In the ever-evolving world of cryptocurrency and bitcoin, few voices resonate as powerfully as Michael Saylor’s. His latest insights from Bitcoin Prague 2025 reveal not just a bullish outlook but a transformative shift in how Bitcoin is perceived and adopted globally. This article dives into the macroeconomic forces, institutional embrace, and geopolitical momentum driving Bitcoin’s rise as a trillion-dollar monetary network, and what that means for investors, corporations, and nations alike.

Table of Contents

- The State of the Macro Economy: Bitcoin Outpaces Traditional Assets

- Bitcoin at a Crossroads: From Speculative Asset to Institutional Powerhouse

- A New Era: Bitcoin as a Strategic National Asset

- Bitcoin: The Next Great Technology and Monetary Infrastructure

- Regulatory and Political Momentum Accelerates Adoption

- Why Bitcoin Treasury Companies Are Surging

- The Global Monetary Revolution Is Underway

- Positioning for the Future: Are You Ready?

- Conclusion

The State of the Macro Economy: Bitcoin Outpaces Traditional Assets

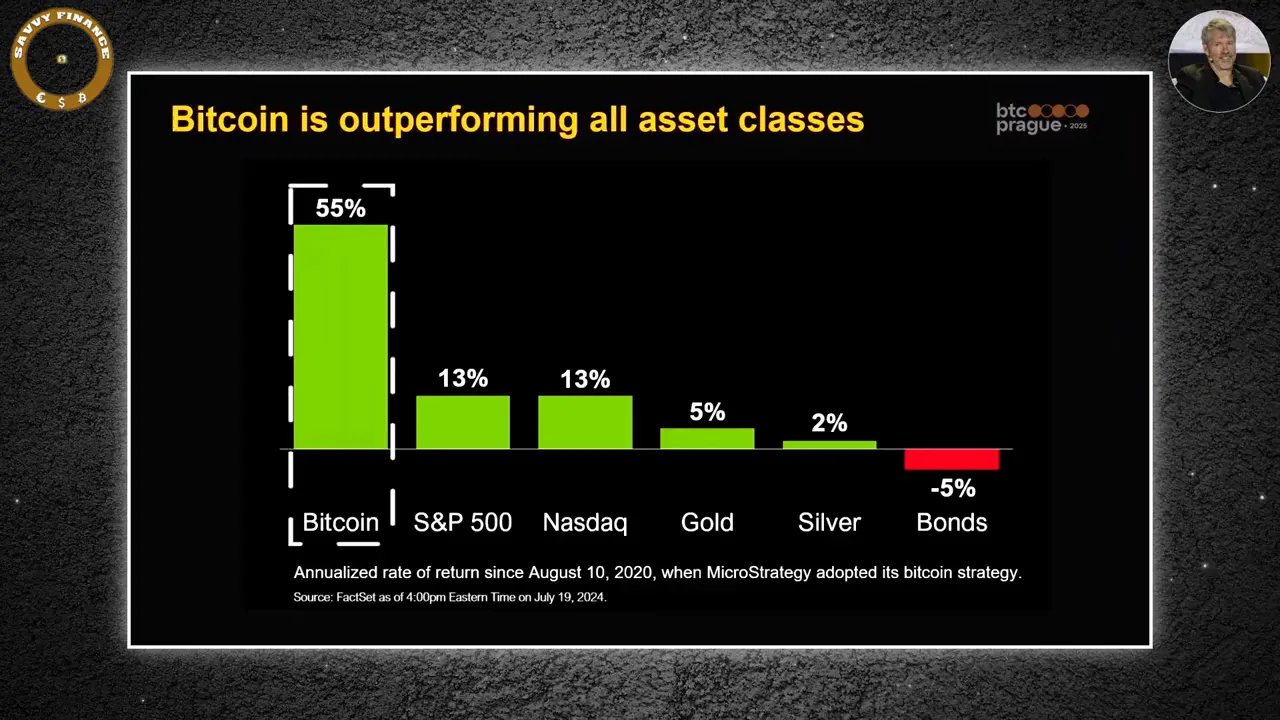

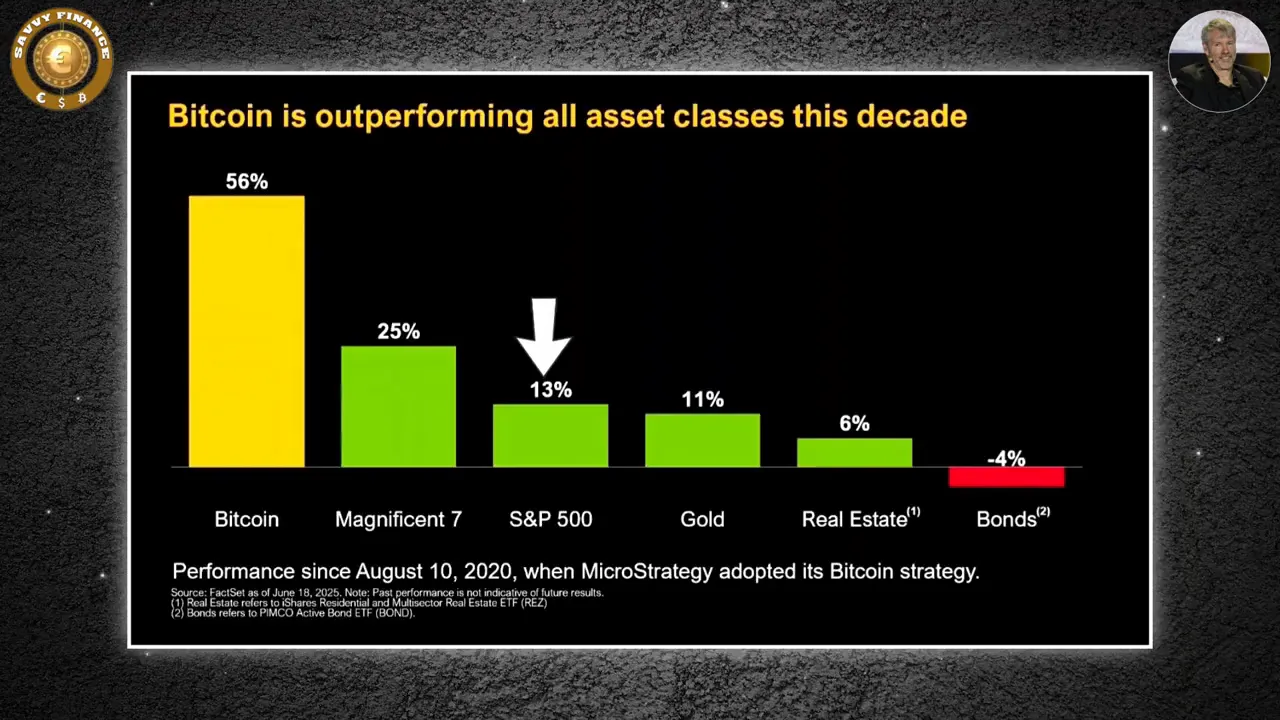

Back in July 2024, Bitcoin was appreciating at 55%, dramatically outperforming traditional asset classes like the Nasdaq and S&P 500. In contrast, gold lagged, silver was lackluster, and bonds were outright losing value. This dynamic underscored Bitcoin’s emerging role as an ethically, economically, and technically sound foundation for the financial industry’s future.

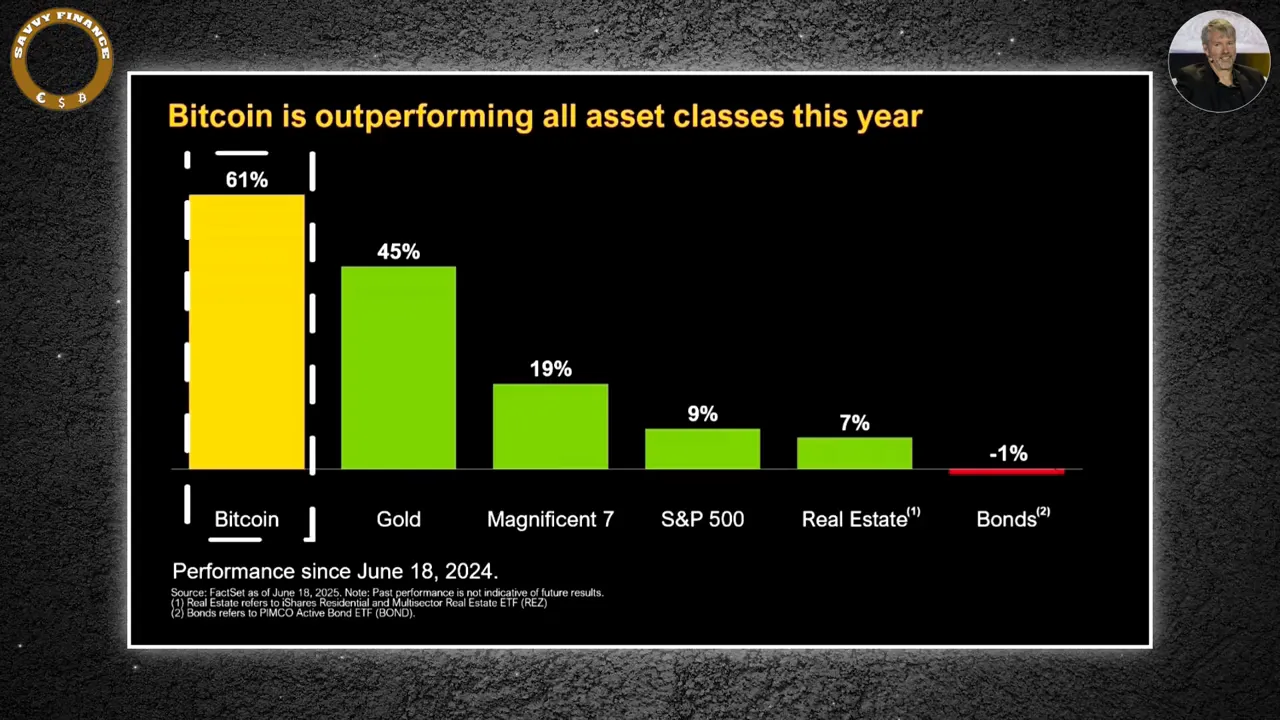

Fast forward twelve months, and Bitcoin continues its robust run, now up 61%, while the "magnificent seven" tech giants and the broader S&P struggle amid tariff wars and fading mainstream confidence. Gold has surged as a safe haven but still trails Bitcoin’s momentum. Real estate remains steady but bonds continue to falter, emphasizing Bitcoin's growing dominance across asset classes this decade.

Bitcoin at a Crossroads: From Speculative Asset to Institutional Powerhouse

In mid-2024, Bitcoin’s market capitalization hovered around $1 trillion, a mere 0.1% of global wealth estimated at over $280 trillion. Institutional capital was cautiously returning after the crypto winter, but mainstream conviction remained tentative. It was during this time that Michael Saylor boldly forecasted Bitcoin’s rise to $13 million per coin over 21 years, implying a 29% annual growth rate and up to 7% of global asset allocation.

What once sounded like science fiction is now unfolding faster than anticipated. Bitcoin has surged over 60% in less than a year, outperforming every major asset class over the past decade. Confidence in legacy assets like bonds, real estate, and tech mega caps has waned due to tariff escalations, monetary uncertainty, and dedollarization trends. Meanwhile, Wall Street analysts have embraced Bitcoin with formal price targets, and Washington officials openly endorse it.

A New Era: Bitcoin as a Strategic National Asset

For the first time in history, a sitting U.S. administration has declared its strategic intent to become the global Bitcoin superpower. This political sea change, marked by pro-Bitcoin figures like JD Vance, Robert F. Kennedy, and others, has accelerated Bitcoin’s institutional adoption. Cabinet-level officials now recognize Bitcoin as a unique decentralized crypto network and digital commodity, signaling profound shifts in government attitudes.

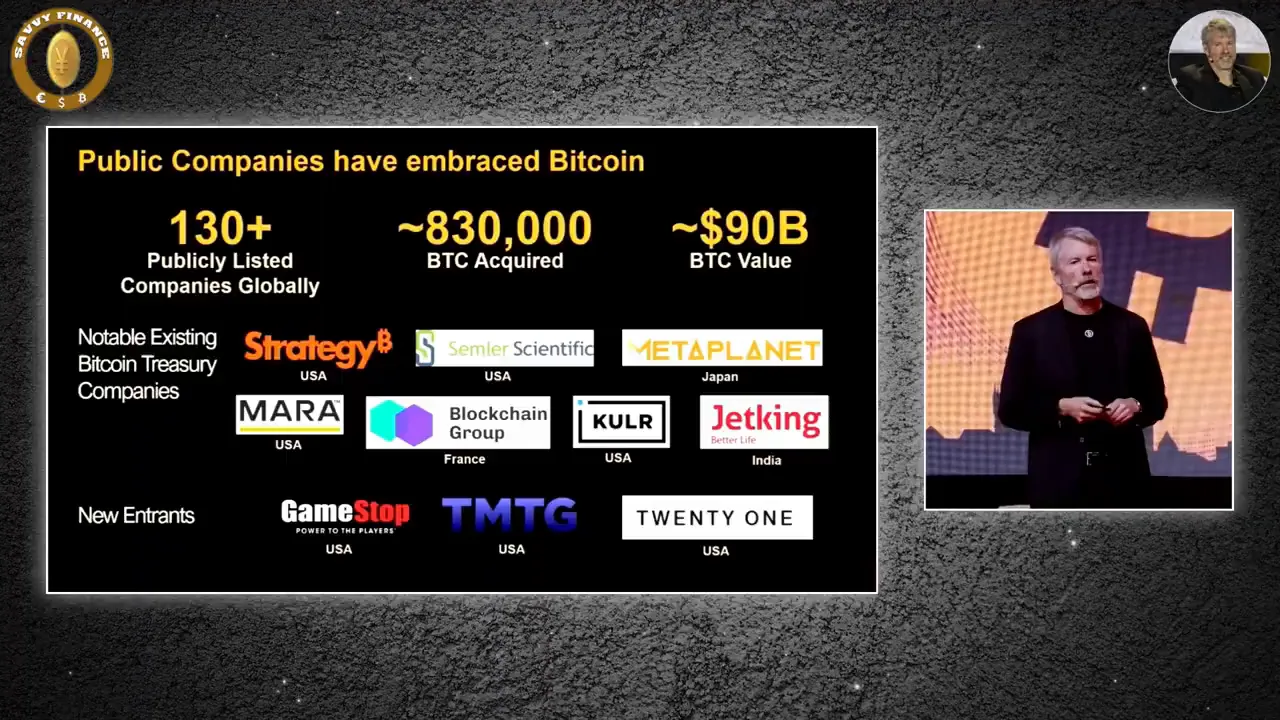

Wall Street has followed suit with $150 billion in capital and 1.4 million Bitcoin held by public companies. MicroStrategy led the charge as the first public company to adopt Bitcoin, initially seen as a contrarian move but now a trend with over 130 companies racing to join the “Bitcoin 100.” Equity analysts have moved Bitcoin from fringe speculation to a mainstream asset class, publishing bullish price targets and research.

Bitcoin: The Next Great Technology and Monetary Infrastructure

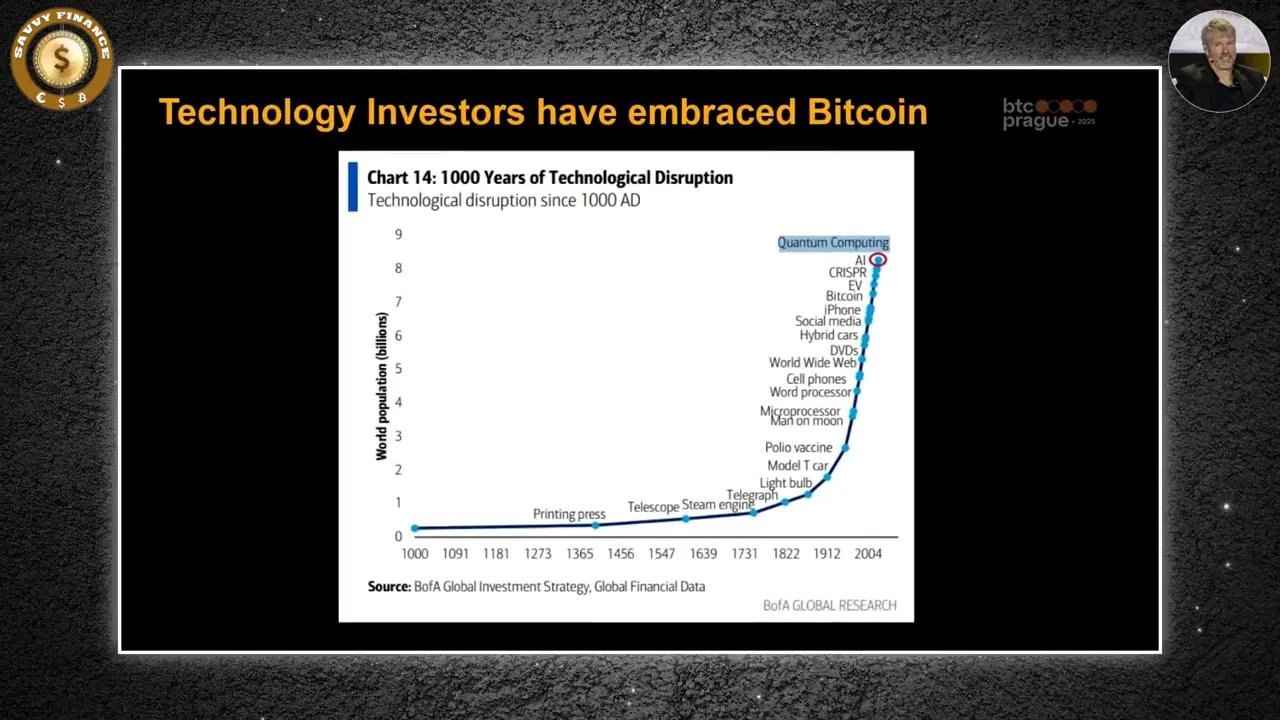

Technology investors liken Bitcoin’s impact to groundbreaking innovations like the light bulb, Model T, and the World Wide Web. It’s no longer a speculative oddity but a foundational technology with global monetary infrastructure potential, comparable to TCP/IP in the early internet days. This institutionalization marks a profound shift in how sound money is defined and valued.

Bitcoin ETFs have gathered over $200 billion in assets, led by BlackRock, Fidelity, and Franklin Templeton, further legitimizing the asset class. Sovereign nations are also joining the fray, treating Bitcoin as a reserve-grade, non-sovereign asset — a hedge against dollar dependency and a bet on digital self-sovereignty in a fragmented global economy.

Regulatory and Political Momentum Accelerates Adoption

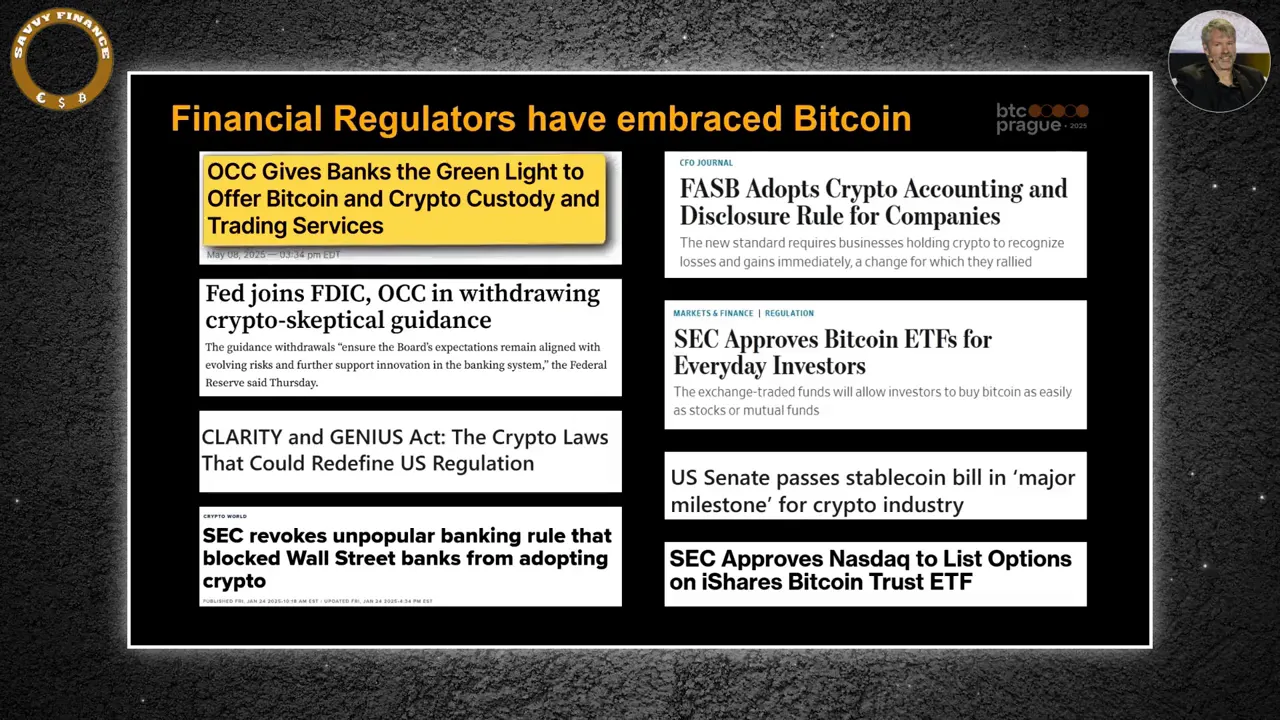

Financial regulators have shifted dramatically in favor of Bitcoin. The OCC encourages banks to support Bitcoin, the Federal Reserve endorses its use, and the SEC approves Bitcoin ETFs. Capitol Hill is actively passing pro-Bitcoin legislation, including the Clarity Act, Genius Act, and Coin Act. State legislatures across the U.S. are also embracing Bitcoin, with governors supporting its adoption.

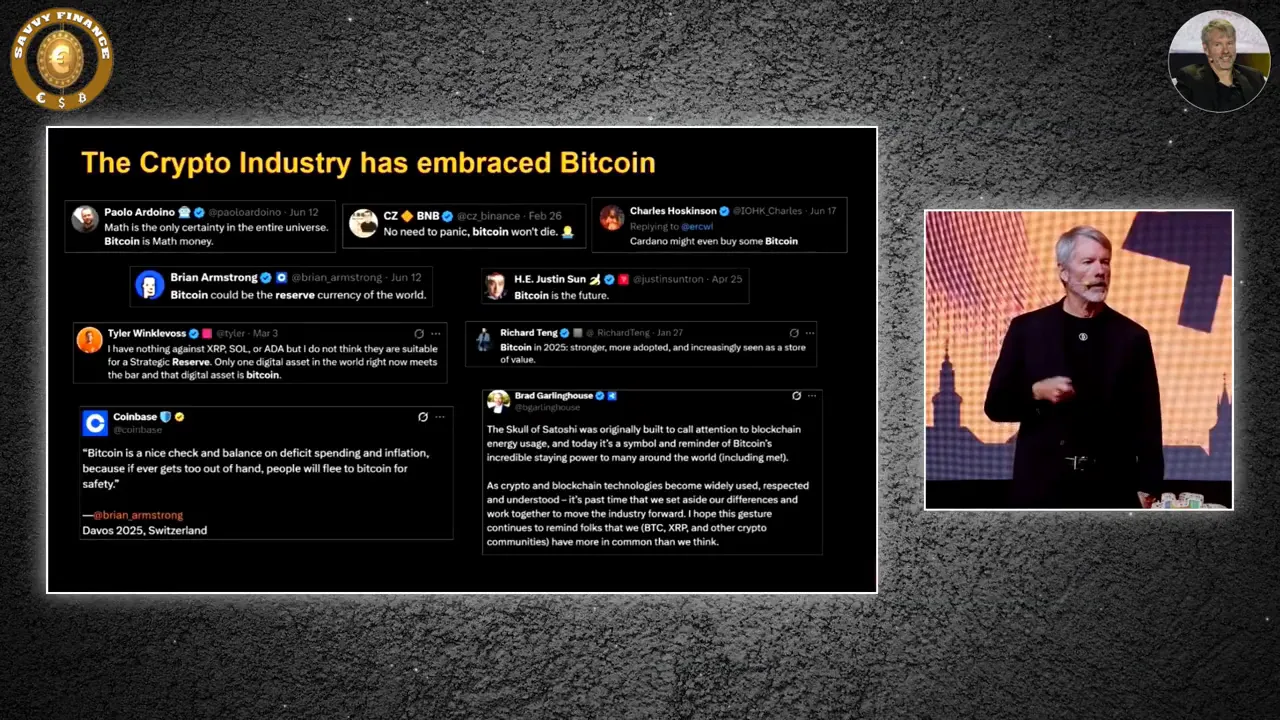

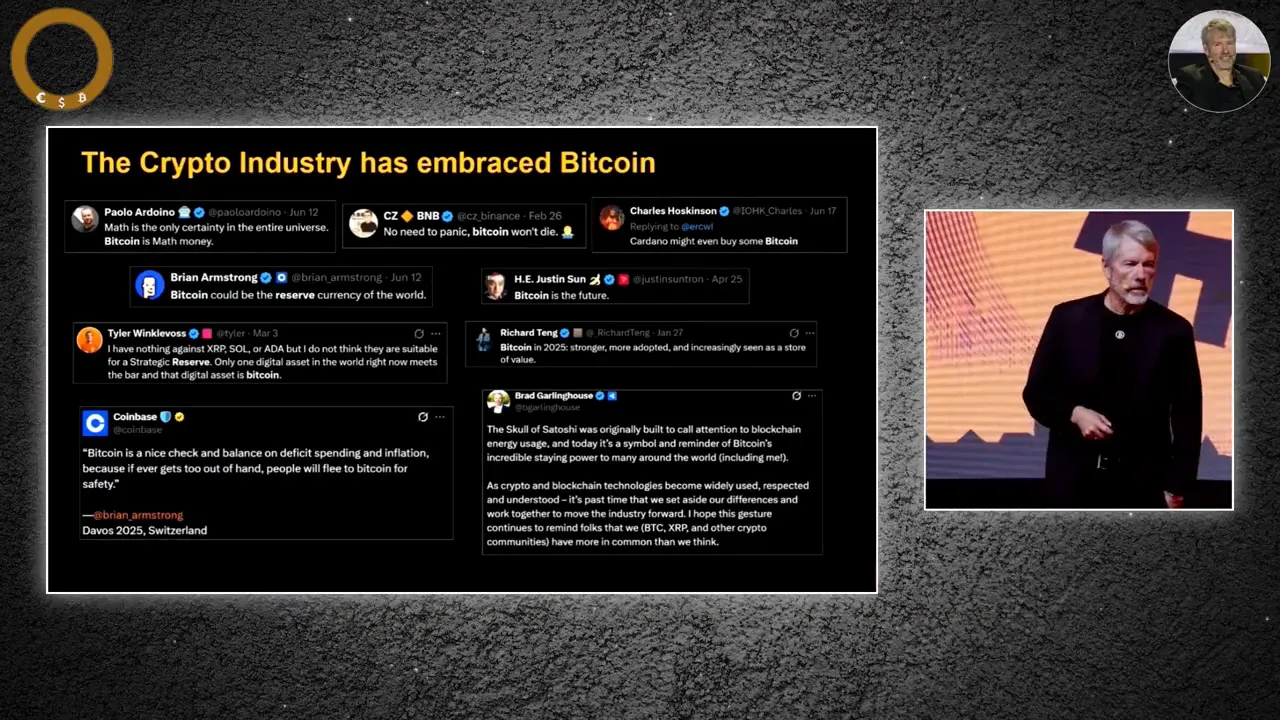

Internationally, governments from the UK to Bhutan, Pakistan to Brazil, and even Russia and China recognize Bitcoin’s strategic importance. The crypto industry itself has unified behind Bitcoin as the foundational reserve currency of the crypto economy, acknowledging its ethical, economic, and technical superiority over other protocols.

Why Bitcoin Treasury Companies Are Surging

Bitcoin’s average annualized return of 56% over nearly five years dwarfs traditional assets and the global cost of equity, estimated at 13%. This means companies holding gold, real estate, bonds, or commodities cannot beat the cost of equity, making those assets dilutive to shareholder value. Bitcoin stands alone as a liquid, accretive asset that can generate profits when companies sell equity to buy it.

As a result, Bitcoin treasury companies like MicroStrategy, Meta Planet, SmarterWeb, and others are catching fire in capital markets worldwide. This capital rotation is just beginning, with Bitcoin still representing only 0.2% of global wealth — indicating enormous growth potential ahead.

The Global Monetary Revolution Is Underway

Despite clear evidence of Bitcoin’s winning trajectory, 99.8% of global capital still acts as if Bitcoin doesn’t exist. This misallocation is unsustainable. The monetary revolution fueled by digital transformation and financial innovation is accelerating, redefining sound money and performance metrics in relation to the true cost of capital.

Bitcoin is no longer just an asset class; it’s becoming a benchmark, base layer, and standard for global finance. Its neutrality, immutability, and decentralization have shifted from perceived flaws to valued features embraced by regulators, corporations, and geopolitical actors alike.

Positioning for the Future: Are You Ready?

As Michael Saylor emphasizes, the past twelve months have seen more momentum behind Bitcoin than the previous twelve years combined. The question for investors, companies, and nations is clear: Are you building with Bitcoin as your foundation, or are you anchored to a system losing trust, yield, and relevance?

Bitcoin’s rise is not hypothetical — it’s a reality already reshaping capital markets and geopolitical strategies worldwide. The opportunity lies in recognizing this shift early and positioning accordingly.

What do you think is the biggest barrier left before Bitcoin fully enters the global financial mainstream? Share your thoughts below.

Conclusion

Bitcoin’s journey from a speculative oddity to a trillion-dollar monetary network is accelerating at an unprecedented pace. Institutional adoption, regulatory clarity, and geopolitical support are converging to make Bitcoin a core component of global finance.

For investors and companies alike, understanding this shift and acting on it could mean the difference between thriving in the new digital economy or being left behind. Bitcoin is not just a technology or asset — it’s the foundation of the future monetary system.

If you found this analysis insightful, consider sharing it to help others understand what mainstream media often overlooks. Staying informed and engaged is key to navigating the rapidly changing landscape of cryptocurrency and bitcoin.

CryptoCurrency, Bitcoin: Michael Saylor's Boldest Bitcoin Prediction June 2025. There are any CryptoCurrency, Bitcoin: Michael Saylor's Boldest Bitcoin Prediction June 2025 in here.