If you’re deep into the world of Bitcoin, Crypto, BTC, Blockchain, CryptoNews, and Investing, then buckle up because I’ve got two huge stories that every XRP holder and retail trader needs to know about. These aren’t your usual market updates or vague rumors — we’re talking monumental developments that could shape the future of XRP and the broader crypto market for months, maybe years, to come.

Welcome to a deep dive into the latest news breaking across the crypto landscape, from the long-awaited conclusion of the Ripple SEC lawsuit to fresh opportunities for retail traders with Robinhood’s new micro futures contracts. Plus, we’ll explore some jaw-dropping moves from the Trump White House regarding a Bitcoin strategic reserve backed by gold. This is one of those moments where you want to pay close attention because these stories could change the game.

The Ripple SEC Lawsuit: The End of a Crypto Saga

After nearly five years of legal battles, Ripple Labs has finally stepped away from its drawn-out fight with the SEC. This lawsuit has been one of the most closely watched regulatory cases in the crypto space — and for good reason. The Securities and Exchange Commission initially accused Ripple of raising a staggering $1.3 billion through unregistered security sales of XRP. The crypto community held its breath as the case dragged on, affecting XRP’s price and investor confidence.

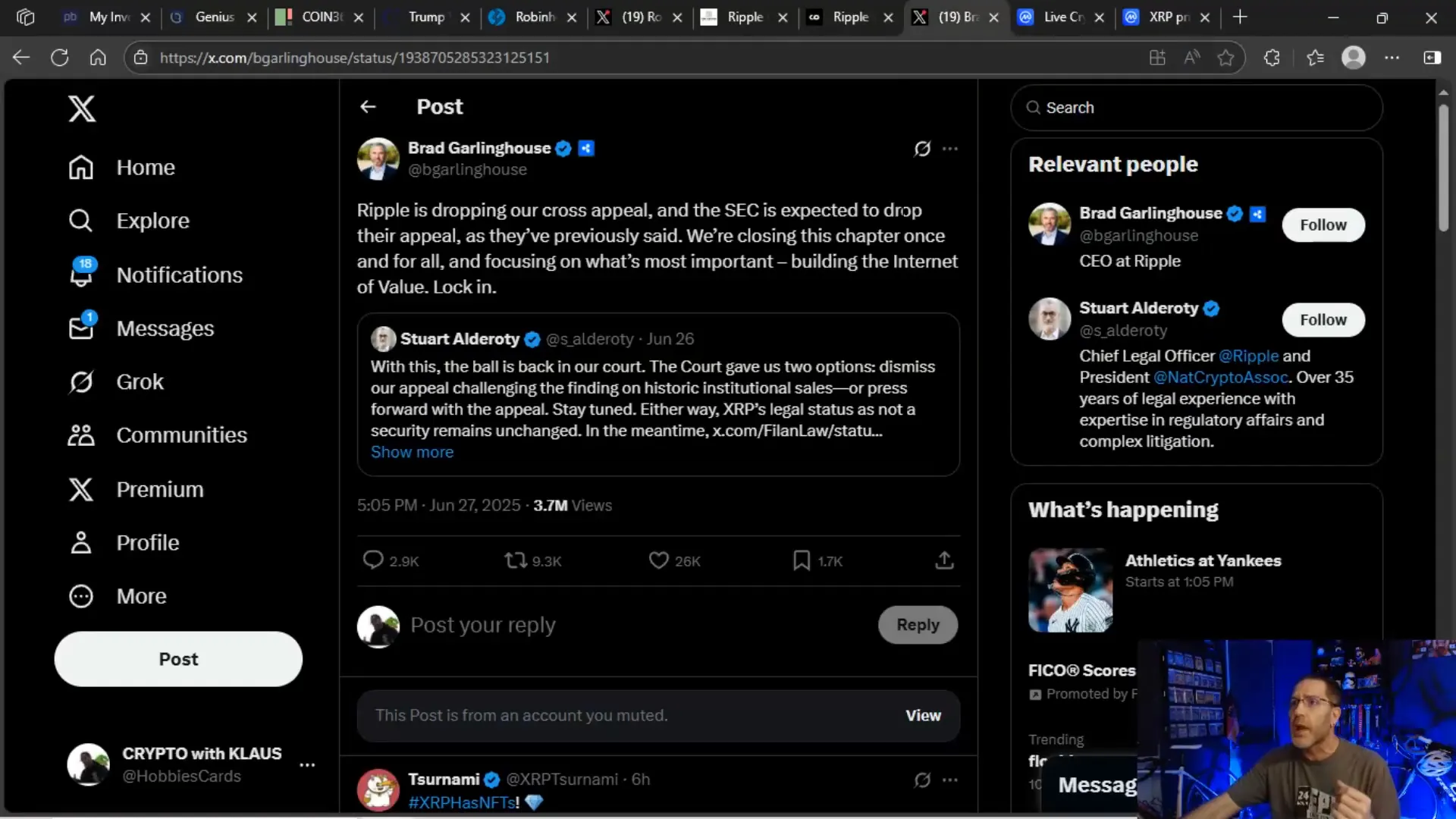

But here’s the kicker: Ripple’s CEO Brad Garlinghouse has confirmed that Ripple will pay a $125 million fine and drop their cross appeal in the lawsuit. The SEC is expected to drop their appeal as well, marking a decisive end to this legal chapter. This figure is a fraction of the $1 billion penalty originally sought by SEC Chair Gary Gensler.

“Ripple is dropping our cross appeal, and the SEC is expected to drop their appeal as we've previously said. We're closing the chapter once and for all and focusing on what's important — building the Internet of Value.” — Brad Garlinghouse

This resolution has been met with widespread relief and optimism among XRP holders and crypto enthusiasts. The drawn-out legal drama has kept a black veil over XRP’s potential, suppressing price action and investor interest. Now that this cloud is lifting, the market is eager to see if XRP will roar back to life.

Why This Matters for XRP Investors

The lawsuit has been a major barrier for XRP. Many investors stayed on the sidelines, wary of regulatory risks. With this resolution, the path clears for:

- Renewed investor confidence: Investors can now feel more secure buying XRP without fear of regulatory crackdowns.

- Potential XRP ETFs: Regulatory clarity could open the door for XRP exchange-traded funds, a huge boost for liquidity and mainstream adoption.

- Ripple IPO prospects: Should Ripple decide to go public, the SEC’s approval becomes more likely now that the legal dust has settled.

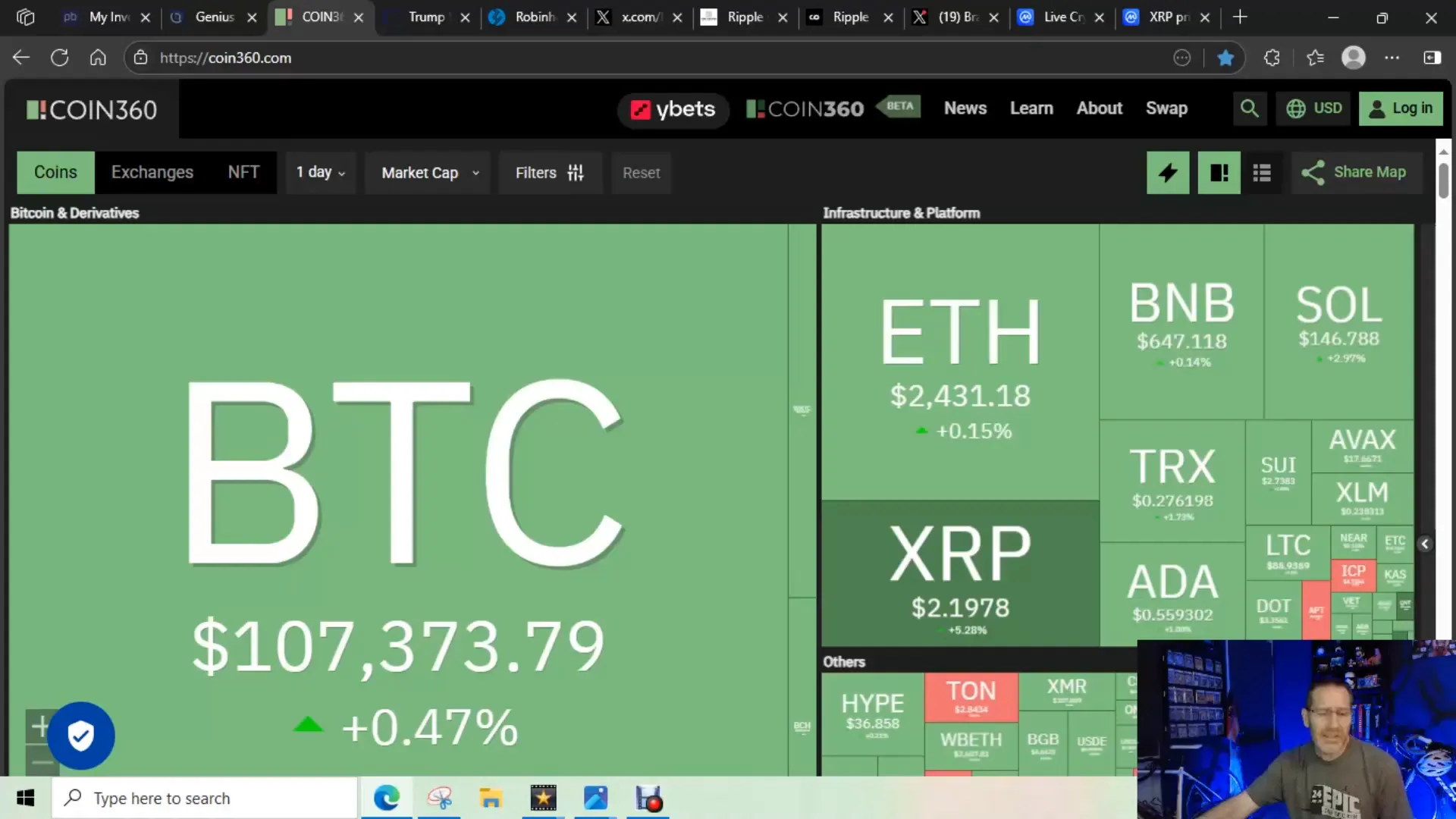

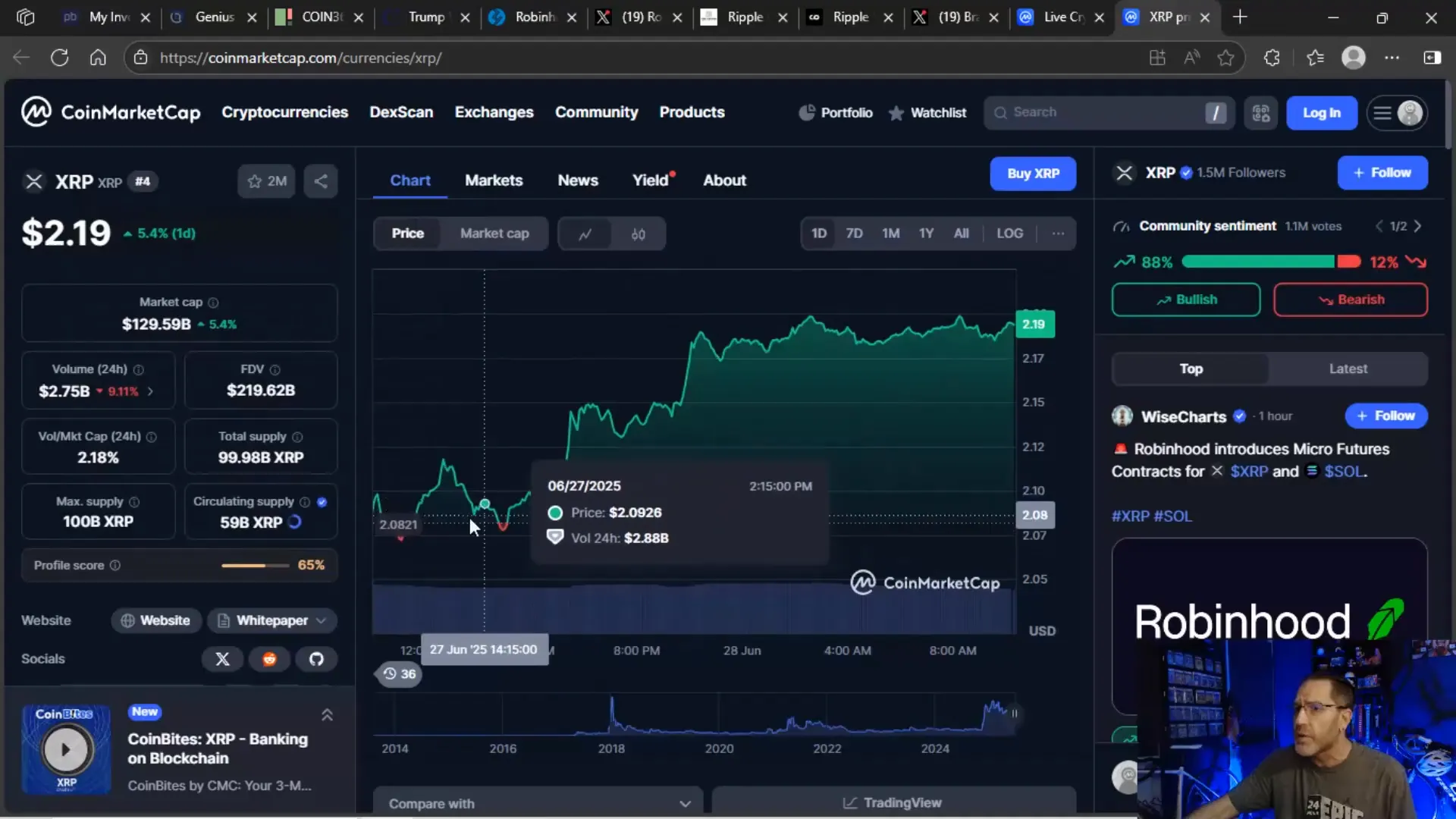

So, will XRP start climbing again? The price has already shown signs of life, with a healthy volume of $2.75 billion flowing into XRP over the last 24 hours. The one-day chart shows a solid bounce from lows around $2.08 to $2.19. This is the kind of optimism that XRP hasn’t seen in years.

But patience is key. The final stamp of approval from Judge Torres is still pending, and only once that’s officially signed off can we expect the market to fully embrace XRP’s next chapter. Once that happens, the “friend zone” price action might turn into the “juicy zone” — where XRP could genuinely start roaring.

Robinhood’s Micro Futures: New Opportunities for Retail Traders

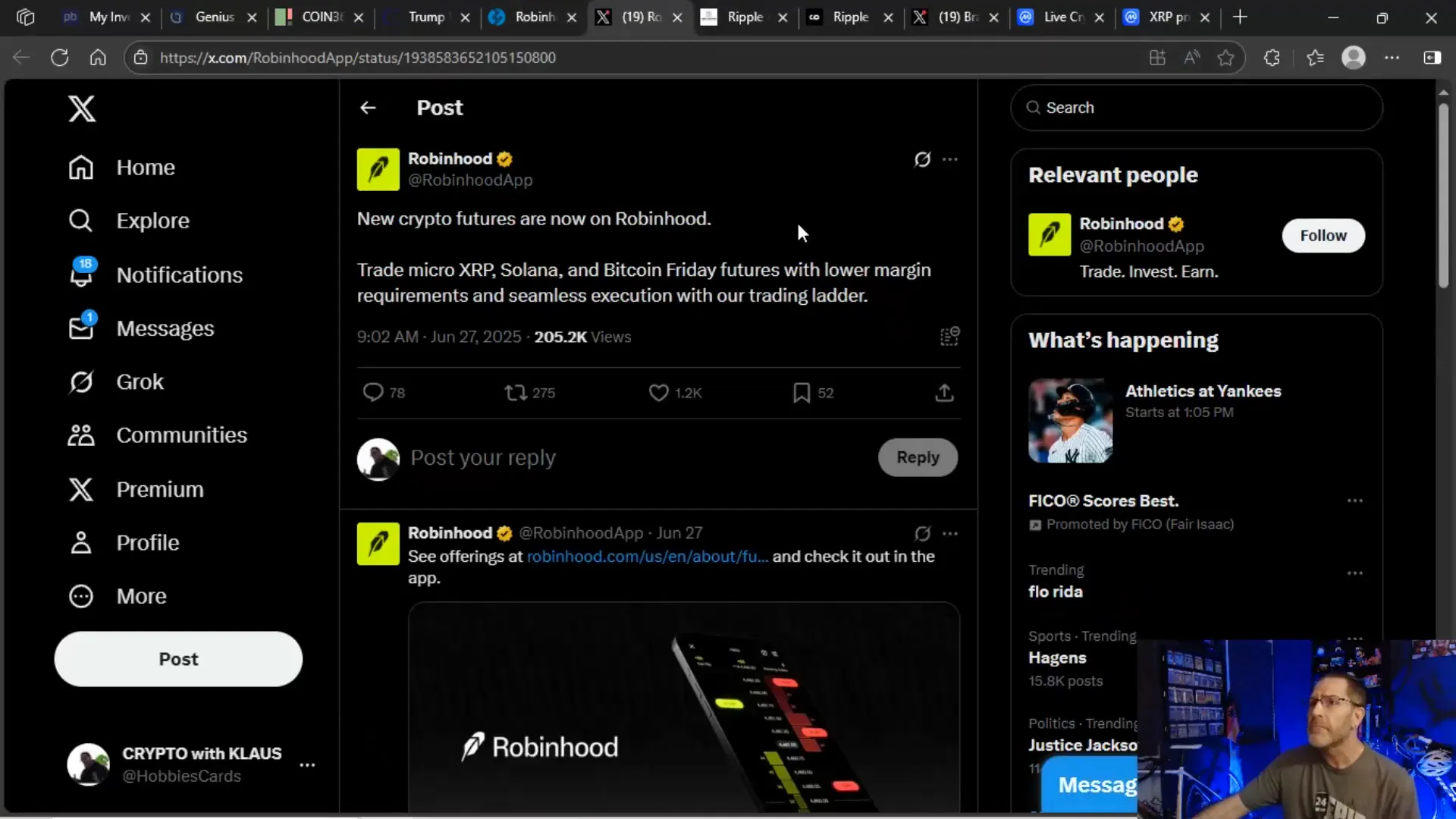

For retail traders who love to speculate or hedge smaller positions, Robinhood just dropped some exciting news. They’ve introduced micro future contracts for XRP, Solana (SOL), and Bitcoin (BTC). This is huge because it lowers the barrier for smaller investors to participate in futures trading without needing massive capital.

Micro futures are scaled-down contracts that allow traders to speculate on price movements or hedge their positions with less risk and lower margin requirements. For XRP, the micro futures contracts allow trading at $2,500 per contract, making it accessible to a wider audience.

This move by Robinhood could inject fresh liquidity into the retail market and provide new tools for traders to capitalize on XRP’s price swings. Whether you want to go long when XRP dips to $1.90 or short when it spikes to $2.50, these new contracts give you that flexibility.

Why Micro Futures Matter

- Lower capital requirements: Smaller contracts mean smaller margin and less risk exposure.

- More trading strategies: Retail traders can hedge or speculate both upwards and downwards, increasing market dynamism.

- Increased retail participation: More players in the market can lead to higher volume and better price discovery.

For many XRP believers, this could be the perfect way to start playing the market with smart, strategic moves instead of just holding or watching from the sidelines.

The Trump White House’s Bitcoin Strategic Reserve Plan: Gold Meets Crypto

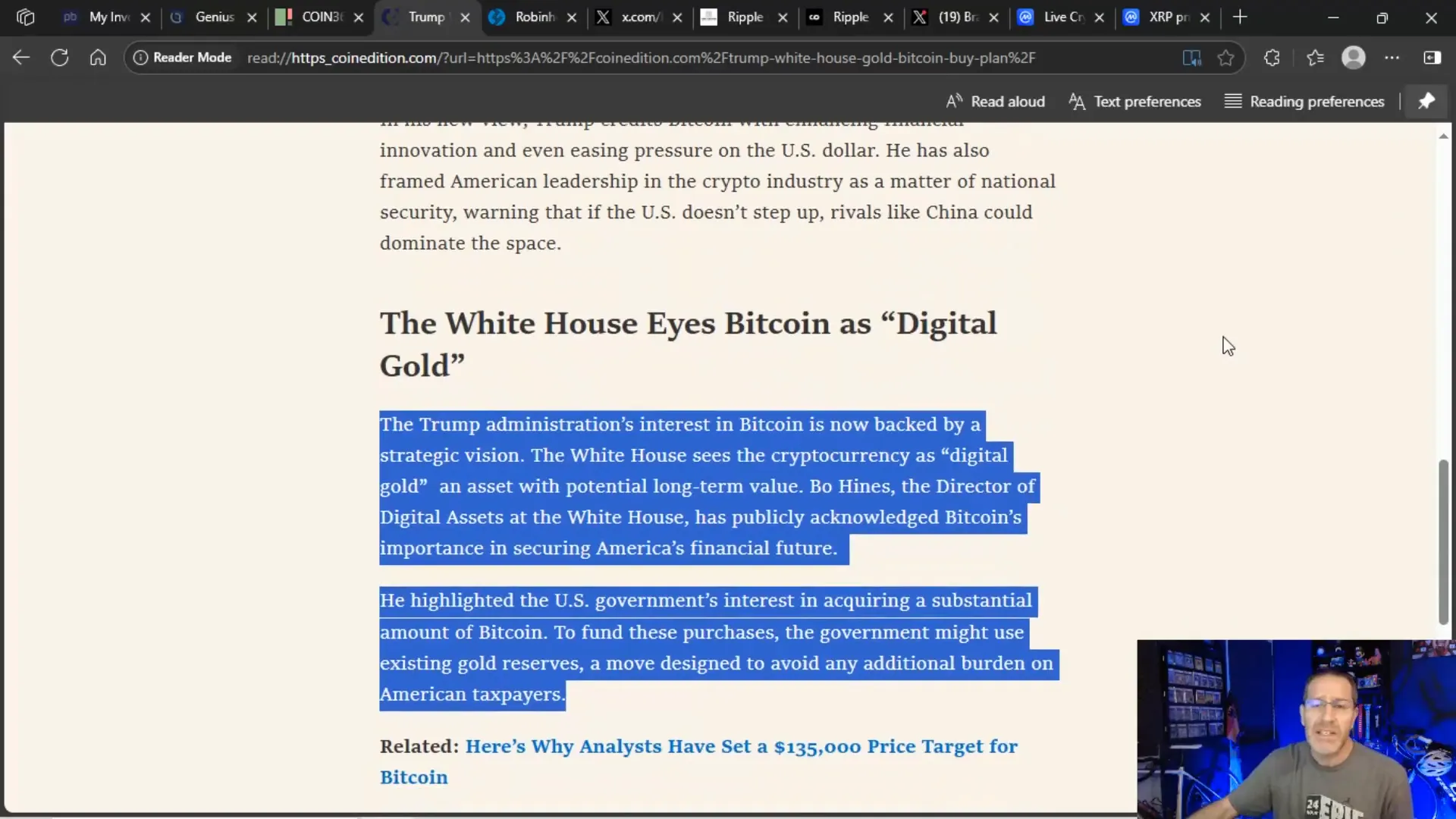

Now, shifting gears to Bitcoin and government strategy — here’s a story that’s flying under the radar but could have massive implications. The Trump White House has been quietly developing a strategic reserve plan involving Bitcoin, backed by gold reserves.

The concept is simple but brilliant: instead of spending new money, the government wants to remain budget neutral by trading in some of the paper profits from their existing gold reserves to buy BTC. This means they’re leveraging the unrealized gains on gold rather than liquidating physical gold holdings or adding to national debt.

“The White House sees BTC as digital gold with potential long-term value. They’re interested in acquiring a substantial amount.” — Beau Hines, Director of Digital Assets at the White House

According to Beau Hines, the U.S. government already holds around 200,000 BTC from various sources, and this new approach is designed to strategically build up a Bitcoin reserve without disrupting budgets or markets.

What This Means for Bitcoin and the Market

- Government-backed BTC reserve: This is a strong bullish signal for Bitcoin’s long-term legitimacy and value.

- Budget neutrality: Using paper profits means no new debt or asset liquidation, a smart financial move.

- Market impact: Increased government demand could tighten supply and drive prices higher.

However, one question remains: will this strategy extend beyond Bitcoin to include altcoins like XRP? As of now, all signs point to a BTC-only strategic reserve, leaving altcoins potentially sidelined in this government-backed vision.

Could this be a bait-and-switch? Or is the government playing it safe by sticking to Bitcoin as the flagship crypto? Time will tell, but for now, Bitcoin’s future looks more intertwined with government policy than ever before.

What’s Next for XRP and the Crypto Market?

So, where does all this leave us? The crypto market is cautiously optimistic. We’re seeing green on the screen, but volume is still relatively low compared to the explosive rallies of late 2023 and early 2024. Many favorites are holding steady or even pulling back slightly after those big pumps.

The key things to watch:

- Final approval from Judge Torres: Once the SEC lawsuit is officially closed, XRP could break out.

- Robinhood micro futures adoption: How quickly will retail traders embrace these new contracts for XRP and others?

- Government BTC reserve developments: Will this strategy spark broader institutional crypto adoption or remain BTC-centric?

- Upcoming legislation: The Genius Act and Clarity Act are on the horizon and could impact crypto regulation and market sentiment.

For XRP holders and crypto investors, staying informed and agile is more important than ever. The market is at a crossroads — regulatory clarity, retail trading innovations, and institutional strategies all converging to redefine the crypto landscape.

Final Thoughts: Time to Celebrate, But Keep Your Eyes Open

This weekend, XRP holders have every reason to celebrate the end of a long legal battle and the fresh opportunities emerging in the market. But like any good investor knows, celebration is just the start — the real work begins now. Watching how the market reacts to these developments, how retail traders seize new tools, and how governments move strategically will be crucial to making smart crypto investing decisions.

Remember, Bitcoin, Crypto, BTC, Blockchain, CryptoNews, and Investing are all connected threads weaving the future of finance. XRP’s story is a pivotal chapter in that narrative, and right now, it’s looking like the dawn of a new era.

Stay tuned, stay smart, and keep riding the waves of innovation and opportunity. The crypto world never sleeps, and neither should your investment strategy.

Bitcoin, Crypto, BTC, Blockchain, CryptoNews, Investing: Two Massive XRP Stories You Can’t Miss. There are any Bitcoin, Crypto, BTC, Blockchain, CryptoNews, Investing: Two Massive XRP Stories You Can’t Miss in here.