In an era marked by macroeconomic turbulence and geopolitical uncertainty, understanding the trajectory of cryptocurrency and bitcoin requires more than surface-level analysis. Drawing on the perspectives of two influential market voices—Tom Lee, cofounder of Fundstrat Global Advisors, and Ray Dalio, founder of Bridgewater Associates—this article dives deep into the evolving landscape shaping risk assets and digital currencies.

Tom Lee’s data-driven optimism contrasts with Ray Dalio’s cautionary warnings about systemic fragility. Together, their views offer a comprehensive framework for investors navigating the critical months ahead. Let’s unpack their insights and explore what they mean for cryptocurrency, bitcoin, and broader market positioning.

Table of Contents

- Tom Lee’s Bullish Case: Visibility, Resilience, and Cash on the Sidelines

- Market Sentiment and Speculation: Echoes of 2021?

- Ray Dalio’s Warning: Systemic Fragility and the Debt Cycle Challenge

- The Multipolar World and the Rise of Digital Alternatives

- What This Means for Investors: Balancing Opportunity and Risk

- Conclusion: Navigating the Critical Months Ahead

Tom Lee’s Bullish Case: Visibility, Resilience, and Cash on the Sidelines

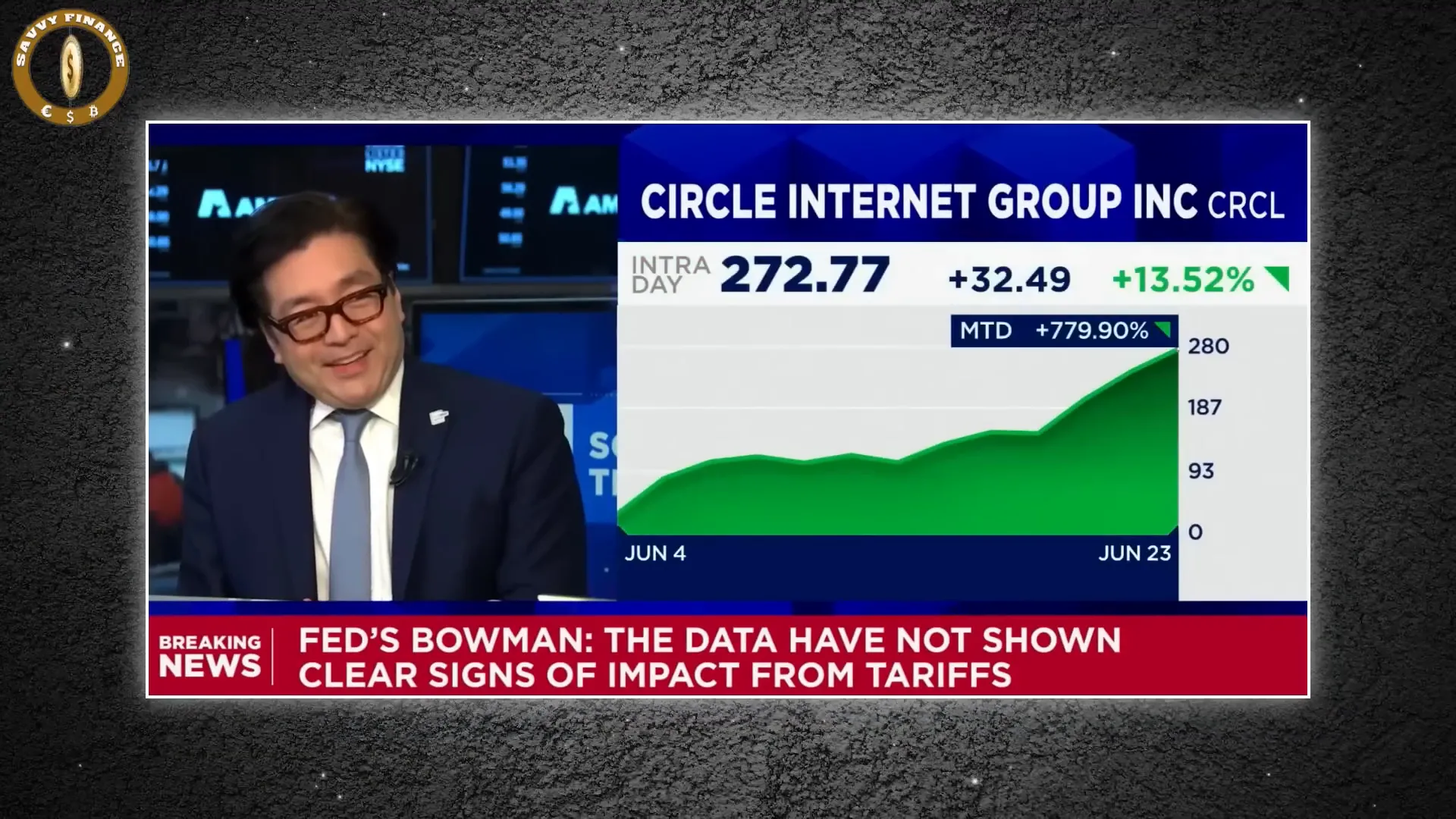

Tom Lee emphasizes that despite headline risks and geopolitical noise, the macro environment is improving on the margins. He points to several key factors bolstering his bullish outlook on cryptocurrency, bitcoin, and risk assets:

- Regulatory and Fiscal Clarity Through 2026: Lee highlights that tariffs, tax legislation, and regulatory frameworks have become more predictable, reducing a major source of market uncertainty.

- Dovish Federal Reserve Signals: The Fed’s reluctance to cut rates has drawn questions, signaling a potential shift toward a more accommodative stance if inflation continues to moderate.

- Inflation Expectations vs. Realized CPI: Inflation expectations remain significantly higher than actual consumer price inflation, which Lee sees as a potential positive surprise if inflation trends downward.

- Corporate Earnings Resilience: Despite concerns about economic weakening, earnings have generally come in stronger than expected, supporting stock valuations.

- Trillions on the Sidelines: Approximately $7 trillion remains parked in money market funds and short-duration treasuries—nearly double pre-pandemic levels—representing a substantial reservoir of liquidity that could fuel asset price appreciation if deployed.

Lee argues that this sidelined cash is especially potent for cryptocurrency and bitcoin. Unlike traditional equities, crypto markets have a relatively thin float and exhibit deep reflexivity, meaning that demand shocks can reprice the entire asset curve quickly. Even a small rotation of institutional capital into digital assets could trigger exponential price moves.

Institutional adoption remains cautious but is gradually increasing. Hedge funds are rotating into crypto, while pension funds and sovereign wealth portfolios are only beginning to explore exposure. This lag creates a bullish asymmetry that could underpin a prolonged revaluation of digital assets.

Market Sentiment and Speculation: Echoes of 2021?

Lee acknowledges signs of speculative behavior creeping back, such as the resurgence of SPACs and unusual valuations reminiscent of 2021. However, he notes a critical difference: institutional investors today are more cautious and see value in the market, unlike the previous cycle when everything was deemed expensive.

Retail investors, particularly the Robinhood community, have been the primary buyers during recent dips, while high net worth individuals and institutions have been raising cash. This dynamic suggests that while speculation exists, it is not yet pervasive across all market participants, preserving a foundation of strength beneath headline volatility.

Ray Dalio’s Warning: Systemic Fragility and the Debt Cycle Challenge

In stark contrast to Lee’s optimism, Ray Dalio presents a sobering analysis of the global economic system’s structural vulnerabilities. Based on decades of research into long-term debt cycles, Dalio’s view encompasses three interconnected pressures:

- High Debt Burdens: Both public and private debt levels are at historic highs, with government deficits reaching $2 trillion annually and debt service costs ballooning.

- Rising Geopolitical Tensions: Global realignment and strategic competition are eroding trust between major powers, fracturing international cooperation.

- Declining Trust in Fiat Currencies: Trust in traditional monetary systems and institutions is waning, prompting shifts toward alternative stores of value.

Dalio likens the credit system to a circulatory system delivering buying power throughout the economy. But when debt grows faster than income, interest payments crowd out productive spending, creating “plaque” that impedes economic health. The current trajectory risks pushing the system “over the edge,” where new debt is required just to service existing obligations.

Dalio proposes a “three-part, three-percent solution” to reduce the federal deficit to a sustainable level (around 3% of GDP), down from the current 7%. This involves balanced adjustments in:

- Spending cuts

- Tax revenue improvements

- Lower interest rates through improved supply-demand dynamics

However, Dalio is clear this is a political challenge as much as an economic one. Despite broad agreement on the need for action, consensus on implementation remains elusive, likened to a boat heading toward rocks with no agreement on how to steer clear.

The Multipolar World and the Rise of Digital Alternatives

Dalio also emphasizes the geopolitical dimension of systemic risk. The weaponization of finance, breakdown in supply chains, and erosion of trust are fragmenting the global system. This environment fuels demand for alternative assets such as gold, productive real assets, and increasingly, digital assets like bitcoin.

Unlike fiat currencies, bitcoin is governed by immutable code, has a fixed supply, and operates on decentralized infrastructure. For Dalio, bitcoin’s independence from central banks and political influence makes it a compelling hedge against monetary debasement, capital controls, and institutional decay.

Dalio acknowledges regulatory and adoption risks but recognizes bitcoin’s evolution into a digital alternative to gold. As traditional assets become increasingly tied to political will, the value of a censorship-resistant, portable store of value grows.

What This Means for Investors: Balancing Opportunity and Risk

Tom Lee’s near-term bullishness and Ray Dalio’s structural warnings are not mutually exclusive. Together, they underscore the complexity of today’s investment landscape, especially for cryptocurrency and bitcoin:

- Liquidity and Earnings Momentum: Favorable conditions could drive risk assets higher in the short to medium term.

- Systemic Fragility: Investors must prepare for potential shocks stemming from debt cycles, geopolitical shifts, and monetary policy challenges.

- Strategic Diversification: Holding a mix of traditional and digital assets may preserve purchasing power and optionality amid uncertainty.

Ultimately, bitcoin and select cryptocurrencies may serve as more than speculative trades—they could be essential components of portfolios designed for resilience in a rapidly changing global environment.

Conclusion: Navigating the Critical Months Ahead

The next few days and months are indeed critical for cryptocurrency, bitcoin, and broader markets. Investors should weigh Tom Lee’s confidence in improving macro visibility and resilient earnings against Ray Dalio’s caution about deep-seated systemic risks.

By understanding both perspectives, investors can better position themselves to capitalize on asymmetric opportunities while managing the risks of a fragmented, debt-laden world. Whether you lean toward Lee’s bullish outlook or Dalio’s systemic warnings, strategic allocation and vigilance will be key in this consequential macro window.

What’s your take? Are you optimistic about cryptocurrency and bitcoin’s upside, or do you share concerns about the fragility of the global financial system? Share your thoughts below.

Cryptocurrency, Bitcoin & The Critical Macro Outlook: Insights from Tom Lee & Ray Dalio. There are any Cryptocurrency, Bitcoin & The Critical Macro Outlook: Insights from Tom Lee & Ray Dalio in here.