In the ever-evolving world of cryptocurrency, one thing is clear: Wall Street is making a strong move into crypto, with Ethereum emerging as the star of this convergence. As the landscape shifts, Ethereum’s price is breaking records, and experts are predicting unprecedented growth in the near future. If you’re wondering why Ethereum is set to explode, and what that means for Bitcoin and the broader altcoin market, you’ve come to the right place.

This article dives deep into the latest insights from market experts, including Tom Lee, and unpacks why Ethereum could hit over $15,000 per coin by 2025. We’ll also explore the factors driving this momentum, the smart money behind these moves, and what it means for anyone invested in cryptocurrency, bitcoin, and altcoins.

Table of Contents

- Wall Street’s Convergence on Ethereum

- Ethereum Price Targets: From $4,000 to $15,000 and Beyond

- Altcoins Rally and Regulatory Clarity on the Horizon

- Smart Money vs. Dumb Money: Who’s Winning the Bitcoin Battle?

- Bitcoin’s Sky-High Price Predictions

- Why Now Is the Time to Act

- Conclusion: Get Serious About Crypto Now

Wall Street’s Convergence on Ethereum

The real game changer happening right now is Wall Street’s growing interest in crypto, with Ethereum taking center stage. This isn’t just hype; it’s a strategic choice by institutional investors and financial giants who are focusing much of their crypto activity on Ethereum’s network.

Why Ethereum? Stablecoins have revolutionized how Wall Street views crypto’s utility. They have created a moment akin to the “ChatGPT moment” for crypto—viral consumer adoption is driving merchant interest, especially outside the US, and banks are beginning to see stablecoins as a viable business model.

Even major players like Citigroup are exploring launching their own stablecoins to manage deposits, underscoring the institutional pivot to Ethereum-based solutions. This convergence is fueling a rally that’s unlike anything we’ve seen before and is expected to continue in waves over the coming months.

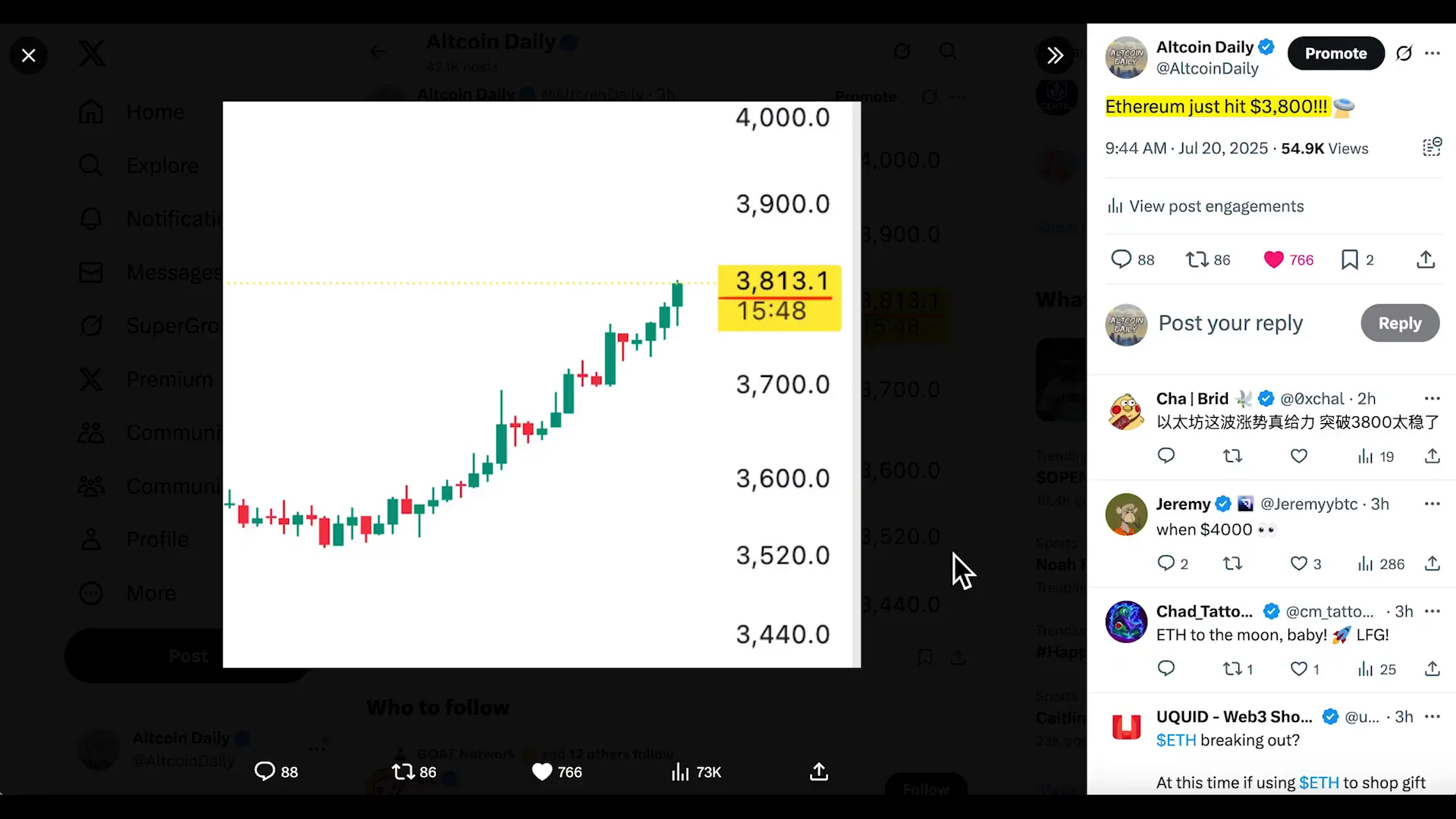

Ethereum Price Targets: From $4,000 to $15,000 and Beyond

The current bullish momentum is supported by technical and fundamental analysis. Market experts like Fundstrat’s Tom Lee and Bitminds’ Mark Newton are bullish on Ethereum’s short- and mid-term prospects. While $4,000 is the immediate target, Tom Lee anticipates Ethereum hitting much higher prices within the next five months and soaring into quadruple digits by 2025.

Sean Farrell, Fundstrat’s head of digital assets research, offers a compelling valuation perspective. By comparing Ethereum’s free cash flow multiples to companies like Circle—which trades at about 130 times EBITDA—Ethereum’s fair value could be closer to $15,000 per coin. This valuation approach reflects Ethereum’s role as a layer-one blockchain platform, similar to how software companies command higher multiples than traditional retailers.

Adding to this, some of the largest OTC desks, such as Wintermute, report being completely sold out of Ethereum, signaling that holders are demanding much higher prices to part with their coins. This scarcity, combined with institutional demand, is a powerful recipe for price appreciation.

What Does This Mean for Investors?

- Short term: Ethereum could reach $4,000 and continue climbing.

- By end of 2024: Price targets between $10,000 and $15,000 are within reach.

- Long term (2025 and beyond): Ethereum’s relevance and adoption could push valuations even higher.

Altcoins Rally and Regulatory Clarity on the Horizon

Ethereum often acts as a proxy for the broader altcoin market, and many altcoins are showing bullish signs right now. The recent passage of the stablecoin act has been a major catalyst, especially for altcoins tied to stablecoins, Ethereum, and Solana.

Looking ahead, the Market Structure Bill, expected to pass by September or October, could provide the regulatory clarity the crypto industry desperately needs. This legislation aims to establish a clear legal framework for stablecoins and other crypto tokens in the United States, encouraging more institutional participation and investor confidence.

With the Senate Bank Committee’s chairman, Tim Scott, pushing to finalize the bill by the end of September, a second bill signing could happen as soon as October. This timeline aligns perfectly with the anticipated rally in altcoins, making the next few months critical for crypto investors.

Smart Money vs. Dumb Money: Who’s Winning the Bitcoin Battle?

Despite the bullish signals, many retail investors remain skeptical, with a large number betting against Bitcoin and crypto markets by shorting. However, data reveals that this “dumb money” is heavily shorting Bitcoin at unprecedented rates, while the smart money—the commercial hedgers like miners and companies transacting in Bitcoin—is actually net long and buying aggressively.

This dynamic is crucial to understand:

- Commercial Bitcoin hedgers: These are insiders who hedge their mining or business operations and are currently the most net long Bitcoin ever.

- Speculators and retail investors: Tend to make poor timing decisions and are shorting Bitcoin heavily.

In other words, the smartest players in the market are positioning for a big Bitcoin surge, while the majority are betting against it. Historically, betting with the smart money has been the winning strategy.

Bitcoin’s Sky-High Price Predictions

Veteran investors like Frank Holmes of Charles Schwab are forecasting remarkable milestones for Bitcoin:

- Near term: Bitcoin could hit $500,000 by Christmas 2024.

- Long term: $10 million per Bitcoin is conceivable as adoption grows and scarcity tightens.

Holmes explains that Bitcoin’s smallest unit, the Satoshi, is currently worth less than a penny. As the price of Satoshis rises to a penny, Bitcoin’s total value will reach a million dollars. With ETFs and investment products allowing people to buy fractional Bitcoin, this creates a perfect storm for exponential price growth.

The adoption curve doesn’t move linearly; it often plateaus before suddenly jumping higher, which is the pattern Holmes expects as widespread adoption accelerates.

Why Now Is the Time to Act

Prices will undoubtedly have ups and downs, but the overall trajectory for cryptocurrency, bitcoin, and Ethereum is bullish. The macroeconomic landscape—characterized by ongoing money printing, fiscal stimulus, and expected changes in Federal Reserve policy—supports this outlook.

Arthur Hayes summarizes this well: increased government spending and deficits, combined with a less independent Fed willing to cut rates and ease monetary policy, will drive inflation and push investors toward fixed supply assets like Bitcoin and Ethereum.

May 2026 could mark a turning point when fiscal debasement accelerates, potentially triggering massive rallies in crypto assets. Millionaires will be made in crypto over the next three to six months, making it imperative to stay informed and engaged.

Conclusion: Get Serious About Crypto Now

The smart money is clearly positioning for a huge surge in Ethereum, Bitcoin, and quality altcoins. Institutional demand, regulatory clarity, and macroeconomic factors are aligning to create one of the most exciting periods in crypto history.

If you’ve been on the sidelines, now is the time to get serious about cryptocurrency, bitcoin, and Ethereum. Educate yourself, follow trusted sources, and consider how you can participate in this transforming market.

Share this knowledge with friends and family—don’t wait six months to bring them into crypto. The opportunity is here, and the next wave of growth could make all the difference.

Stay tuned for more updates, interviews, and deep dives into altcoins and market trends. The future of crypto is bright, and the time to act is now.

Cryptocurrency, Bitcoin, and Ethereum: Why Ethereum Could Soar Over $15k in 2025. There are any Cryptocurrency, Bitcoin, and Ethereum: Why Ethereum Could Soar Over $15k in 2025 in here.