The financial world is buzzing with a powerful message: the bull market is far from over. Despite widespread skepticism, data-driven insights from market experts like Fundstrat’s Tom Lee and ARK Invest’s Cathie Wood reveal that we’re witnessing a resilient recovery in both traditional equities and cryptocurrencies like bitcoin and ethereum. As we step into the second half of 2025, understanding the signals behind this rally is key to positioning yourself for the opportunities ahead.

Table of Contents

- Climbing the Wall of Worry: Why This Bull Market Is Different

- The Most Hated V-Shaped Rally: What Tom Lee Sees

- Crypto’s Bullish Momentum: Bitcoin, Ethereum, and Beyond

- Ethereum’s Rising Role in Global Finance

- What This Means for Investors in Cryptocurrency and Bitcoin

- Conclusion: The Bull Market Is Just Getting Started

Climbing the Wall of Worry: Why This Bull Market Is Different

It’s natural to be cautious. Tariffs, geopolitical tensions, Fed-policy uncertainty, and political controversies have all loomed large in investors’ minds. Yet, the market has continued to climb steadily through these challenges. Cathie Wood describes this as “climbing a wall of worry,” a hallmark of the most durable bull markets.

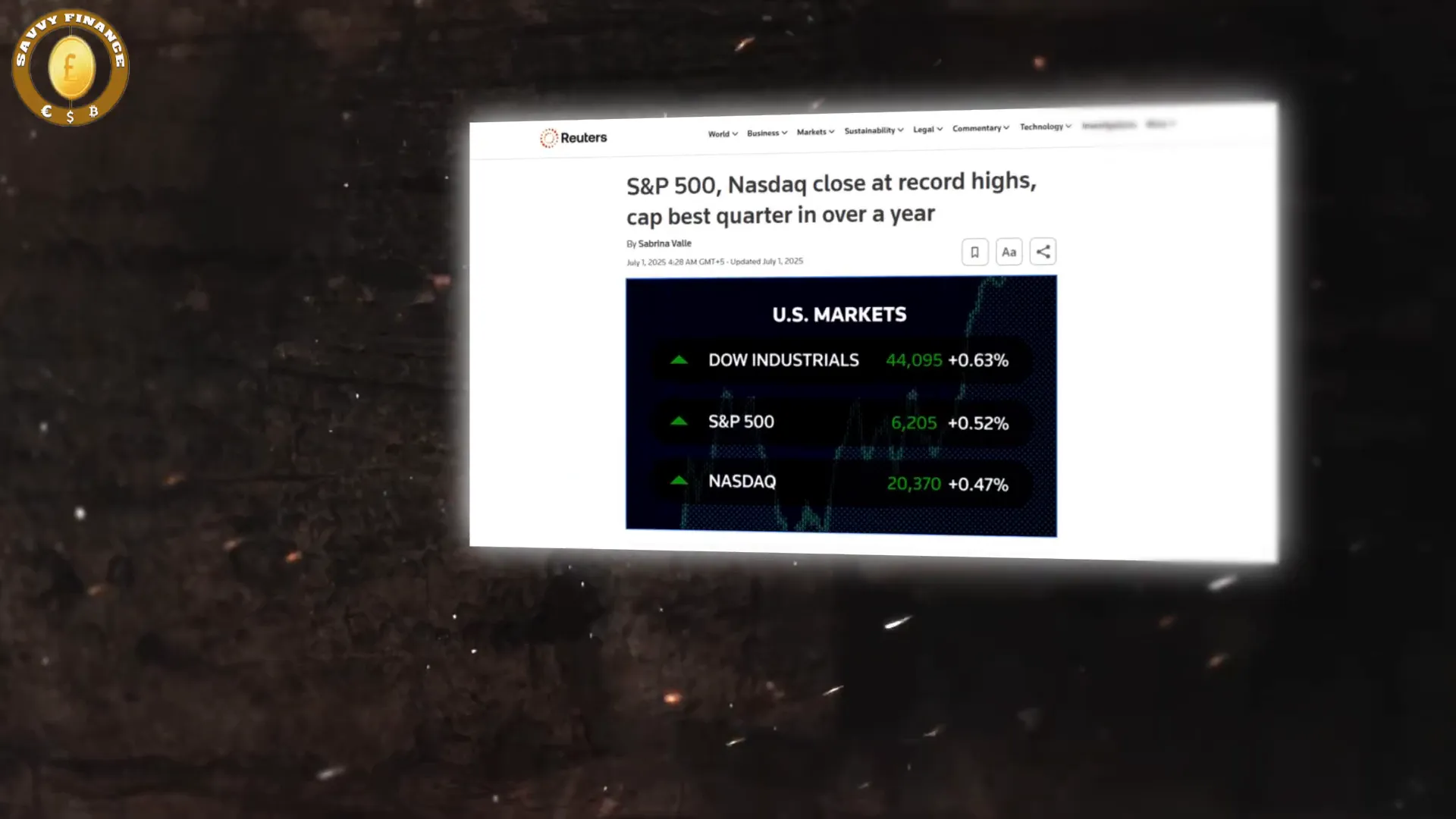

Despite the noise, the S&P 500 is pushing record highs, the Nasdaq 100 just completed its best quarter since mid-2020, and tech-driven growth sectors are once again leading the charge. The Ark Innovation ETF’s 24% year-to-date gain and the collapse of volatility (VIX) from recent peaks are strong indicators that confidence is returning.

Interest Rates, Housing, and Deregulation: The Hidden Drivers

One of the key signals Cathie highlights is the probable decline in interest rates. Housing data, often a lagging indicator, is starting to show signs of recovery after a steep plunge in 2022 caused by rising rates. Manufacturing, too, is poised for a comeback as rates ease and deregulation efforts take hold.

Deregulation, she argues, is unleashing “animal spirits,” fostering productivity and innovation. This is crucial because increased productivity tends to drive inflation lower than expected, supporting sustained economic growth. When combined with potential tax cut certainty and incentives like immediate expensing of capital goods, the stage is set for a robust recovery.

The Most Hated V-Shaped Rally: What Tom Lee Sees

Tom Lee calls the current recovery “the most hated V-shaped rally.” Why? Because it followed a waterfall decline in stocks that scared many investors into selling at the lows. Yet, a powerful indicator lies in the VIX volatility index: whenever it drops from above 60 to below 30, a decisive bottom has been made.

Today, the VIX hovers near 16.5, far below crisis levels, signaling that many investors are underestimating the strength of this rebound. Lee points to muted inflation outside of tariffs, better-than-expected visibility on trade issues, and the bond market pricing in rate cuts over the next 12 months as tailwinds for stocks.

The Impact of Deficits and Stablecoins

Despite concerns about a $3.3 trillion deficit, the bond market's reaction has been surprisingly calm, with the 10-year Treasury yield dropping to 4.2%. Lee attributes this partly to the hidden value on the US balance sheet—from natural resources to gold—and increasingly, the rise of stablecoins.

Stablecoins, currently a $250 billion industry, are poised to replace many foreign holders of US Treasuries. Their growth, especially outside the US, could further solidify the dollar’s dominance in a digital form.

Crypto’s Bullish Momentum: Bitcoin, Ethereum, and Beyond

While equities rally, the crypto market is showing strong bullish momentum. Bitcoin is holding steady above key support levels, signaling growing confidence from both institutional and retail investors. Ethereum is gaining strength amid anticipation of upcoming upgrades, and capital is flowing into altcoins tied to AI, real-world assets, and DeFi infrastructure.

On-chain activity is rising, exchange balances are dropping, and long-term holders remain firm, suggesting tightening supply just as demand picks up. Yet, investor sentiment remains skeptical, with bearish sentiment still elevated relative to historical norms.

Institutional Inflows and Market Broadening

Cathie Wood points to a structural shift in the market: capital is moving beyond mega caps into small caps and innovative sectors. This broadening often indicates rising liquidity and a higher tolerance for volatility—conditions that historically precede crypto bull runs.

Bitcoin ETF inflows resumed strongly in June 2025, with over $2.5 billion in net inflows led by BlackRock and Fidelity, signaling renewed institutional confidence.

Ethereum’s Rising Role in Global Finance

Tom Lee highlights Ethereum as a central player in the convergence of traditional finance and crypto. Stablecoins, likened to the “ChatGPT of crypto” for their viral adoption, largely operate on Ethereum’s blockchain, which acts as the backbone and architecture for these digital assets.

Lee has taken on a leadership role as chairman of a new Ethereum-focused treasury initiative, aiming to accumulate Ethereum to secure the network and influence its future. This initiative includes blue-chip investors from both the financial and crypto worlds, such as Founders Fund, Kraken, Galaxy Digital, and Pantera.

Why Owning Ethereum Matters

Ethereum’s proof-of-stake network requires validators to secure transactions and maintain trust. By accumulating and staking Ethereum, financial institutions can help secure stablecoins like USDC and USDT on a blockchain aligned with US regulatory oversight.

With stablecoins expected to grow from $250 billion to potentially $2 trillion, Ethereum’s network fees and role as the settlement layer for next-gen digital finance will expand significantly. This growth supports US dollar dominance globally, as stablecoins denominated in dollars facilitate financial transactions worldwide.

What This Means for Investors in Cryptocurrency and Bitcoin

The combined insights from Cathie Wood and Tom Lee paint a compelling picture: the market is transitioning from skepticism to resilience, and from crisis to opportunity. The macroeconomic backdrop is shifting towards easing inflation, falling interest rates, and broadening market participation.

For cryptocurrency investors, this environment is fertile ground. Bitcoin remains a safe haven digital gold, while Ethereum’s expanding institutional utility and stablecoin integration position it as a foundational piece of the future financial system. The digital asset space is not only following the broader market recovery but has the potential to lead the next phase of global economic transformation.

Key Signals to Watch in the Second Half of 2025

- Volatility trends, especially the VIX, as indicators of investor confidence and market bottoms.

- Sector rotation beyond mega caps into innovation and small caps, signaling rising risk tolerance.

- Institutional inflows into Bitcoin ETFs and Ethereum treasury initiatives as signs of growing mainstream adoption.

- Macro indicators like housing, manufacturing, and inflation data showing signs of recovery.

- Regulatory and technological developments impacting Ethereum’s ecosystem and stablecoin usage.

Conclusion: The Bull Market Is Just Getting Started

Despite the noise of political drama, tariff fears, and Fed uncertainty, the data tells a story of strength and resilience. The “most hated V-shaped rally” is unfolding with solid fundamentals beneath the surface. Interest rates are likely to fall, productivity gains are on the horizon, and deregulation is sparking innovation.

Cryptocurrency, bitcoin, and Ethereum are not just speculative plays; they are integral parts of a broader financial transformation. As institutional capital flows in and macro risk appetite returns, digital assets stand poised to lead the next wave of growth.

For investors ready to look beyond the headlines, the message is clear: the bull market is just getting started.

What do you think? Are you aligned with Cathie Wood and Tom Lee’s optimistic outlook, or do you see risks the market is overlooking? Share your thoughts and join the conversation.

Cryptocurrency, Bitcoin, and the Bull Market: 100% Proof That the Rally Is Just Getting Started. There are any Cryptocurrency, Bitcoin, and the Bull Market: 100% Proof That the Rally Is Just Getting Started in here.