Hey crypto enthusiasts, buckle up! Today, we’re diving deep into some of the hottest topics swirling around the cryptocurrency world right now. From Brad Garlinghouse’s bold XRP message to insider stock moves at MicroStrategy, and the ever-persistent question of whether Bitcoin (BTC) is about to take a nosedive — we’ve got it all covered. Plus, we’ll break down what Binance’s stance on XRP really means and what big events are lined up in the coming week that could shake things up. So, grab your coffee, sit back, and let’s get into the nitty-gritty of Bitcoin, Crypto, BTC, Blockchain, CryptoNews, and Investing!

Brad Garlinghouse’s XRP Tattoo and Message: Locked In 1000%

Let’s start with Ripple’s CEO, Brad Garlinghouse. This guy is not just talking the talk—he’s literally got an XRP tattoo to back up his belief in the crypto asset that has made his company a fortune. Brad’s message is clear and loud: “Lock in, zero doubt, one thousand percent.” That’s some serious confidence!

Now, some folks have been roasting Brad for getting inked in his fifties—calling it cringe or a middle-aged man’s folly. But honestly, why not? If XRP has been a game-changer for him and Ripple, why wouldn’t you want to show your loyalty that way? It’s like wearing your success on your sleeve, quite literally.

Think about it — Brad and Ripple have made millions from XRP. His tattoo isn’t just a personal statement; it’s a rallying cry for the XRP army to stay strong and focused. Whether you find it cool or cringe, it’s undeniable that Brad’s commitment is 1000% locked in.

But here’s the kicker: Brad’s tattoo and message aren’t happening in a vacuum. The crypto market is watching closely, especially with Ripple’s ongoing legal battle nearing a resolution. This tattoo could be a subtle way to drum up even more support as the XRP community braces for what’s next.

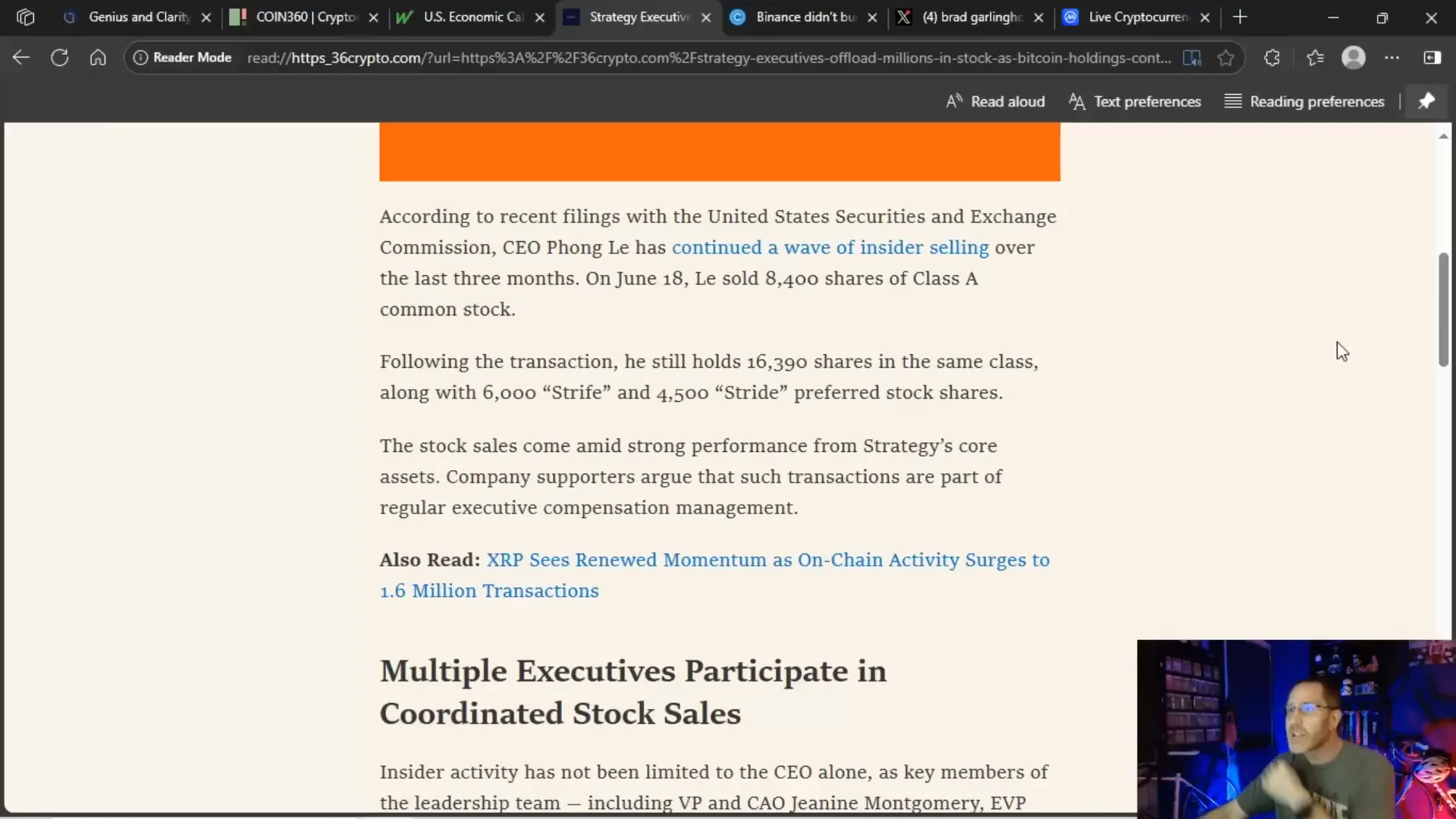

MicroStrategy Insiders Dumping Stock: Panic or Profit-Taking?

Switching gears, let’s talk about MicroStrategy — or as some now jokingly call it, “Strategy.” Over the past three months, insiders at the company have been offloading millions of shares. CEO Michael Saylor’s successor, Fong Li, sold 8,400 shares on June 18th alone, and left with 16,000 shares. But he’s not the only bigwig cashing out.

Key members of the leadership team, including Vice President & CAO Janine Montgomery, Executive VP & General Counsel Mei Lingxiao, and CFO Andrew Kang, have also sold shares. Directors Carl Rickerten and Jared Patton joined the party too, with 26,000 and nearly 10,000 shares sold respectively. In total, insider selling worth 13.6 million shares happened within the last month.

This might sound alarming at first glance—are these insiders signaling a crash? Are they pushing the panic button because they see a black swan event on the horizon? Here’s the twist: during this same period, no insider purchases have been reported. So, they’re selling but not buying back in.

Meanwhile, MicroStrategy’s core asset—Bitcoin—is still performing strongly. The insiders might simply be cashing in on profits, lining their pockets, and diversifying their holdings. CEO Fong Li and the team could be reallocating their wealth, possibly into more Bitcoin or stablecoins, as hinted by recent talks about selling ADA to buy BTC and stablecoins.

It’s a classic case of “take some chips off the table” but it doesn’t necessarily mean the market is about to crash. Still, it’s a signal worth watching for all BTC and crypto investors.

Binance and XRP: Did CZ Really Believe or Just Follow the Money?

Binance’s CEO, Changpeng Zhao (CZ), has been vocal about XRP’s continued listing on Binance throughout the SEC saga, even when many US-based exchanges delisted it. CZ says XRP “stayed listed through the entire SEC saga,” underscoring Binance’s commitment to the asset.

But let’s be real here—exchanges don’t act out of the goodness of their hearts. They make money on trading volume and volatility. So, Binance’s decision to keep XRP listed likely stemmed from the revenue generated through XRP transactions. When you have a coin that moves a lot, that’s money in the exchange’s pocket.

Right now, crypto market volume hovers around $70 billion, but XRP’s volume is a modest $1.24 billion — the lowest seen in months on a Sunday. That’s a clear sign that volume is drying up, and exchanges like Binance, Uphold, and others are pushing hard to keep traders active, ringing the bell to buy and sell to keep those profits flowing.

So, do you trust CZ’s XRP hype or just the fact that Binance wants to keep making money? Maybe a little bit of both. Binance’s global backing of XRP is consistent, but it’s also a business decision—volume equals revenue. Let’s not forget, Binance also peddles Bitcoin hard because BTC's volume is absolutely bonkers, making up $33 billion of that $70 billion market volume.

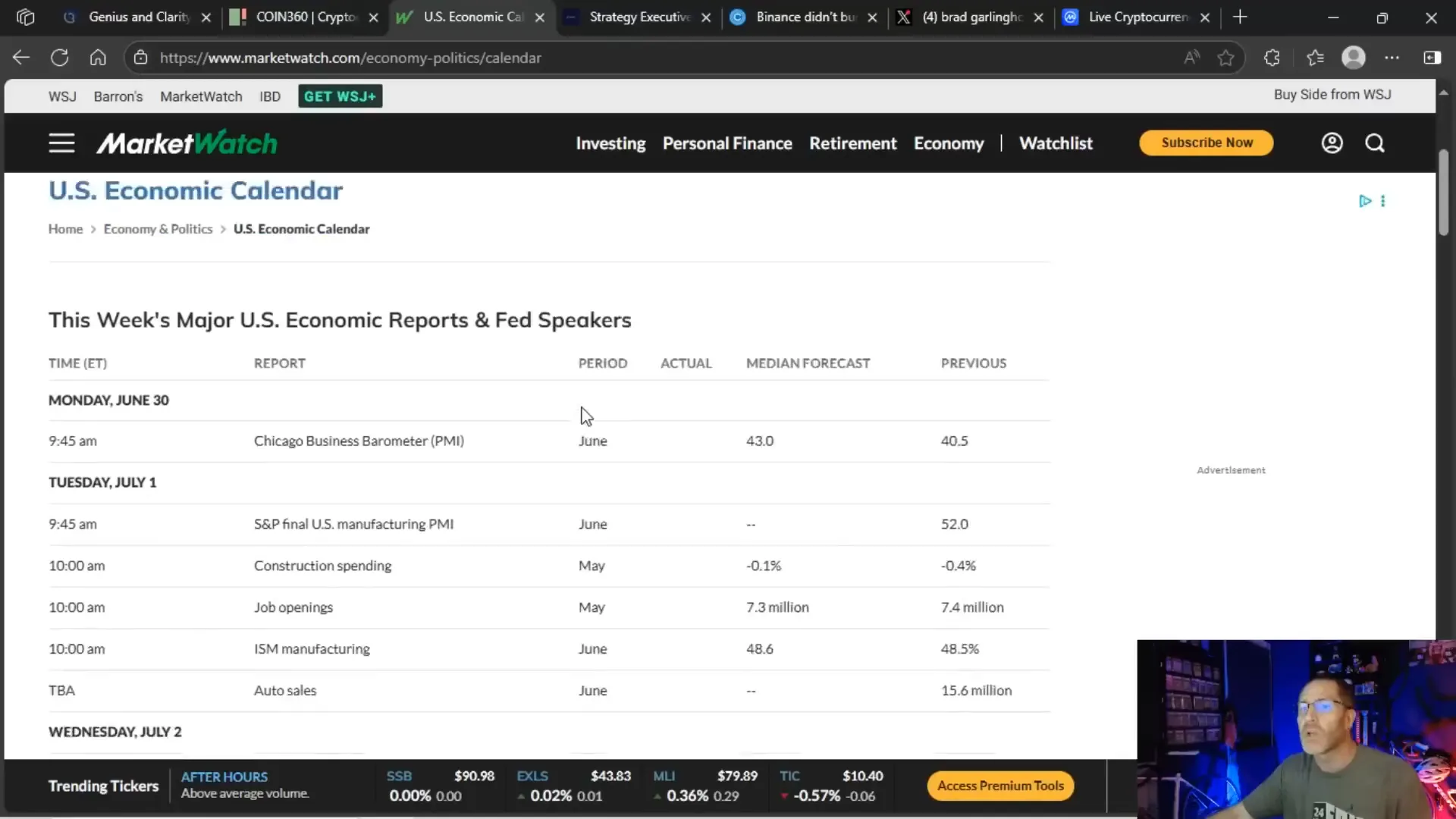

What’s Ahead This Week? Key Market Events to Watch

Looking ahead, the crypto market is in a somewhat quiet phase for the week. We have some economic data coming up that could influence markets, but nothing earth-shattering:

- Tuesday: Auto sales and manufacturing index — unlikely to cause major market shifts.

- Wednesday & Thursday: Employment and unemployment stats — these could have more impact but still moderate.

- Friday, July 4th: US markets close for Independence Day, which historically leads to low trading volumes.

The crypto market, despite being 24/7, tends to mimic US traditional market hours. So expect the start of the week to be the most active, with volumes winding down as we approach the holiday weekend.

Low volume means low volatility, which often translates to less price movement. Unless some geopolitical or unexpected news fires up the market, expect a slow, steady drift.

Altcoins vs. Bitcoin: The Regulatory Hang-Up

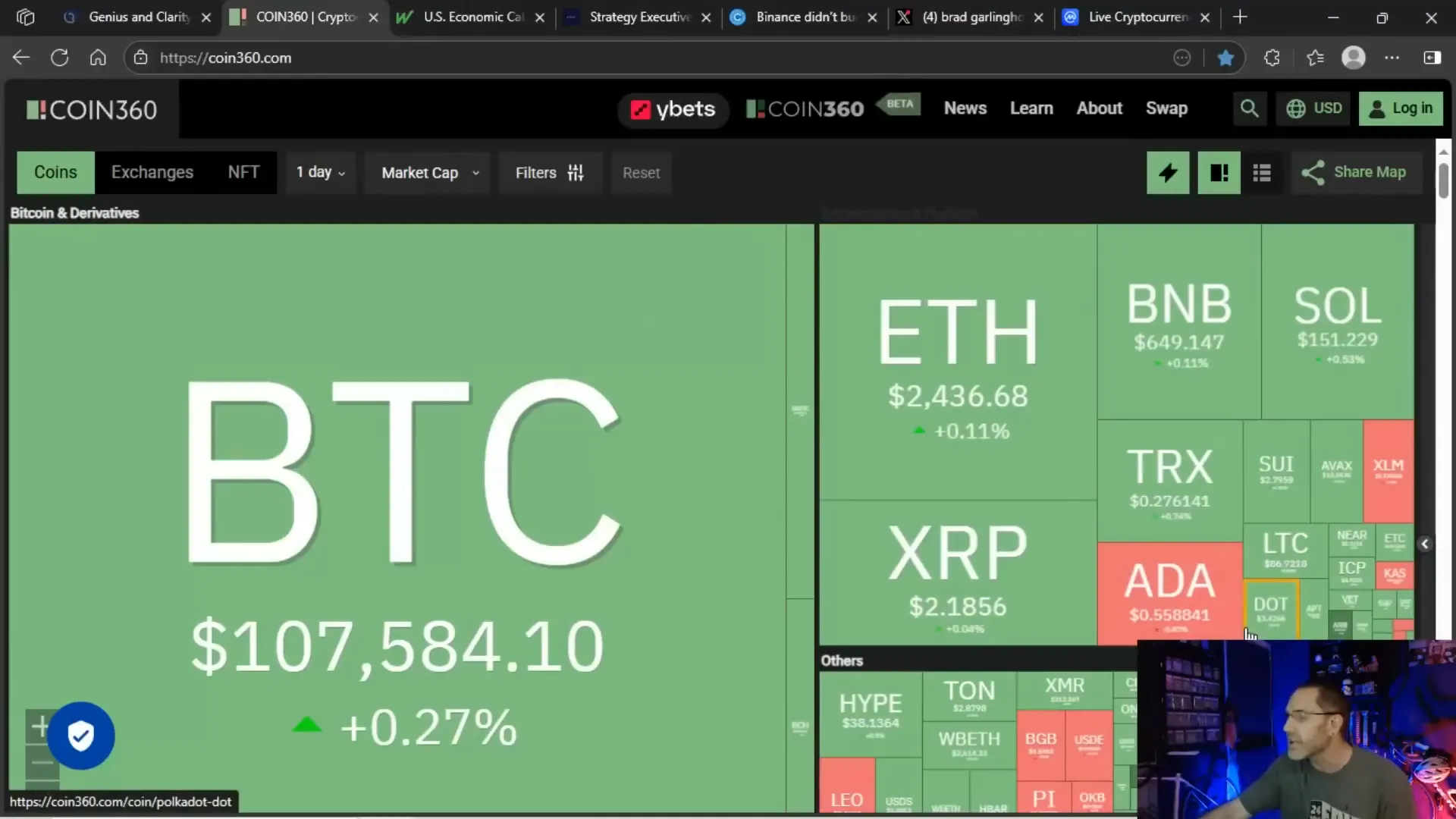

Here’s where things get interesting. Bitcoin is currently just 3% shy of its all-time high, and institutional inflows into BTC continue to grow steadily. Companies are piling into Bitcoin as a strategic asset, but the altcoin market? Not so much.

Altcoins like ADA, Pi Coin, and HBAR are struggling. For example, ADA is hovering around 55 cents, with rumors that Charles Hoskinson has been selling $100 million worth of ADA to buy BTC and stablecoins. Pi Coin is in danger of dropping to the 40-cent range after a major announcement, and HBAR is around 14.8 cents.

Why the disparity? Regulations—or the lack thereof—are the main culprit. The crypto industry eagerly awaits clarity on major bills like the Stablecoin Bill and the Clarity Act. The Stablecoin Bill is advancing, but the Clarity Act, which would regulate the broader crypto market including altcoins, seems stuck.

Without these regulations, big companies hesitate to dive into altcoins as strategic reserves. They prefer the safety and regulatory clarity Bitcoin currently offers. This regulatory limbo keeps altcoins in a holding pattern, waiting for a green light.

Volume Trends: What the Numbers Tell Us

Volume is the lifeblood of crypto markets because exchanges make money off it. When volume dries up, exchanges start sweating because their profits depend on high trading activity – whether prices go up or down.

Looking at XRP’s volume over the past year, the big spikes we saw in November and December are shrinking. Weekend and weekday volumes are both pulling back, and with the upcoming July 4th weekend, expect volumes to hit some of the lowest levels in months.

For context, recent XRP volumes have hovered around $2.1 billion, compared to January’s highs, which saw volumes exceeding $3 billion on many days, with some days even hitting $11 billion. That’s a significant decline in market activity.

What does this mean? Players in the market will have to pull out bigger stunts and more exciting news to reignite interest. The tricks that worked in late 2022 and early 2023 aren’t doing the job anymore. The crypto market needs fresh catalysts to bring back the heat.

How Exchanges Keep Crypto Markets Spicy and Relevant

Exchanges like Binance and others thrive on volatility and volume. They don’t care if the market’s going up or down—just that it’s moving. Whether it’s geopolitical tensions in the Middle East, high-profile spats between influential figures like Trump and Elon Musk, or major legal battles like Ripple’s, these events spike volume and keep exchanges flush with cash.

Right now, the market feels less spicy than it was during the explosive months of November, December, and January. The excitement has waned, and volume is cooling off. So, expect exchanges and market movers to ramp up the drama and news flow to bring back the buzz.

Maybe we all need some tattoos to show our crypto loyalty! I’ve got mine, so no hating here. It’s all about passion and belief in what you’re holding. And with the market cooling, that passion might be just what we need to keep the momentum alive.

Your Move: What to Watch and Expect

Here’s the bottom line for anyone invested or interested in Bitcoin, Crypto, BTC, Blockchain, CryptoNews, and Investing:

- Watch the insiders: The selling at MicroStrategy may just be profit-taking, but it’s a signal to keep your eyes open for shifts.

- Keep an eye on XRP: Brad Garlinghouse is doubling down, Binance is holding strong, but volume is slipping. Legal clarity could be the next big catalyst.

- Bitcoin dominance continues: BTC is the go-to for institutions right now, and the altcoin market waits for regulatory green lights.

- Volume is king: Exchanges make money on trading activity, so expect more noise and hype to keep volumes up.

- Upcoming market events: Economic data early in the week and the US market holiday will temper volume and volatility.

Stay sharp, keep your strategies flexible, and get ready for what could be a slow week ahead unless some geopolitical fireworks light up the sky. Remember, in crypto, it’s all about staying ahead of the curve and being ready for the next big move.

What do you think? Is Brad’s tattoo a bold symbol of faith or just hype? Are the MicroStrategy insiders signaling a shift, or just smart money moves? And how much longer will the altcoins wait for regulatory clarity? Drop your thoughts, and let’s keep this conversation spicy!

Until next time, keep your eyes on the charts and your mind on the game.

Bitcoin, Crypto, BTC, Blockchain, CryptoNews, Investing: What’s Next for XRP, MicroStrategy, and the Market?. There are any Bitcoin, Crypto, BTC, Blockchain, CryptoNews, Investing: What’s Next for XRP, MicroStrategy, and the Market? in here.