If you’ve been tracking the crypto landscape lately, you know that government regulation, political drama, and market movements are shaping the future of digital assets like never before. Recently, Ripple’s CEO Brad Garlinghouse took center stage at a Senate crypto hearing that stirred up a lot of buzz. The event wasn’t just about crypto tech or market speculation—it was a wild ride of politics, opinions, and regulatory uncertainty. Here’s a comprehensive recap and analysis of everything that went down, delivered with the kind of no-nonsense style you expect from a true crypto insider.

This article breaks down the key moments, the players involved, the implications for XRP and other cryptos, and what it means for Bitcoin, BTC, blockchain innovation, and crypto investing in the near future. Ready? Let’s get into it.

Setting the Stage: The Senate Crypto Hearing and Who Was There

The hearing was a significant event, featuring Brad Garlinghouse, the CEO of Ripple, who was invited to testify on cryptocurrency regulations. He was one of the few pro-crypto voices on the panel. On the other side, you had folks like Richard Painter and a representative from the Mossad, both of whom were decidedly skeptical or even hostile toward crypto.

There was a clear divide in the room, with some panelists pushing for stronger regulation, others defending crypto’s potential, and a heavy dose of political tension coloring the entire discussion. The hearing wasn’t just about blockchain technology or the merits of digital currencies—it was also about politics, power struggles, and the future direction of crypto governance in the United States.

Brad Garlinghouse’s Opening Statement: XRP in the Spotlight

Garlinghouse’s opening remarks were succinct but important. He emphasized Ripple’s use of the XRP Ledger as a decentralized, battle-tested, open-source blockchain that facilitates fast, low-cost, and highly scalable transactions. His exact words:

"Ripple leverages the XRP ledger, a decentralized battle tested open source blockchain, and its native digital asset XRP to facilitate payments. XRP is built to enable fast, low cost, highly scalable transactions."

That was the extent of XRP’s mention in the hearing. Outside of this, Garlinghouse wasn’t asked many questions, which was a disappointment to many watching the event live. The lack of deeper inquiry into XRP’s role and Ripple’s challenges with the SEC left a lot of room for speculation about the hearing’s effectiveness.

The Political Underbelly: How Trump and TDS Took Center Stage

One of the most striking things about the hearing was how much political tension, specifically related to former President Trump, dominated the conversation. Democrats on the panel repeatedly raised questions about Trump’s involvement in crypto, particularly his meme coin and stablecoin ventures. The focus was less on crypto innovation and more on Trump’s financial interests, with questions like:

- How much money is Trump making on his meme coin?

- How much money is Trump making on stablecoins?

- If new crypto legislation passes, will it unfairly enrich Trump?

This political framing created a toxic environment that overshadowed the broader regulatory and technological discussions. It was clear that the Democrats wanted to connect crypto to Trump’s activities, almost as if Trump’s involvement was the biggest obstacle to crypto’s progress.

This dynamic introduced a level of “TDS” (Trump Derangement Syndrome) into the crypto debate, which only deepened partisan divides and distracted from more pressing regulatory matters.

Regulatory Battles: Genius Act, Stablecoin Act, and the Clarity Act

Among the key takeaways from the hearing was the discussion of upcoming regulatory bills that could shape crypto’s future in the U.S. Three pieces of legislation stood out:

- The Genius Act (Stablecoin Act): This bill appears to have bipartisan momentum and is expected to pass. It primarily focuses on stablecoins, aiming to implement clear regulatory frameworks for these digital assets.

- The Clarity Act: This bill aims to regulate the broader range of cryptocurrencies beyond stablecoins. However, it faces significant opposition and is likely to encounter serious hurdles, potentially stalling or dying in committee.

- New Regulatory Framework Proposal: Some panelists suggested the need for an entirely new regulatory structure, which would mean scrapping the Clarity Act and starting fresh. This approach would delay meaningful legislation but might result in a more coherent framework in the long term.

The debate over these bills revealed deep divisions about how crypto should be regulated. Some wanted the SEC and CFTC to continue their current approach, which many criticize for stifling innovation through enforcement actions rather than clear rules. Others pushed for fresh legislation that better fits the unique nature of blockchain and digital assets.

Meme Coins as Collectibles? The Baseball Card Analogy

One of the more unusual moments during the hearing was the suggestion to treat meme coins like collectibles—akin to baseball cards or Pokémon cards. The argument was that if meme coins are collectibles, they wouldn’t fall under the jurisdiction of the SEC or CFTC, thus avoiding the need for new regulations.

This comparison raised eyebrows for good reason. If meme coins are just collectibles, then trading coins like the Trump or Melania meme coin would be no different than trading sports cards. This analogy was used to justify a hands-off regulatory approach for certain digital assets, but it also highlighted how little consensus exists on how to classify and regulate various types of crypto.

The Divide Between Democrats and Republicans: No Unity in Sight

The hearing made it painfully clear that crypto has become a highly partisan issue. While there was some hope that bipartisan support for crypto legislation might emerge—especially after last year’s crypto market rally—those hopes were dashed.

Instead, the hearing revealed a sharp divide:

- Democrats: Focused heavily on Trump’s crypto ties, expressed skepticism about crypto’s role, and leaned towards stricter regulation or enforcement.

- Republicans: More likely to support crypto innovation but still cautious about certain risks.

This partisan split is problematic for the future of crypto legislation. The crypto market thrives on certainty and clear rules, but political gridlock means delays, confusion, and missed opportunities.

It’s especially frustrating given that many investors and companies expected a more united front after the 2022 elections, when crypto-friendly policies seemed possible from both sides of the aisle. Instead, it now looks like crypto might be collateral damage in broader political battles.

Market Reaction: XRP and Crypto Prices Amid the Hearing

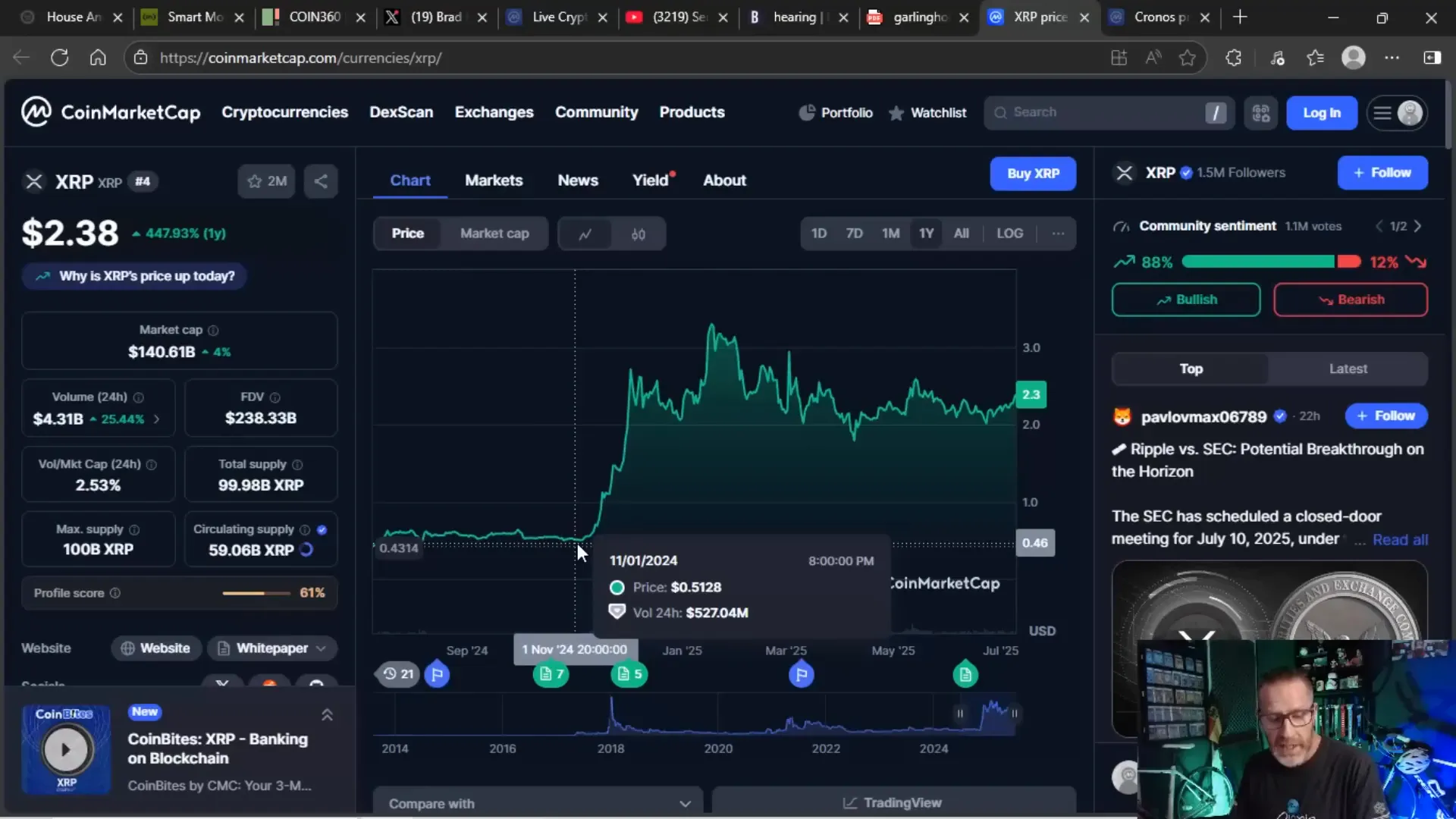

Despite the messy political theater, XRP and other cryptocurrencies showed resilience during the hearing. XRP’s price touched $2.40 at one point before settling around $2.38, signaling that investors were holding steady despite uncertainty.

Bitcoin was also strong, with prices hitting around $109,390, and Ethereum trading near $2,665. Some altcoins began moving, driven by optimism around upcoming legislation and ETF announcements.

Still, the market remains cautious. The potential delay or failure of the Clarity Act could hinder broader crypto adoption and innovation, while the political infighting adds volatility to investor sentiment.

Why Didn’t Garlinghouse Get More Questions?

A big disappointment for many watching was how few questions Brad Garlinghouse was asked. Given his experience dealing with the SEC’s regulatory challenges—especially during the Gensler era, when enforcement was heavy-handed—many expected a deeper interrogation of his views and insights.

Instead, the hearing largely skirted around Garlinghouse’s pain points, missing a valuable opportunity to discuss how regulation can be improved to foster innovation rather than stifle it.

This lack of engagement raises concerns about whether lawmakers truly understand the nuances of crypto technology and the hurdles companies face.

TDS and the Crypto Debate: When Politics Overshadows Progress

The hearing was a prime example of how political emotions—particularly Trump Derangement Syndrome (TDS)—have permeated the crypto conversation. Instead of focusing on how to create effective, fair regulations, much of the discussion was mired in partisan attacks and distractions.

Ironically, while lawmakers criticized crypto insiders for potential conflicts of interest, they ignored similar behaviors in traditional markets. Insider trading by politicians in stocks is an ongoing issue that gets far less scrutiny, yet it remains legal or unpunished in many cases.

This double standard undermines trust and makes it harder to have honest conversations about crypto’s risks and benefits.

Watch Out for the BTC Maxis

Another noteworthy dynamic was the behavior of Senator Loomis, who came across as a Bitcoin maximalist ("BTC Maxi"). During the hearing, she repeatedly praised Bitcoin without asking substantive questions about other cryptocurrencies or the broader crypto ecosystem.

Her grandstanding for BTC, without engaging with the complexities of altcoins like XRP, suggests a bias that could influence regulatory outcomes. If Bitcoin maximalists dominate the conversation, altcoins may be sidelined or unfairly regulated.

Investors and crypto enthusiasts should be cautious of this, as it could shape future policies that favor Bitcoin at the expense of innovation elsewhere.

What’s Next? Crypto Week and the Road Ahead

Looking ahead, the crypto community is keeping a close eye on next week’s Crypto Week in the House of Representatives. This event could be a turning point, potentially advancing the Genius Act and other legislation that supports stablecoins and digital assets.

However, the Clarity Act’s future remains uncertain, with many expecting it to stall or be scrapped in favor of a new comprehensive regulatory framework. While delays are frustrating, starting fresh might lead to better laws that align with crypto’s unique characteristics.

For investors, traders, and blockchain enthusiasts, the key takeaway is to stay informed and be prepared for ongoing volatility in both the market and regulatory environment.

Final Thoughts: Navigating the Messy Crypto Regulatory Landscape

This Senate hearing was a microcosm of the broader challenges facing the crypto industry today. It showcased the political divides, regulatory confusion, and market uncertainty that define this moment in crypto history.

Despite the drama and setbacks, there is cause for cautious optimism. XRP and other cryptos are holding strong, and the push for clearer, fairer regulations continues. The hope is that lawmakers will move past partisan distractions and craft policies that protect investors while promoting innovation.

For now, crypto investors should keep their eyes on legislative developments, remain skeptical of political grandstanding, and remember that the blockchain revolution is far from over.

As always, stay savvy, keep learning, and don’t let the noise distract you from the bigger picture.

Resources & Further Reading:

- Brad Garlinghouse’s Senate Testimony on Twitter

- Full Senate Hearing Transcript and Info

- Garlinghouse’s Written Testimony

- XRP Price and Market Data

Bitcoin, Crypto, BTC, Blockchain, CryptoNews, Investing: Deep Dive into the XRP Garlinghouse Senate Crypto Hearing. There are any Bitcoin, Crypto, BTC, Blockchain, CryptoNews, Investing: Deep Dive into the XRP Garlinghouse Senate Crypto Hearing in here.