interest rates than the United States of America, which has one of the hottest and strongest economies in the world. So why hasn't Jerome Powell cut it all?”

This disconnect between policy signals and market expectations creates uncertainty—often leading to the kind of volatile trading conditions we saw today. It’s a reminder that even the smartest minds in finance sometimes leave us guessing.

Following the Yellow Lines: Trading Strategy Breakdown

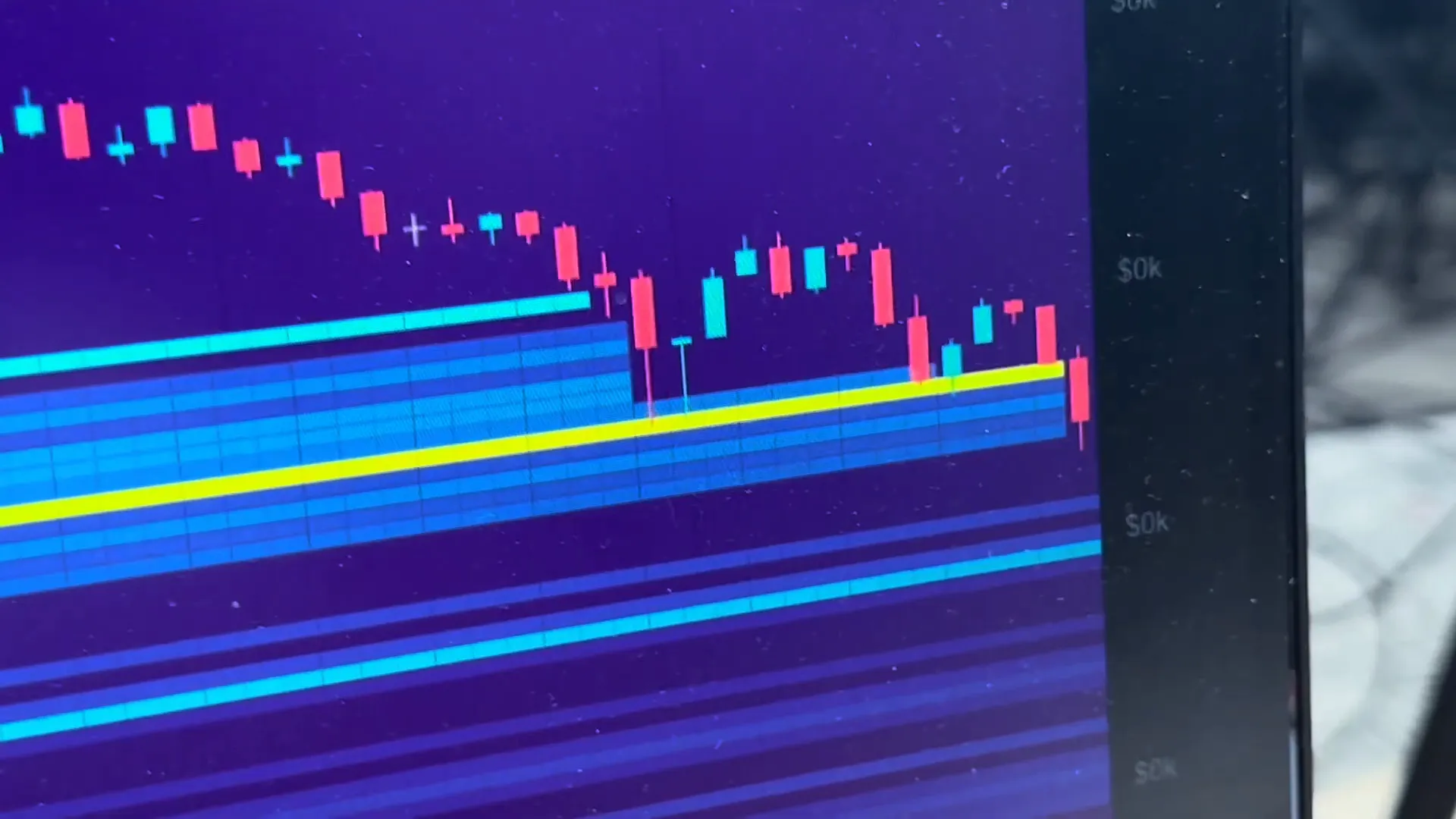

Let’s get into the nitty-gritty of the trading strategy that’s driving this challenge. The core principle is simple but effective: follow the yellow lines. These lines represent key support and resistance levels on the charts.

- Short positions are taken when the price hits the upper yellow line (resistance).

- Long positions are entered when the price reaches the lower yellow line (support).

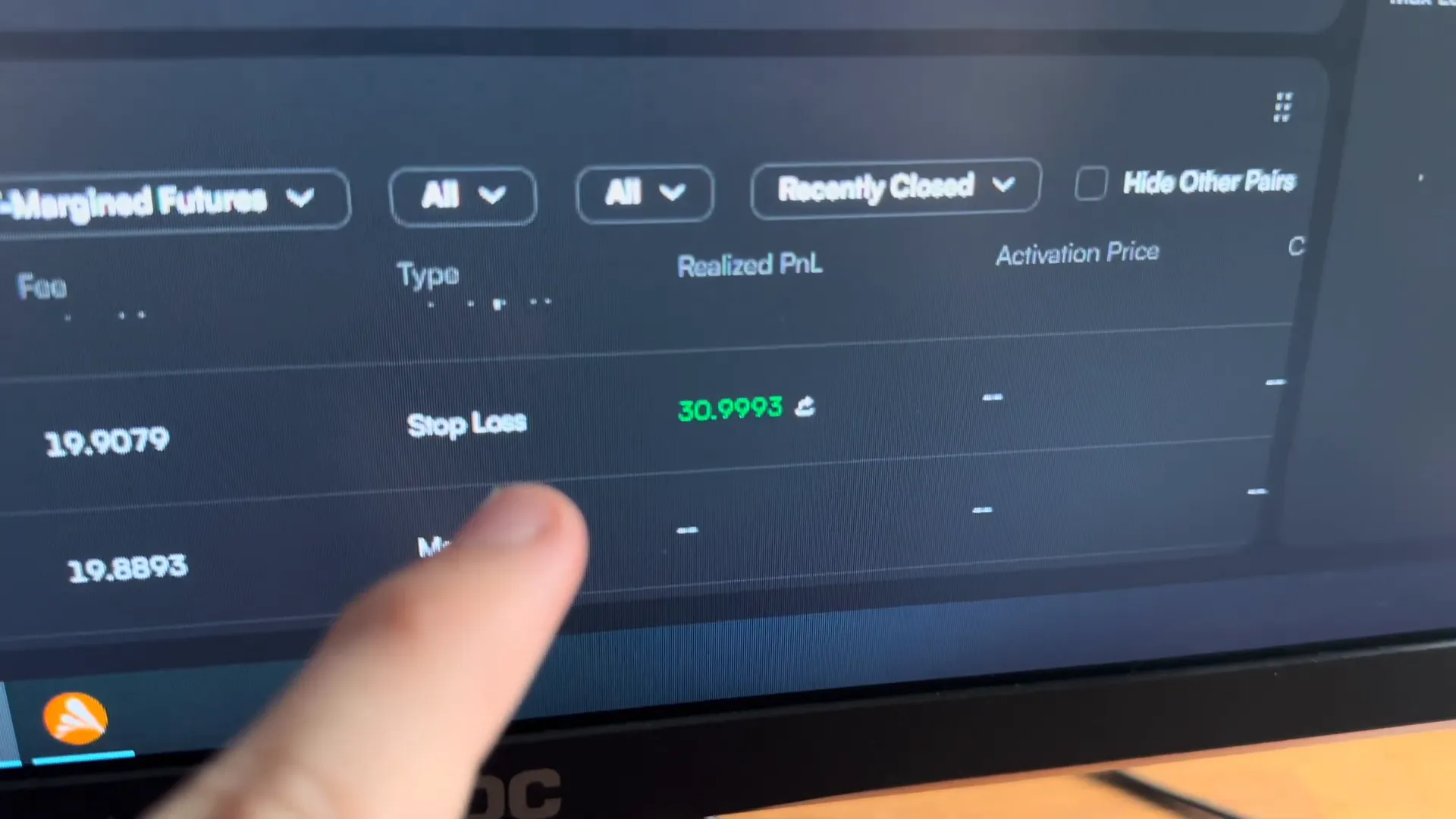

By sticking to this strategy, we minimize emotional trading and focus on high-probability setups. Today, we hit our first take profit target with a $105 realized profit, which already set the tone for a successful day.

With the initial profit locked in, the rest of the trade was essentially free money, allowing us to take on more risk or wait patiently for the next signal.

Trading Highlights: Ethereum and Solana in Focus

Ethereum has been a strong performer lately, and today was no exception. Catching a long on ETH early in the day paid off with a 4% gain. But the real excitement came from Solana (SOL), which saw a significant liquidation sweep.

For those unfamiliar, a liquidation sweep happens when stop-loss orders are triggered en masse, causing a rapid price movement that “clears out” weaker hands and sets up a potential reversal. Recognizing these sweeps is critical for timing entries and exits.

The Solana trade was particularly interesting because of a recent announcement involving Robinhood, which had driven the price down over the last two days. Almost all liquidity had been swept out, leaving a thin order book and a potential bounce setup.

“The price has come down and the entry point has been filled... Chat is going nuts.”

Once the final liquidity was eaten up, the bounce began. We entered the trade and quickly saw a $42 gain, with the community in the Discord channel spamming the fire emoji in excitement. Adding a take profit order at the next key level locked in more gains, bringing the day’s total profit to around $260.

Balancing Life and Trading: Gym Time and Strategy Patience

Trading isn’t just about staring at charts all day. Balance is essential. After locking in profits, it was time to hit the gym. Fitness is a crucial part of maintaining mental clarity and discipline in trading.

However, the challenge of leg day remains. Despite regular workouts, results can sometimes feel elusive, a frustration many traders and fitness enthusiasts share.

Staying hydrated and managing physical stress is just as important as managing market stress. Even a quick sauna session can help reset the mind and body for more focused trading sessions ahead.

Wrapping Up Day Three: Profits, Lessons, and Next Steps

Returning home from the gym, a frenzy of liquidation sweeps had triggered stop losses, including ours at 6%. But thanks to earlier take profits of 13% and 14%, along with a $30 overnight gain, the day ended with a solid profit of about $280.

While $280 might seem modest, it represents a 12.5% gain on the overall portfolio in just one day—a remarkable achievement in the volatile world of crypto trading.

This day’s journey reminds us that disciplined trading, patience, and a keen eye on market fundamentals and news can turn small accounts into substantial portfolios over time.

Why Following CryptoNews and Market Sentiment Matters

In crypto, staying ahead means staying informed. The dynamic interplay of politics, economics, and market psychology creates an environment where news like Trump vs. Musk or Powell’s rate comments can make or break trades.

Understanding these factors and integrating them into your trading strategy can give you an edge. It’s not just about charts and numbers; it’s about reading the story behind the market movements.

How to Stay Connected and Trade Smart

If you want to follow along with these trades and be part of a community that shares real-time insights, joining a Discord trading group can be invaluable. Our Discord channel is buzzing with active traders sharing setups, tips, and market news.

Additionally, using trusted trading indicators like those found on Fomo.io helps simplify decision-making and keeps emotions in check. These tools help visualize support and resistance levels, liquidation points, and other key metrics that are crucial for successful crypto trading.

Final Thoughts on the Road to $10,000 and Beyond

Day three of the $1,000 to $10,000 Porsche challenge shows that consistent profits come from a blend of strategy, discipline, and adapting to market conditions. The Bitcoin, Crypto, BTC, Blockchain, and CryptoNews landscape is ever-changing, and traders who stay informed and patient stand to win big.

From political battles to Fed policy pivots, every piece of news is a potential market mover. By following the yellow lines, managing risk, and keeping a cool head, the road to $10,000—and eventually that Porsche GT3—is well within reach.

Stay tuned, stay sharp, and keep trading smart!

Donald Trump DEPORTS Elon Musk: Day 3 of the Porsche Trading Challenge with Bitcoin, Crypto, and Market Insights. There are any Donald Trump DEPORTS Elon Musk: Day 3 of the Porsche Trading Challenge with Bitcoin, Crypto, and Market Insights in here.