Photo by Norman Wozny on Unsplash

If you’re invested in crypto or bitcoin, now is a crucial time to stay alert. The market has been relatively calm lately, but a significant event looms on the horizon that could shake things up. Let’s dive into what’s happening, why it matters, and how you can prepare as a crypto investor.

Market Recap: Calm Before the Storm?

Bitcoin has been holding steady, hovering around $107,000. It briefly touched $108,000 but then settled back down, making for an uneventful day in crypto. Altcoins, however, seem a bit weaker lately, still hovering without much momentum.

The silver lining? Crypto-related stocks are on the rise. Companies like Circle jumped 7%, Coinbase climbed nearly 6%, and others like Robinhood and MicroStrategy also saw gains. The broader stock market is doing well too, but there’s a looming wildcard that many might be overlooking — the tariff situation between the U.S. and China, and its ripple effects globally.

Why Tariffs Matter to Crypto and Bitcoin Investors

Right now, we’re in the middle of a 90-day tariff pause between the U.S. and China. While this truce is in effect, markets have stabilized and even rebounded. But once it ends, tariffs could return at a 30% base rate in the U.S., and potentially up to 50% in the European Union on imported goods. This tariff stalemate has both sides threatening to increase tariffs, which could disrupt markets significantly.

The timing is critical: the pause ends right after the 4th of July holiday, and by July 9th, we could see whether new deals get made or if tensions escalate. Since tariffs were first announced, markets crashed, then recovered during the pause — so what happens next could impact everything from stocks to crypto prices.

Tariffs Are Generating Billions — But Who’s Paying?

Interestingly, tariffs have generated massive revenue — over $26.7 billion in the last month alone, and more than $121 billion overall. But there’s still a mystery about who’s ultimately bearing the cost: importers, manufacturers, or consumers? This uncertainty adds another layer of risk as we approach July 9th.

Bitcoin: The Bright Spot Amidst Uncertainty

Despite the potential market shakeups, Bitcoin holders have reason to feel confident. Currently, 99% of Bitcoin addresses are in profit — meaning almost everyone holding Bitcoin is ahead. Bitcoin is only about $5,000 away from its all-time high of $112,000, which might seem far but is actually quite close in this market.

Even if you bought at the peak, using a Dollar-Cost Averaging (DCA) strategy means you’re likely in the green by now. This resilience is why Bitcoin matters so much, why I cover it so frequently, and why adoption keeps growing.

Bitcoin Adoption Is Accelerating

Already, three U.S. states have established Bitcoin reserves, with Texas being the latest. Over 22 other states are considering similar moves, aiming for a total of 25 soon — and eventually all 50 states will likely follow. This momentum is supported by Bitcoin ETFs, international interest, and publicly traded companies buying Bitcoin as a treasury asset.

The Power of Bitcoin as a Wealth Generator

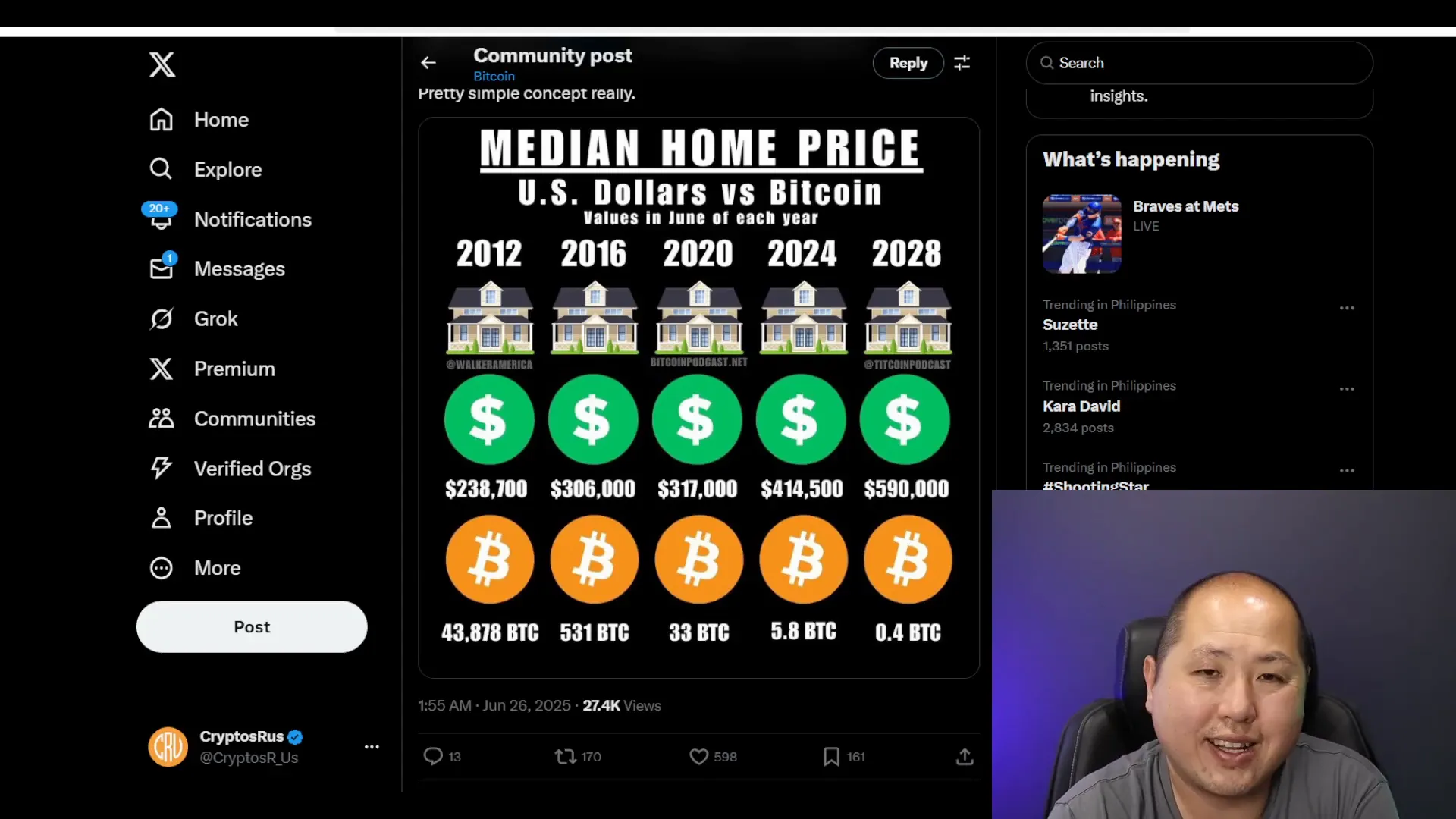

Here’s a striking example of Bitcoin’s potential against inflation. Back in 2012, shortly after Bitcoin was created, you would have needed nearly 44,000 Bitcoin to buy an average-priced home of $238,000. Fast forward to 2024, and the median home price in the U.S. is around $414,000, but you’d only need about 5.88 Bitcoin to buy it. In just over a decade, Bitcoin’s appreciation means you spend far fewer coins for a more expensive asset.

Looking ahead, this trend suggests that in four years, you might need less than half a Bitcoin to buy a home — assuming Bitcoin continues to rise. Inflation, while often seen negatively, actually benefits asset holders like Bitcoin investors. Inflation is only bad if you’re holding cash; for assets, it’s a boon.

Crypto Assets as Collateral for the American Dream

There’s even talk about changing housing commission rules to allow crypto assets as collateral for loans. This means you could prove your wealth with your Bitcoin holdings to help secure a mortgage. CZ, a well-known crypto figure, predicts that the future’s American dream won’t be owning a home, but owning 0.1 Bitcoin.

Right now, 0.1 Bitcoin is roughly $10,700. But as Bitcoin appreciates, that same fraction could be worth $100,000 or even $1 million. It might sound far-fetched today, but the trajectory is clear.

Other Key Crypto Market Updates

- Coinbase futures launch: Starting July 21st, Coinbase will offer futures trading, allowing leverage trading for the first time on the platform. This move could significantly boost Coinbase’s revenue. If you’re new to leverage trading, remember to be cautious — set stop losses and avoid greed.

- Regulatory shifts: Under former SEC Chair Gary Gensler, derivatives and futures were considered securities. That’s changing, reflecting how the crypto landscape is evolving.

- Major investments: Trump’s World of Financial recently secured a $100 million investment from a UAE fund — a huge endorsement for crypto finance.

- Ripple updates: The SEC and Ripple’s legal battle saw a proposed settlement reduction from $125 million to $50 million, but a judge denied the change. Despite legal hurdles, Ripple is pushing forward, integrating Wormhole to connect XRP Ledger with 35+ blockchains, and planning smart contract upgrades and DApps similar to Ethereum and Solana.

What Should Bitcoin and Crypto Investors Do Now?

Right now, things look good — crypto is recovering strongly since the April bottom, stocks are up, and markets are stable thanks to the tariff pause. But with the pause ending soon, brace yourself for volatility. Whether tariffs return or new deals are struck, the week after July 4th could be pivotal.

For Bitcoin holders, the fundamentals remain strong. Adoption is growing, infrastructure is improving, and Bitcoin continues to prove its worth as a resilient store of value. Stay informed, keep a cool head, and remember that long-term thinking is key in the crypto world.

Final Thoughts

If you’re invested in crypto or bitcoin, now’s the time to stay vigilant. The next few weeks could bring big changes, especially with tariffs and regulatory developments on the horizon. But Bitcoin’s steady growth and increasing adoption show why it remains a cornerstone of the crypto universe.

Keep your eyes on the market, manage risks carefully, and stay strong. The future of crypto and bitcoin is bright — and it’s only getting started.

Stay tuned and keep your crypto knowledge sharp. The ride ahead promises to be exciting!

Bitcoin Investors: Brace for July 9 – What Crypto and Bitcoin Holders Need to Know. There are any Bitcoin Investors: Brace for July 9 – What Crypto and Bitcoin Holders Need to Know in here.