Photo by Norman Wozny on Unsplash

Today marked an electrifying milestone for the world of crypto, especially bitcoin. Bitcoin surged into uncharted territory, breaking its previous all-time high and currently hovering around an impressive $111,000. This upward momentum wasn’t just isolated to bitcoin; many altcoins and crypto-based stocks joined the rally, signaling a renewed vigor in the market. Let’s dive into what’s driving this surge, the key players involved, and what it means for investors and enthusiasts alike.

What Fueled Bitcoin’s Breakout?

Earlier today, I shared a liquidation heat map highlighting critical short positions in the market. When bitcoin gained momentum, it triggered a wave of short liquidations, pushing the price past the $111,000 mark. This short squeeze didn’t stop there—it propelled bitcoin even higher to a new peak of approximately $112,164 before settling back near $111,000. Holding strong at this level daily is a clear sign that momentum is building steadily.

So, what sparked this movement? The answer lies largely in the stock market, particularly with tech giant Nvidia. Nvidia made history by becoming the first company to hit a $4 trillion market cap, sparking bullish sentiment across Wall Street’s tech sector. This enthusiasm spilled over into the crypto markets, encouraging fresh buying and reinforcing positive momentum for bitcoin and its peers.

Macro Factors and Market Sentiment

While the Federal Reserve’s recent minutes were released today, they didn’t offer much new information to excite the market. Contrary to some expectations, there is no indication of an interest rate cut this month. The Fed remains cautious, with any potential easing likely postponed until September, and even then, only modest reductions (around 50 basis points) are anticipated.

Meanwhile, political voices like former President Trump have publicly demanded aggressive interest rate cuts—calling for a three percentage point drop from the current 4.5% rate. However, these demands are unrealistic given the Fed’s current stance, and such rhetoric has little direct impact on bitcoin’s price movement.

Why Bitcoin Is Still Rising Despite Uncertainty

Despite uncertainties around tariffs, inflation, and the Fed’s policies, these macroeconomic worries often push investors toward bitcoin as a hedge. Institutional investors, retail buyers, and long-term holders continue to accumulate bitcoin, driven by improving fundamentals and technical indicators.

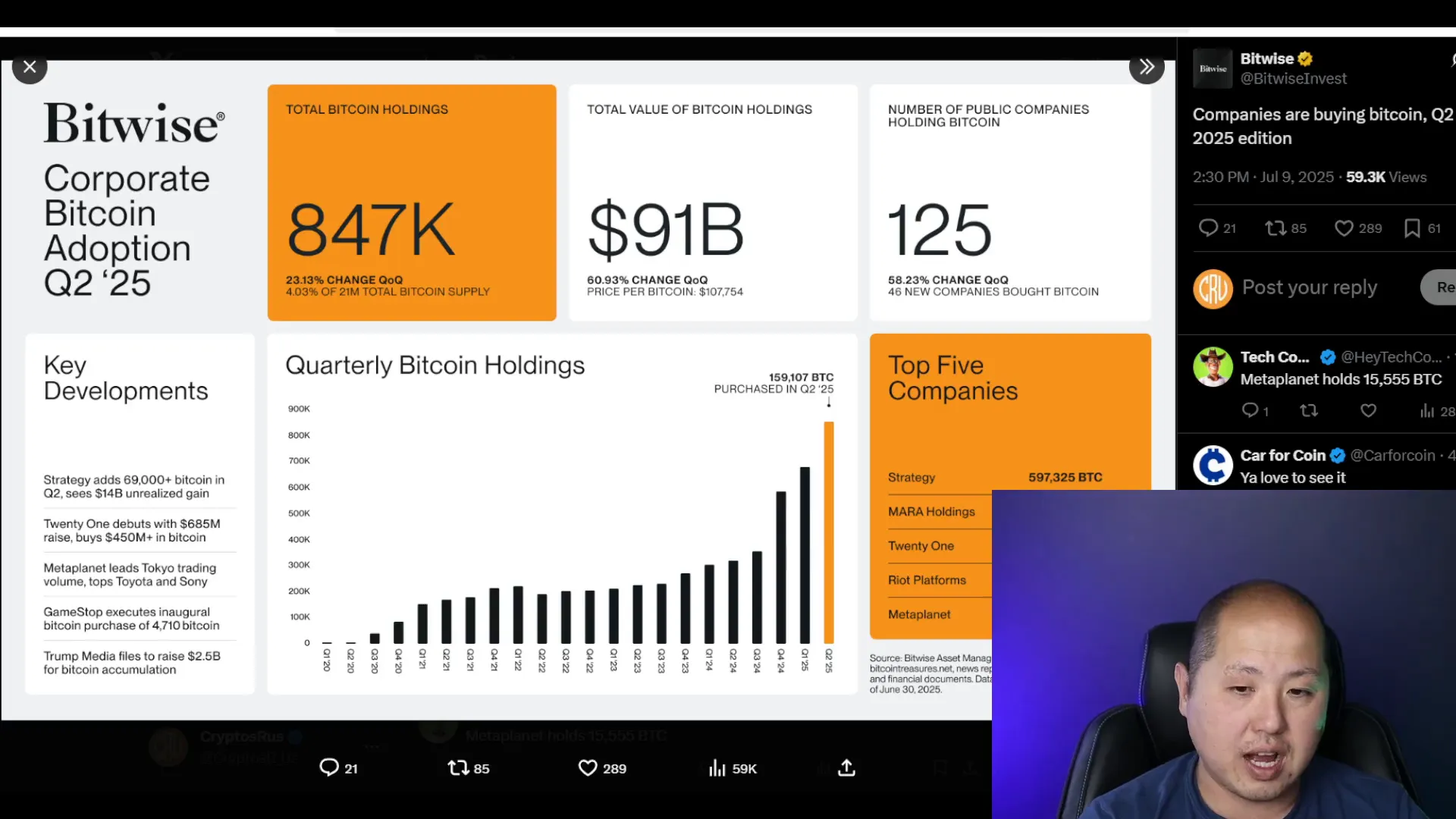

Companies embracing bitcoin strategies are thriving. For example, BlackRock’s Larry Fink holds around 700,000 bitcoins, and Michael Saylor is close behind with nearly 600,000. In Q2 alone, companies like Marathon Digital, Riot Blockchain, and Metaplanet made significant bitcoin purchases totaling over 159,000 coins—excluding ETFs.

These strategic investments are paying off. Metaplanet, a Japanese firm, contributed a remarkable 9.3% to the total returns of the Tokyo Stock Exchange index over the past year. Meanwhile, El Salvador’s President Nayib Bukele has been steadily dollar-cost averaging, buying roughly one bitcoin per day, now sitting on an unrealized gain of $400 million—a 137% increase.

Technical Indicators Point to More Gains Ahead

Bitcoin has recently broken out of a key trading channel, signaling the potential for another leg up. Technical patterns like the inverse head and shoulders formation project bitcoin reaching $132,000 as the next target. Other bullish indicators suggest a possible surge toward $150,000 in the near term.

It’s important to remember that bitcoin’s overall trajectory has been bullish for over 15 years. While there have been dramatic rises and falls, the long-term trend points skyward—toward $1 million and beyond. This journey may take decades, but the path is clear: bitcoin is heading to the moon.

Altcoins and Crypto Stocks Join the Rally

The excitement isn’t limited to bitcoin. Ethereum is pushing back toward $2,800, Suie has climbed above $3, XRP is at $0.240, Solana is around $156, and Avalanche is nearing $20. This broad-based rally highlights the growing strength and diversity within the crypto ecosystem.

What’s Next for Crypto Investors?

For those staying strong and committed to the game, the outlook is promising. The combination of institutional buying, retail enthusiasm, improving macro conditions, and positive technical setups suggests that the crypto market is poised for further gains. Watching how Asian markets respond tonight will be crucial, as their buying activity could add another boost.

Stay tuned, stay informed, and keep your eyes on the charts—the next big move could be just around the corner.

Remember, patience is key in this journey. Bitcoin’s rise is not a sprint but a marathon, and the destination promises to be well worth the wait.

Summary: Why Bitcoin and Crypto Are Surging Now

- Bitcoin broke into new all-time highs, reaching over $111,000.

- Nvidia’s historic $4 trillion market cap fueled tech sector optimism.

- The Fed’s cautious stance delayed any immediate rate cuts.

- Institutional and corporate bitcoin buying is robust and growing.

- Technical patterns indicate bitcoin is ready for further upward moves.

- Altcoins and crypto stocks are also rallying, supporting the overall market strength.

Stay strong, stay invested, and watch this space for more updates on the fascinating world of crypto and bitcoin.

Bitcoin Sets New Record: All-Time Highs Shattered in the Crypto Market!. There are any Bitcoin Sets New Record: All-Time Highs Shattered in the Crypto Market! in here.