In the fast-moving world of cryptocurrency and bitcoin, understanding market cycles, investment strategies, and profit-taking is essential for success. Today, we dive deep into the expert insights shared by Ran Neuner, a seasoned Bitcoin veteran and founder of Crypto Banter, who reveals his thoughts on the current crypto bull run, altcoin season, and how to navigate the market with a clear, disciplined approach.

Table of Contents

- Background: From Media Mogul to Crypto Influencer

- Where Are We in the Current Crypto Bull Run?

- Is It Too Late to Buy Bitcoin?

- How Trump’s Policies Could Influence Crypto’s Bull Run

- Ethereum vs. Solana: Which Is the Better Bet?

- What Will Altcoin Season Look Like in 2025?

- Ran’s 2025 Crypto Portfolio: Conservative but Strategic

- Gaming and AI: The Emerging Blue Chips

- Profit Taking Advice: The Tortoise vs. Hare Approach

- Final Thoughts

Background: From Media Mogul to Crypto Influencer

Ran Neuner's journey into crypto started after he achieved significant success in traditional business, including selling South Africa’s largest media and marketing company for over $150 million. Having reached his initial financial goals, Ran wanted to make a mass impact on a global scale—crypto provided that opportunity.

He began streaming daily to keep disciplined in studying crypto, which quickly translated into profitable investments not only for himself but also for his growing community. Today, Ran leads a team of researchers and focuses on transparent communication about market moves and strategies, all aimed at building the most profitable crypto community worldwide.

Where Are We in the Current Crypto Bull Run?

Crypto markets are often described in four-year cycles, and Ran points out that we are now in the third such cycle. By comparing historical Bitcoin price charts, he notes a familiar pattern emerging that suggests the market could reach a peak as soon as November 2025—roughly 130 days away.

He warns that if the anticipated aggressive bull run occurs, Bitcoin could surge to between $200,000 and $250,000 by year-end. However, Ran also holds out hope for a longer, more sustained bull market that could push prices even higher over time. Ultimately, the market’s trajectory will depend on timing and the intensity of the final rally phase.

Is It Too Late to Buy Bitcoin?

Many investors wonder if they’ve missed the boat on bitcoin. Ran explains that bitcoin’s value is driven by network effects, similar to how WhatsApp became exponentially more valuable as more users joined. While everyone in your social circle might have WhatsApp, far fewer own bitcoin, meaning there is still substantial room for growth.

He advises gauging adoption by asking how many friends own bitcoin; as long as fewer than half do, it’s still early in the cycle. This network growth principle suggests that buying bitcoin now can still be a sound long-term decision.

How Trump’s Policies Could Influence Crypto’s Bull Run

Ran discusses the impact of former President Trump’s policies, especially tariffs and debt ceiling increases, on the crypto market. Although tariffs initially caused concern, they are unlikely to return at previous levels because lower interest rates are needed to refinance US debt.

The recent “big beautiful bill” raising the US debt ceiling by $4 trillion is particularly bullish for bitcoin. Increased government spending combined with lower interest rates tends to weaken the US dollar, which historically benefits risk assets like bitcoin and equities.

Ethereum vs. Solana: Which Is the Better Bet?

When it comes to altcoins, Ran is more bullish on Solana from a technological standpoint. Solana’s upgrades offer transaction speeds of 100 milliseconds and the capacity to handle over 700,000 transactions per second—far surpassing Ethereum’s 45 transactions per second and longer finality times.

However, Ethereum has strong institutional backing, with major players like Coinbase and Robinhood building on its ecosystem due to its layer-two scalability and regulatory compliance advantages. This makes Ethereum a safer bet for Wall Street investors.

Ran recommends holding a mix of both Solana and Ethereum in your portfolio to balance innovation and institutional adoption. If bitcoin reaches $200,000–$250,000, Ran predicts Solana could triple or more, reaching $600 to $900.

What Will Altcoin Season Look Like in 2025?

Unlike previous cycles where altcoins across the board surged, Ran expects this altcoin season to be different. The market is now segmented into:

- Bitcoin

- Institutional and DeFi-focused altcoins (e.g., ETH, SOL, SUI)

- Dead or “zombie” coins

- Meme coin casino

He foresees a concentrated run in layer-one blockchains and DeFi protocols supported by Wall Street, followed by multiple narratives such as AI-related projects emerging in parallel. The meme coin sector will remain a high-risk “casino” for speculative traders seeking 10x returns, but for serious investors, focusing on sound layer-one and DeFi projects with clear value propositions will be key.

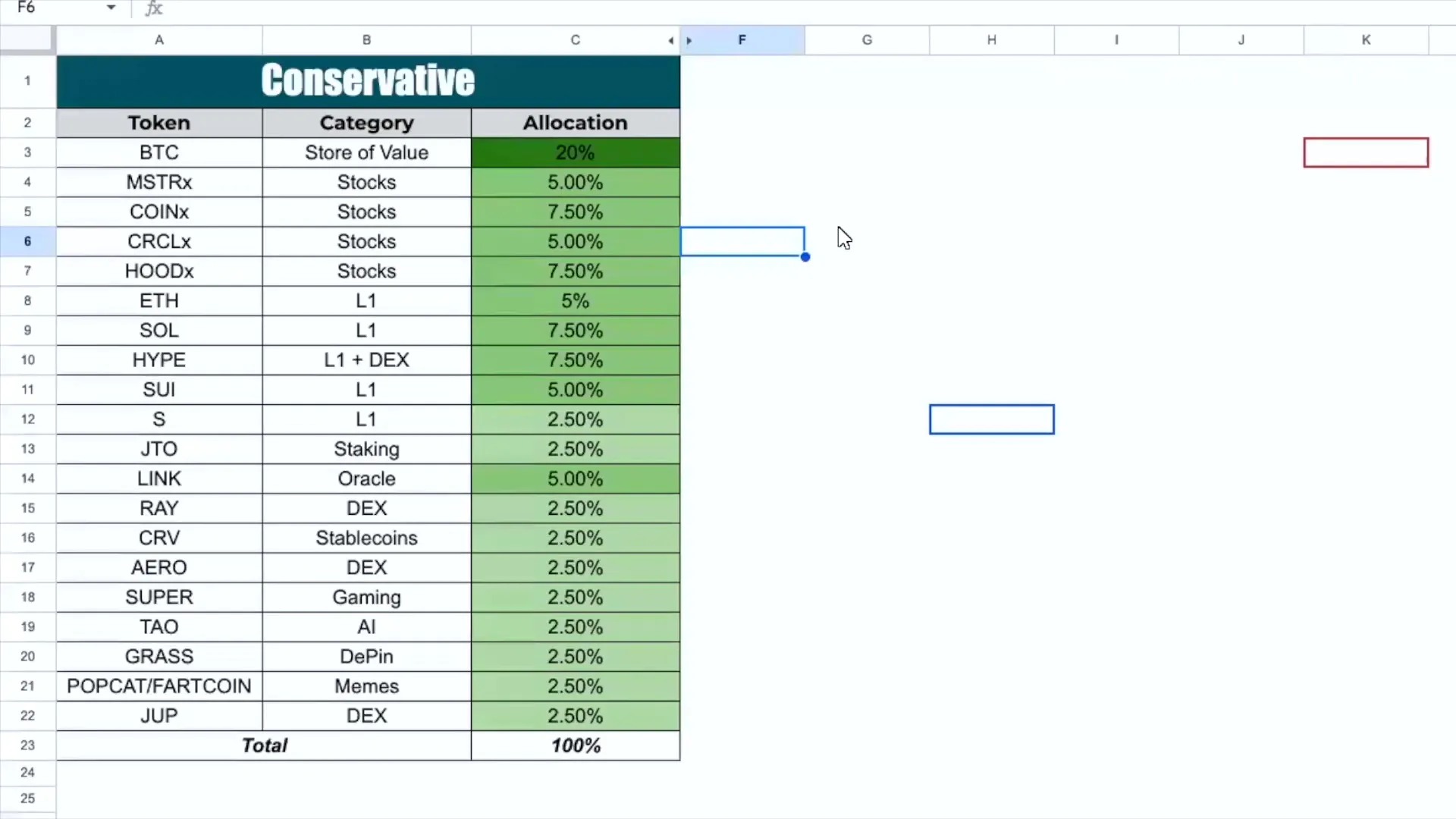

Ran’s 2025 Crypto Portfolio: Conservative but Strategic

Ran’s portfolio strategy is built around diversification and risk management:

- 20% in Bitcoin – The core store of value and the foundation of any crypto portfolio.

- 25% in crypto-related stocks – Companies like MicroStrategy, Coinbase, Circle, and Robinhood provide exposure to crypto infrastructure with potentially less volatility than tokens.

- Layer-1 blockchains and DEXs – Ethereum, Solana, and emerging players like Sui, combined with decentralized exchanges like Raydium and Aerodrome, where actual trading volume and leverage drive growth.

- High-potential altcoins – Midcap projects like Sonic Phantom, Raydium, and Tau, which have 3x to 5x upside potential if the market runs strongly.

He emphasizes owning the layers where value is created and traded rather than speculating heavily on individual projects, which have a high failure rate. Trading platforms with leverage are also attractive due to the outsized returns leverage can generate.

Gaming and AI: The Emerging Blue Chips

Ran identifies two “blue chip” areas within crypto gaming and AI:

- Gaming: Super (hype-driven) and Godzilla (fundamentally strong, yet undervalued) alongside Ronin, the blockchain behind Axie Infinity.

- AI: Tau, which Ran describes as the “Bitcoin of AI,” is a promising play with significant upside potential.

While gaming is not Ran’s primary focus, these projects offer interesting opportunities for those seeking exposure to emerging crypto sectors.

Profit Taking Advice: The Tortoise vs. Hare Approach

One of Ran’s most valuable insights is his advice on taking profits in crypto. He compares investors to the fable of the tortoise and the hare:

"The hare chases all the shiny objects: meme coins, AI agents, jumping back and forth between narratives. The tortoise sticks to a clear thesis: blockchain layers, DEXs, and one or two solid projects."

Ran stresses that while the hare may feel like winning during the cycle, the tortoise ultimately keeps more money by avoiding distractions and managing risk. His key takeaway is simple but powerful:

"Crypto is not about how much money you make, it’s about how much money you keep."

Experience taught Ran that chasing hype often leads to losses, while disciplined investing and timely profit-taking preserve capital and build real wealth over cycles.

Final Thoughts

Ran Neuner’s approach to cryptocurrency and bitcoin investing is grounded in experience, discipline, and clarity. By understanding market cycles, focusing on core layers of value creation, and maintaining emotional control, investors can position themselves for success in 2025 and beyond.

Whether you’re a beginner or seasoned investor, adopting a “tortoise” mindset—steadily building a diversified portfolio and resisting distractions—can help you navigate the thrilling yet volatile world of crypto with confidence.

Remember, the crypto market is complex and fast-changing, but with the right strategy and mindset, it offers unparalleled opportunities for growth.

Crypto Banter’s Exact Profit Taking Strategy for 2025 Altcoin Season: Insights on Cryptocurrency and Bitcoin. There are any Crypto Banter’s Exact Profit Taking Strategy for 2025 Altcoin Season: Insights on Cryptocurrency and Bitcoin in here.