Cryptocurrency markets, especially Bitcoin, have long followed a familiar script: every four years, Bitcoin halves, prices skyrocket, retail investors rush in driven by FOMO (fear of missing out), altcoins surge, and chaos ensues. But this cycle is different. As Bitcoin approaches historic highs, the typical frenzy is missing. Instead, a quieter, more methodical accumulation is underway, led not by retail traders but by institutions.

In this article, we’ll dive deep into this evolving landscape, exploring what’s really driving Bitcoin’s price, the risks hidden beneath the surface, and how investors can navigate a bull market that’s breaking all the old rules.

Table of Contents

- From FOMO Frenzy to Silent Institutional Accumulation

- Why This Cycle Is Different: Bigger, Slower, and More Stable

- Liquidity and Risk: The Late-Stage Bull Market Dynamics

- The Hidden Risks Behind Corporate Bitcoin Treasury Buyers

- How to Navigate This Unpredictable Bull Market

- The Long-Term Vision: Bitcoin as the Future of Money

- Final Thoughts: A Cycle Like No Other

From FOMO Frenzy to Silent Institutional Accumulation

Historically, Bitcoin’s bull runs have been characterized by flat price action followed by sudden vertical breakouts, fueled by retail mania. In 2017 and 2021, once prices surged, retail investors flooded in, chasing the hype and pushing prices even higher. But this time around, the scene is starkly different.

Bitcoin has nearly doubled from a year ago, blasting through previous all-time highs. Yet, instead of exuberance, the market energy is quiet. The usual TikTok traders and YouTube hype trains are absent. On-chain analyst Willie Woo highlights this eerie silence as a cause for concern — or perhaps a signal.

“This cycle doesn't follow the old rules. The retail mania? It's missing. Just calm, relentless accumulation.”

Who is buying then? The answer is institutions. BlackRock, Fidelity, and sovereign wealth funds are quietly stacking Bitcoin, treating it as infrastructure rather than a speculative trade. This shift from retail-driven hype to billion-dollar institutional flows is reshaping the market dynamics.

Why This Cycle Is Different: Bigger, Slower, and More Stable

Bitcoin’s market cap has doubled since the last cycle, from around $1 trillion to $2 trillion, bringing some natural stability. Willie Woo explains that while previous cycles saw rapid vertical moves driven by retail FOMO, this time the needle moves slower and requires billions of dollars just to make a noticeable impact.

Institutional buying is staged and consistent, especially around major events like the BlackRock ETF launch. This steady accumulation contrasts sharply with the rapid, volatile spikes of the past.

However, this stability is relative. The broader environment – what Woo calls “global macro” – is far from smooth. Bitcoin is like a robust truck with good suspension, but the road ahead is rough terrain. Global economic uncertainty, rising volatility, and liquidity concerns mean the market may appear more unstable even as the system itself strengthens.

Liquidity and Risk: The Late-Stage Bull Market Dynamics

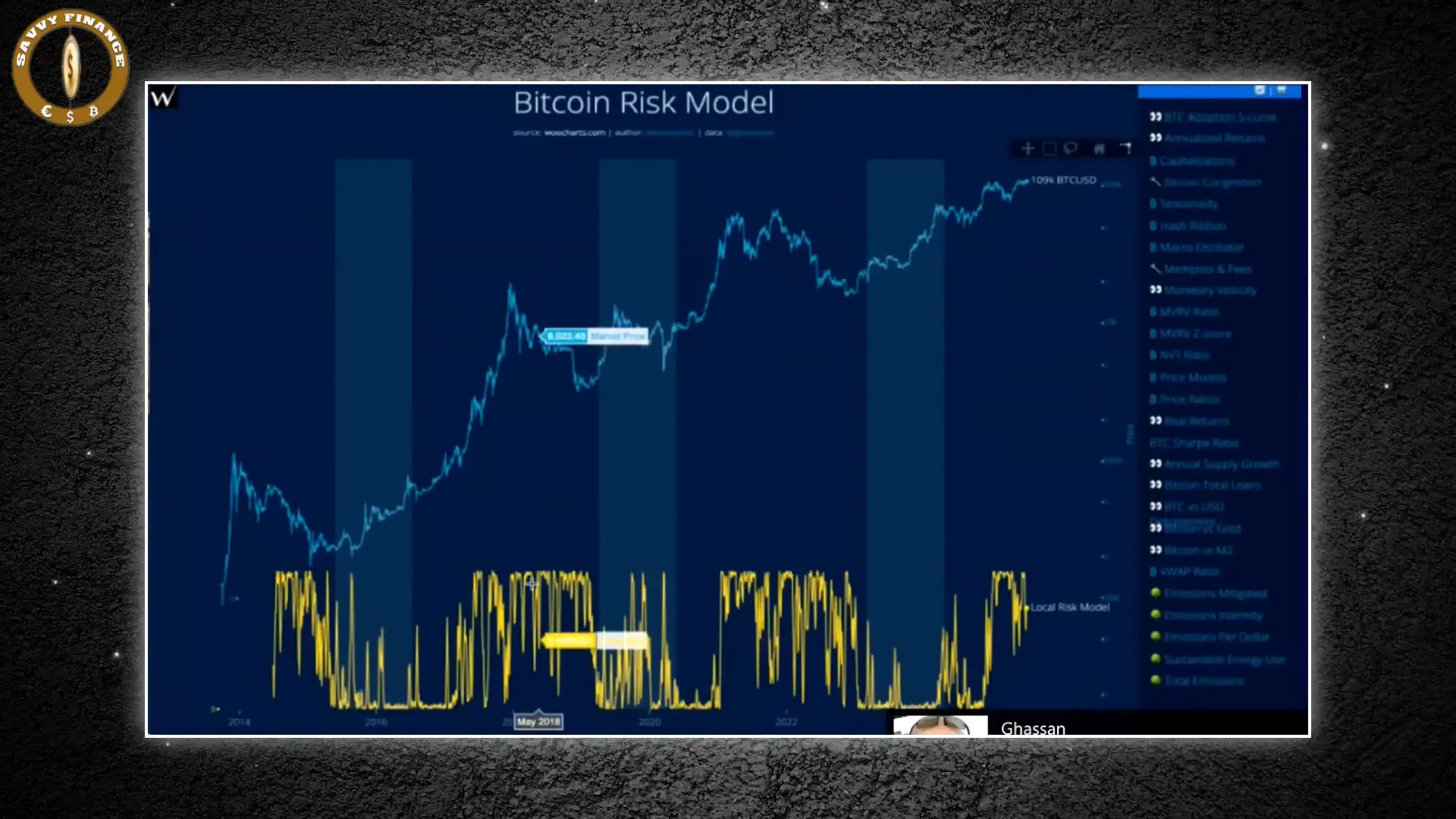

Liquidity—the amount of cash flowing into the market—is a critical factor in identifying market tops. Woo’s risk model compares liquidity inflows to Bitcoin’s market capitalization. Early in the bull run, liquidity is strong, supporting price increases and keeping risk low.

But as the cycle progresses, liquidity starts to drop relative to market cap, increasing risk and volatility. According to Woo, Bitcoin has now entered this late-cycle risky zone, where pullbacks can be sharp and unpredictable.

Despite this, Woo expects Bitcoin to break all-time highs again, fueled by anticipated money printing and economic policies. Yet, timing the exact peak is nearly impossible. The market may top anywhere from September to as late as March next year, and volatility will remain high.

The Hidden Risks Behind Corporate Bitcoin Treasury Buyers

One of the biggest twists in this cycle is the rise of Bitcoin treasury companies like MicroStrategy and Meta Planet. These firms buy Bitcoin for their balance sheets, which sounds bullish. But their buying patterns drain liquidity from the broader market because investors buy shares in these companies rather than Bitcoin directly.

This funneling effect means less direct capital inflow into Bitcoin, muting the explosive rallies of previous cycles.

More importantly, some of these treasury-backed companies use leverage and short-term debt to fund Bitcoin purchases. Meta Planet’s EVO fund, for example, operates like a hedge fund using debt to amplify returns. If the market turns and they can’t roll over their debt or exercise warrants, they might be forced to sell Bitcoin rapidly, triggering a cascade of liquidations.

These hidden debt structures create a time bomb lurking beneath the surface, threatening sudden market shocks that could catch many investors off guard.

How to Navigate This Unpredictable Bull Market

With the usual retail frenzy absent and institutions quietly dominating, this bull market demands a smarter, more cautious approach. Trying to call the exact top is a recipe for disaster, as volatility at market peaks is notoriously unstable.

Willie Woo recommends three key strategies for investors:

- Shift into stablecoins and yield strategies: Use crypto arbitrage or market-neutral trading setups that generate returns even in flat or falling markets. Sitting idle in volatile tokens without a plan invites losses.

- Hold Bitcoin with a long-term mindset: Despite the turbulence, Bitcoin remains the strongest asset in crypto. It’s designed to survive and thrive, making it the only asset worth holding through the chaos.

- Watch for shorting opportunities—but wait for the right moment: Avoid jumping in too early. The best time to hedge is after clear signs of a market peak, during the “dead cat bounce” — a small fake recovery before a full drop. Target over-leveraged treasury companies trading at unrealistic premiums for potential shorts.

The Long-Term Vision: Bitcoin as the Future of Money

Beyond the immediate bull market dynamics and risks, Willie Woo’s vision for Bitcoin is expansive. He sees Bitcoin not just as digital gold or a store of value, but as the future of money itself: a secure, decentralized currency immune to inflation, government control, and banking intermediaries.

He predicts Bitcoin’s market cap could soar far beyond current levels — not stopping at $2 trillion or $5 trillion, but potentially reaching $100 trillion. This isn’t a fantasy but a forecast of a complete reset of the global financial system as we know it.

Final Thoughts: A Cycle Like No Other

This cryptocurrency cycle is breaking all the old rules. The familiar retail crowd frenzy is missing, replaced by a silent, institutional takeover. Hidden debt and leverage create unseen risks, and global economic headwinds add complexity.

Volatility may be low now, but the road ahead is uncertain and bumpy. Timing the top is nearly impossible, but those who prepare with smart strategies and a long-term mindset have the best chance to thrive.

For every Bitcoin investor, understanding these shifts is essential. The biggest story in finance may just be beginning — quietly, steadily, and with more at stake than ever before.

Cryptocurrency, Bitcoin: The Most Important Bull Market Update Every Investor Needs to Know. There are any Cryptocurrency, Bitcoin: The Most Important Bull Market Update Every Investor Needs to Know in here.