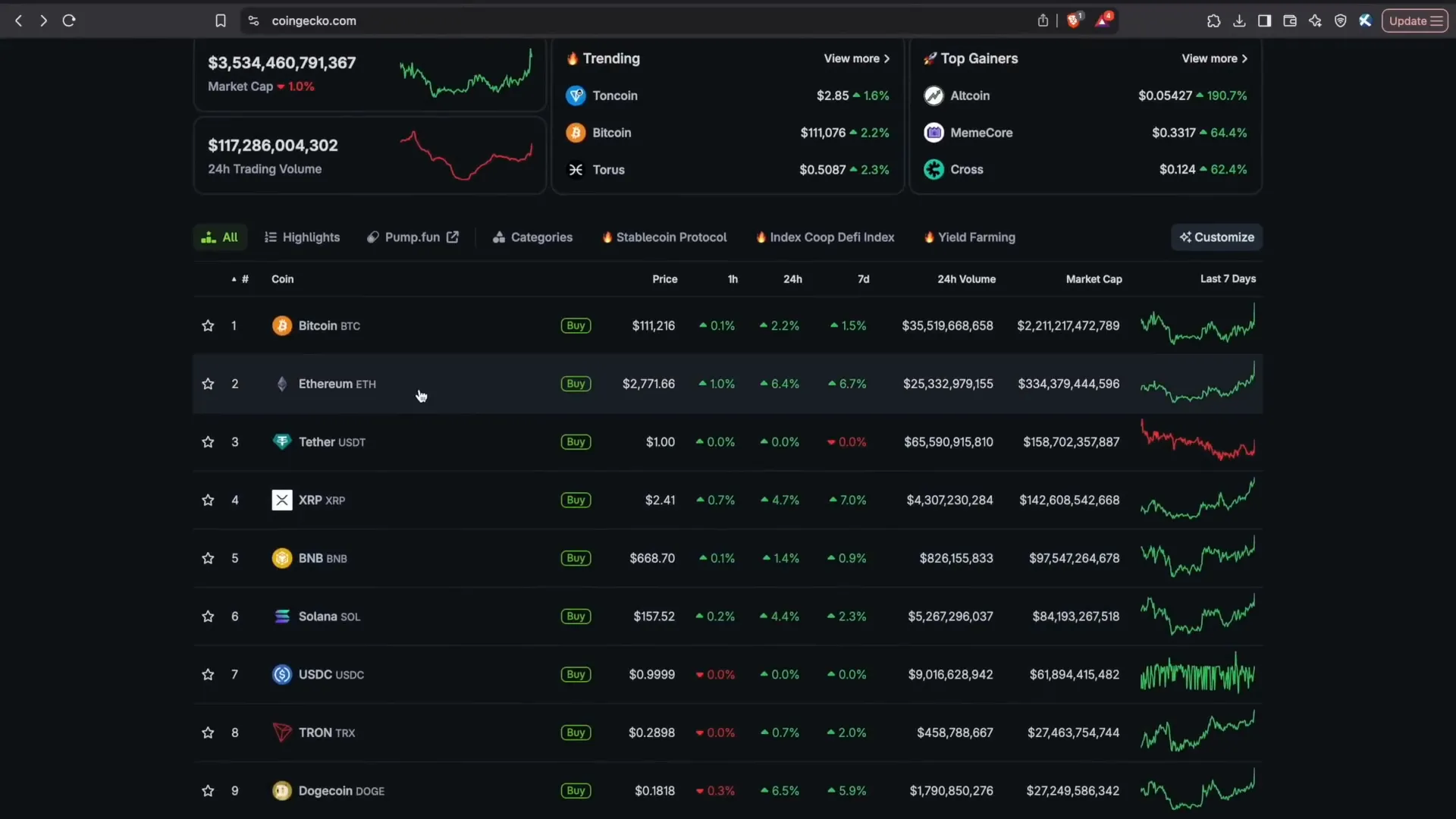

The United States stands at the forefront of global innovation with its deepest capital markets and top-tier technical talent. This unique combination has fueled the nation’s growth since its inception, and there’s no reason why the US shouldn’t be the undisputed leader in digital assets and blockchain technology. Today, more than 55 million Americans actively participate in the crypto economy, which now boasts a market cap exceeding $3.3 trillion.

Understanding the recent movements in cryptocurrency prices, especially Bitcoin, Ethereum, and XRP, requires a look into the evolving regulatory landscape and the significant legislation shaping this market. Let’s dive into what’s driving the momentum and why now might be the best time to step into this dynamic space.

Table of Contents

- The Game-Changing Role of Crypto Market Legislation

- Bitcoin ETFs: The Catalyst for Institutional Involvement

- Financial Advisors: The Untapped Force in Crypto Adoption

- The Future of Altcoins in a Regulated Market

- Why Now Is the Time to Get In

- Final Thoughts

The Game-Changing Role of Crypto Market Legislation

Brad Garlinghouse, CEO of Ripple—the company behind XRP, currently the fourth largest cryptocurrency globally—recently addressed the Senate Banking Committee. His message was clear: prioritize the passage of comprehensive market structure legislation for digital assets. This legislation is essential to provide the clarity and regulatory framework the industry has long awaited.

The absence of clear rules has kept many institutional investors on the sidelines and pushed innovation offshore, limiting regulatory oversight and exposing consumers to higher risks. The market structure bill aims to fix this by defining key elements such as what constitutes a coin, a layer-one decentralized application (dApp) platform, NFTs, and lending protocols. This clarity is crucial for attracting “whale money”—large institutional investors—who currently hesitate to dive in due to uncertainty.

Bitcoin ETFs: The Catalyst for Institutional Involvement

One of the most pivotal moments in crypto history occurred at the start of 2024, when Bitcoin ETFs were approved. This regulatory green light allowed financial giants like BlackRock, Fidelity, and Charles Schwab to legally offer Bitcoin exposure to their clients. Prior to this, retail investors—everyday people like you and me—were able to “front-run” institutions, getting in early before the big players could participate.

This shift is monumental. The floodgates are opening for institutional money, which has been largely absent from Bitcoin ownership until now. The approval of Bitcoin ETFs triggered a significant increase in demand, which was immediately reflected in price movements.

Unlike the internet bubble of the late 1990s and early 2000s, where the beneficiaries were mostly accredited investors within the US, the crypto market is truly global and inclusive. The upcoming legislation and regulatory clarity will enable a much wider audience—including financial advisors who currently cannot recommend crypto products—to participate.

Financial Advisors: The Untapped Force in Crypto Adoption

In the United States alone, there are over 300,000 financial advisors who regularly consult with clients about stocks, bonds, and mutual funds. However, most are currently restricted from recommending Bitcoin or similar crypto products. This is about to change.

As clearer regulations come into place, these advisors will become a powerful marketing team for Bitcoin and other cryptocurrencies, bringing them into mainstream portfolios. While some firms have thousands of advisors still unable to discuss crypto, it’s estimated that within five years, nearly all will be able to do so.

This upcoming wave of endorsements from traditional finance will further fuel the growth and acceptance of cryptocurrencies like Bitcoin, Ethereum, and XRP.

The Future of Altcoins in a Regulated Market

While Bitcoin has made significant strides with ETF approval, altcoins have faced more regulatory hurdles. Despite this, several altcoins have grown impressively over the past decade, even under uncertain legal conditions.

Looking forward, the stablecoin bill and the market structure bill will provide the much-needed regulatory clarity to unlock the potential of altcoins. This will likely trigger a surge similar to what Bitcoin experienced with ETF approval, but this time, it will benefit Ethereum, XRP, Solana, and other promising projects.

For instance, Supra, a newer chain, recently processed over 5 million transactions in a single day—surpassing previous weekly records and rivaling Ethereum layer two solutions. This highlights the rapid technological advances happening in the space.

Other projects worth watching include BitTensor, which is gaining attention for its AI-focused blockchain initiatives, and partnerships like Ripple’s recent collaboration with BNY Mellon, a trusted custody bank, signaling increasing institutional confidence.

Cryptocurrencies Poised to Thrive

- Ethereum: A foundational platform for decentralized applications with growing institutional interest.

- XRP: Positioned strongly due to Ripple’s active leadership and partnerships.

- Solana: Known for its speed and scalability, expected to make significant gains.

- BitTensor: A promising AI-focused blockchain project linked with major players like BlackRock.

- Supra: Demonstrating rapid transaction growth and innovative finance features.

Why Now Is the Time to Get In

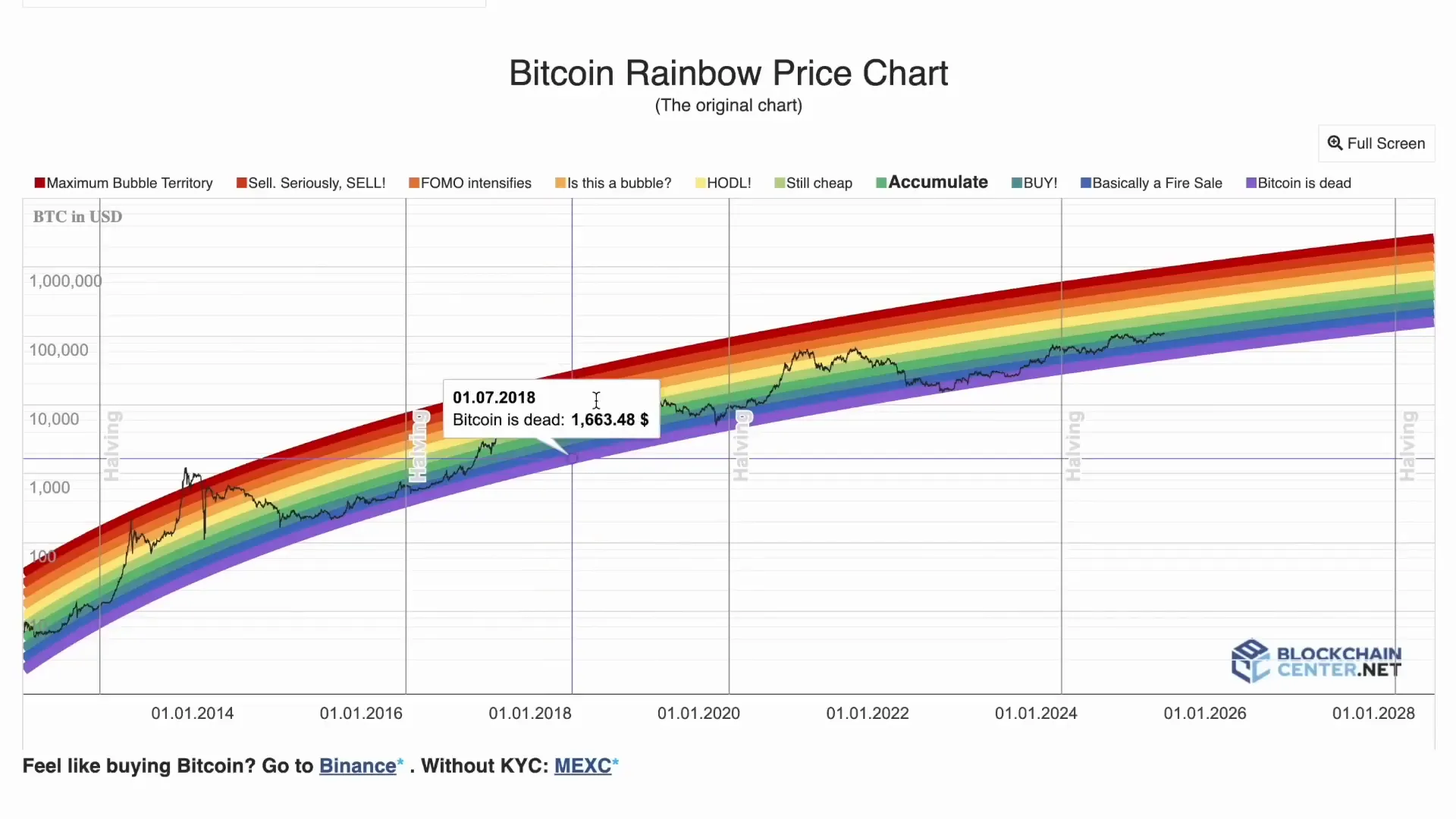

If you’re wondering whether it’s too late to invest in cryptocurrencies like Bitcoin, Ethereum, or XRP, consider the bigger picture: the industry is still in its early days. The recent market gains are largely driven by retail investors ahead of institutional money entering the space in full force.

The stablecoin bill, which has passed Congress but awaits the president’s signature, will enable the onramps for large investors and provide them with the regulatory certainty needed to confidently invest.

This shift from regulatory headwinds to tailwinds is creating an environment ripe for growth. For those who start paying attention now, the next five to ten years could be incredibly rewarding.

Final Thoughts

The US has all the ingredients to become the global crypto capital, but it hinges on smart regulation and clear market structures. Legislation like the market structure bill and stablecoin bill will define the future of the industry, unlocking massive opportunities for both investors and innovators.

As a cryptocurrency enthusiast or investor, staying informed and prepared is crucial. The days when retail investors could get in early before the institutions are fading. Soon, financial advisors and major firms will be recommending crypto assets widely, and the market will experience a new wave of adoption.

Remember, the crypto revolution is still in its infancy. By understanding the regulatory landscape and the technology driving these changes, you position yourself for success in this evolving market.

Stay curious, stay informed, and most importantly, stay early.

Cryptocurrency, Bitcoin, and the Real Reason Behind Their Recent Surge. There are any Cryptocurrency, Bitcoin, and the Real Reason Behind Their Recent Surge in here.