Bitcoin, the flagship of the cryptocurrency world, has always captivated investors with its volatility, potential for enormous gains, and the evolving dynamics of its market. Recently, an unprecedented event shook the crypto investing landscape: Wall Street, led by none other than BlackRock, purchased a record-breaking amount of Bitcoin—even though the price was already at an all-time high. This bold move not only underscores the growing institutional appetite for Bitcoin but also hints at a possible massive rally ahead, potentially reshaping the future of blockchain investing.

In this deep dive, we’ll unpack the details behind this historic purchase, explore the supply and demand economics that are driving Bitcoin’s price, and reveal an astonishing future price target that could redefine the crypto market in the coming weeks.

Wall Street’s Record-Breaking Bitcoin Buying Spree

Yesterday marked a monumental day for Bitcoin and the broader crypto ecosystem. Despite Bitcoin trading at an all-time high, Wall Street investors dove in, snapping up more Bitcoin than ever before—well, almost. This day recorded the second highest inflow of Bitcoin ETFs in history, with a staggering $1.17 billion worth of Bitcoin purchased via ETFs alone.

What makes this event even more remarkable is the key driver behind this surge: BlackRock. Their clients alone accounted for approximately $448 million of Bitcoin purchases on this single day, leading the charge for institutional investors. BlackRock’s enthusiasm for Bitcoin signals a shift in how traditional finance views and embraces cryptocurrency as a legitimate asset class.

To put this into perspective, the only time Bitcoin ETF inflows were higher was on November 7, 2024, right after Donald Trump’s election victory, when Wall Street bought $1.37 billion worth of Bitcoin. This parallel offers important clues about the market’s trajectory.

Why Are Institutions Buying Bitcoin at All-Time Highs?

At first glance, buying Bitcoin when it’s already at its peak might seem counterintuitive. Traditional wisdom suggests avoiding assets at record highs due to the risk of a reversal. However, institutional investors like BlackRock operate with different strategies and horizons. Their aggressive purchases despite high prices indicate a strong conviction in Bitcoin’s long-term value and potential for further gains.

The primary catalyst for this buying frenzy is the growing adoption of Bitcoin ETFs (Exchange Traded Funds), which have made it easier for institutional investors to gain exposure to Bitcoin without the complexities of holding the asset directly. ETFs provide a regulated, familiar vehicle that fits into traditional portfolio management frameworks, making Bitcoin more accessible for large-scale investments.

Bitcoin’s Supply Constraints and Institutional Demand

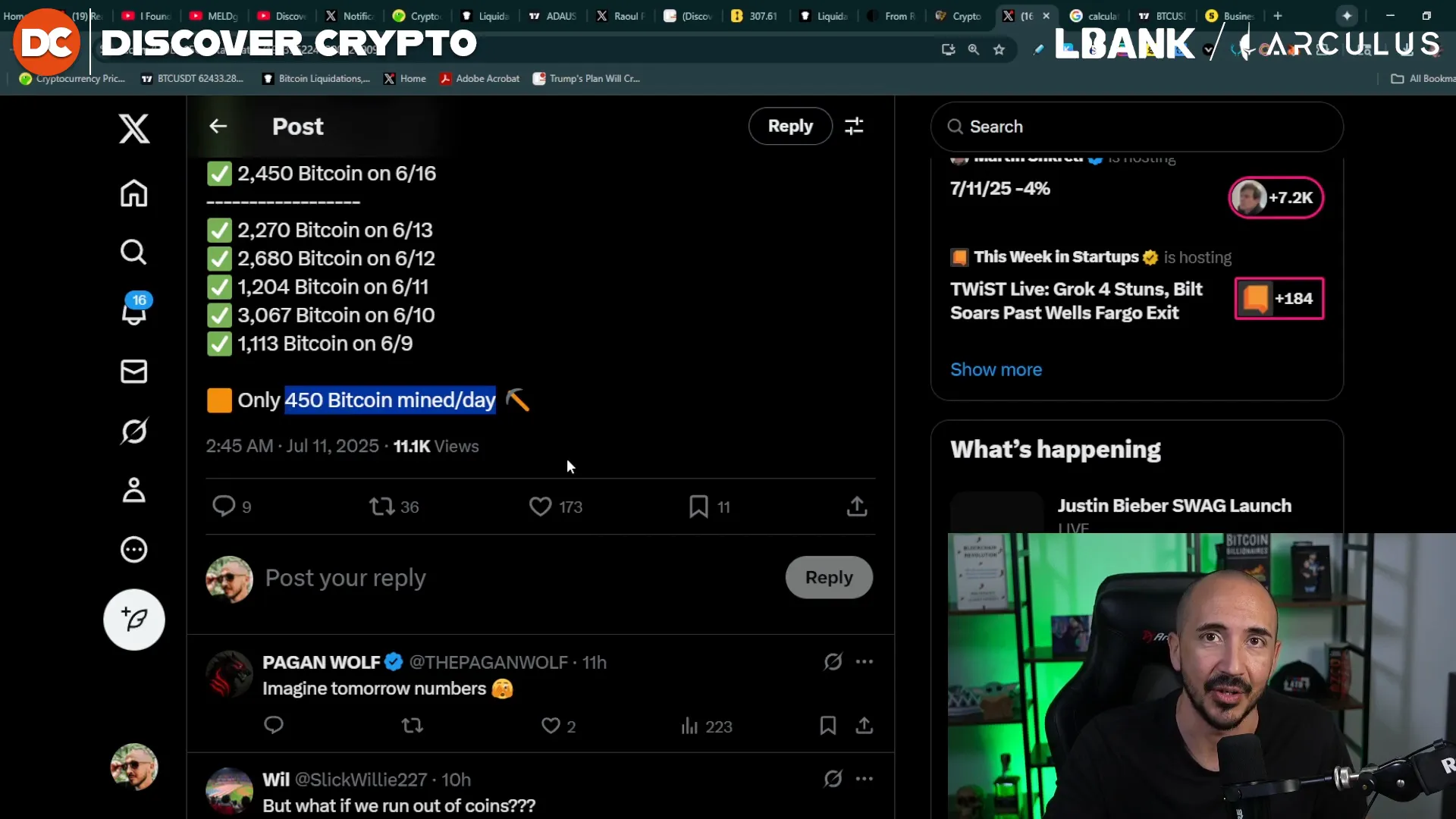

One of the key factors driving Bitcoin’s price dynamics is its limited supply. Unlike fiat currencies, which can be printed endlessly, Bitcoin’s supply is capped by its coded protocol. Only 450 new Bitcoins are mined every day, providing a strict supply ceiling that fuels scarcity.

Yesterday, Wall Street’s Bitcoin ETF purchases amounted to roughly 4,000 Bitcoins—more than eight times the daily supply of new Bitcoin entering the market. This kind of demand pressure, especially from institutional players, tightens available supply even further and creates upward momentum for prices.

The Bitcoin Mining Process: A Quick Refresher

Bitcoin mining operates on a predictable schedule: every 10 minutes, miners receive a block reward of approximately 3.125 Bitcoins. Given there are 6 blocks mined every hour and 24 hours in a day, this results in the daily issuance of 450 new Bitcoins.

This steady but limited inflow of new Bitcoins is a critical factor in supply and demand economics. When demand from institutional buyers exceeds this limited supply, it exerts strong upward pressure on the price.

Institutional Buying Trends: Not Just a One-Off

BlackRock’s recent purchases are not an isolated event. The data reveals a sustained pattern of large Bitcoin acquisitions:

- Before the Fourth of July holiday weekend, they purchased 2,000 Bitcoins.

- Earlier in the week, they acquired over 3,000 Bitcoins.

- In June, purchases included 3,000 Bitcoins on the 25th, 4,000 on the 24th, and a massive 6,000 on the 17th.

Given only 450 Bitcoins are mined daily, these purchases represent a significant portion of the newly minted supply, further underscoring the intensity of institutional demand.

Analyzing Bitcoin’s Price Action: Patterns and Predictions

To understand what BlackRock’s buying spree could mean for Bitcoin’s price, it’s useful to examine historical price patterns and how institutional inflows have influenced market movements.

Let’s revisit November 7, 2024—the day with the highest Bitcoin ETF inflows ever. On that day, Bitcoin experienced a strong green candle, indicating a significant price surge fueled by institutional buying. Following this, Bitcoin rallied by 53% over the next 41 days, a remarkable pump that sent prices soaring.

Current Price Structure Mirrors November 2024

Today, Bitcoin’s price action is echoing a similar structure. Recently, Bitcoin hit a new all-time high, then consolidated, and subsequently pushed to a fresh all-time high again. This pattern closely mirrors the setup seen before the November 7 pump.

Many traders might hesitate to buy Bitcoin at an all-time high, fearing a pullback. However, BlackRock’s aggressive buying suggests otherwise—they are betting on continued upward momentum despite the high price.

What Could a 53% Bitcoin Rally Look Like Now?

Using the November 7 pattern as a benchmark, applying a 53% rally over 41 days from the recent bottom of Bitcoin’s green candle translates into a potential price target of approximately $171,000 by August 21, 2025.

This projection is bold but grounded in historical market behavior and the current wave of institutional inflows. If this scenario unfolds, it would represent one of the most explosive Bitcoin bull runs in history, driven primarily by large-scale institutional adoption.

What This Means for Crypto Investors and the Blockchain Ecosystem

The implications of this institutional buying surge extend far beyond just Bitcoin’s price. They signal a broader maturation of the crypto market and increased confidence from traditional financial institutions in blockchain technology and digital assets.

Why Institutional Inflows Matter

- Market Legitimacy: With giants like BlackRock leading Bitcoin ETF inflows, crypto assets gain credibility within mainstream finance.

- Increased Liquidity: Large institutional investments bring more liquidity, reducing volatility and improving market stability.

- Long-Term Holding: Institutions tend to hold assets longer, reducing sell pressure and fostering sustained price growth.

- Broader Adoption: Institutional interest often paves the way for wider adoption of blockchain technologies across industries.

Strategic Takeaways for Investors

For investors in Bitcoin, crypto, and blockchain projects, this moment offers several key insights:

- Don’t Fear High Prices: Institutional buying at all-time highs can signal confidence and potential for further gains.

- Watch ETF Flows: Monitoring Bitcoin ETF inflows can provide early signals of major market moves.

- Understand Supply Constraints: The limited daily supply of Bitcoin amplifies the impact of large purchases on price.

- Stay Informed: Keep abreast of institutional activity and regulatory developments, as these factors heavily influence market dynamics.

Looking Ahead: The Future of Bitcoin and Crypto Investing

BlackRock’s record Bitcoin purchases are more than just a headline—they represent a seismic shift in how Bitcoin and crypto assets are perceived and valued. The confluence of limited supply, institutional demand, and favorable price patterns suggests that Bitcoin could be on the cusp of a monumental rally.

While no investment is without risk, the data-driven insights point toward a bullish outlook for Bitcoin over the coming weeks and months. For investors passionate about crypto, blockchain, and BTC, understanding these trends and positioning accordingly could be the key to capitalizing on the next major wave in the crypto market.

As always, approach investing with caution, conduct your own research, and consider your risk tolerance. The crypto world is dynamic and evolving, but right now, the stars seem aligned for a new chapter in Bitcoin’s storied journey.

BlackRock Triggered Bitcoin's NEXT HUGE Move! What This Means for Bitcoin, Crypto, BTC, Blockchain, and Investing. There are any BlackRock Triggered Bitcoin's NEXT HUGE Move! What This Means for Bitcoin, Crypto, BTC, Blockchain, and Investing in here.