The cryptocurrency market is on the cusp of a monumental influx—trillions of dollars are poised to enter, with Bitcoin and a select group of altcoins leading the charge. This isn’t just another speculative rally; it’s a fundamentally driven shift that could redefine the crypto landscape for years to come. Let’s dive into why this surge is happening, which coins are set to benefit, and what this means for investors looking to navigate the evolving market.

Table of Contents

- The Coming Tsunami: Trillions Flowing Into Cryptocurrency

- Bitcoin’s Bullish Trajectory: Expect Consolidations and New Highs

- The 5 Altcoins Set to Shine in the Coming Bull Run

- Looking Ahead: What Investors Should Keep in Mind

- Conclusion

The Coming Tsunami: Trillions Flowing Into Cryptocurrency

The crypto market is about to experience an unprecedented capital injection. Industry insiders and analysts alike are signaling that trillions of dollars currently on the sidelines will soon flood into digital assets, primarily through Bitcoin and associated ETFs. This wave is not speculative hype but a result of tangible developments in regulation, institutional adoption, and shifting market infrastructure.

Kevin O’Leary, famously known as “Mister Wonderful,” has been vocal about this next phase in crypto’s evolution. He highlights a key legislative milestone: the expected passing of the Market Structure Bill within the next few months. This legislation will pave the way for the Market Infrastructure Act, a critical piece of regulation that will clarify whether Bitcoin is treated as a commodity or security. Once this is settled, the floodgates open for trillions of dollars to be indexed into Bitcoin and crypto ETFs.

Why This Matters for Bitcoin’s Price

The significance of this regulatory clarity cannot be overstated. It signals the transition from the speculative “wild west” phase of crypto to a more mature market where institutional money can flow freely. These institutions control trillions in managed wealth, and once they are able to comfortably invest in Bitcoin ETFs, the demand will far exceed the limited supply.

Bloomberg analyst James Safart points out that major financial players like JP Morgan and Merrill Lynch are just beginning to solicit Bitcoin and crypto sales actively. This is the largest unlocking of capital in Bitcoin’s history and a powerful driver for price appreciation.

Bitcoin’s Bullish Trajectory: Expect Consolidations and New Highs

Bitcoin’s upward trajectory is expected to continue, but with the typical ebb and flow of bull markets. There will be periods of consolidation lasting days, weeks, or even months, where prices stabilize before climbing to new levels. This pattern is common and healthy, allowing markets to absorb gains before pushing higher.

Michael Saylor’s thesis offers a clear lens to understand Bitcoin’s value proposition: the difference between money and speculation lies in the behavior of the largest holders. If Bitcoin is truly money, the biggest holders will be accumulating more, not selling off. Wealthy investors treat Bitcoin like luxury real estate or fine art—assets they hold and buy more of over time to preserve and pass on wealth.

Bitcoin as Digital Wealth Storage

Bitcoin provides a unique service: the ability to store wealth digitally without relying on traditional banks. In an era marked by geopolitical tensions, tariffs, and economic uncertainty, this function is increasingly valuable. More people are joining this movement, fueling demand and pushing the price higher.

The 5 Altcoins Set to Shine in the Coming Bull Run

While Bitcoin remains the cornerstone of crypto portfolios, the next bull cycle is expected to spotlight five altcoins that are rising above the rest. These coins are gaining traction not just for speculative reasons but because of their fundamental adoption and network activity.

The top five altcoins to watch include:

- Ethereum (ETH) – The backbone of decentralized applications and tokenization, Ethereum is experiencing a resurgence driven by stablecoins and tokenized assets on its network.

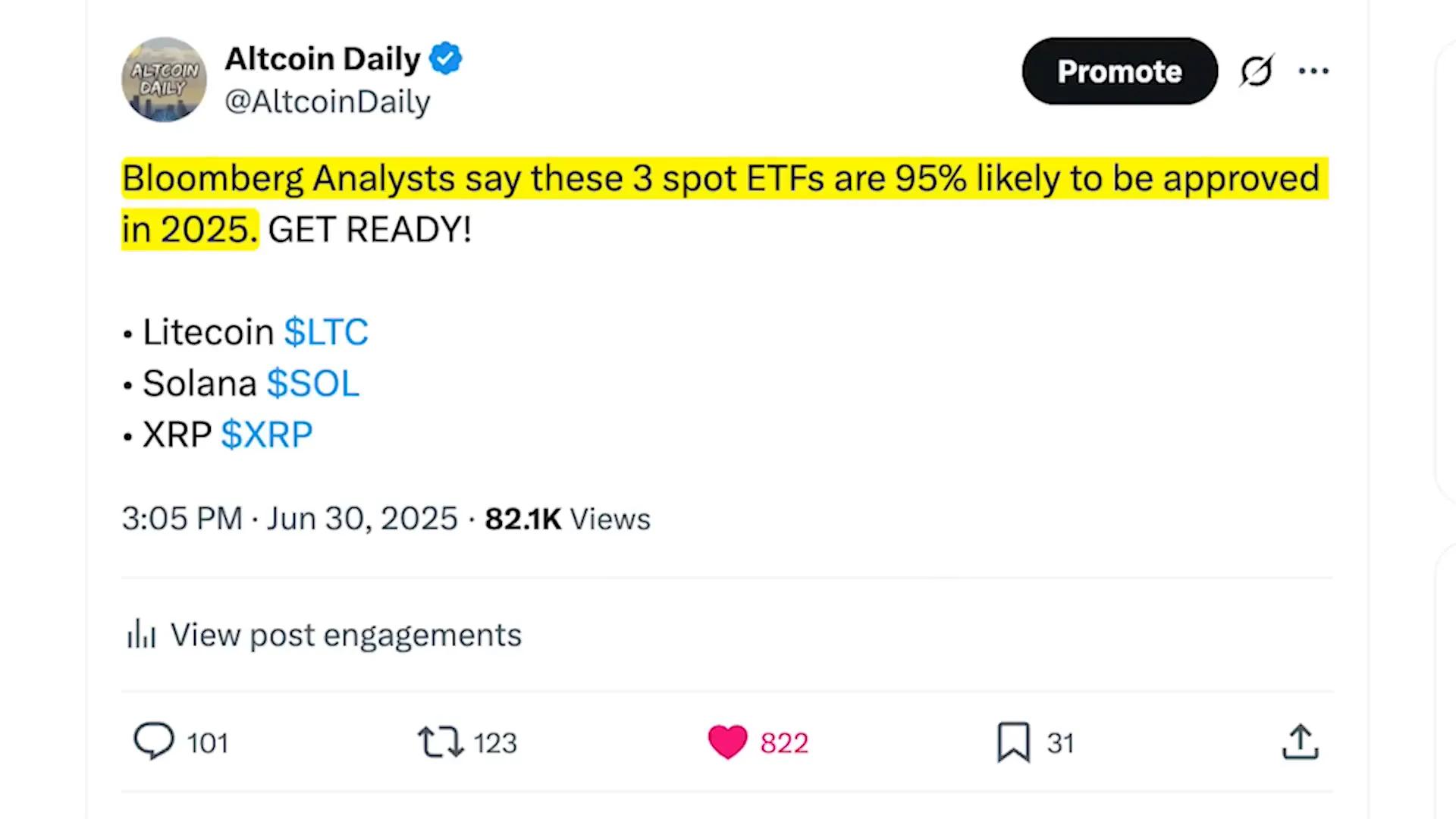

- Solana (SOL) – Known for its high-speed and low-cost transactions, Solana is becoming a favorite in the Layer 1 ecosystem.

- XRP – Despite past regulatory hurdles, XRP remains a strong contender with growing institutional interest.

- Litecoin (LTC) – A veteran coin with a long history, though slightly less bullish this cycle compared to others.

- Dogecoin (DOGE) – Often dismissed as a meme coin, Dogecoin benefits from strong community and brand culture, making it a likely inclusion in upcoming ETFs.

Beyond these, coins like Cardano, Polkadot, Hedera Hashgraph (HBAR), and Avalanche are also gaining attention and could be part of diversified crypto ETF portfolios.

Why This Cycle Is Different

Unlike the speculative frenzies of 2017 and 2021, today’s rally is grounded in fundamentals. Institutional demand, clearer regulations, and real-world adoption are driving prices rather than pure hype. This creates a more sustainable environment for growth and less volatile price swings.

Looking Ahead: What Investors Should Keep in Mind

The crypto market is entering a pivotal phase. Here are key takeaways for investors:

- Accumulate Bitcoin: As the foundation of digital wealth, Bitcoin should be the primary focus for long-term accumulation.

- Watch Institutional Movements: Keep an eye on ETF inflows and announcements from major financial institutions, as these signal growing adoption.

- Consider Select Altcoins: Ethereum, Solana, XRP, and a few others have strong fundamentals and could offer significant upside during altcoin season.

- Prepare for Volatility: Expect periods of consolidation and price swings as the market digests new capital and regulatory changes.

- Stay Informed: Regulatory developments, macroeconomic events like Fed meetings, and geopolitical tensions will all influence market dynamics.

As Matt Hogan succinctly puts it, the current rally is “100% fundamentals driven,” with persistent institutional demand colliding against limited Bitcoin supply. This dynamic could push Bitcoin toward new all-time highs, potentially reaching $200,000 by year-end.

Conclusion

The next chapter of cryptocurrency is unfolding as trillions of dollars prepare to enter the market, backed by real adoption, regulatory clarity, and institutional interest. Bitcoin remains the anchor asset, but a select group of altcoins is poised to capture significant gains alongside it. This cycle is fundamentally different from past speculative waves, offering a unique opportunity for investors to build long-term wealth in digital assets.

Whether you’re a seasoned HODLer or new to the space, now is the time to pay attention, accumulate wisely, and position yourself for what could be the most transformative crypto cycle yet.

Cryptocurrency, Bitcoin, and the $5 Trillion Wave Set to Transform 5 Crypto Coins. There are any Cryptocurrency, Bitcoin, and the $5 Trillion Wave Set to Transform 5 Crypto Coins in here.