In the evolving world of cryptocurrency, Bitcoin has long been considered king. But as new developments unfold, Ethereum is rapidly gaining ground, signaling that the much-anticipated altcoin season is finally upon us. This article delves into the latest trends, regulatory signals, and emerging opportunities shaping the crypto market today.

Table of Contents

- Ethereum ETF Inflows Surge: A Sign of Institutional Confidence

- The GENIUS Act and Ethereum’s Dominance

- Regulatory Signals: Ethereum’s Status and the Future of Altcoins

- Understanding Altcoin Season: What to Expect

- Spotlight on Quality Projects: Burn Metaverse and Beyond

- Institutional Interest Expands: Solana and AI Crypto Innovations

- The Future of Tokenization: Ondo Finance’s Vision

- Conclusion: A Bull Market for Cryptocurrency and Bitcoin Alternatives

Ethereum ETF Inflows Surge: A Sign of Institutional Confidence

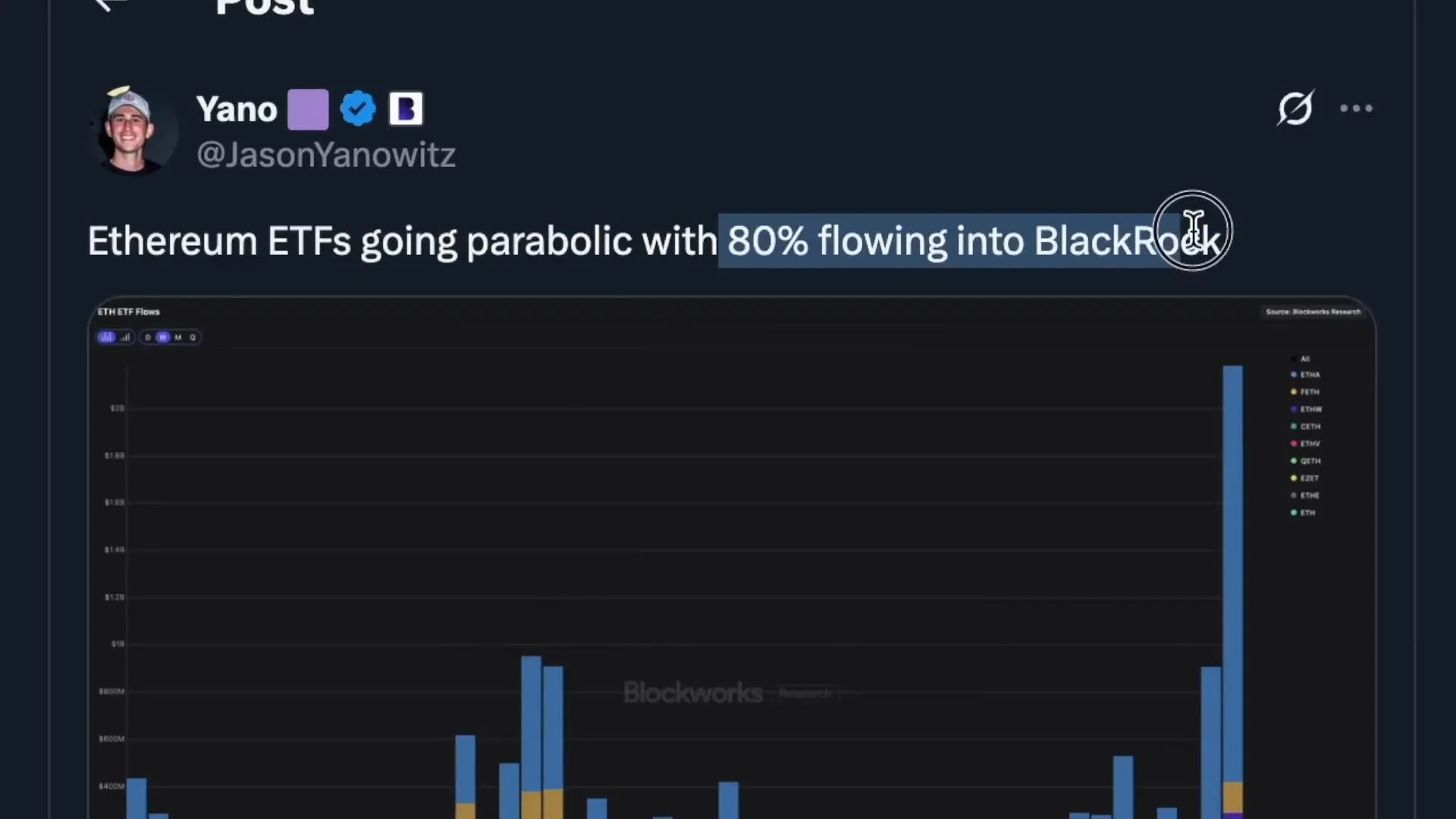

The crypto landscape is witnessing a remarkable shift as Ethereum ETF inflows are skyrocketing. Over 80% of these inflows are directed towards BlackRock, one of the most powerful financial institutions globally. Larry Fink, BlackRock’s CEO, is accumulating Ethereum in significant volumes, marking a pivotal moment for tokenization in finance.

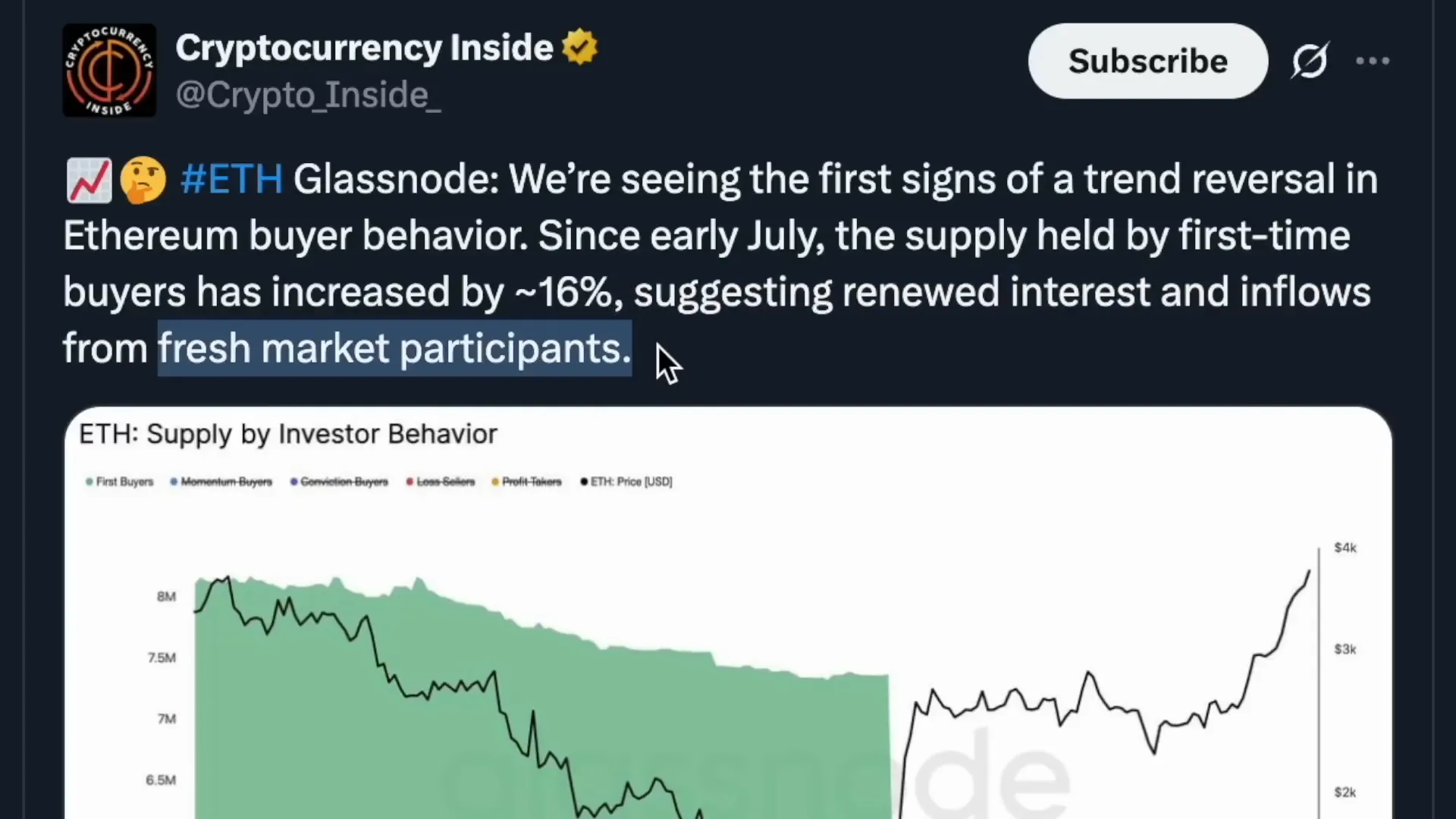

In just the past week, U.S. spot Ethereum ETFs attracted over $2.1 billion, the largest weekly inflow since their inception. This surge represents a clear trend reversal, signaling fresh market participants are eager to invest in Ethereum.

To put it simply, if Bitcoin was once the “landline,” Ethereum is now the “iPhone” of the crypto world—offering more utility and growth potential. Contrary to popular belief, Ethereum has outperformed Bitcoin over the last decade by a staggering 50x, making it a compelling investment choice.

The GENIUS Act and Ethereum’s Dominance

The recent passing of the stablecoin bill, signed into law by former President Trump, has further solidified Ethereum’s position. More than 50% of all stablecoins are deployed on the Ethereum blockchain, creating a dynamic similar to Google's dominance in internet search with 90% market share compared to minor players like Yahoo or Bing.

This regulatory clarity and adoption make Ethereum the largest beneficiary of the GENIUS Act, reinforcing its foundational role in the burgeoning tokenized asset economy. As stablecoins grow, so does Ethereum’s influence, with over 30% of all Ethereum fees generated by stablecoin transactions.

Regulatory Signals: Ethereum’s Status and the Future of Altcoins

One of the most encouraging signs for Ethereum investors comes from SEC Chair Paul Atkins, who has informally stated that Ethereum is not considered a security by the SEC. While official confirmation is still pending, this stance is a strong signal that regulators are embracing Ethereum and similar digital assets.

Atkins described Ethereum as a critical component for many other digital currencies, indicating that companies will continue to invest strategically in Ethereum’s ecosystem. This pro-crypto regulatory environment paves the way for broader institutional adoption and market growth.

Understanding Altcoin Season: What to Expect

Altcoin season is a cyclical event where altcoins, including Ethereum and other quality projects, experience significant price appreciation. Here’s how the cycle typically unfolds:

- Bitcoin reigns supreme: For years, Bitcoin is the dominant crypto asset as investors stack and hold.

- Ethereum gains utility recognition: Investors recognize Ethereum’s utility and the stablecoin ecosystem built on its blockchain.

- Network congestion and rising fees: As Ethereum’s price rises, network congestion leads to higher gas fees.

- Altcoins benefit: Faster and cheaper layer-one alternatives like Binance Coin (BNB) and Solana start gaining momentum.

- Speculative frenzy: Investors dive into smaller altcoins seeking big gains, often followed by a bear market phase before the cycle repeats.

Currently, Ethereum gas fees are relatively low due to the early stage of mass adoption, but this will change once mainstream users flood the network, triggering congestion and higher fees. This congestion historically sparks renewed interest in quality altcoins and Ethereum layer twos.

Spotlight on Quality Projects: Burn Metaverse and Beyond

As altcoin season approaches, it’s crucial to focus on quality projects with strong fundamentals. One such project is Burn Metaverse, a crypto MMORPG that combines AI, GameFi, and Web3 technologies to create immersive real and virtual world connections.

- Burn Metaverse is in open beta with an imminent launch on iOS and Android.

- It features a deflationary token model, rewarding players with stablecoin USDT rather than inflating token supplies, reducing sell pressure.

- Players can burn tokens to receive discounts in-game, tightening the limited token supply.

- Monthly buybacks use 10% of the game's fiat income to repurchase tokens, supporting price stability.

- Innovations like wearable tech integration and a new secure messaging app, “The Brain,” aim to enhance the metaverse experience.

Projects like Burn Metaverse illustrate the creative potential in crypto gaming and metaverse sectors, offering unique investment and participation opportunities during altcoin season.

Institutional Interest Expands: Solana and AI Crypto Innovations

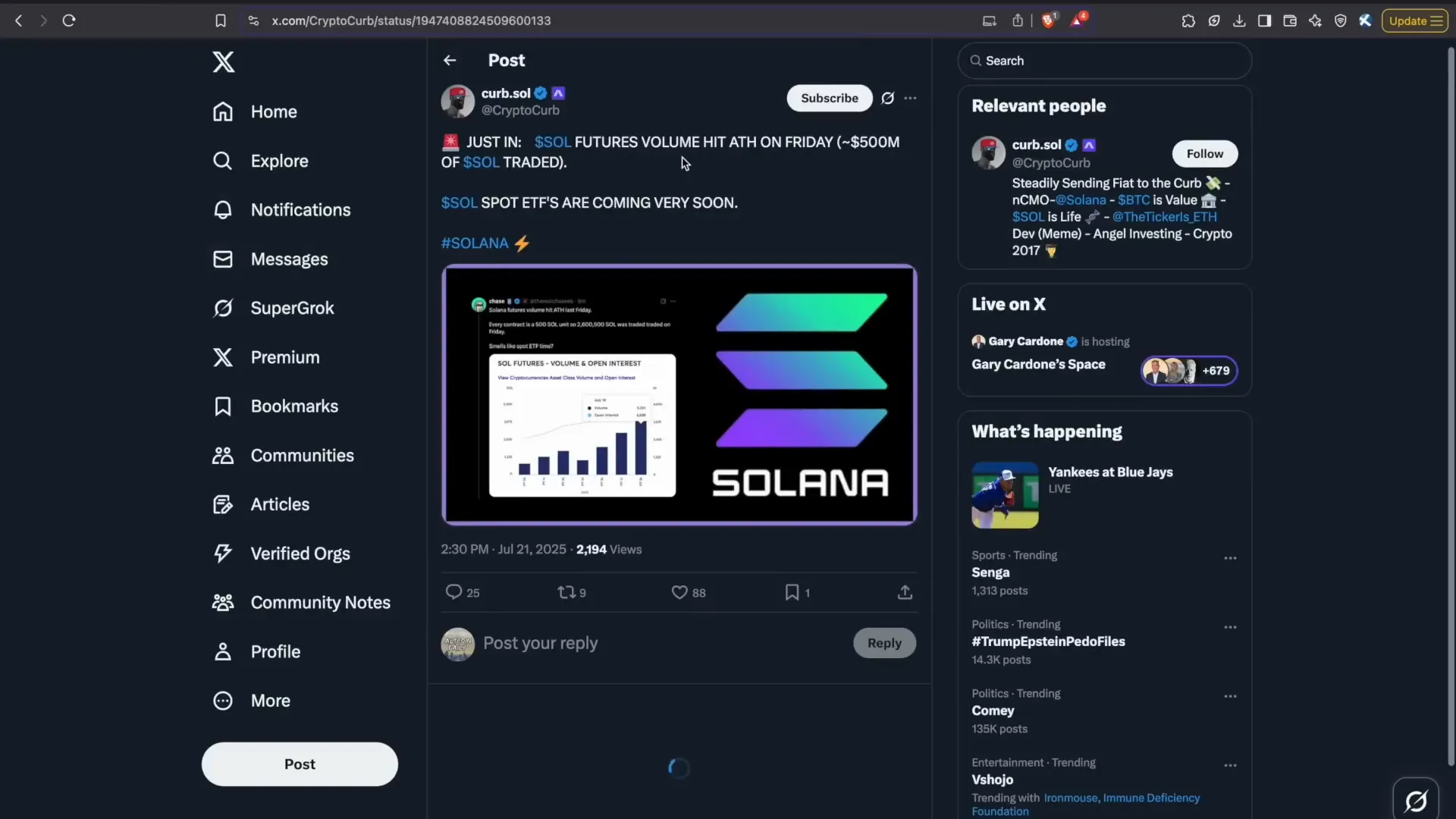

Besides Ethereum, other altcoins like Solana are gaining institutional attention. Solana futures recently hit an all-time high with $500 million traded, and spot ETFs for Solana are on the horizon. This indicates growing demand for direct exposure rather than just futures contracts.

In the AI crypto space, Chain GPT is making waves. Magic Eden, the leading NFT marketplace for Solana, has partnered with Chain GPT to launch an AI NFT generator that transforms simple prompts into minted art collections—merging AI with blockchain creativity.

For those bullish on AI-powered cryptos, these developments represent exciting frontiers. Also, free opportunities like earning Chain GPT tokens (cGPT) through engagement are available until early August.

The Future of Tokenization: Ondo Finance’s Vision

Looking ahead, Ondo Finance is spearheading the tokenization of securities, following the blueprint stablecoins set for the dollar. The vast majority of regulated financial assets are expected to settle on blockchain rails within the next decade.

Ondo’s projections highlight a long-term bull market in tokenization, potentially lasting decades, as financial markets embrace blockchain technology for efficiency and transparency.

Conclusion: A Bull Market for Cryptocurrency and Bitcoin Alternatives

The crypto market is entering a new phase where Ethereum’s utility, regulatory clarity, and institutional backing are driving a significant shift. Bitcoin remains foundational, but Ethereum and quality altcoins are poised to benefit from growing adoption and technological advancements.

As altcoin season begins, investors should focus on projects with real utility, strong tokenomics, and institutional support. Whether it’s Ethereum ETFs going parabolic, innovative metaverse games like Burn, or the rise of Solana and AI cryptos, the landscape is rich with opportunity.

Stay informed and ready to navigate this evolving market, as the bull run in cryptocurrency and bitcoin alternatives looks set to last for years to come.

Cryptocurrency, Bitcoin, and the Rising Ethereum Bull Market: Altcoin Season Begins. There are any Cryptocurrency, Bitcoin, and the Rising Ethereum Bull Market: Altcoin Season Begins in here.