In a world where the total global assets exceed one quadrillion dollars, Bitcoin’s current market cap of around two trillion may seem insignificant—especially to nation-states engaged in geopolitical conflicts. Yet, the deeper truth about fiat currencies, central banks, and the emerging power of Bitcoin reveals a seismic shift in how money functions, how governments finance wars, and how individuals can protect their wealth. This article unpacks the essential insights from Lynn Alden’s analysis, shedding light on why Bitcoin isn’t just another investment but a revolutionary alternative to the failing fiat system.

Table of Contents

- The Illusion of Scale: Bitcoin vs. Global Financial Markets

- Central Banks: The Hidden Engine of War and Inflation

- The True Cost of Fiat: Inflation, Debt, and Endless War

- Bitcoin: The Antidote to Monetary Manipulation

- The Road Ahead: A Crossroads for Money and Power

- Final Thoughts

The Illusion of Scale: Bitcoin vs. Global Financial Markets

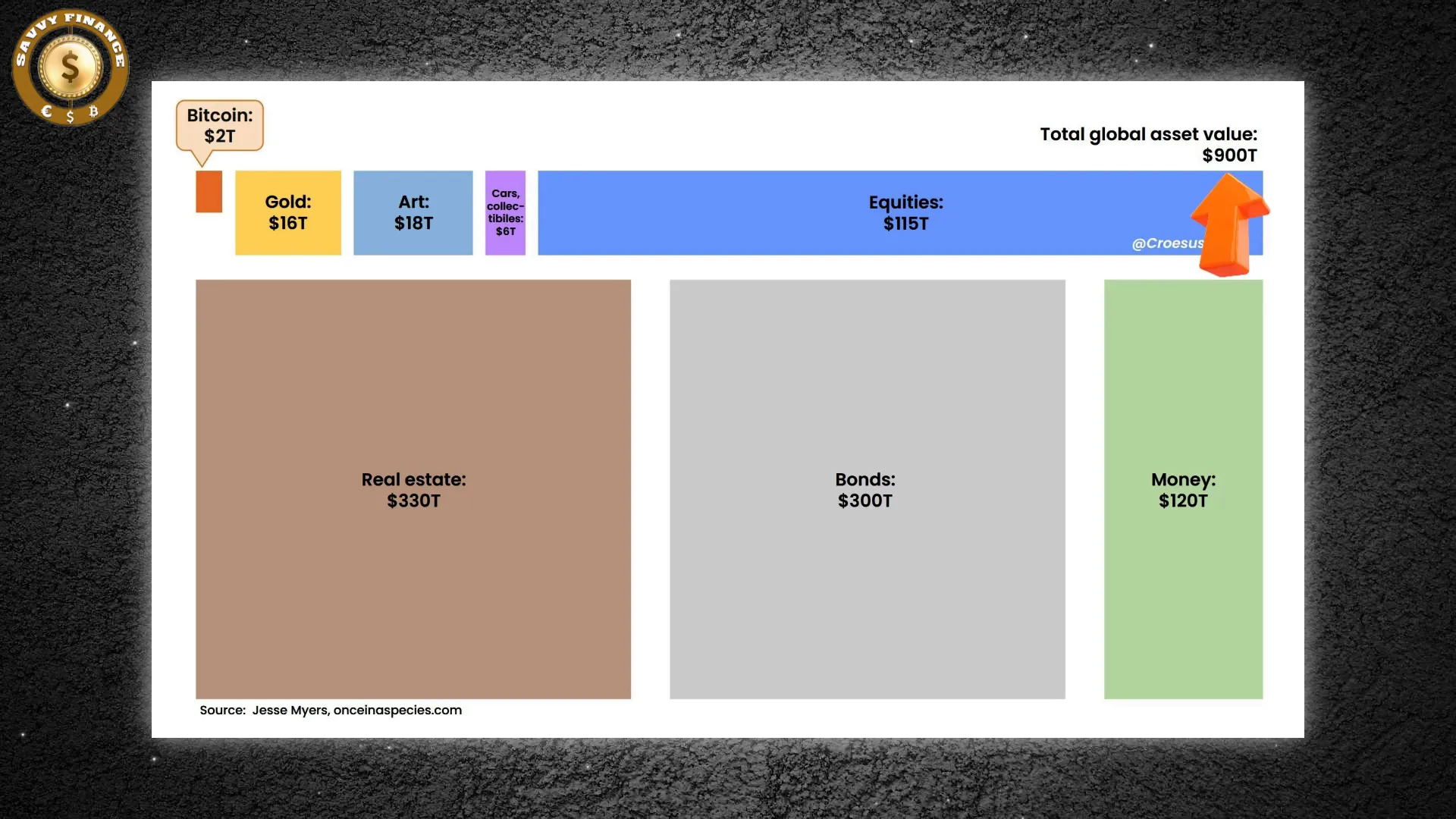

Bitcoin’s market cap, roughly two trillion dollars, is a mere drop in the ocean compared to the vastness of global financial markets. To put it in perspective:

- The US bond market alone is valued at about $36–37 trillion.

- Global sovereign bond markets reach tens or even hundreds of trillions.

- The global money supply surpasses $100 trillion.

At this scale, Bitcoin’s impact on nation-states’ ability to wage war or finance large-scale operations is currently negligible. It would require Bitcoin to grow at least tenfold or more to begin influencing these entrenched systems meaningfully.

However, this doesn’t mean Bitcoin isn’t solving critical problems today. For millions of people locked out of traditional payment systems or seeking protection from currency debasement, Bitcoin offers a vital lifeline.

Central Banks: The Hidden Engine of War and Inflation

Central banks are often portrayed as neutral technocrats who simply adjust interest rates and inflation targets. But the reality is far more complex and unsettling. Central banks have become the backbone of government financing, especially in times of crisis and war.

Instead of raising taxes to fund wars or massive deficits, governments rely on central banks to expand the monetary base—essentially printing money out of thin air. This process inflates the currency, erodes the purchasing power of savers, and widens the wealth gap.

Every crisis—whether a financial crash, war, or bond market turmoil—becomes an excuse to expand central bank balance sheets. The result is always the same:

Devalue the currency, preserve the regime.

This is the hidden cost of empire. From the US to the UK to Japan, the system is rigged to keep credit expanding, even if it means sacrificing the long-term value of your money.

How Central Banks Fund Sovereigns Behind the Scenes

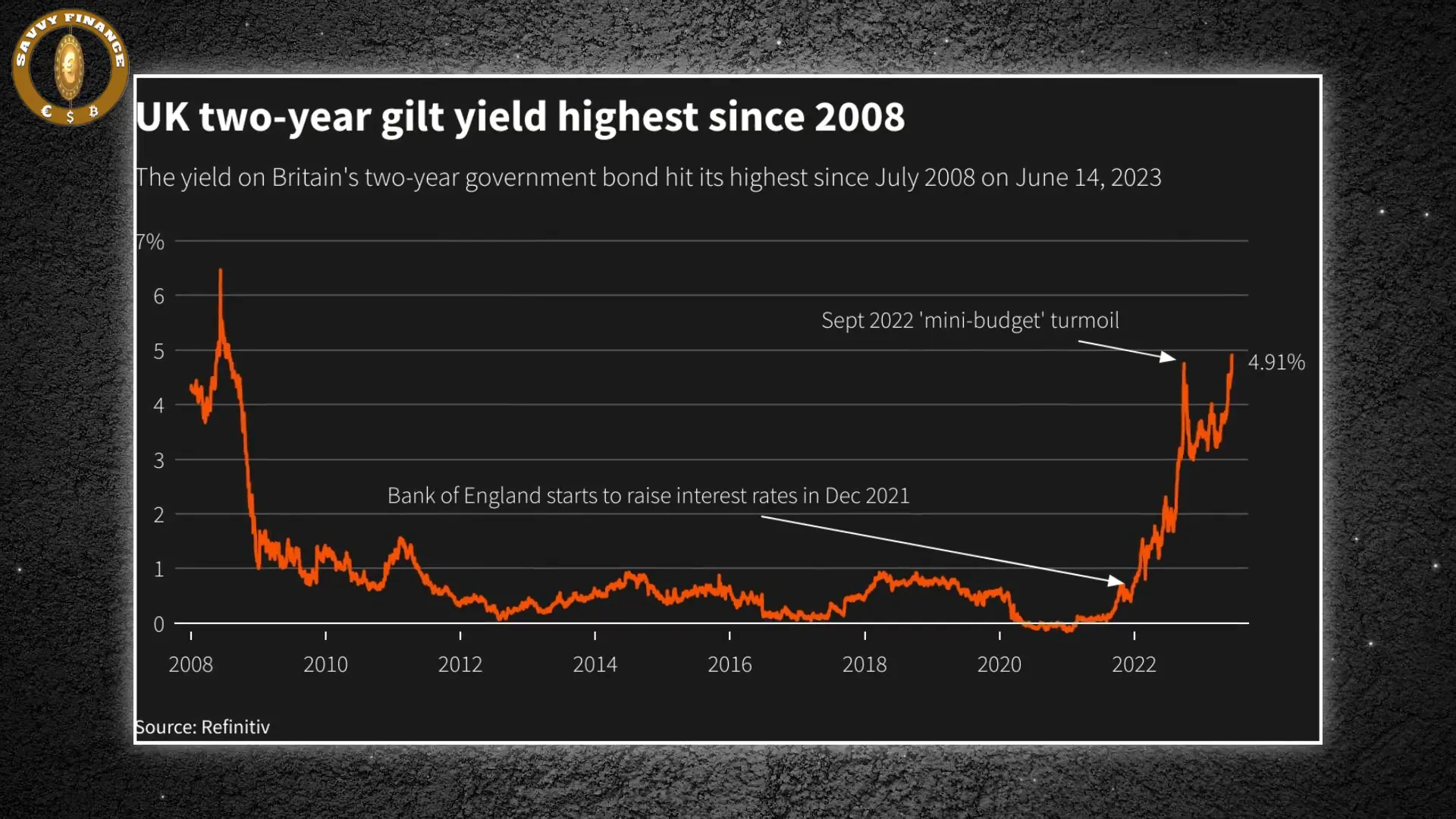

Central banks operate as the foundational ledger for fiat currency, controlling the size of the money supply to manage economic stability. But a critical, often unspoken function is their role in funding sovereign debt. When governments face disorderly bond markets or excessive spending, central banks step in to buy bonds or print more money, effectively preventing defaults or market crashes.

A recent example is the 2022 UK gilt crisis, where the Bank of England abandoned its balance sheet reduction plans and increased its holdings to stabilize the bond market. This flexibility, while stabilizing in the short term, perpetuates a cycle of debt and inflation that ultimately harms savers and citizens.

Central Banks and Economic Cycles: Arsonists or Firefighters?

Central banks often claim to be countercyclical—stimulating the economy during downturns and cooling bubbles during booms. However, their interventions frequently sow the seeds of the next crisis. For example, liquidity injections during the late 1990s helped fuel the dot-com bubble, and subsequent rate cuts inflated the 2008 housing bubble.

Rather than stabilizing, central bank policies tend to be procyclical, prioritizing short-term fixes over long-term stability. This creates a treadmill where credit must continually expand to avoid recessions, pulling consumption and debt forward from the future.

The True Cost of Fiat: Inflation, Debt, and Endless War

Fiat money is not neutral. It is a deliberate tool designed to fund the state at any cost. Lynn Alden emphasizes that over 600 fiat currencies have existed throughout history, and nearly all have eventually collapsed to zero. This is no accident—it’s the system’s design.

Every dollar printed erodes trust in the currency. Every rate cut or bond bailout widens inequality by rewarding debtors and punishing savers. The system encourages speculation over saving and short-term gains over long-term investment.

From World War I abandoning the gold standard to modern conflicts like Iraq and Ukraine, wars are financed not by direct taxation but by monetary debasement. The consequences manifest in rising food prices, collapsing currencies like the Argentine peso or Turkish lira, and social unrest.

Bitcoin: The Antidote to Monetary Manipulation

Bitcoin enters this landscape as a scarce, borderless, and decentralized alternative immune to political manipulation. Unlike fiat, Bitcoin’s supply is fixed and predictable, governed by math rather than politics.

Its decentralized nature means no single entity can weaponize it to fund wars or bail out failing governments. As more people recognize the inherent flaws of fiat, Bitcoin offers a lifeboat in a storm of global debasement.

Though still early in its adoption—at just a two trillion dollar market cap—Bitcoin’s growth trajectory suggests it will eventually undermine the very foundations of state power over money. When a meaningful percentage of the global population chooses Bitcoin over fiat, it will erode seigniorage and monetary control.

Why Bitcoin’s Next Tenfold Growth is Overdue

Bitcoin’s rise won’t happen overnight. Its adoption is a massive network effect that requires time, trust, and resilience. Jeff Booth and Lynn Alden highlight that Bitcoin is antifragile but not invincible—its future depends on remaining decentralized and secure.

As Bitcoin becomes faster than fiat currency and harder than gold, it will continue gaining market share. This shift could force nation-states to compete with a monetary system they cannot control, limiting their ability to fund deficits through inflation.

Bitcoin also presents a digital age solution for money, unlike gold or equities, which cannot be easily used for everyday transactions in the modern economy.

The Road Ahead: A Crossroads for Money and Power

We stand at a critical juncture. Fiat systems are stretched to their breaking points, burdened by debt, inflation, and geopolitical risks. The world is searching for a harder truth—a fairer ledger that answers to no one.

Bitcoin is that ledger. It offers an escape from the slow-motion theft embedded in fiat currencies. As more individuals opt out of traditional systems, governments will find it harder to finance wars, bailouts, and endless debt cycles.

For savers, investors, and citizens alike, understanding this shift is vital. Bitcoin isn’t just an investment; it’s a rejection of monetary manipulation and a step towards financial freedom.

Final Thoughts

The interplay between central banks, fiat currencies, and Bitcoin paints a picture of profound change. Central banks have long fueled empires through inflation and debt, sacrificing long-term value for short-term stability. Bitcoin, with its fixed supply and decentralized nature, challenges this paradigm.

While Bitcoin’s current scale may seem small, its potential to reshape the global financial order is immense. As the world grapples with the consequences of monetary debasement, Bitcoin’s role as a sound alternative will only grow stronger.

For those seeking to protect their wealth and understand the future of money, embracing the lessons of Lynn Alden’s insights is essential. The question is no longer if Bitcoin will rise, but how soon it will redefine money as we know it.

Cryptocurrency, Bitcoin, and the Future of Money: Why Central Banks Are About to Shatter All Expectations. There are any Cryptocurrency, Bitcoin, and the Future of Money: Why Central Banks Are About to Shatter All Expectations in here.