Hey, crypto fam! If you’ve been watching the market lately, you’ve probably noticed something — some of our favorite cryptocurrencies are deep in the red. XRP, XLM, and other big names are selling off hard, and the reason might sting a bit. The much-anticipated “Big Beautiful Bill” that was supposed to bring some sweet crypto tax relief? Well, it passed — but without any of the crypto benefits we were promised.

In this deep dive, we’ll unpack what went down with the bill, why US-based crypto companies and miners got left out in the cold, and what this means for your favorite coins and investments. Plus, we’ll get into the heated Linqto saga with John Deaton, the pro-XRP lawyer who’s not holding back on his thoughts about the Ripple pre-IPO shares mess. Strap in — this is a rollercoaster, and it’s not just the market that’s dropping.

Market Madness: XRP, XLM, and More Going Deep Red

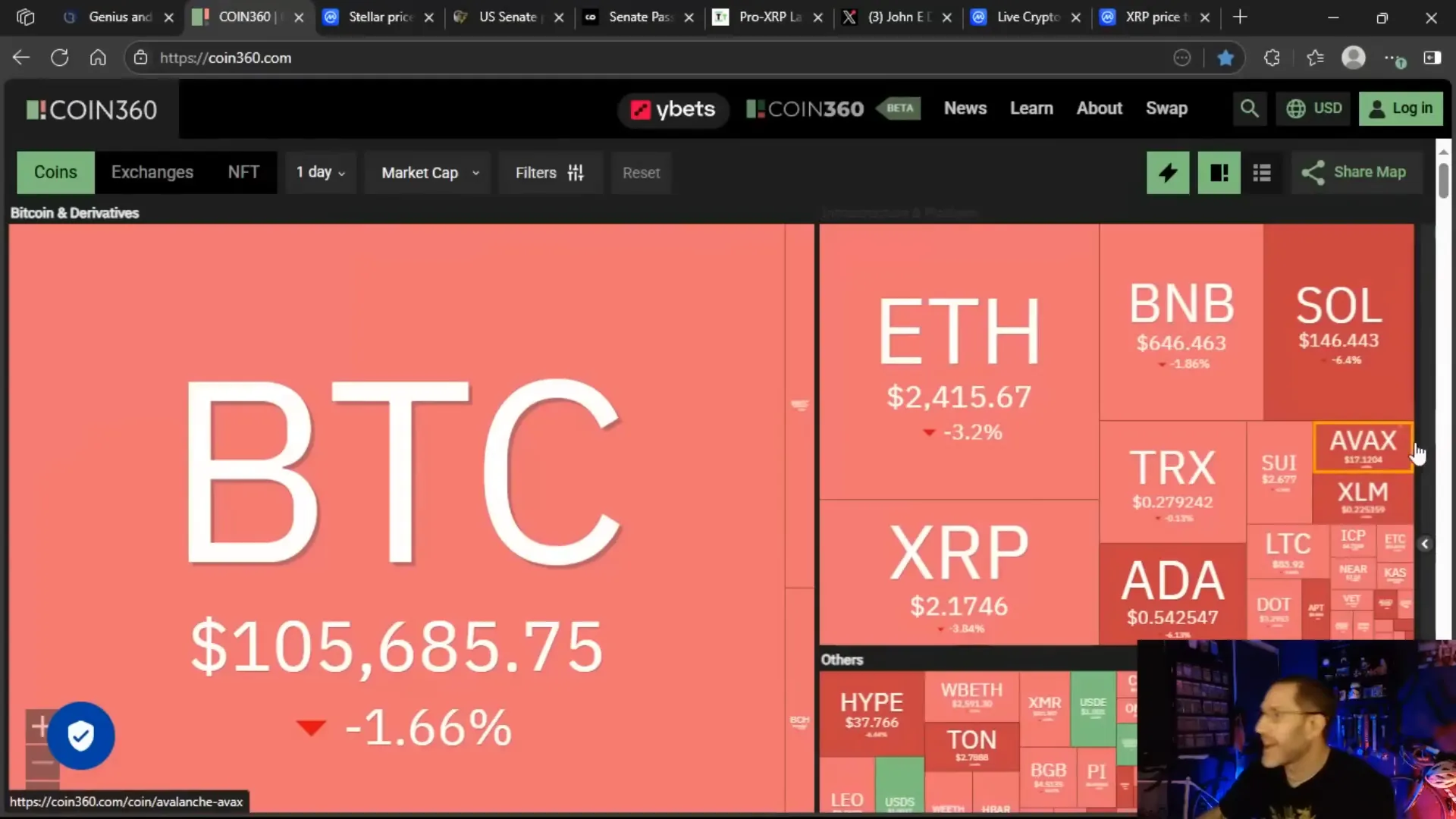

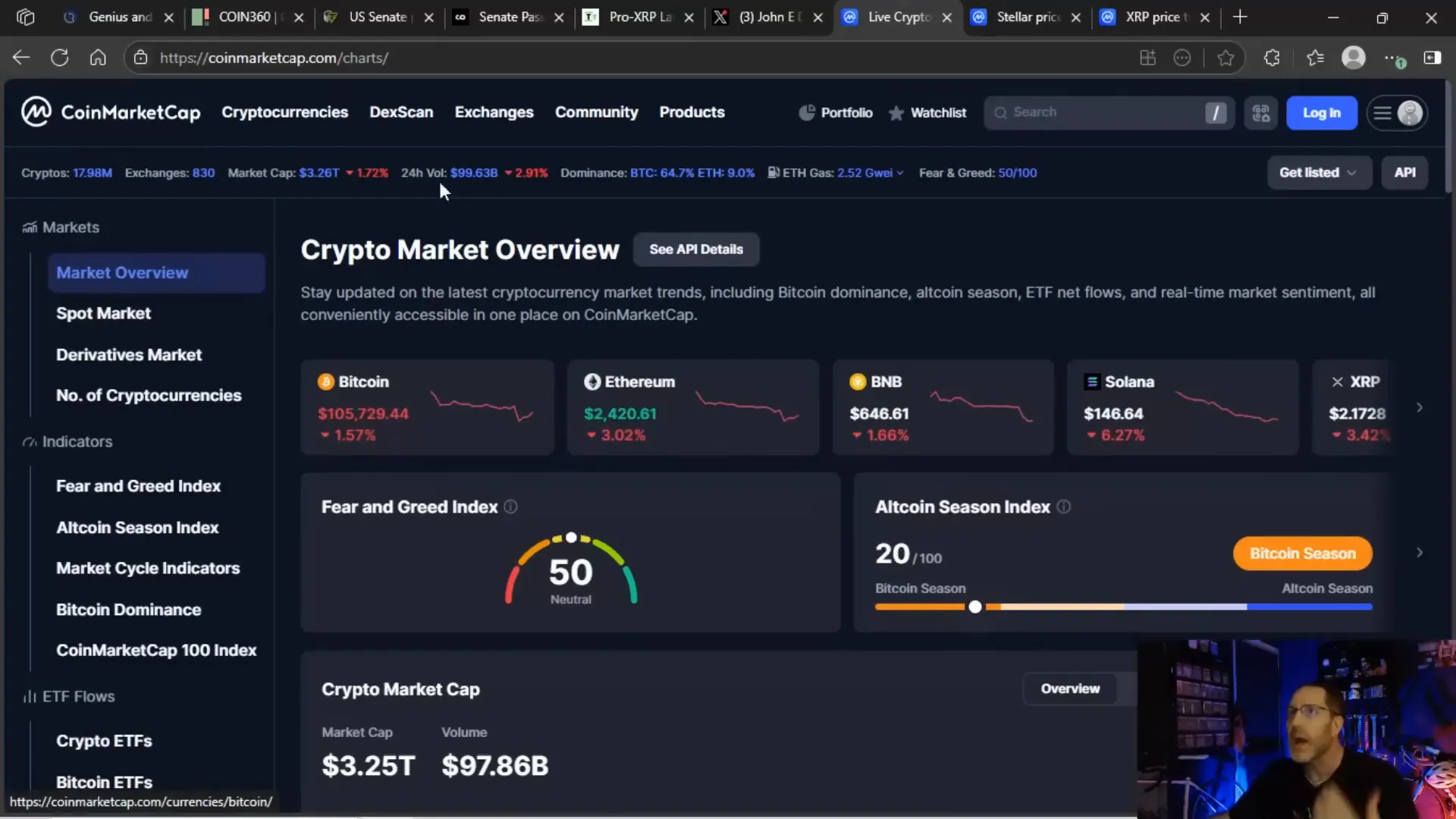

First things first: the market is bleeding. Stellar Lumens (XLM) is seeing a massive sell-off, dropping around 5% in a single stretch. XRP’s price isn’t looking so hot either, and Bitcoin (BTC), while not as volatile, is dipping too. Solana and Cardano (ADA) aren’t spared either, with ADA sliding below 55 cents.

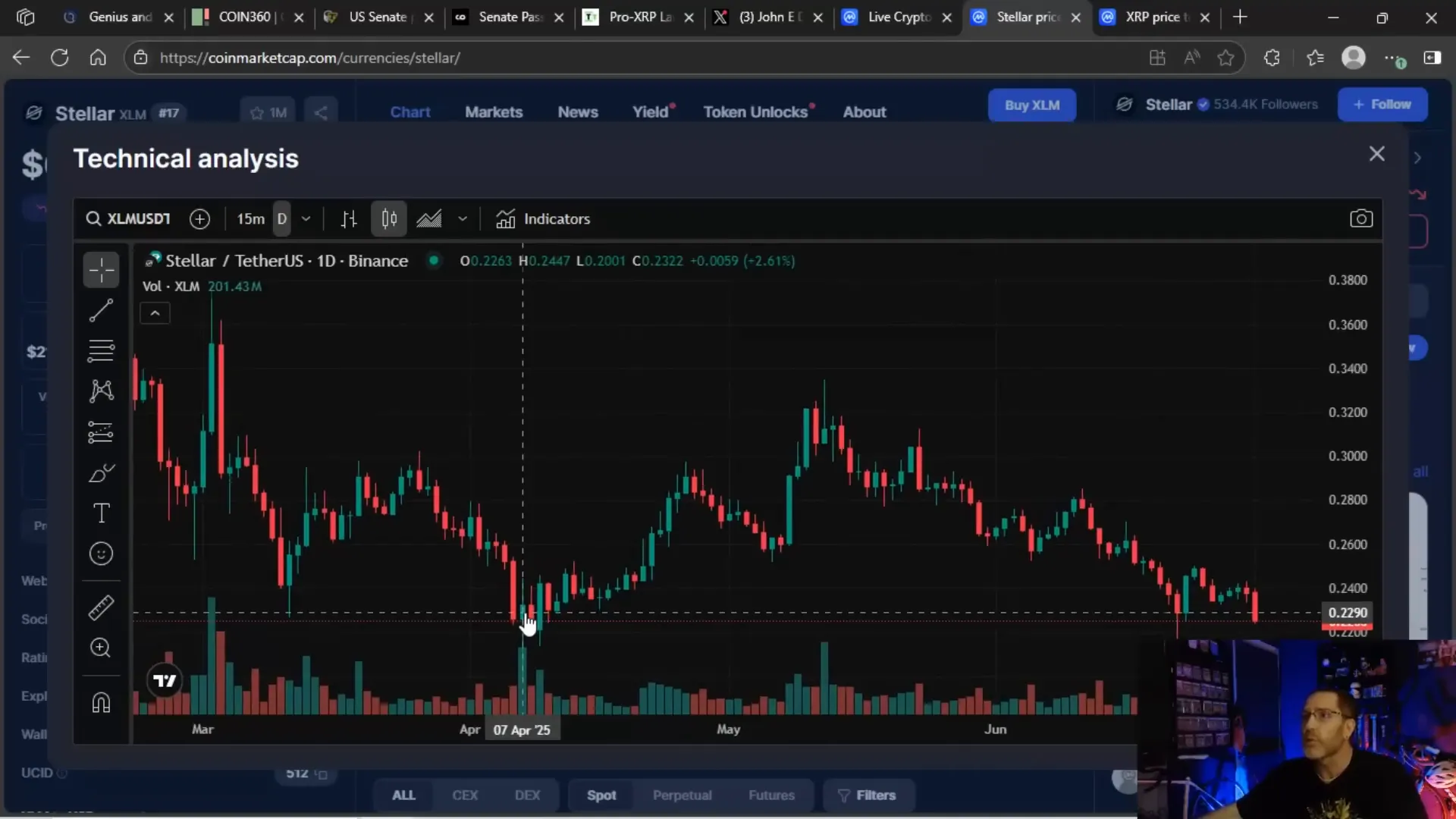

Here’s the kicker — if XLM continues to break through its recent candlesticks, we could be looking at a full rewind to November 2023 prices. That means dropping from around 20 cents back down to 10 cents, wiping out months of gains. For traders and investors, that’s a serious red flag.

What’s driving this sell-off? The biggest culprit is the disappointment around crypto tax provisions that were expected but didn’t make it into the latest Senate budget bill.

What the Charts Are Saying

Looking at the charts, XLM is particularly fragile. There’s only one day in recent memory where prices were lower than today — April 7, when the low touched 20.01 cents. If that support breaks, the next major floor is around 10 cents. And this isn’t just a blip; XLM has been on a slow, steady decline since the November pump.

XRP’s chart tells a slightly different story. It’s been relatively flat, hovering around the $2 mark. While that might sound stable, it puts XRP in what I call the “friend zone” — not exciting enough to buy heavily, but not cheap enough to stack aggressively either. The trading volume is still healthy at around $4 billion in the last 24 hours, meaning exchanges like Binance and Coinbase are raking in fees, but retail investors are stuck waiting for a real breakout.

The Big Beautiful Bill: What Happened with Crypto Tax Provisions?

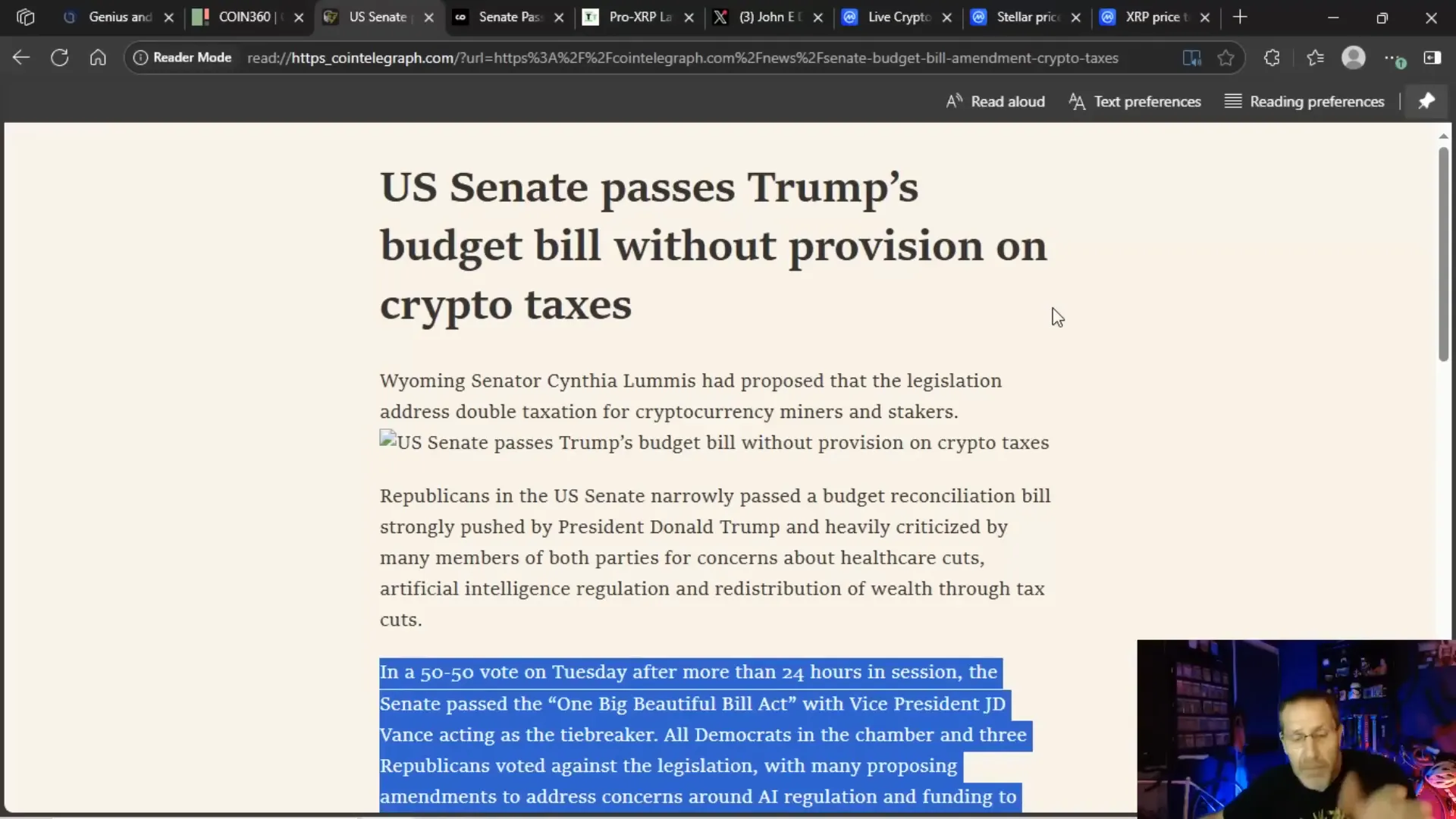

So, what went wrong? The Senate passed the budget bill after a grueling 24-hour marathon session, with the vote split 50-50. Vice President JD Vance cast the tiebreaker vote in favor, breaking a deadlock caused by three Republicans voting against the bill. But despite all the drama and anticipation, the bill didn’t include any of the crucial crypto tax amendments that many in the community were counting on.

Remember all those promises? No taxes on crypto gains, no double taxation for Bitcoin miners, and special tax breaks for US-based crypto companies? Yeah, none of that made it. Senator Cynthia Loomis and other crypto advocates pushed hard in the final hours, but the Senate simply ran out of time to include these provisions.

"We just ran out of time," they said, reflecting on missed opportunities to address double taxation and other key issues.

That’s a pretty raw deal for the crypto community, especially since many investors and companies were banking on these tax reforms to ease the regulatory burden and encourage growth. Instead, we’re left with overpromising and underdelivering — a classic tale from the US government.

Why Did Crypto Tax Provisions Matter So Much?

Double taxation has been a thorn in the side of Bitcoin miners for years. Here’s the issue: when miners successfully mine BTC, they are taxed on the newly created coins as income. Then, when they sell those coins, they’re taxed again on capital gains. It’s like getting taxed twice on the same asset, which puts miners at a significant disadvantage.

The proposed amendments aimed to fix this by exempting miners from this double taxation and providing other tax relief to US-based crypto companies. Had these provisions passed, it would have been a major win for the industry, potentially boosting prices and encouraging further innovation.

Instead, the bill’s failure to address these issues has led to a swift negative reaction in the market. US-based crypto companies like those behind ADA, XLM, and SOL have taken some of the hardest hits, dragging the entire sector down in sympathy.

The Linqto Saga: John Deaton’s Fiery Take on Ripple Shares

While the tax bill disappointment is a big story, it’s not the only drama shaking the crypto world. The Linqto platform — a private equity investment platform many of you got involved with for Ripple pre-IPO shares — has hit a major snag. Operations were halted in February 2025 due to regulatory scrutiny, and now investors are left wondering if they’ll ever get their money back.

John Deaton, a prominent XRP lawyer and advocate, isn’t holding back his frustration. He’s made it crystal clear that simply returning investors’ initial contributions without accounting for asset appreciation is a raw deal and would let Linqto pocket the profits unfairly.

Here’s the situation: Ripple recently ran a buyback program offering $175 per share. Some investors bought in through Linqto at an average cost of around $33 per share. If Linqto merely refunded the original $33 without factoring in Ripple’s buyback price, the platform would keep the difference — a financial windfall at the expense of investors.

Deaton warns:

"No way are the people who screwed us over going to benefit from us over. I'm not letting that happen without a fight to the death."

This has understandably caused frustration and anger among investors. Some might even try to offload their interests to opportunists looking to cash in on fearful sellers. Deaton cautions the community to be vigilant and not fall prey to these tactics.

What Does This Mean for Ripple Investors?

If you’re affected by the Linqto halt, you’re probably feeling the heat. With funds inaccessible and regulatory clouds looming, the path forward is uncertain. But the key takeaway is this: simply getting your principal back isn’t enough — the appreciation and value growth need to be recognized to make investors whole.

Market Sentiment and What’s Next for Crypto Investors

With the tax bill passing sans crypto benefits and the Linqto drama unfolding, market sentiment is understandably sour. The volume on exchanges is high — currently around $99 billion — but much of this is from selling pressure, not buying enthusiasm.

Jerome Powell’s recent comments and the anticipated 25 basis point rate cut expected in the September Federal Reserve meeting aren’t doing much to inspire confidence either. The market has largely priced in this modest cut, so it’s unlikely to spark a meaningful rally.

Meanwhile, the European Central Bank has been more aggressive, cutting rates multiple times, but the US market remains jittery. Crypto traders are playing the classic pump-and-dump games, buying on dips and selling on small price spikes, but without strong fundamentals or regulatory clarity, the market feels like it’s treading water.

The Friend Zone: Why XRP’s Price Action Feels Stuck

Back to XRP, the “friend zone” I mentioned earlier is frustrating for buyers and holders alike. At $2.17, it’s not cheap enough to aggressively buy, especially since sub-$2 prices were available recently. Yet it’s not high enough to make selling for a profit very attractive either — XRP has been hovering in this dull zone for a while.

This stagnant price movement means a lot of investors are waiting on the sidelines, hoping for a catalyst that just isn’t coming anytime soon.

What Should Investors Do Now?

So, with all this chaos and disappointment, what’s the play? Here are some key points to consider:

- Don’t panic sell: The crypto market is volatile and prone to swings. While the tax bill news is a setback, it’s not the end of the world for crypto investing.

- Watch for support levels: Especially with XLM, keep an eye on critical support around 20 cents and 10 cents. A breach below these could signal deeper declines.

- Stay informed about regulatory developments: The Senate’s failure doesn’t mean the fight is over. Advocacy and lobbying efforts continue, so stay engaged with credible sources.

- Be cautious with private equity platforms: The Linqto saga is a cautionary tale. Always research and understand the risks before investing in private or pre-IPO crypto shares.

- Consider accumulation zones: For some coins, the current dip might be a good entry point. But do your own research and consider your risk tolerance.

Final Thoughts: Crypto’s Rocky Road Ahead

The recent Senate bill passing without crypto tax provisions is a huge disappointment, but it’s also a stark reminder that the crypto industry’s regulatory landscape is still a work in progress. The promises of tax relief and special treatment for US-based crypto companies didn’t materialize this time, dragging prices down and shaking investor confidence.

On top of that, the Linqto-Ripple shares drama adds fuel to the fire, leaving many investors feeling burned and wary. But in true crypto fashion, this is just another twist in the rollercoaster ride that is Bitcoin, crypto, BTC, blockchain, and investing.

Keep your eyes on the charts, stay informed, and prepare for the long haul. The market might be red now, but history shows that crypto’s resilience often surprises us all.

Remember: in the world of crypto, overpromising and underdelivering is sadly the norm. But with the right knowledge and patience, we can navigate these stormy seas and come out stronger on the other side.

Bitcoin, Crypto, BTC, Blockchain, CryptoNews, Investing: Why XRP, XLM, and Crypto Tax Hopes Just Took a Massive Hit. There are any Bitcoin, Crypto, BTC, Blockchain, CryptoNews, Investing: Why XRP, XLM, and Crypto Tax Hopes Just Took a Massive Hit in here.