The cryptocurrency world is ever-evolving, with some projects soaring while others falter. One project that has recently caught my critical eye is Stellar XLM. Despite billions poured into its development, Stellar’s blockchain is showing alarming signs of decline. And at the helm of this sinking ship? Denelle Dixon, the CEO of Stellar Development Foundation. Today, I’m diving deep into the hard stats and facts that reveal why Stellar XLM is dead in the water, why investors are fleeing, and why the leadership must be held accountable.

This isn’t about hate or baseless criticism — it’s about cold, hard numbers and a brutally honest look at Stellar’s performance. If you’re invested in crypto or blockchain technology, this story is crucial to understand the realities of the space beyond the hype and promises.

The Illusion of Progress: What Denelle Dixon Says vs. What the Data Shows

Denelle Dixon often reminds us that “the work doesn’t stop at issuance,” emphasizing that success in stablecoins and blockchain means liquidity, usability, and choosing the right blockchain. Sounds great, right? But here’s the kicker: if building and liquidity are so critical, why are the Stellar network’s on-chain transactions declining?

Logic says more development should lead to more users and more transactions. But the opposite is happening.

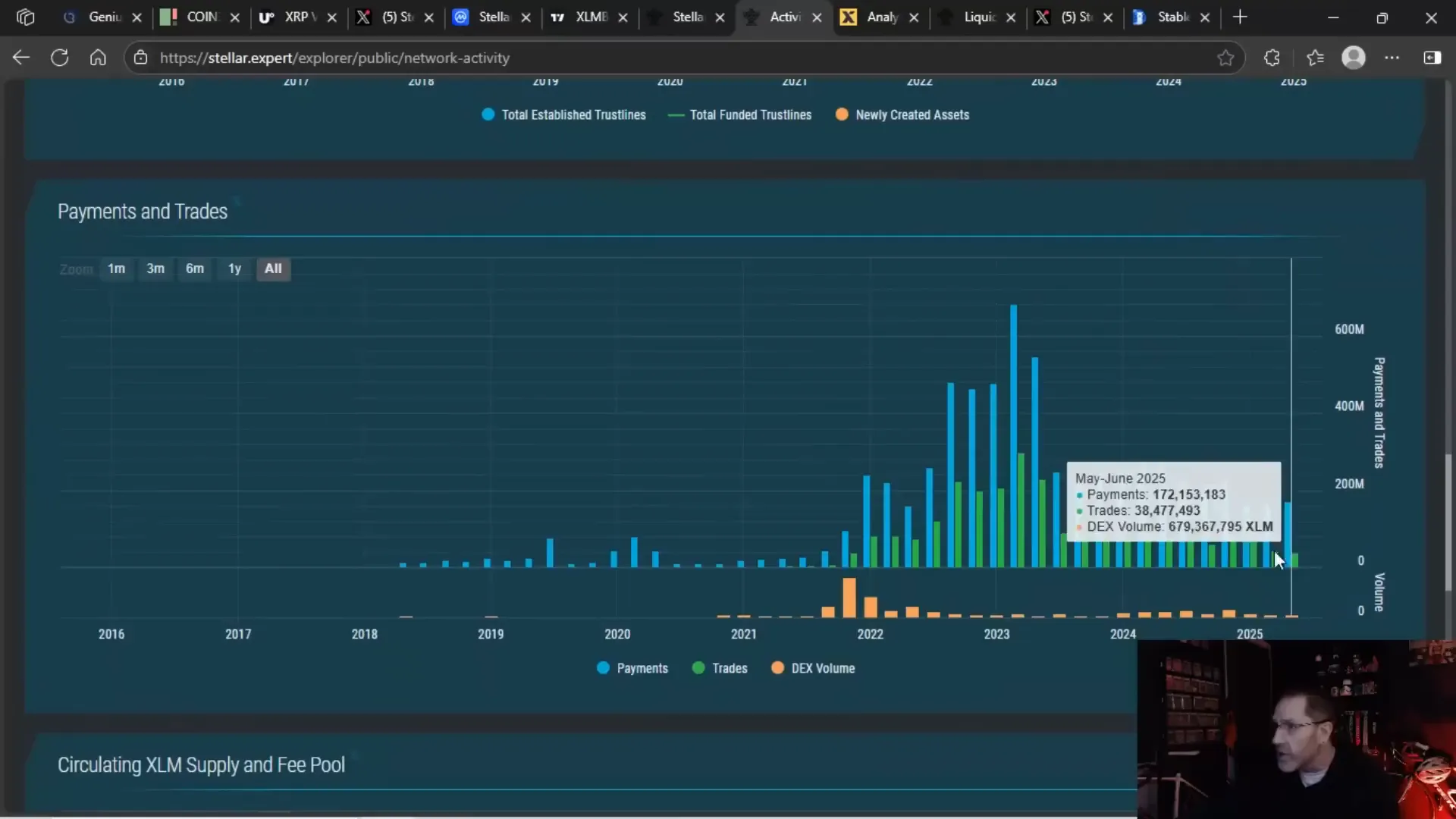

- Transactions on Stellar are dropping — the orange line on the transaction charts peaked in 2022-2023 and is now dwindling.

- Payments are going down — payments peaked in 2023 but have taken a nosedive since, with a 75% drop in payment volume over the last two years.

To put numbers to it, from May to June recently, Stellar processed only 172 million payments, most of which were tiny “sprinkles” — fractions of a penny. Compare that to 681 million payments just two years prior, and you see a dramatic contraction.

This is not adoption or usability. This is shrinkage — a big red flag for a project that claims to be building and growing.

Fee Pool and Token Burn: Where’s the Value Going?

Many argue that Stellar’s native token, XLM, is valuable because it’s being burned through transaction fees, theoretically making the token scarcer and more valuable. But again, the stats tell a different story.

- The fee pool for XLM is shrinking because transactions are declining.

- Only about 6.5 million XLM have been burned, which is negligible compared to the total supply.

- There are 50 billion XLM tokens in circulation, so burning a few million isn’t going to make a dent.

This means no “fee pool riches” are coming for investors, as the token supply keeps ballooning while demand and usage stagnate or fall.

XLM Trading Volume and Price Action: A Rollercoaster Without Stability

XLM’s native token trading volume is weak and highly volatile, bouncing between pumps and dumps without any sustained upward momentum. After the November election, which many hoped would stabilize crypto markets, XLM didn’t hold its gains. Instead, it started sliding back down.

Retail and institutional investors are clearly losing interest, as evidenced by the declining price and volume. Looking back, the biggest price spikes for XLM weren’t driven by Stellar’s own achievements or news but rather by external market forces:

- The 2017-2018 ICO boom gave XLM a lift — but this was a market-wide phenomenon, not Stellar-specific.

- The 2020-2022 lockdown and zero interest rate environment pushed liquidity into crypto broadly, lifting many assets including XLM.

- The July 2023 legal ruling involving XRP lifted XLM briefly — again, not Stellar’s own news.

- The November election and shifting pro-crypto political sentiment caused a spike, unrelated to Stellar itself.

None of these were Stellar’s own doing — they were external tailwinds. When those winds fade, so does XLM’s momentum.

Liquidity on Stellar: A Pathetic Situation

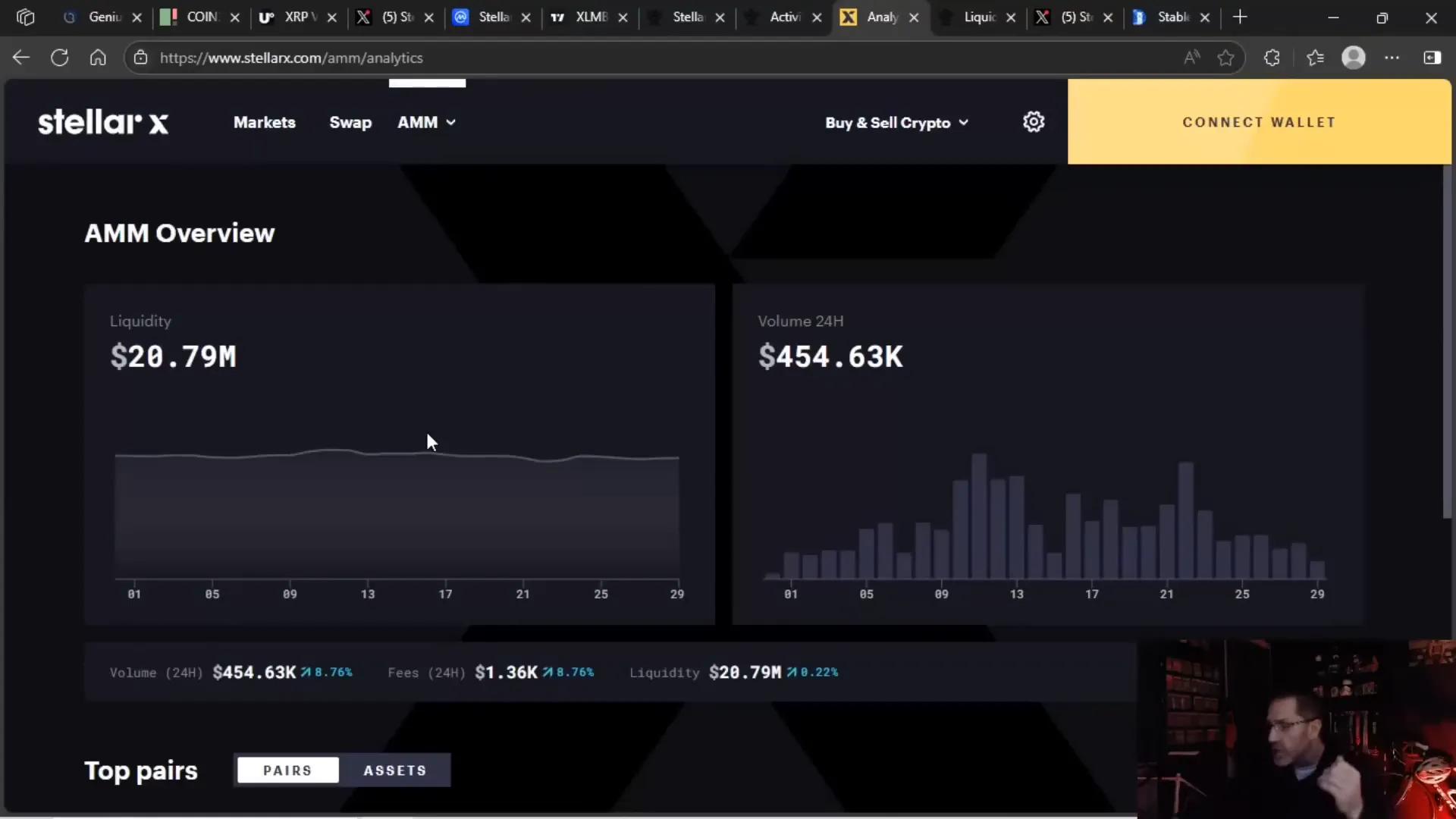

Liquidity is the lifeblood of any blockchain ecosystem, especially for tokens and stablecoins. Stellar promised to be a hub for liquidity, but the reality is embarrassing:

- Total liquidity on Stellar’s chain is only about $20 million — a paltry sum considering billions of dollars have been invested.

- When Stellar announced its liquidity pools around three to four years ago, it had $13 million locked. In all that time, it only grew by $7 million.

- This is a pathetic growth rate for liquidity, especially when compared to other blockchains.

Even worse, many of the largest liquidity pools on Stellar are flagged as scams or unsafe assets. This undermines trust and further discourages legitimate investors.

Debunking the Myth: Stellar’s Liquidity vs. Other Chains

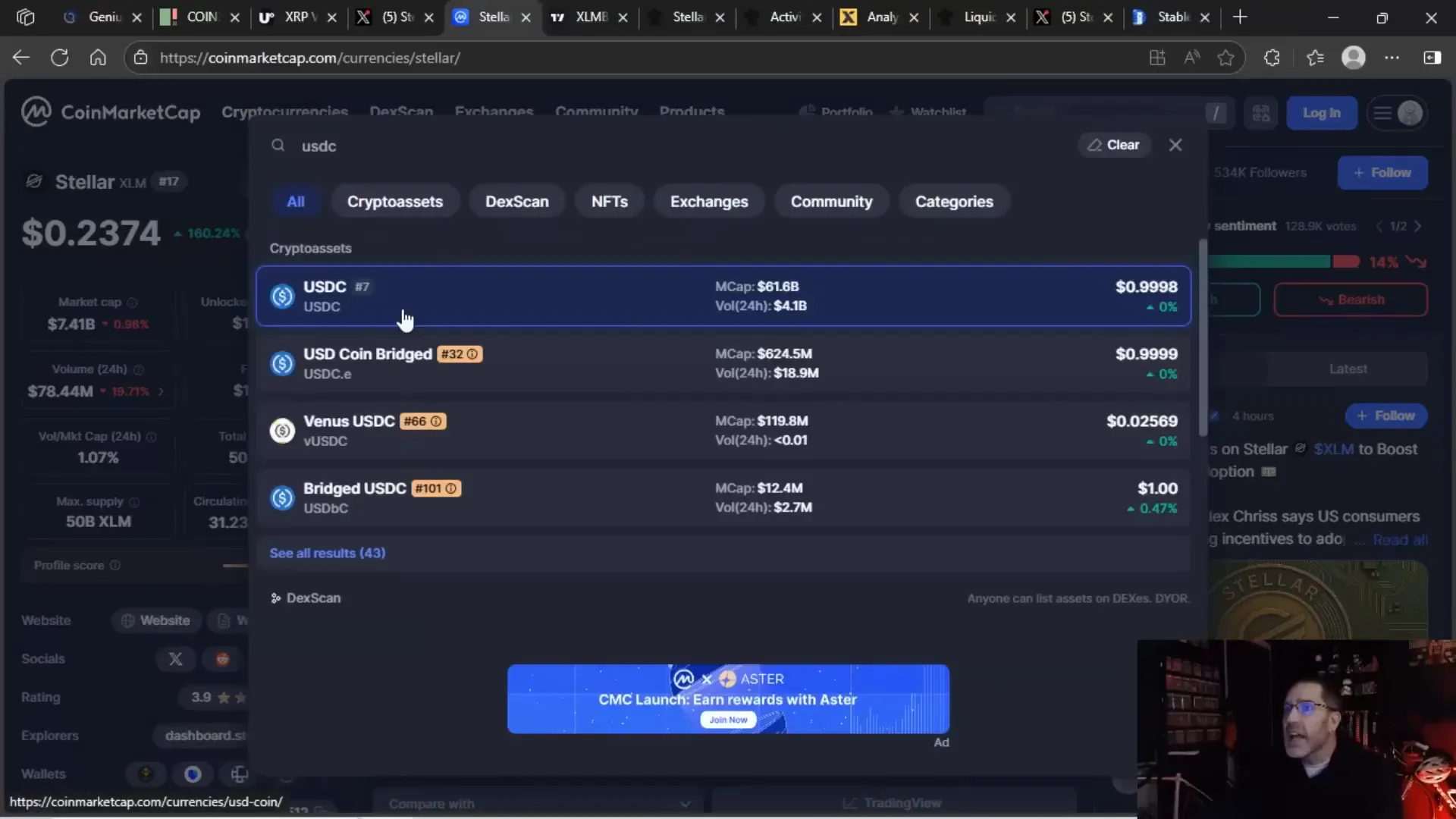

On social media, you’ll find “Stellar experts” claiming that the “real liquidity” for USDC stablecoin is on Stellar, and that XRP’s USDC is a trap. These claims are flat-out lies.

Let’s look at the facts:

- The largest liquidity pool on Stellar currently is the Benji token, which is unavailable to retail investors — so this liquidity is inaccessible for most.

- USDC’s liquidity on Stellar is about $157 million.

- USDC’s total market cap across all chains is over $60 billion.

- Doing the math, only about 0.2% of USDC liquidity exists on Stellar.

That’s right — less than one percent. The vast majority of USDC liquidity remains on Ethereum and other competing blockchains.

Circulating Supply Growing, But Adoption Shrinking

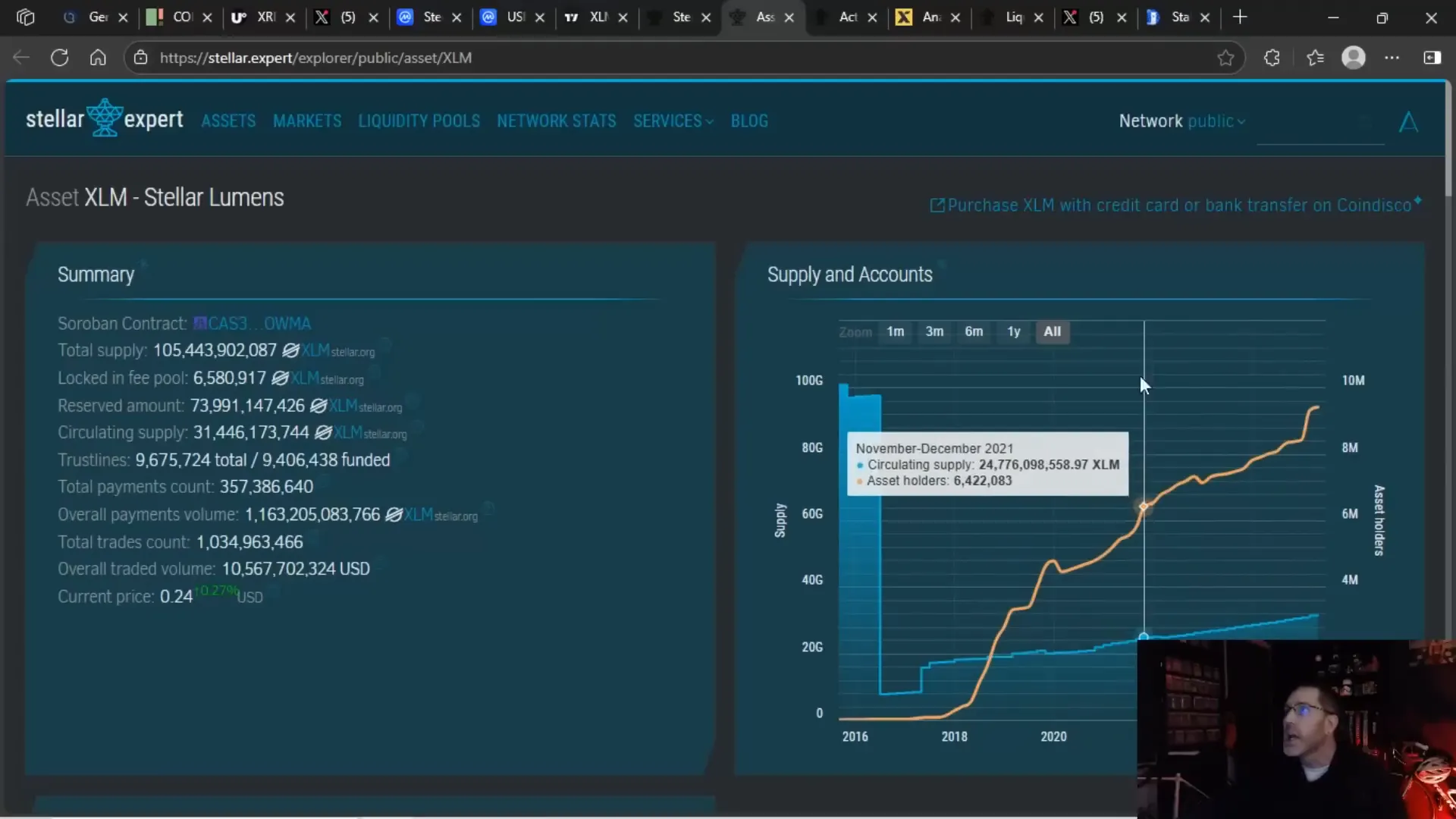

Another troubling trend is the continuous growth of XLM circulating supply. Currently, there are about 31 billion XLM in circulation, with a total supply expected to reach 50 billion.

Why is this a problem? Because Stellar keeps dumping more XLM onto the open market, flooding supply without corresponding demand growth. The result? Price pressure and diminished investor confidence.

This supply growth occurs despite the lack of meaningful on-chain activity, liquidity, or institutional interest. It’s a recipe for disaster.

Why Investors Are Fleeing Stellar

The picture is clear: Stellar’s blockchain is bleeding users, liquidity is stagnant or shrinking, and the tokenomics are working against holders. Investors — both retail and institutional — are voting with their wallets and exiting.

Here’s why:

- Declining on-chain transaction volume — fewer transactions mean less use and less value generated on Stellar.

- Shrinking payments volume — payments dropped 75% in two years, signaling loss of adoption.

- Pathetic liquidity growth — only $20 million locked despite billions invested.

- Major liquidity pools flagged as scams — undermines confidence and security.

- USDC liquidity on Stellar is negligible — less than 0.2% of USDC liquidity is on Stellar.

- Native token volume and price are volatile and declining — no sustained growth or stability.

- Circulating supply keeps growing, diluting value.

- No major stablecoins launching on Stellar — a red flag for institutional interest.

Denelle Dixon: The Person Responsible

Leadership matters. And when billions are poured into a project with such disappointing results, the person at the helm must be held accountable. Denelle Dixon has been leading Stellar throughout this period, and the data paints a damning picture.

Despite the billions spent, Stellar’s chain is losing ground. Dixon’s repeated promises of “building” and “tokenization” have not translated into real-world adoption or growth.

Investors and observers can make excuses all they want — blaming market cycles, competition, or external factors — but other crypto projects are thriving in the same environment. Stellar is not.

Simply put: Stellar’s poor performance is on Dixon’s watch.

How Stellar Compares to Other Cryptos

When you zoom out and compare Stellar to Bitcoin and other leading cryptocurrencies, the contrast is stark.

- XLM vs BTC price charts show a clear downtrend for Stellar.

- Bitcoin dominance is growing while altcoins like Stellar flail.

- Other chains are attracting institutional capital and stablecoin launches, while Stellar remains stagnant.

- Despite being fast, cheap, and reliable, Stellar is not the preferred choice for liquidity or stablecoin issuance.

This is telling. Stellar’s technology alone isn’t enough; execution and leadership are critical. And Stellar is falling short.

What Investors and Crypto Enthusiasts Should Take Away

Here’s the brutal truth for anyone invested in Stellar or considering it:

- Don’t be fooled by hype or empty promises of “building” — look at the real data.

- Transactions, payments, liquidity, and token volume are all declining or stagnant.

- Major stablecoins are not launching on Stellar, signaling lack of institutional trust.

- Stellar’s circulating supply keeps growing, diluting value for holders.

- Leadership must change for Stellar to have a chance at revival.

The crypto space is brutal and unforgiving — projects that don’t deliver tangible results lose relevance fast. Stellar is at a crossroads, and without accountability and new leadership, its future looks bleak.

Final Thoughts: The Reality Beyond the Hype

Stellar XLM was once seen as a promising blockchain with unique advantages — fast transactions, low fees, and a focus on payments and stablecoins. But the current reality is starkly different.

Billions spent, millions of tokens dumped, declining on-chain activity, pathetic liquidity growth, and a lack of institutional stablecoin launches paint the picture of a project in decline. And all of this under the leadership of Denelle Dixon.

This is a cautionary tale for crypto investors and enthusiasts: always look beyond the hype and ask the tough questions. Where is the usage? Where is the liquidity? Where is the institutional adoption? If the answers are “nowhere” or “shrinking,” it’s time to reconsider your position.

Stellar XLM is dead unless there’s a serious course correction, and that starts with new leadership focused on delivering real results, not just promises.

For those watching Bitcoin, Crypto, BTC, Blockchain, CryptoNews, and Investing trends, Stellar’s decline is a reminder that in crypto, execution is everything. The market rewards builders who deliver real value, not just talk.

Bitcoin, Crypto, BTC, Blockchain, CryptoNews, Investing: Why Stellar XLM Is Dead and Denelle Dixon Is to Blame. There are any Bitcoin, Crypto, BTC, Blockchain, CryptoNews, Investing: Why Stellar XLM Is Dead and Denelle Dixon Is to Blame in here.