Welcome to the latest deep dive into the exhilarating world of Bitcoin, Crypto, and the broader blockchain ecosystem. As prices surge and charts light up with bullish signals, it’s clear that the crypto market is entering an electrifying phase. This comprehensive analysis covers Bitcoin's breakout to new all-time highs, Ethereum's current resistance challenges, and the promising movements in Solana, XRP, and Chainlink. With insights grounded in technical analysis and market momentum, this article is your go-to guide for understanding where the crypto market is headed and how to position yourself for potential gains.

Bitcoin: Breaking New Records and Setting Ambitious Targets

Bitcoin is currently on a tear, smashing through previous price ceilings and setting fresh all-time highs. At the moment, Bitcoin has crossed over the $122,000 mark, a tremendous milestone that marks the beginning of a massive bullish breakout. This surge is supported by a compelling technical setup and a short squeeze that’s playing out in the short term, fueling more momentum.

Weekly Bitcoin Chart: Bull Market Confirmed with Cautionary Signals

On the weekly chart, the Super Trend indicator remains green, affirming that Bitcoin is still firmly in a bull market. However, traders should note the potential bearish divergence forming between higher highs in price and lower highs in the weekly Relative Strength Index (RSI). While this divergence isn’t confirmed yet, it’s a signal to watch closely as it could hint at a future correction or consolidation phase.

The Power of the Three-Day Bitcoin MACD Crossover

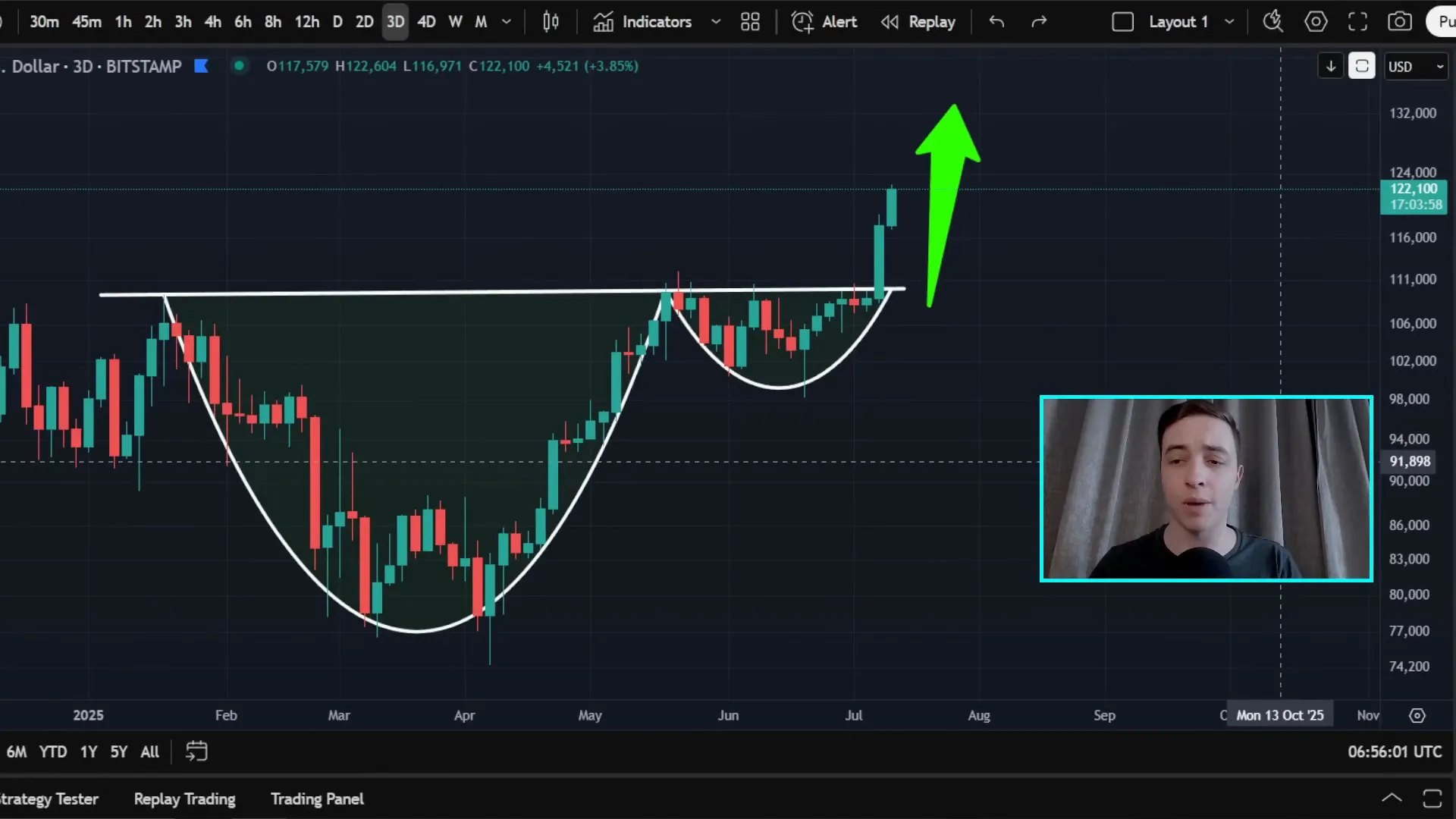

Moving to a slightly shorter timeframe, the three-day Bitcoin chart has recently confirmed a bullish crossover in the MACD (Moving Average Convergence Divergence) indicator. This crossover is a classic momentum signal that has historically preceded significant upward price moves lasting weeks or even months. Given that this bullish crossover was confirmed just days ago, the market is poised for continued upward momentum.

In fact, this crossover coincides with the breakout of a bullish cup and handle pattern on the three-day chart, a strong technical formation that sets a lofty price target of approximately $153,000 per Bitcoin. From the current price, this implies roughly a 25% upside potential. For those who entered positions at the breakout, the move could be as high as 40%, representing a massive opportunity for traders and investors alike.

Managing Risk: Turning Your Bitcoin Trade into a Risk-Free Opportunity

While the market looks bullish, smart traders always manage risk. One prudent technique is to move your stop loss slightly above your entry price after the trade moves in your favor. This strategy effectively turns your trade into a risk-free position. In the worst-case scenario, if the price suddenly reverses, your stop loss will close your position with a slight profit, protecting your capital while allowing you to ride the trend.

Personally, I remain long on Bitcoin from the breakout level and have adjusted my stop loss to just above my entry price. This approach lets me capitalize on the ongoing bullish momentum while safeguarding against unexpected downturns.

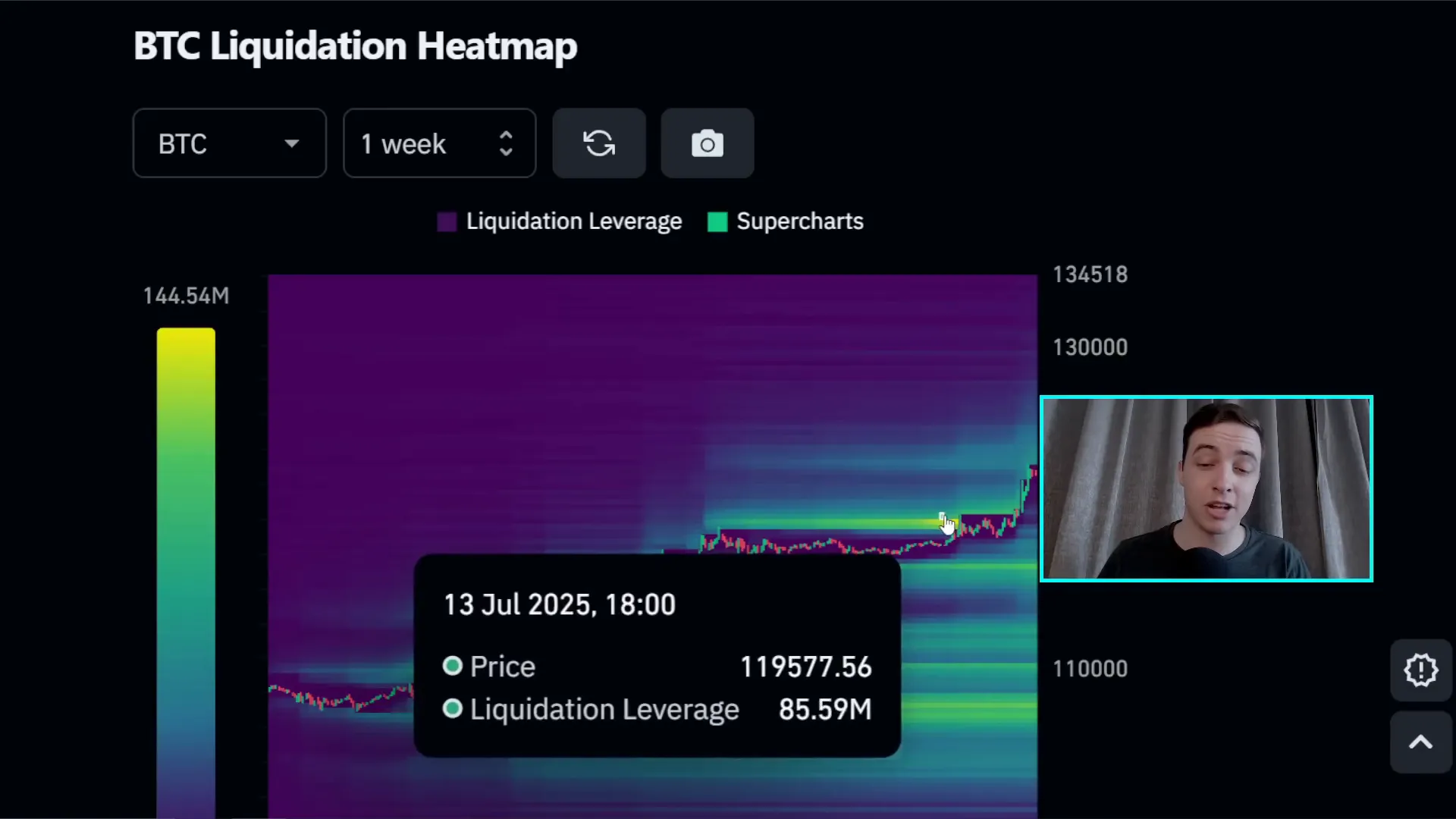

Short Squeeze Dynamics and Bitcoin Liquidation Heat Map

A key driver behind Bitcoin’s recent surge is a short squeeze. When traders holding short positions get liquidated due to rising prices, it triggers a cascade of buying pressure that propels prices even higher. The Bitcoin liquidation heat map reveals that recent price action has wiped out a significant cluster of short positions near the $119,000 to $120,000 zone. This event cleared the path for Bitcoin to breakout decisively, eliminating immediate resistance and setting the stage for further gains.

With this liquidity cleared, Bitcoin currently faces few immediate short-term resistance levels, meaning the bulls are in control. However, new liquidity zones will likely develop as the price continues to rise, so ongoing monitoring of these levels is crucial for timing entries and exits.

Key Support and Resistance Levels to Watch

- Resistance: The immediate resistance Bitcoin is challenging is the 1.618 Fibonacci extension level around $121,000 to $122,000. Daily candle closes above this level will confirm the breakout and pave the way for higher targets.

- Support: Previous resistance zones are expected to flip into support as Bitcoin climbs. These include key Fibonacci retracement levels and areas where price consolidation occurred during the breakout.

Short-Term Price Action and RSI Behavior

Zooming into the four-hour Bitcoin chart, the recent price surge pushed the short-term RSI into extremely overbought territory. This led to a brief cooling-off period where the price moved sideways to reset momentum. However, this reset was shallow, and the RSI quickly re-entered overbought levels, signaling the market’s strong bullish drive.

It’s normal to see minor pullbacks and sideways action in such scenarios, so traders should expect occasional pauses in the uptrend without panicking. The key is to keep an eye on the larger timeframes, which still show robust momentum and bullish trends.

Ethereum’s Battle Against Resistance and Its Relationship with Bitcoin

Ethereum is also making significant moves, continuing its bullish breakout from a major resistance zone between $2,700 and $2,800. This area, once a ceiling, is now expected to act as support should Ethereum experience any short-term pullbacks.

Resistance Ahead for Ethereum

Despite the bullish momentum, Ethereum faces resistance in the $3,000 to $3,050 range, with a secondary resistance zone between $3,250 and $3,300. A confirmed breakout above $3,300 could see Ethereum racing back toward its previous highs set near the end of 2024.

Ethereum vs. Bitcoin: Underperformance in the Short Term

Examining the ETH/BTC pair on the daily chart reveals Ethereum is currently struggling against Bitcoin. After a brief period of outperforming Bitcoin, Ethereum has encountered significant resistance and is showing signs of rejection. This means Ethereum is underperforming Bitcoin in the short term but not necessarily bearish against the US dollar.

For traders, this suggests it makes more sense to hold Bitcoin over Ethereum at the moment, given Bitcoin’s stronger price action. However, a confirmed breakout above this ETH/BTC resistance level would flip the structure and potentially make Ethereum the preferred asset moving forward.

Solana: Testing Resistance with a Bullish Outlook

Solana is retesting a critical resistance level around $167. This zone is crucial; failure to break and hold above it may lead to rejections, while a confirmed breakout would open the door to higher price targets.

Price Targets and Support Levels

- Upside Targets: A solid close above $167 could propel Solana toward $180-$185, followed by a golden pocket zone between $191 and $199. Beyond that, prices near $230 are possible.

- Support Zones: If Solana faces rejection, short-term support lies between $155 and $156, with stronger support at $143 to $146.

Bullish Cup and Handle Confirmed

On the 8-hour timeframe, Solana has confirmed a breakout from a bullish cup and handle pattern. After retesting the old neckline as new support around $158, the price has bounced higher, reinforcing the bullish structure. A break back below $158 would invalidate this pattern and could trigger a retest of support levels.

XRP: Poised for a Breakout Towards New Highs

XRP is currently testing a significant Fibonacci resistance zone between $2.80 and $3.00. A decisive daily candle close above $3.00 would likely trigger a continued bullish move targeting the all-time high near $3.40.

Support and Momentum

If XRP confirms this breakout, previous resistance levels are expected to flip into strong support. Additionally, a golden pocket support zone exists between approximately $2.55 and $2.62, providing a solid cushion for price declines.

The trend and momentum for XRP are extremely bullish, with price action appearing almost linear on the daily chart—a pattern that’s not unusual for XRP during strong rallies. Minor cool-offs on shorter timeframes are normal and should not be a cause for concern.

Chainlink: Breaking Resistance and Building Momentum

Chainlink has just confirmed a significant breakout above $15.50, marking a major shift in price structure and increasing bullish momentum. This breakout clears a key resistance level, making it easier for Chainlink to continue its upward trajectory.

Resistance and Targets

- Next resistance lies between $16.40 and $16.50.

- A successful break above this zone opens the path toward local highs around $17.50 to $18.00.

Potential Short-Term Pullback

On the 4-hour chart, a possible bearish divergence is forming, characterized by higher highs in price but lower highs in the RSI. While not yet confirmed, this could lead to a short-term pullback or sideways consolidation lasting a few days before the bullish trend resumes.

How to Position Yourself in This Bullish Crypto Environment

The current market conditions across Bitcoin, Ethereum, Solana, XRP, and Chainlink suggest a strong bullish environment with multiple opportunities for investors and traders. However, navigating this fast-moving market requires preparation and access to reliable trading platforms.

For those looking to capitalize on these opportunities, setting up accounts on crypto exchanges that offer bonuses and flexible trading options is essential. Platforms like Beautynext and 2Bit provide no-KYC access from many countries, making it easier to start trading quickly. These exchanges also offer deposit and trading bonuses, effectively giving you extra capital to trade with — a great advantage in volatile markets.

Remember, managing risk is just as important as chasing profits. Use stop losses wisely, consider position sizing carefully, and keep an eye on key support and resistance levels highlighted in this article.

Understanding Market Dynamics Beyond Price Movements

It’s important to remember that price movements in cryptocurrencies are influenced by a confluence of factors, including market sentiment, liquidity, macroeconomic trends, and technical triggers like breakouts and divergences. Short squeezes, for example, are powerful catalysts that can accelerate price moves quickly, as we’ve seen recently with Bitcoin.

Technical patterns such as cup and handle formations, Fibonacci retracements, and MACD crossovers offer valuable insights into potential future price action but should be used in conjunction with market context and sound risk management.

Final Thoughts: The Crypto Market Momentum is Real

The crypto market is buzzing with bullish momentum across major assets. Bitcoin’s record-breaking run, Ethereum’s breakout attempts, and the promising setups in Solana, XRP, and Chainlink all point towards a dynamic and exciting phase ahead.

While minor pullbacks and consolidations are normal and healthy for sustained trends, the overall picture points to a market ripe with opportunities for those prepared to act. Whether you’re a long-term investor or a tactical trader, now is a time to stay informed, vigilant, and ready to capitalize on the evolving crypto landscape.

Keep monitoring key levels, use smart risk management, and consider positioning yourself to benefit from this bullish wave in Bitcoin, Crypto, BTC, Blockchain, and beyond.

Bitcoin, Crypto, BTC, Blockchain, CryptoNews, Investing: Bitcoin & Altcoins Are Finally Breaking Out!. There are any Bitcoin, Crypto, BTC, Blockchain, CryptoNews, Investing: Bitcoin & Altcoins Are Finally Breaking Out! in here.