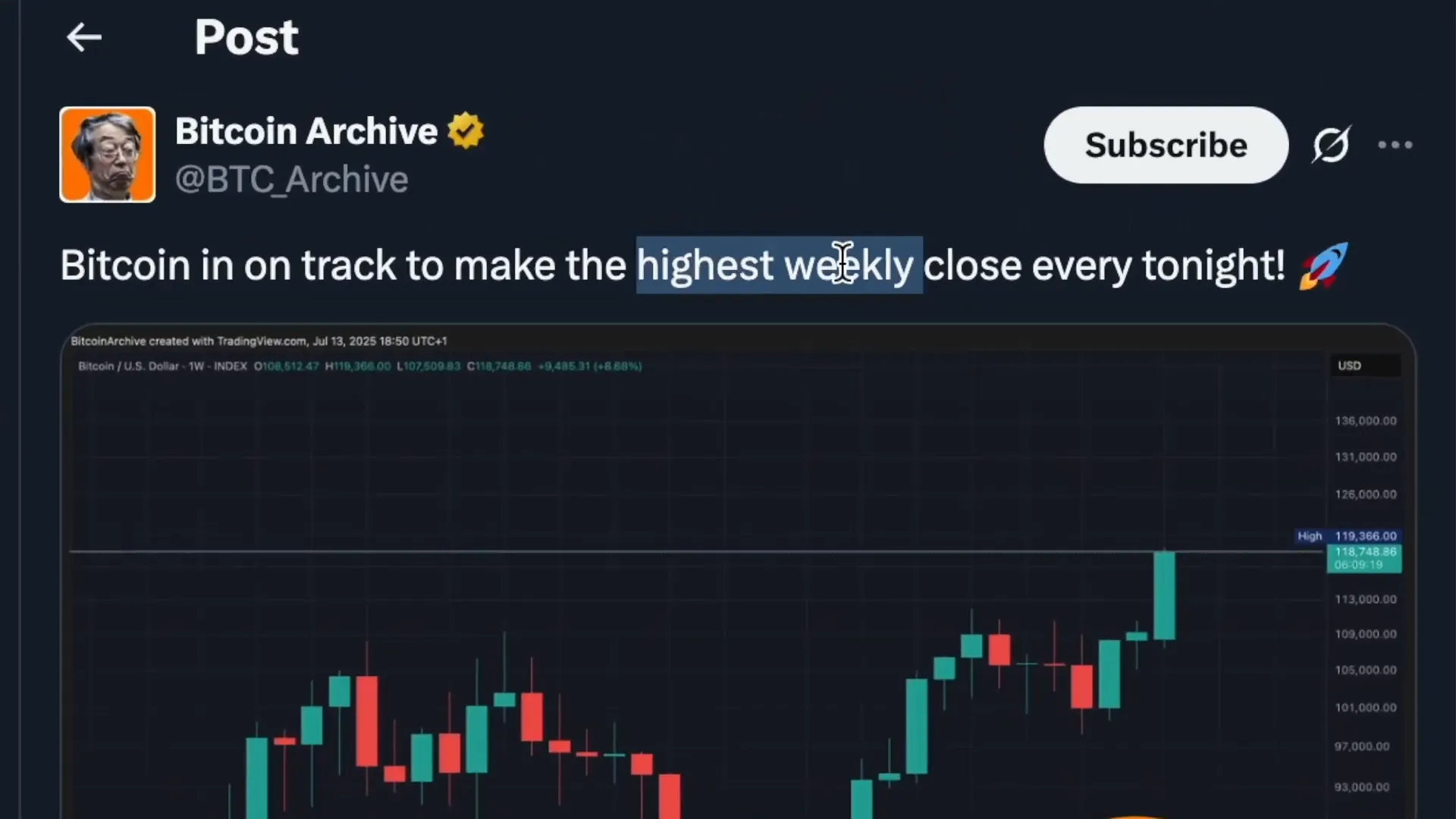

Bitcoin has just done something it’s never done before—hitting a new all-time high and on track to close the week at its highest level ever. As cryptocurrency enthusiasts watch this historic moment unfold, there’s much more than just price action fueling the excitement. This week marks a pivotal turning point for the entire crypto industry, driven by anticipated regulatory clarity that could reshape how digital assets are perceived, traded, and invested in across the United States.

Table of Contents

- Crypto Week in Congress: A Game Changer

- Why This Market Structure Bill Matters More Than Bitcoin ETFs

- Bitcoin’s Market Cap: On the Verge of Surpassing Amazon

- Understanding Bitcoin’s Value Despite No Cash Flow

- Looking Ahead: What This Means for Crypto Investors

Crypto Week in Congress: A Game Changer

For over 15 years, the crypto community has awaited clear federal guidelines on digital assets. This week, that long-anticipated change is coming to a head. Beau Hines, executive director on former President Trump’s advisors for digital assets, recently called it “Crypto Week in the House.” This is a big deal for anyone invested in cryptocurrency.

Two crucial bills are moving forward:

- The Genius Act (Stablecoin Act): Already passed by Congress, this bill is headed to the president’s desk this week. It sets the regulatory framework for stablecoins, a critical component of the crypto ecosystem.

- The Clarity Act: Currently, digital assets operate in a regulatory gray area. The SEC and CFTC lack clear jurisdictional boundaries, leaving investors and entrepreneurs uncertain and innovation stifled. The Clarity Act aims to change that by establishing a clear federal framework.

This legislation will create a codified exemption pathway for digital commodity projects to raise capital, support secondary market trading, and allow SEC-registered entities to participate in digital commodity markets. Essentially, it’s about making America the crypto capital of the world.

Why This Market Structure Bill Matters More Than Bitcoin ETFs

Some say this market structure bill and the stablecoin legislation will have a bigger impact than the Bitcoin ETF approvals, which already shook the market significantly. Just last week, U.S. Bitcoin ETFs bought over 23,000 Bitcoin, while only around 3,150 new Bitcoins were mined. This means ETFs are soaking up all available Bitcoin, pushing prices higher.

However, the real game-changer is regulatory clarity for Ethereum and other digital assets. Ethereum, the second largest cryptocurrency, remains in regulatory limbo—neither officially classified as a security nor a commodity. This uncertainty keeps institutional investors cautious, limiting their willingness to invest.

Here’s a glimpse into the confusion: Over two years ago, SEC Chair Gary Gensler couldn’t definitively say whether Ethereum was a security or not. This lack of clarity has persisted, but the upcoming legislation aims to resolve it, opening the door for big money to confidently invest in Ethereum and beyond.

"Is ether a commodity or a security?" — Gary Gensler, SEC Chair (paraphrased)

"That uncertainty is bad." — Congressional remarks on SEC’s regulatory clarity

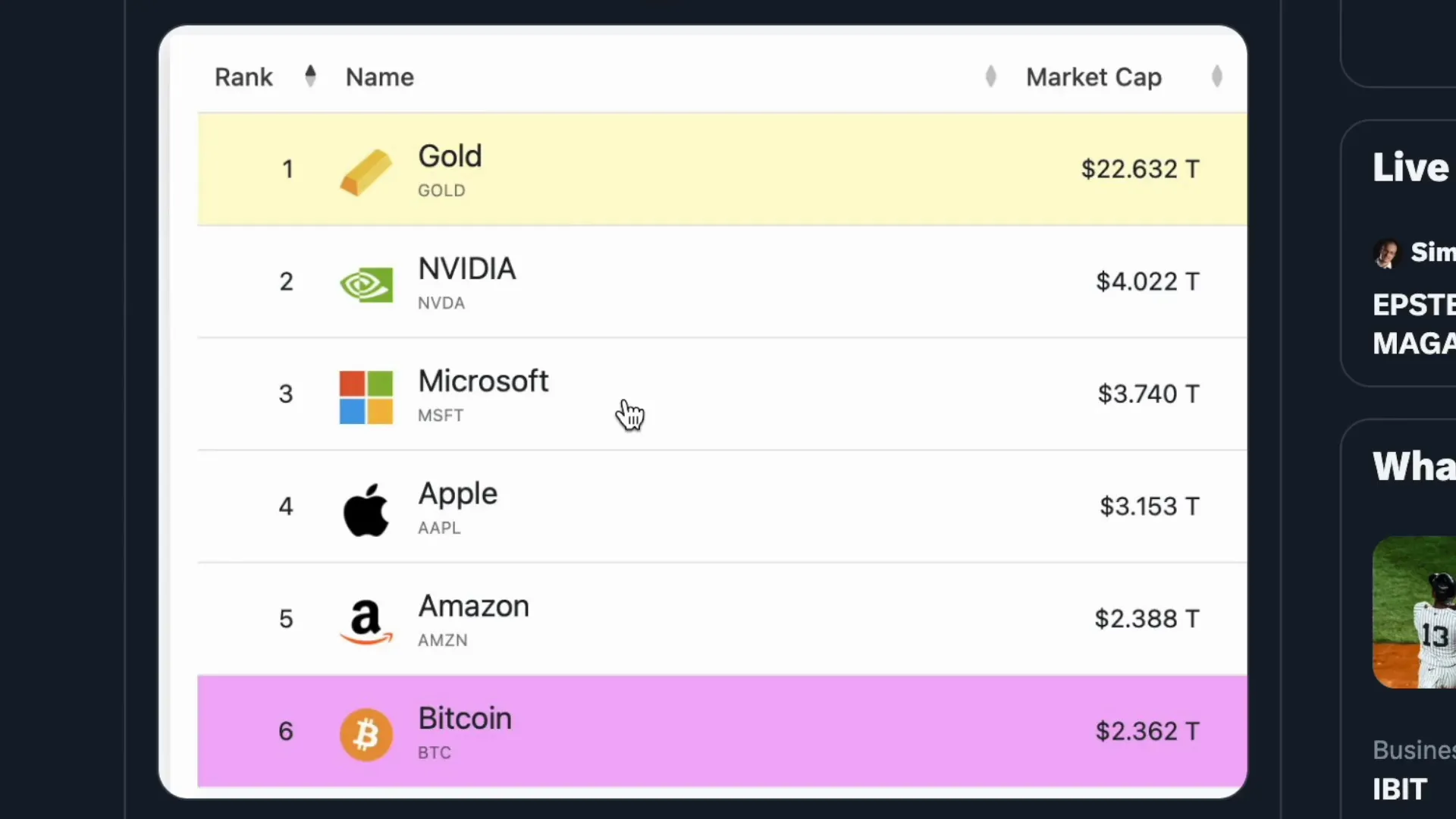

Bitcoin’s Market Cap: On the Verge of Surpassing Amazon

In the broader financial landscape, Bitcoin is making waves beyond just the crypto community. Currently valued at around $2.36 trillion, Bitcoin is about to surpass Amazon’s market cap of $2.388 trillion. While it’s not competing with Amazon as a business, Bitcoin’s use case is often compared to gold—earning the nickname “digital gold.”

Bitcoin offers distinct advantages over gold:

- It’s easier to transport

- More portable and divisible

- Mathematically scarce, unlike gold’s perceived scarcity

Many believe Bitcoin is undervalued relative to gold and expect it to reach parity or higher within the next five to seven years.

Understanding Bitcoin’s Value Despite No Cash Flow

One of the most common questions about Bitcoin is: how can it be valuable if it produces no cash flow? This is a sticking point for many investors who are used to valuing assets based on their income generation, like stocks or real estate.

Consider this example: Bonds and real estate provide consistent cash flows, but if the underlying currency is losing value due to inflation, those cash flows might not increase your real wealth. In fact, if you buy a bond paying $1 per year for seven years at $100 today, you’re effectively losing money over time.

Similarly, real estate might generate rental income, but if the currency weakens, the nominal cash flows don’t translate into real wealth growth when measured against better stores of value like Bitcoin.

Bitcoin’s strength lies in being “good money” — it is immutably scarce, portable, durable, divisible, and fungible. Unlike other assets, Bitcoin is designed to hold value over time in a way that outpaces inflationary fiat currencies.

"Bitcoin has no cash flow, and that's okay." — A perspective that challenges traditional valuation models

Investors are increasingly recognizing that holding wealth outside of Bitcoin, especially in cash-flowing assets priced in a depreciating currency, might not make sense. Bitcoin’s unique monetary properties make it the best money humanity has ever seen.

Looking Ahead: What This Means for Crypto Investors

This week is monumental not just for Bitcoin, but for the entire cryptocurrency market. Clear regulatory frameworks will unlock institutional capital, reduce uncertainty, and foster innovation in the U.S. crypto space. While Bitcoin continues to dominate headlines with its historic price performance, altcoins like XRP and Cardano are also gaining attention and will benefit from the broader positive momentum.

For investors and enthusiasts, staying informed about both Bitcoin and altcoins is crucial as this new chapter unfolds.

In summary:

- New legislation will provide clarity and regulatory certainty for digital assets.

- Bitcoin is reaching historic market caps, challenging traditional financial giants.

- Ethereum and other altcoins stand to explode once regulatory clarity arrives.

- Bitcoin’s value proposition as digital gold remains strong despite lacking cash flow.

It’s a thrilling time to be part of the cryptocurrency world. The stage is set for a new era of growth, adoption, and innovation.

Stay tuned, stay informed, and as always, keep exploring the exciting world of cryptocurrency and bitcoin.

Cryptocurrency, Bitcoin, and the Historic Week Ahead: Why This Rally Is Different. There are any Cryptocurrency, Bitcoin, and the Historic Week Ahead: Why This Rally Is Different in here.