Welcome to the most thrilling moment on Wall Street, where all eyes are now fixed on cryptocurrency, bitcoin, and especially Bitcoin itself. The buzz is palpable, and the market is entering a phase of true price discovery that could push Bitcoin to unprecedented heights. If you’re wondering why experts are so bullish and what’s driving this surge, you’ve come to the right place. Let’s break down the key factors fueling this momentum, the legislative landscape shaping crypto’s future, and why now might be the perfect time to be bullish on Bitcoin and crypto as a whole.

Table of Contents

- Bitcoin Breaking Barriers: The Start of a Price Discovery Phase

- Crypto Week in Washington: A Regulatory Turning Point

- Why Bitcoin and Crypto Are the Greatest Bull Trade of the Century

- Final Thoughts: Are You Buying or Selling?

Bitcoin Breaking Barriers: The Start of a Price Discovery Phase

Bitcoin has just shattered its previous all-time high of around $110,000, currently soaring to $123,000 and climbing. This breakthrough is more than just a number—it signals that Bitcoin is entering a genuine price discovery phase, which means the market is searching for its new valuation without historical precedents holding it back.

Experts like Marcus Thielen, CIO and founder of TenX Research, paint a compelling picture. He highlights a significant supply crunch in Bitcoin, pointing out that only three crypto exchanges now hold more than 150,000 BTC combined. This means fewer Bitcoins are available on exchanges, pushing demand higher as institutional and corporate investors scoop up available supply.

"Only three crypto exchanges have more than 150,000 BTC left. There’s not a lot of Bitcoins left on exchanges, and that’s why people are scrambling to get their hands on Bitcoin right now."

Institutional interest is booming, with Bitcoin ETFs purchasing over $15 billion in just the last six to eight weeks. This influx of capital, combined with a lack of retail participation (due to the high price per Bitcoin), makes the current rally unique and powerful.

Price Targets and Market Sentiment

Looking ahead, price targets are ambitious but grounded in historical trends. Thielen notes that after a short-term breakout about ten days ago, Bitcoin typically rallies by 20%, which could bring the price to approximately $133,000 by August or September. Beyond that, option markets and futures trading show the market gravitating toward round numbers like $140,000 to $160,000 by year-end, driven by capital inflows and short squeezes.

This momentum is reinforced by the cessation of downward pressure from options expiring at the end of Q2, and the unwinding of short sellers, which further fuels the upward price movement.

Crypto Week in Washington: A Regulatory Turning Point

This week marks a pivotal moment for cryptocurrency as the U.S. House of Representatives tackles three major crypto bills aimed at clarifying regulations and fostering innovation:

- Stablecoin Bill: Set to be signed into law, this bill establishes oversight for stablecoins, which are critical for crypto market stability.

- Market Structure Bill: Defines jurisdictional boundaries between the SEC and CFTC, providing clearer rules for crypto assets.

- Anti-CBDC Bill: Designed to block the Federal Reserve from issuing its own digital currency, which many see as a competitor to decentralized cryptocurrencies.

These legislative efforts aim to transform the U.S. into the global crypto capital by closing regulatory gaps without creating loopholes. This shift is expected to protect consumers and encourage responsible innovation.

"We are not creating loopholes; we are closing regulatory gaps. It’s high time to fix a broken regulatory structure that has failed American consumers and innovators."

Bitcoin, as the leading cryptocurrency by market cap, stands to benefit directly from this clearer regulatory environment, reinforcing its legitimacy and institutional acceptance.

Institutional Embrace and Market Impact

CNBC's Mackenzie Sigalos and other market commentators emphasize that Bitcoin is no longer a contrarian bet but part of the institutional consensus. High-profile figures like Jim Cramer predict that even skeptics such as JPMorgan CEO Jamie Dimon may soon "go all in" on crypto, signaling a potential major shift in Wall Street’s stance.

Tom Lee and other analysts note that many institutions are borrowing money to buy Bitcoin and Ethereum, leveraging capital to maximize returns. This trend of relentless capital raising and reinvestment is a powerful wealth-building strategy that could accelerate Bitcoin’s price gains.

Why Bitcoin and Crypto Are the Greatest Bull Trade of the Century

John Blank, chief equity strategist at Zacks, calls the current crypto rally “the bull trade of the century.” Several factors contribute to this bullish outlook:

- Record ETF Inflows: Bitcoin ETFs have collectively amassed over $140 billion, with BlackRock’s Bitcoin fund alone nearing $90 billion in assets.

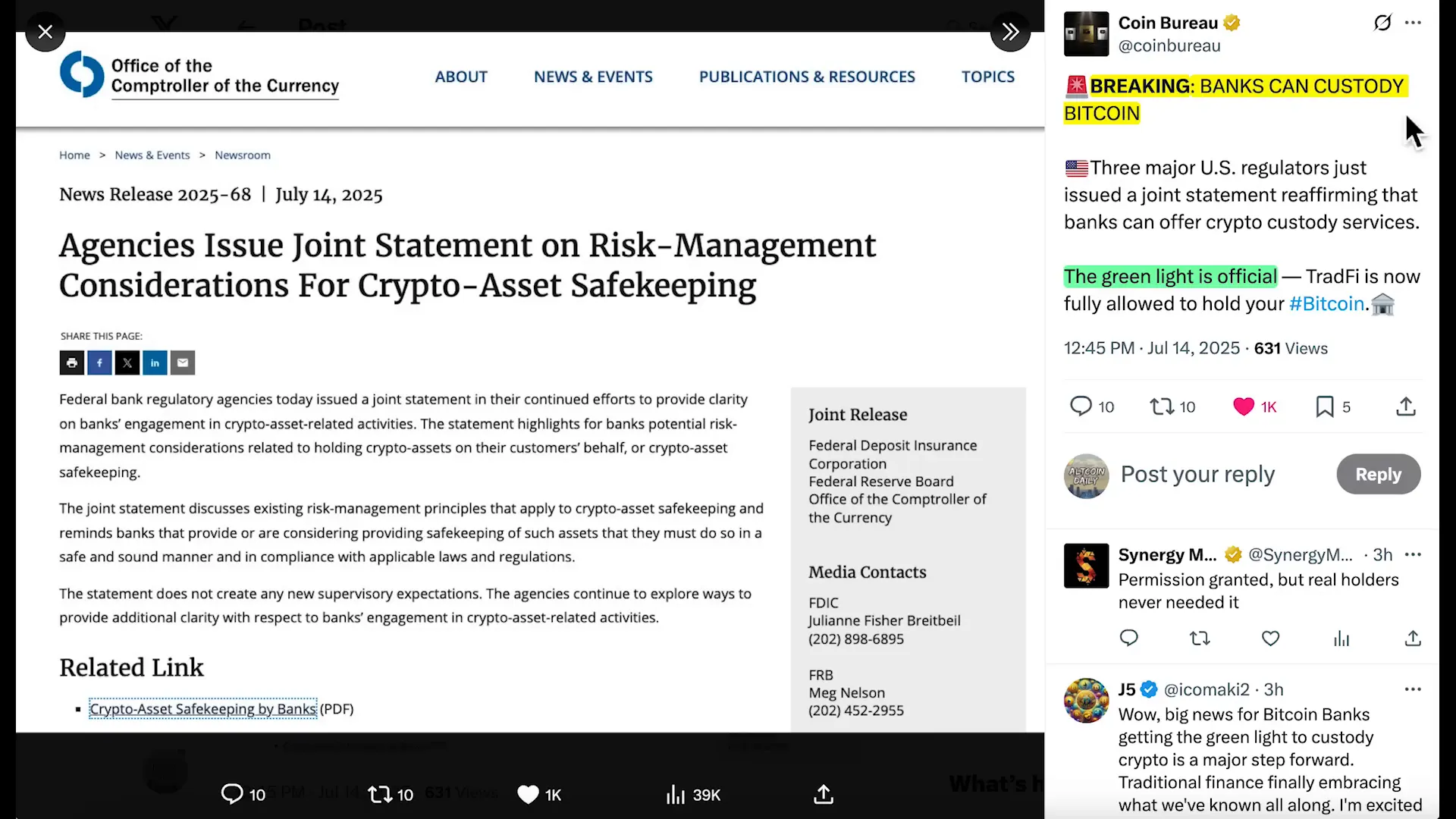

- Regulatory Green Lights: Recent joint statements from major U.S. regulators have officially allowed banks to custody Bitcoin and crypto, integrating traditional finance (TradFi) with crypto.

- Market Infrastructure Growth: Companies like Coinbase joining the S&P 500 and potential entry of retail giants like Walmart and Amazon into stablecoin business indicate expanding mainstream adoption.

This convergence of factors suggests that Bitcoin and select altcoins are positioned for substantial growth, making now a compelling time for investors to consider accumulating crypto assets.

Michael Saylor’s Winning Strategy: Keep Buying Bitcoin

Michael Saylor, a well-known Bitcoin advocate, sums up the winning approach perfectly: relentless accumulation. His advice is clear—continually raise and reinvest capital into Bitcoin as fast and as much as possible. The compounding velocity of capital creates exponential wealth growth over time.

"The way you win over the next ten years is to keep buying Bitcoin. Raise and reinvest capital relentlessly as fast as you can."

Saylor describes a practical method involving leveraging assets like equity in a business or a mortgage-free home to borrow money at low rates and invest in Bitcoin, capturing the spread between borrowing costs and Bitcoin’s rising returns. This strategy underscores the importance of not just holding Bitcoin but actively using capital to compound gains.

Final Thoughts: Are You Buying or Selling?

With so many bullish catalysts converging—from supply shortages and institutional demand to favorable legislation and strategic capital deployment—the cryptocurrency, bitcoin market is heating up like never before. The question for you is simple: are you buying or selling?

This year promises to be a defining moment for crypto investors. Staying informed and strategic could make all the difference in capturing the upside of this historic bull run. Remember, as the saying goes in the crypto world, "He who has the most Bitcoin at the end of the game wins."

So, what’s your strategy? Are you ready to join the greatest show on Wall Street and capitalize on the cryptocurrency revolution?

Cryptocurrency, Bitcoin: Why Bitcoin Is About to Go "Out of Control" and What You Need to Know. There are any Cryptocurrency, Bitcoin: Why Bitcoin Is About to Go "Out of Control" and What You Need to Know in here.