Something unusual happened to Bitcoin last month that caught the attention of crypto enthusiasts worldwide. The network’s hash rate—the total computational power securing the blockchain—plummeted sharply. This sharp decline suggested a mass shutdown of Bitcoin miners, sparking immediate speculation about the cause. While many quickly pointed fingers at Iran, the reality is far more complex and reveals intriguing insights into the global cryptocurrency landscape.

This article dives deep into the factors behind Bitcoin’s hash rate drop, the role of Iran’s Bitcoin mining ambitions amid sanctions, and the broader implications for cryptocurrency security and geopolitics.

Table of Contents

- Understanding Bitcoin’s Hash Rate and Why It Matters

- The Ripple Effects of Miner Migrations

- Bitcoin’s Built-In Resilience: Difficulty Adjustment Mechanism

- The June Hash Rate Crash: Iran in the Spotlight

- Heat Waves and Economic Pressures in the US

- Iran’s Complex Relationship with Bitcoin and Sanctions

- Legalization and the Dual Mining Economy

- The Islamic Revolutionary Guard Corps (IRGC) and Bitcoin Mining

- Crypto as an Economic Shelter for Iranians

- Tehran’s Contradictory Crypto Policies

- How Iran’s Crypto Strategy Compares Globally

- Looking Ahead: What the Hash Rate Drop Tells Us

Understanding Bitcoin’s Hash Rate and Why It Matters

Bitcoin’s hash rate measures the total computing power miners contribute to secure the network and validate transactions. A high hash rate means more security and resilience against attacks, while a sudden drop can signal network vulnerability and instability.

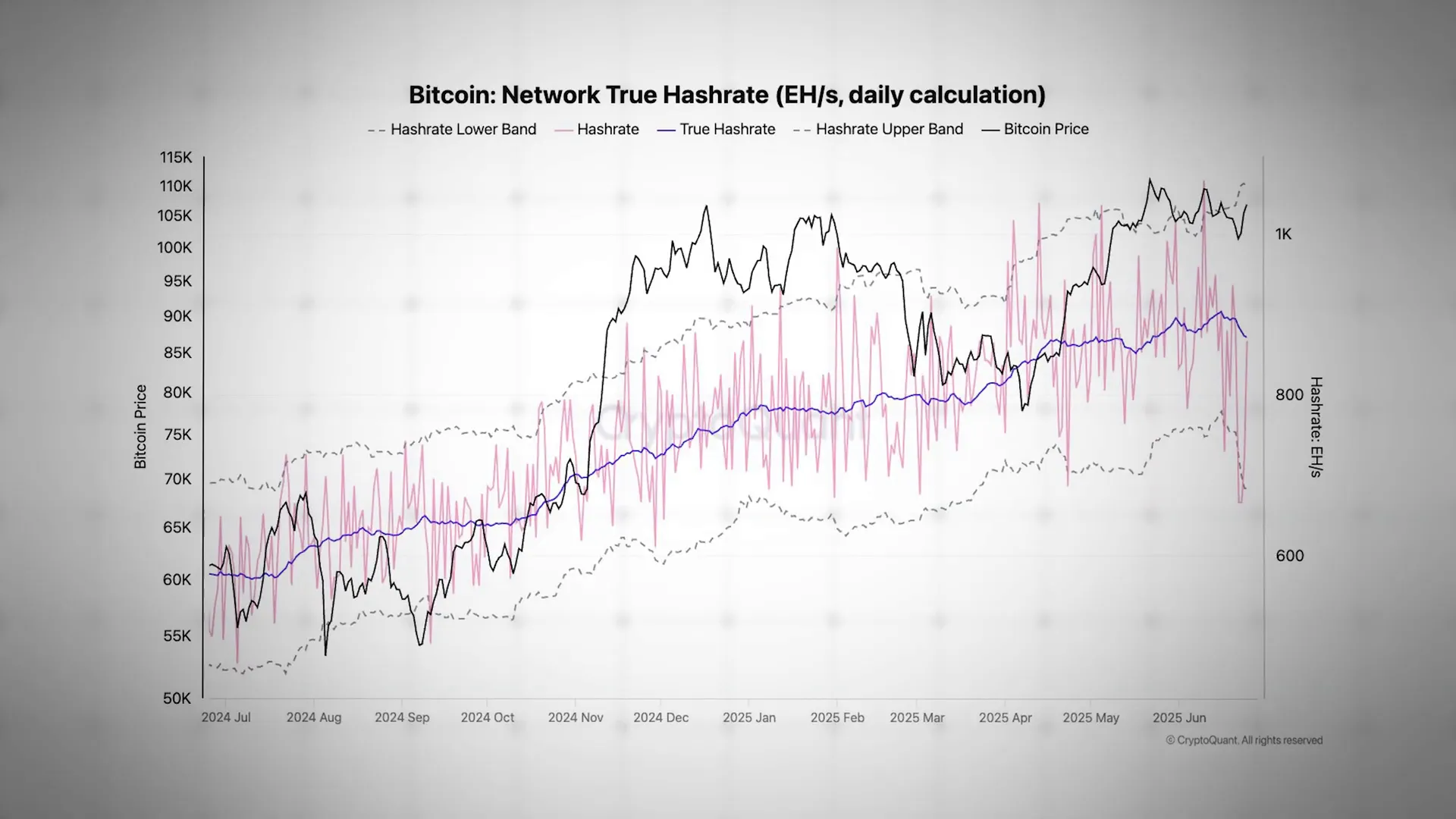

In June, Bitcoin’s hash rate fell by over 15% within about ten days—the steepest and fastest drop in three years. The last time Bitcoin experienced a drop this drastic was during China’s major crackdown on miners in mid-2021.

At that time, China hosted roughly 75% of Bitcoin’s global hash rate. When the government ordered mining facilities to shut down, entire provinces went dark, cutting the global hash rate nearly in half. This event caused significant uncertainty about Bitcoin’s future, but miners quickly relocated to other countries, and the network eventually recovered, reaching new all-time highs.

The Ripple Effects of Miner Migrations

Following China’s crackdown, miners sought new homes. Kazakhstan emerged as a popular destination due to its cheap energy and proximity to China, eventually accounting for 18% of the global hash rate by late 2021.

However, Kazakhstan’s aging coal-powered grid struggled under the sudden surge in demand. In January 2022, unrelated mass protests led the government to impose a nationwide internet blackout, which knocked miners offline and caused the global hash rate to plunge by over 13% overnight.

This forced miners to move again, mainly to the US and Russia, highlighting a major lesson: Bitcoin’s computing power is vulnerable when concentrated in regions with fragile infrastructure or political instability. Such centralization risks expose significant portions of the network to local disruptions.

Bitcoin’s Built-In Resilience: Difficulty Adjustment Mechanism

Despite these shocks, Bitcoin’s protocol is designed to adapt. The network automatically adjusts the difficulty of mining every 2,016 blocks (roughly two weeks) to maintain a steady block production rate of about every 10 minutes.

When hash rate drops significantly, the difficulty decreases, making it easier and more profitable for remaining and new miners to find blocks. This self-regulating feature ensures the network continues to function, though transactions may slow temporarily right after a crash until the adjustment kicks in.

This mechanism explains why hash rate volatility—while concerning—is not catastrophic for Bitcoin’s long-term security and operation.

The June Hash Rate Crash: Iran in the Spotlight

When Bitcoin’s hash rate dropped sharply last June, many in the crypto community quickly blamed Iran. The timing aligned suspiciously with geopolitical events: Israeli and US strikes on Iranian facilities led to widespread power outages and internet blackouts within the country.

Iran has long been a significant but somewhat opaque Bitcoin mining hub. On June 20th, the Iranian government shut down most of the country’s internet citing defense against cyberattacks, and blockchain data showed the global hash rate dipped by about 2.2% simultaneously. A few days later, power outages from strikes caused another 1% drop.

However, these events combined only explain about 3.2% of the total 15% hash rate decline. Moreover, the hash rate was already falling before these incidents, dropping over 6% between June 15th and 20th.

Heat Waves and Economic Pressures in the US

The other major factor behind the hash rate drop lies with the US, which contributes over 40% of Bitcoin’s global hash rate. In mid-June, the US experienced a brutal heat wave, which created a nightmare scenario for miners.

Mining hardware generates immense heat and requires powerful cooling systems. When ambient temperatures soar, cooling becomes more difficult and costly. At the same time, air conditioning demand spikes, driving electricity prices higher.

Many large-scale US miners have contracts that pay them to reduce power usage during peak demand, often selling electricity back to the grid. With soaring electricity prices—New York saw the highest power costs in months—many miners chose to power down temporarily, starting the downward trend in hash rate.

The US heat wave thus put significant economic pressure on the network’s largest player, with the acute shocks in Iran’s infrastructure outages accelerating the decline.

Iran’s Complex Relationship with Bitcoin and Sanctions

Iran’s involvement in Bitcoin mining is deeply intertwined with its geopolitical and economic challenges, especially US sanctions reimposed in 2018. These sanctions targeted Iran’s oil industry and cut the country off from global banking systems like SWIFT, severely restricting its ability to conduct international trade.

Bitcoin emerged as an alternative financial lifeline. Iran possesses vast energy resources and benefits from heavily subsidized electricity—sometimes costing as little as 1 to 2 cents per kilowatt-hour. For Bitcoin miners, electricity is the biggest operational cost, making Iran a mining haven.

In 2024, mining one Bitcoin in Iran cost about $1,300 in electricity, while the market price hovered near $100,000—an astounding profit margin of nearly 8,000%.

The Iranian government capitalized on this “digital alchemy,” converting its cheap energy into Bitcoin and using it to pay for imports, effectively exporting energy over the internet rather than by traditional oil tankers.

Legalization and the Dual Mining Economy

In 2019, Iran legalized cryptocurrency mining and established a licensing system. Licensed miners had to sell all mined Bitcoin to the central bank, which then used the crypto to facilitate sanctioned imports. However, the government likely forced miners to sell at significant discounts.

Despite this legal framework, illegal mining exploded due to the lucrative profits. By 2021, Iran’s president admitted that 85% of mining was unlicensed, with illegal farms popping up in abandoned factories, government buildings, and even mosques.

This created a two-tiered system: a small legal sector feeding the state, and a sprawling underground network operating largely beyond government control.

The Islamic Revolutionary Guard Corps (IRGC) and Bitcoin Mining

The IRGC, a powerful military and economic force in Iran, reportedly dominates much of the underground mining sector. By 2023, state-affiliated entities, including the IRGC, controlled roughly 100,000 of Iran’s 180,000 mining devices, giving them majority control over the nation’s mining capacity.

This expansion has strained Iran’s already fragile power grid. Illegal mining consumed up to 2,000 megawatts—equivalent to the output of two to three nuclear power plants—contributing to frequent rolling blackouts that affect both industry and daily life.

Legislative measures have strengthened the IRGC’s privileged position, including exemptions from utility payments and authorization to establish private power plants, creating structural advantages unavailable to private miners.

Crypto as an Economic Shelter for Iranians

Sanctions have devastated Iran’s economy, with the rial facing continuous collapse and inflation soaring. Many Iranians have turned to cryptocurrency as a safe haven for their savings, alongside traditional assets like gold.

By 2023, about 25% of Iranians reportedly owned crypto, using it practically to preserve wealth, make international purchases, and receive funds from abroad—activities complicated by sanctions.

However, this widespread public adoption of crypto fuels capital flight, as citizens use crypto to move money out of the country, undermining the government’s goal of stabilizing the economy through mined Bitcoin.

Crypto outflows from Iran surged 70% last year, reaching an estimated $4.18 billion. These outflows often spike during geopolitical tensions, as Iranians seek the safety of blockchain-based assets.

Tehran’s Contradictory Crypto Policies

Iran’s approach to crypto regulation is complex and often contradictory. While endorsing mining to generate state revenue, the government simultaneously tries to curb public crypto use to prevent capital flight.

Authorities have shut down crypto on-ramps, halted exchange withdrawals during currency crises, and imposed crypto curfews to limit exchange operating hours.

In January 2025, Iran designated its central bank as the sole crypto market regulator, overseeing a pilot of its Central Bank Digital Currency (CBDC), the “Crypto Real.” Like CBDCs worldwide, the Crypto Real aims to bring digital finance under total state surveillance, contrasting with the crypto ecosystem Iranians use to escape oversight.

How Iran’s Crypto Strategy Compares Globally

Iran’s strategy is unique in that it focuses on crypto production—leveraging cheap energy to build a global financial network from scratch. This contrasts with countries like Russia, which use crypto primarily for sanctioned international trade and have experimented with ruble-pegged stablecoins backed by sanctioned banks.

Despite these efforts, US sanctions remain aggressive. The US Treasury has sanctioned key Iranian crypto players, exchanges, and IRGC-linked individuals allegedly funding proxy groups. Binance was fined heavily in late 2023 for processing billions in transactions for Iranians, tightening global market access.

At its peak, Iran controlled between 4.5% and 8% of Bitcoin’s global hash rate, generating around $1 billion in government revenue. Recent estimates place this share at about 3.1%, reflecting power shortages, government crackdowns, and increased global competition.

Looking Ahead: What the Hash Rate Drop Tells Us

Bitcoin’s hash rate drop in June was mostly driven by the US heat wave and economic pressures on the network’s largest mining hub, with Iranian miner outages playing a smaller but notable role.

This episode reveals much about the geopolitical and economic forces shaping Bitcoin mining. It underscores vulnerabilities when mining power concentrates in unstable regions and highlights Bitcoin’s resilience through its difficulty adjustment mechanism.

More importantly, it sheds light on Iran’s complex, dual-edged relationship with cryptocurrency—both a tool for economic survival amid crippling sanctions and a channel for capital flight that challenges government control.

For anyone interested in cryptocurrency, bitcoin, and the evolving interplay between digital assets and geopolitics, this story offers a fascinating glimpse into the challenges and opportunities shaping the future of crypto mining worldwide.

Bitcoin’s Sudden Hash Rate Drop: Unpacking Iran’s Role and the Bigger Picture in Cryptocurrency. There are any Bitcoin’s Sudden Hash Rate Drop: Unpacking Iran’s Role and the Bigger Picture in Cryptocurrency in here.