If you’re deep into the world of Bitcoin, Crypto, BTC, Blockchain, CryptoNews, and Investing, then you know how wild this space can get. From epic price pumps to frustrating dumps, and from high-stakes legal battles to central bank drama, it’s a rollercoaster ride every day. Today, we’re diving into some of the hottest topics shaking up the crypto universe: the XRP SEC Ripple lawsuit, Jerome Powell’s stubborn stance on interest rates, Deutsche Bank’s bold crypto custody move, and the current state of price action for Solana, TonCoin, and other favorites.

Grab a coffee, buckle up, and let’s unpack the real story behind the headlines and price charts.

Solana, TonCoin, and XRP: Price Action Chaos or Opportunity?

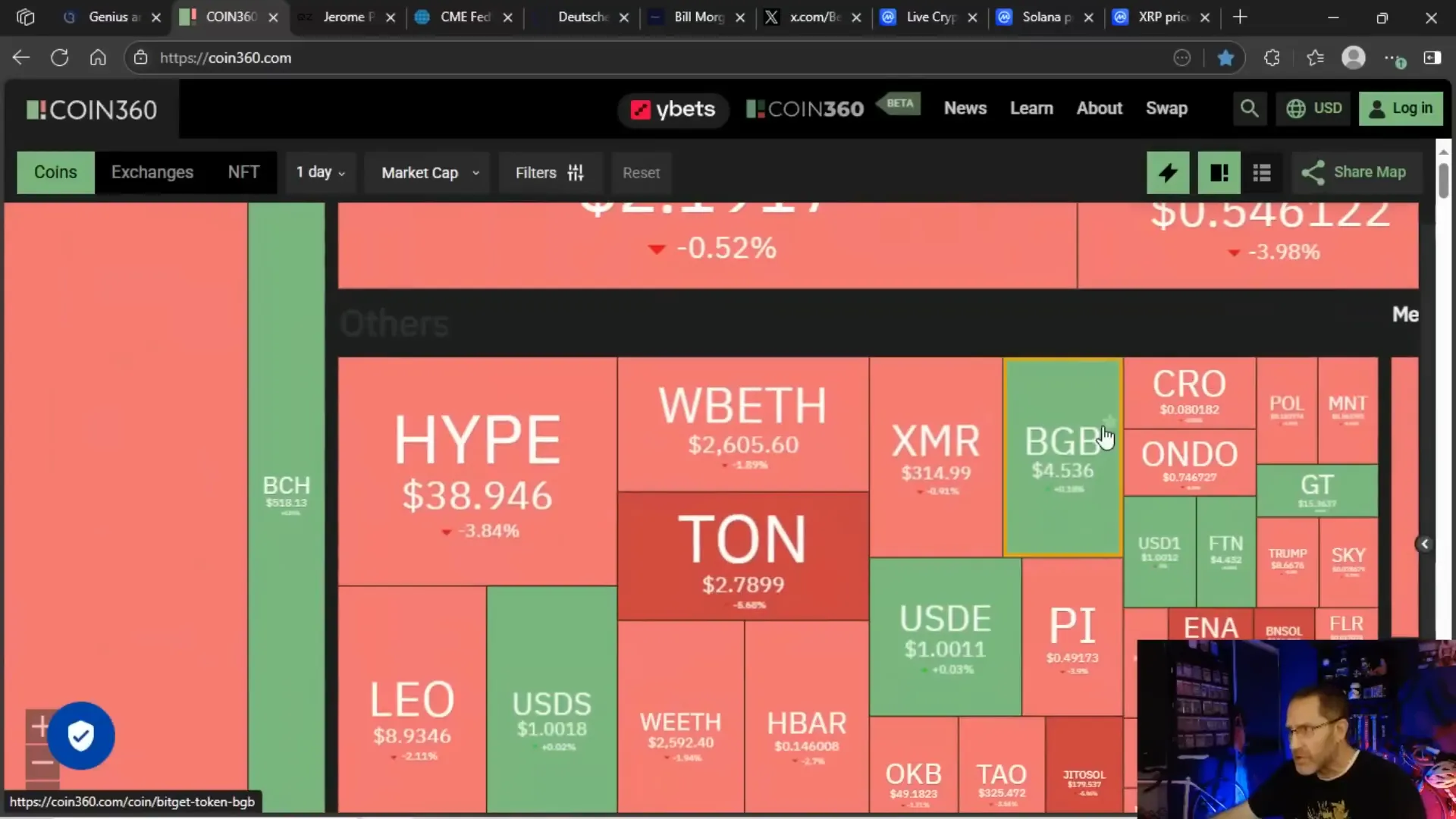

First up, let’s talk about price action because, let’s be honest, that’s what most of us are watching closely every single day. Solana (SOL) is melting down hard, down a brutal 5.6% in the last 24 hours alone. It’s not just a small dip; it’s a serious red flag on the charts.

Looking at the one-day chart for Solana, it’s clear the crypto is struggling. It’s not just Solana, though—TonCoin is also deep in the red, but here’s where things get interesting. TonCoin might be signaling an opportunity. When coins dip hard, savvy investors look for those buy zones. TonCoin’s current price action could be a golden entry point, but like anything in crypto, caution is key.

Then we have XRP, the perennial drama queen of the crypto world. XRP’s price has been a rollercoaster, with pumps and dumps that leave traders exhausted and confused. One viewer summed it up perfectly: “I just waited because I knew it would dump again, unfortunately.” Market manipulation, pumps, dumps, and the elusive hope for a breakout—these are the themes that have defined XRP’s 2023.

One of the big questions swirling around XRP is who’s pulling the strings behind these price swings. Is it the elites? Bitcoin maximalists? Ripple insiders? Automated market makers? Bots? The truth is, no one really knows, but what’s clear is that these oscillations create both headaches and opportunities for traders.

Playing the Dips and Tips

For those who’ve been paying attention, the price swings between $2.10 and $2.30 have been predictable enough to trade around. Many savvy stackers have been buying below $2 and selling near the top of that range, effectively “playing the dips and tips” to avoid missing out on gains. Volume is up a whopping 96%, hitting $4.4 billion, which means exchanges are making serious money regardless of whether XRP is up or down.

So, if you’ve been selling at $2.30 and buying back in at $2.10, congrats—you’re playing the market smart. But is this manipulation? Probably. Is XRP ever going to run free and break out for good? Possibly, but don’t hold your breath just yet.

Bill Morgan’s Take: The SEC vs. Ripple Case Won’t Spark New Price Action

Here’s where things get real. Bill Morgan, a renowned crypto attorney, recently dropped a bombshell analysis on the Ripple SEC lawsuit. According to him, the much-anticipated court ruling won’t move XRP’s price anymore—it’s old news.

Remember the big pump in July 2023 when the court essentially sided with Ripple’s argument that XRP isn’t a security? That pump took XRP from $0.46 to $0.93 in just a few weeks, but then all those gains vanished by mid-August. That rally was the “Torres pump,” named after the judge’s ruling, and it was the last major price action tied directly to the case.

Morgan’s point is simple: if you’re still waiting for a big price surge based on the final resolution of the SEC case, you’re chasing a ghost. The market already reacted to all the major news over 18 months ago. The final outcome? It’s unlikely to spark any fresh, significant pumps.

So why do people keep hoping for that big “XRP pump” after the case closes? Because hope is a powerful thing in crypto. But as Morgan bluntly puts it, that ship has sailed, and the hype around the case’s price impact is outdated.

Jerome Powell and the Fed: No Rate Cuts Anytime Soon

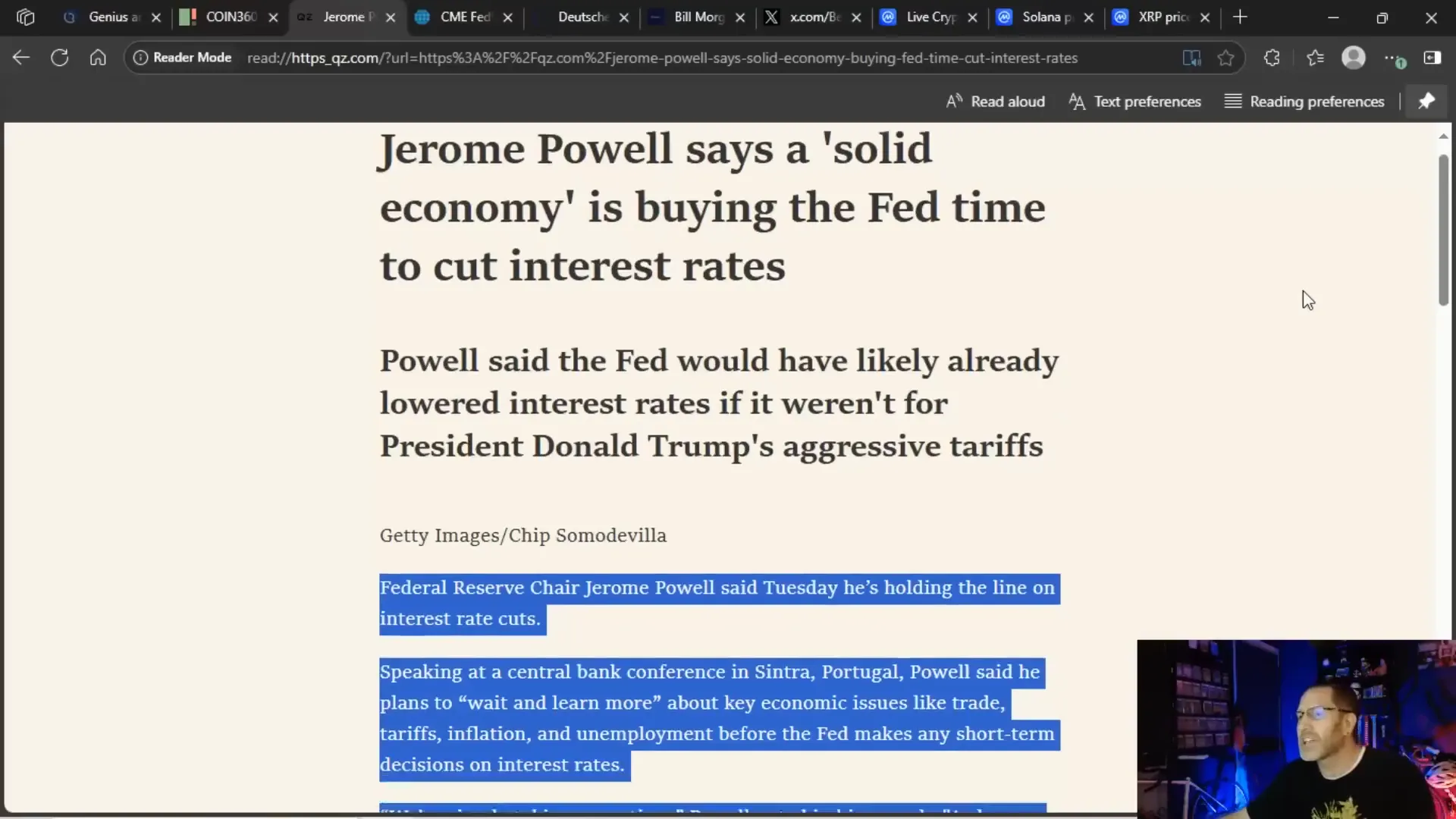

Now, shifting gears to the macro side of things—Jerome Powell, the Federal Reserve chair, is making waves with his unwavering stance on interest rates. Despite the pain consumers and businesses are feeling with high borrowing costs, Powell insists the economy is “too healthy” for rate cuts right now.

At a central bank conference in Sintra, Portugal, Powell said the Fed is “taking some time” to gather more data before making any short-term decisions on interest rates. He pointed to factors like trade tariffs, inflation, and unemployment as key variables that need more clarity. This cautious approach is frustrating to many, especially since the average person is getting crushed by high credit card rates, mortgage interest, and auto loans.

Powell also indirectly took a jab at former President Donald Trump’s tariff policies, suggesting that if it weren’t for those, the Fed would’ve already cut rates. This political tug-of-war over monetary policy adds another layer of complexity to the economic landscape.

What’s Next for Interest Rates?

- On July 30th, there’s an 80% chance Powell will “pause” rate changes, meaning no cuts and rates will stay high.

- The first likely rate cut isn’t expected until the September 17th Fed meeting, with a 92% chance of a cut then.

- There’s no Fed meeting in August, so the market will have to wait for that September decision.

Leaving rates high for longer means consumers face higher borrowing costs, discretionary spending gets squeezed, and business growth slows down. This environment creates tough conditions for the average American, who unlike the elites Powell talks about, probably pumps their own gas and feels the pinch daily.

Deutsche Bank’s Big Crypto Move: Custody Service Launching in 2026

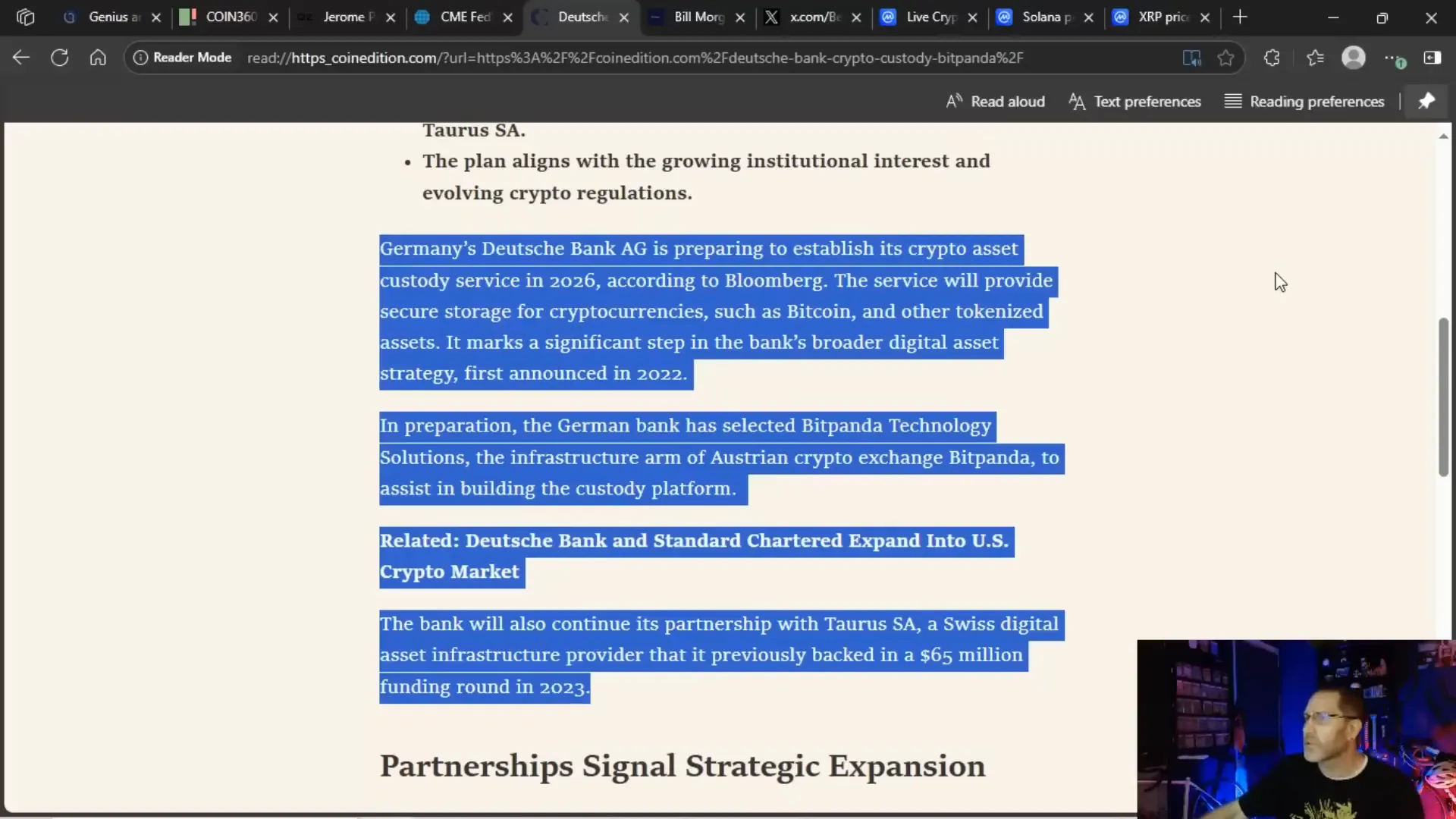

On the institutional front, Deutsche Bank is making headlines for planning to launch a Bitcoin and crypto custody service in 2026. This move signals the bank’s serious commitment to digital assets and is part of a broader digital asset strategy first announced in 2022.

The custody service will provide secure storage solutions for cryptocurrencies like BTC and other tokenized assets, a key infrastructure piece for institutional investors wanting to safely hold crypto.

To build this service, Deutsche Bank has partnered with BigPanda Technology Solutions and will continue collaborating with Taurus SA, a Swiss digital asset infrastructure provider. This partnership aims to create a secure and scalable platform for crypto custody.

While Deutsche Bank has a controversial past, including allegations related to questionable client dealings, this crypto custody initiative shows that traditional financial giants are increasingly taking crypto seriously. The institutional influx of money into BTC and other assets is real and growing.

Institutional Inflows and Market Manipulation: The Double-Edged Sword

Speaking of institutional money, it’s worth noting that over 80% of institutional crypto investment has been flowing into Bitcoin. This is a massive vote of confidence in BTC’s long-term value and stability compared to altcoins.

However, this influx of big money brings its own challenges. The crypto market is notorious for manipulation, and the bots and whales behind the scenes often make it hard for retail investors to catch a break.

Price manipulations, especially in altcoins like XRP and Solana, are driven by automated bots and large players who profit from the volatility. As soon as an announcement hits or a tweet from influential figures like Trump or Elon Musk stirs the pot, the entire market can tank within seconds.

This isn’t your average retail investor rushing to sell—it’s high-frequency trading bots reacting instantly to news, causing rapid market sell-offs and spikes. Regulation might help, but it’s unlikely to stop these manipulative practices entirely because large financial players have deep pockets and sophisticated tech.

Why This Matters for Your Crypto Portfolio

Understanding these forces is crucial for anyone investing in Bitcoin, Crypto, BTC, Blockchain, CryptoNews, and Investing. The market isn’t a simple free-for-all; it’s a battleground where big players often control the flow and direction of prices.

For retail investors, this means:

- Be cautious about chasing pumps and hype, especially around legal cases or Fed announcements.

- Look for consistent buy zones and play the dips smartly.

- Keep an eye on volume spikes—they often signal manipulation and opportunity.

- Don’t expect massive moves from single events like the conclusion of the XRP SEC case.

- Prepare for a longer wait for rate cuts and macroeconomic relief, likely not until September.

Putting It All Together: What’s the Takeaway for Crypto Investors?

The crypto market is complicated, messy, and often unfair. Jerome Powell’s Fed is keeping rates high for the elites while the average person struggles with debt. Deutsche Bank and other institutions are moving into crypto, bringing more money but also more manipulation potential. XRP’s legal drama has played out mostly already, and any new price action tied to the case is unlikely to be significant.

That said, there are opportunities for those who know where to look. Coins like TonCoin and Solana are flirting with buy zones, and savvy traders can still profit by playing the dips and tips with assets like XRP. But always be ready for sudden moves, and remember that bots and big money often control the market’s pulse.

Ultimately, staying informed, cautious, and patient is your best strategy in the Bitcoin, Crypto, BTC, Blockchain, CryptoNews, and Investing world. It’s a game of endurance and smarts, not just hype and hope.

Stay sharp, stack wisely, and don’t let the big players steamroll you. The crypto future is bright, but only if you play it smart.

Bitcoin, Crypto, BTC, Blockchain, CryptoNews, Investing: What’s Really Happening with XRP, Jerome Powell, and the Crypto Market?. There are any Bitcoin, Crypto, BTC, Blockchain, CryptoNews, Investing: What’s Really Happening with XRP, Jerome Powell, and the Crypto Market? in here.