Welcome to a deep dive into the current state of the cryptocurrency market, focusing on Bitcoin, Ethereum, Solana, XRP, and Chainlink. The crypto world is buzzing with anticipation as Bitcoin approaches a critical breakout point, signaling potential new price targets and trading opportunities. If you’re keen on understanding the nuances behind these movements and how to position yourself strategically, this detailed analysis will provide you with valuable insights. Let’s explore the latest trends, momentum indicators, and key resistance and support levels shaping the market today.

Bitcoin Price Analysis: On the Verge of a Breakout

Bitcoin is inching closer to breaking through a significant line of resistance, a development that could activate a new bullish price target. As of now, the market is showing a mixture of neutral and cautious signals across various time frames, making it essential to understand where momentum stands before making any trading decisions.

Weekly Bitcoin Chart and Momentum Indicators

Starting with the weekly Bitcoin price chart, the SuperTrend indicator remains green, signaling that the larger bull market is still intact. However, the weekly Bitcoin MACD is lacking momentum. This neutrality suggests that we shouldn't expect any significant bullish or bearish moves on the weekly scale just yet.

One critical technical pattern to note is the formation of a massive bearish divergence on the weekly chart. While this is a warning sign, it hasn’t yet shifted the overall neutral stance significantly over the past day.

Three-Day Time Frame: Cup and Handle Pattern Emerges

On the three-day chart, momentum remains subdued, echoing the weekly chart’s neutral sentiment. However, a potentially bullish cup and handle pattern is forming, which could signal a significant upward move if confirmed.

This pattern will only be validated if Bitcoin's price closes above the neckline, which is approximately at $110,000, on a three-day candle. Until such a breakout is confirmed, this bullish pattern remains a potential rather than a certainty.

Daily Bitcoin Chart: Descending Parallel Channel

The daily Bitcoin chart reveals a descending parallel channel characterized by slightly lower highs and lower lows, indicating a mild bearish trend but overall neutrality. Key levels to watch include resistance around $109,000 to $110,000 and support near $100,000, with a center line providing additional support just below $105,000.

Additional support exists around $103,000 and $98,000, while resistance also appears at $112,000. These levels create a framework within which Bitcoin's price is currently oscillating.

Short-Term Bitcoin Price Movements: Six-Hour and Two-Hour Charts

Zooming into the six-hour chart, Bitcoin is struggling near the $109,000 level, although this resistance area is losing significance compared to a few days ago. Expect minor resistance around $109,000 and more substantial resistance between $110,000 and $110,500. Support is present at $107,500 and between $105,500 and $106,500.

Unfortunately, momentum remains lacking, with Bitcoin bouncing sideways rather than making decisive moves. This sideways action reflects market indecision.

On the two-hour chart, Bitcoin is forming a symmetrical triangle (also called a horizontal triangle) with descending highs and slightly ascending lows. The resistance line is near $108,900, and support is around $107,700.

A confirmed breakout above $109,000 with candle closes would activate a bullish price target around $111,500, representing a 2-3% potential upside move. While this may seem modest, leveraged positions, such as 10x long trades, could yield significant profits in this scenario.

Conversely, a break below $107,700 would activate a bearish price target near $105,200, presenting a potential short-term trading opportunity for day traders. Each candle on this chart represents two hours, meaning these moves could materialize quickly.

Trading Strategy: Wait for Confirmation

It’s crucial to emphasize that these price targets are not active until confirmed by a breakout or breakdown. No trades should be entered based on these patterns until the price decisively moves beyond the resistance or support lines.

Support and resistance levels within these patterns can cause price bounces or rejections, which traders should expect. For example, price may bounce off support before hitting a bearish target or reject resistance before reaching a bullish target.

Liquidity and Potential Fakeouts

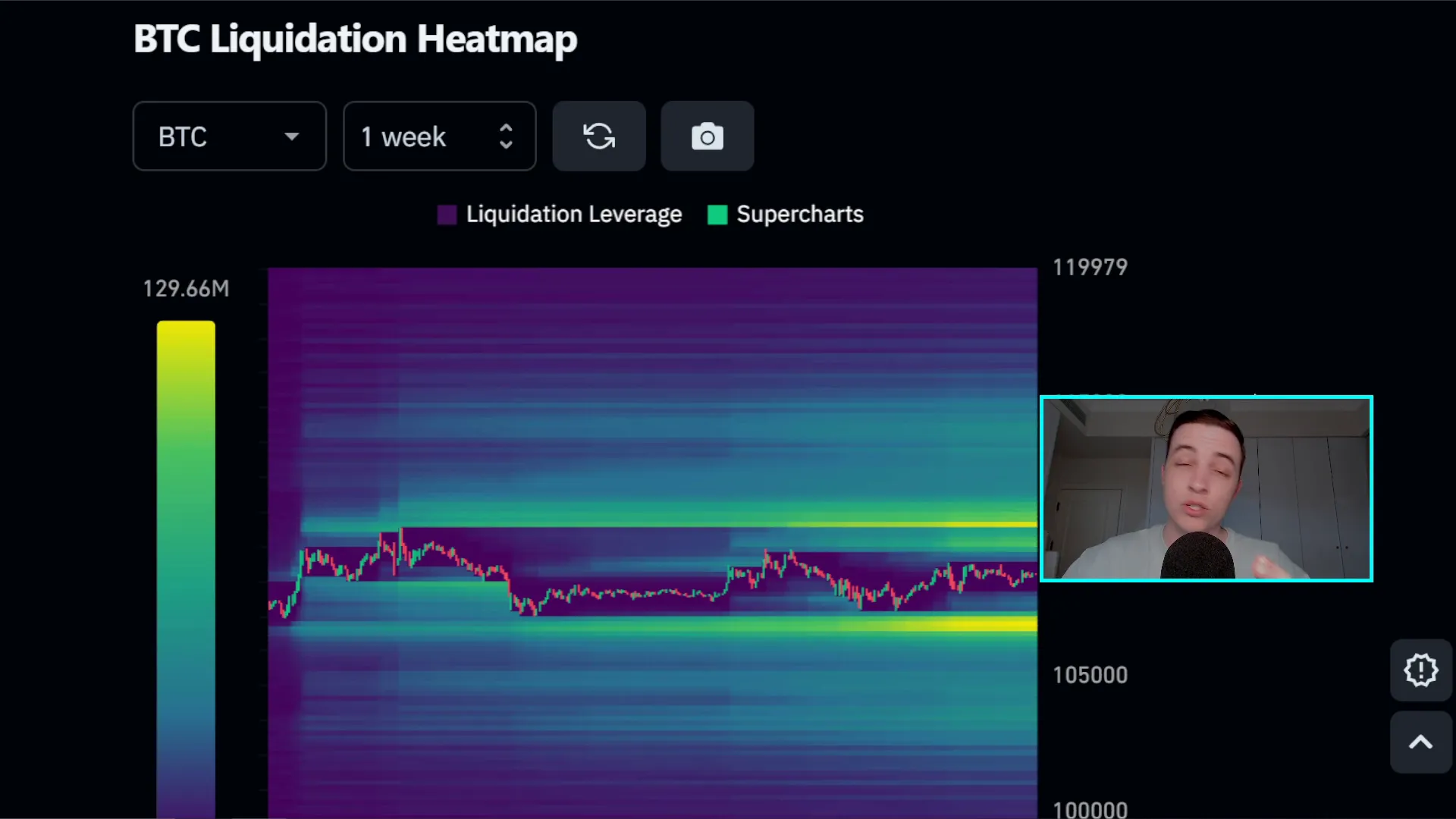

Examining the Bitcoin liquidation heat map reveals significant liquidity clusters just below and above the current price. This liquidity accumulation suggests potential fakeout scenarios where the price may briefly break support or resistance to trigger stop losses before reversing direction.

For instance, a break below support might take out downside liquidity near $107,000 before the price reverses upward to hit upside liquidity around $110,600. The reverse could also happen on an upside breakout.

Ethereum Price Analysis: Continuing Sideways Relief

Ethereum is currently experiencing a short-term bullish relief phase within a broader sideways trading range. On the daily chart, ETH is fluctuating between roughly $2,400 and $2,800.

Resistance is expected between $2,700 and $2,800, while support lies around $2,380 to $2,400. Given the lack of momentum, Ethereum’s price action is likely to remain range-bound for the coming days or even weeks, mirroring Bitcoin's overall market sentiment.

If Bitcoin manages a breakout, it could help Ethereum continue its bullish relief towards resistance levels. However, Ethereum will likely struggle to break above these zones without stronger market catalysts.

Solana Price Analysis: Neutral, Lacking Momentum

Solana recently bounced off an important support area between $143 and $146 but remains neutral overall. The price is bouncing sideways with no clear bullish or bearish momentum.

Resistance levels to watch include a minor resistance around $155 and a more significant resistance between $166 and $167.

Should Ethereum and Bitcoin continue their short-term bullish relief, Solana may follow suit, potentially testing the higher resistance zone near $167. Until then, the price action remains relatively flat and indecisive.

XRP Price Analysis: Testing Key Resistance

XRP is currently challenging a significant resistance zone between $2.31 and $2.36. This area has proven difficult to break through several times over recent weeks and months.

A confirmed breakout with candle closes above $2.36, ideally on a daily time frame, would be highly bullish. The next resistance targets would then be:

- Approximately $2.44 to $2.45

- The local high set in mid-May near $2.61 to $2.62

Holding above $2.36 as new support would represent a breakout from a major range, significantly increasing the probability of further upward movement towards $2.60 and beyond.

Shorter-Term Patterns: Rising Wedge Formation

On the six-hour chart, XRP may be forming a rising wedge, which is typically a bearish pattern. Confirmation requires a break either above resistance or below support.

Key levels here include:

- Support around $2.27

- Resistance around $2.36

A break below support could trigger a bearish price target near $2.09. Between the support and target, additional support levels exist near $2.21 and $2.17.

However, if the larger time frame breakout above $2.36 happens, it may invalidate the bearish implications of the rising wedge on the shorter time frame, favoring a bullish outlook instead.

Chainlink Price Analysis: Breaking Resistance and Gaining Momentum

Chainlink has recently confirmed a 12-hour candle close above a key short-term resistance zone between $13.70 and $13.90. This breakout paves the way for further bullish relief towards the next resistance levels:

- $14.40 to $14.50

- $15.30 to $15.50

Despite this positive price action, overall momentum remains neutral with a slight bullish bias. This cautious optimism reflects the absence of major catalysts to push prices decisively higher.

Short-Term Momentum Breakout

Over the last day, the Chainlink RSI on the four-hour chart broke out above a descending resistance line, invalidating a prior short-term bearish divergence. This is a positive technical signal suggesting that short-term bearish pressures have eased.

Trading Platforms and Bonuses: Preparing for Opportunities

For traders looking to capitalize on these potential moves, it’s important to be ready on reliable crypto exchanges. Platforms like BTNX and 2Bit offer no KYC trading, allowing access from almost any country. Both provide significant trading bonuses that can enhance your initial capital:

- BTNX: Up to $45,000 in bonuses, including deposit bonuses (e.g., deposit $1,000 and get $200 bonus).

- 2Bit: Similar no KYC exchange with attractive bonuses.

Using these platforms can help you leverage short-term price movements effectively, whether you’re trading long or short positions. Always check your local regulations before trading.

Final Thoughts: Navigating a Market on the Cusp

The cryptocurrency market is currently at a pivotal crossroads. Bitcoin's potential breakout above a critical resistance zone could set the tone for the broader market, influencing altcoins like Ethereum, Solana, XRP, and Chainlink.

Momentum remains generally neutral to slightly bullish across many assets, but key technical patterns and liquidity levels suggest that significant moves may be imminent. Traders should watch for confirmed breakouts or breakdowns to activate defined price targets and trading strategies.

Remember, patience and discipline are critical. Wait for clear entry signals, respect support and resistance levels, and consider using leverage cautiously to maximize potential gains while managing risk.

Whether you're an experienced trader or just getting started, staying informed and prepared will position you to navigate this dynamic market effectively.

Bitcoin, Crypto, BTC, Blockchain, CryptoNews, Investing: Imminent Breakout and Key Market Updates. There are any Bitcoin, Crypto, BTC, Blockchain, CryptoNews, Investing: Imminent Breakout and Key Market Updates in here.