If you’ve been following the crypto world recently, you know the market is buzzing with activity. From Bitcoin breaking all-time highs to XRP battling the $3 mark with massive volume, the scene is vibrant. Institutional money is flowing in alongside retail investors, signaling a new phase in cryptocurrency investing. And while some regulators like the Bank of England are throwing shade on stablecoins, the market’s momentum is undeniable.

Welcome to this deep dive into the latest in Bitcoin, Crypto, BTC, Blockchain, CryptoNews, and Investing. We’ll unpack the explosive volume in XRP, the monumental inflows into crypto funds, the curious case of Bitcoin ETF demand dwarfing mining supply, and the regulatory landscape challenging stablecoins. Whether you’re an XRP veteran or just dipping your toes into crypto, this article has got the insights you need to stay ahead.

The XRP Showdown: $3 Mark and $12.5 Billion Volume

Let’s kick things off with XRP, which is currently the star of the show. In the last 24 hours, XRP has clocked an eye-watering $12.5 billion in trading volume, fiercely battling the $3 price level. This isn’t just a quick pump-and-dump; the move has been sustained over several days, indicating strong support and institutional interest.

To put this into perspective, this move started around July 10th, and unlike previous surges that lasted only a day or two, this one has held strong for four days and counting. The candlestick charts on the 15-minute timeframe show constant pushes toward the $3 level, with volume backing each attempt. This suggests a battle between bulls and bears at this psychological price barrier.

For those wondering about chasing the price higher, the advice is clear: don’t chase. Many seasoned investors, myself included, are holding steady with existing positions, letting the market unfold. But for newcomers or those with unfilled bags, this momentum could be an attractive entry point—just proceed with caution and strategy.

Why Is This Move Different?

Historically, XRP’s major price moves were sharp but short-lived, with dramatic spikes followed by quick dumps. This time, the move is slower but more deliberate, with volume sustaining the price level. This indicates that both retail and institutional players are in the game, creating a two-headed momentum engine.

This long, steady push is healthier for the market, as it builds support levels and reduces the risk of a sudden crash. It’s also a sign of confidence in XRP’s fundamentals, especially as we head into what many are calling “crypto week,” a period expected to bring increased activity and news flow.

Altcoins and Market Sentiment: Green Across the Board

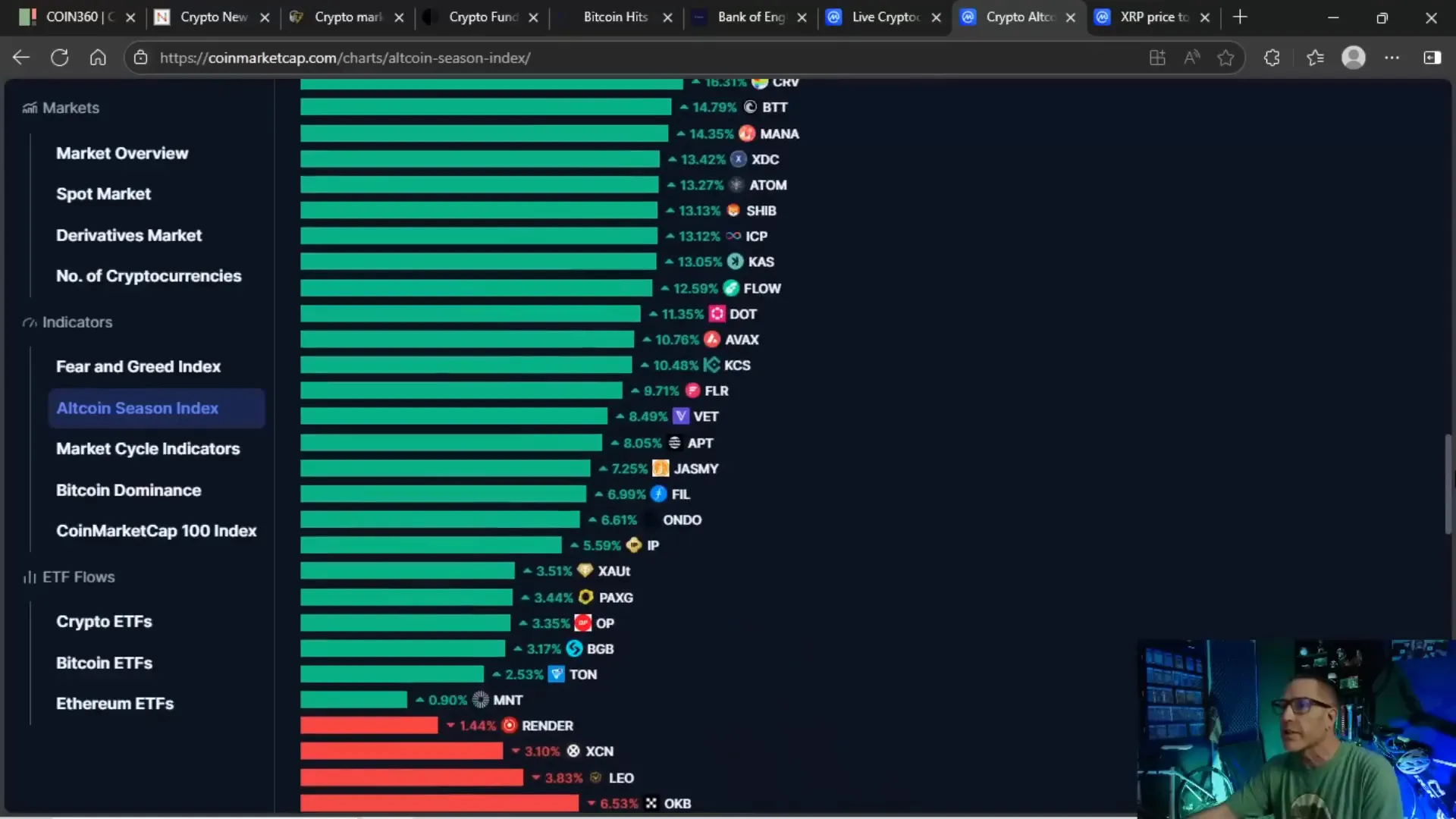

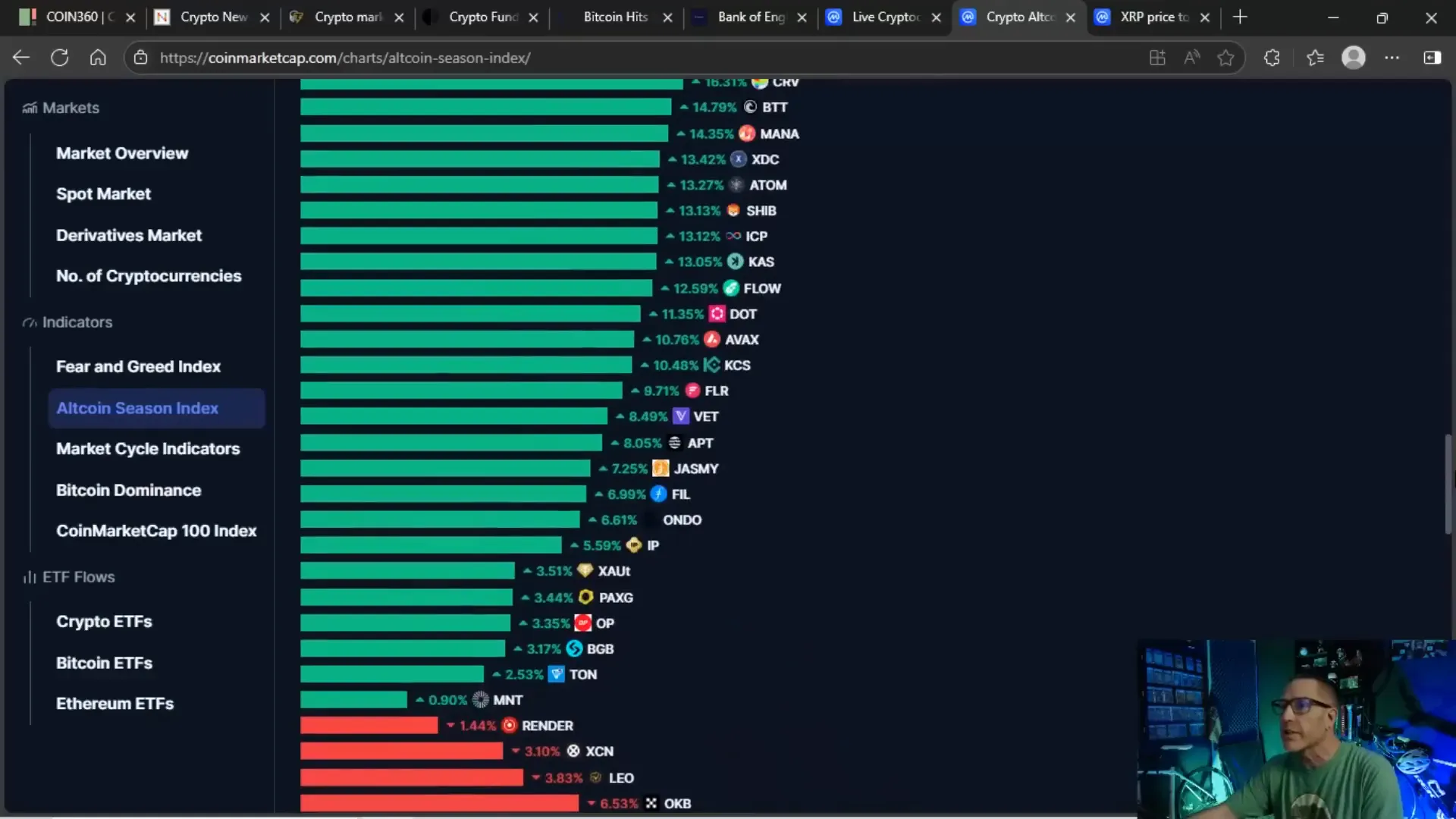

If you glance at the altcoin index over the past 90 days, you’ll notice a sea of green. Most cryptocurrencies are trending upward with very few in the red. This broad-based strength is a telltale sign of a healthy altcoin season, where smaller coins gain momentum alongside Bitcoin and major assets like XRP.

Currently, 33 out of 100 altcoins are showing solid gains, indicating a vibrant market that goes beyond just BTC and XRP. This diversity in price action is encouraging for investors looking to diversify their portfolios and capitalize on emerging projects.

Bitcoin’s Meteoric Rise and ETF Frenzy

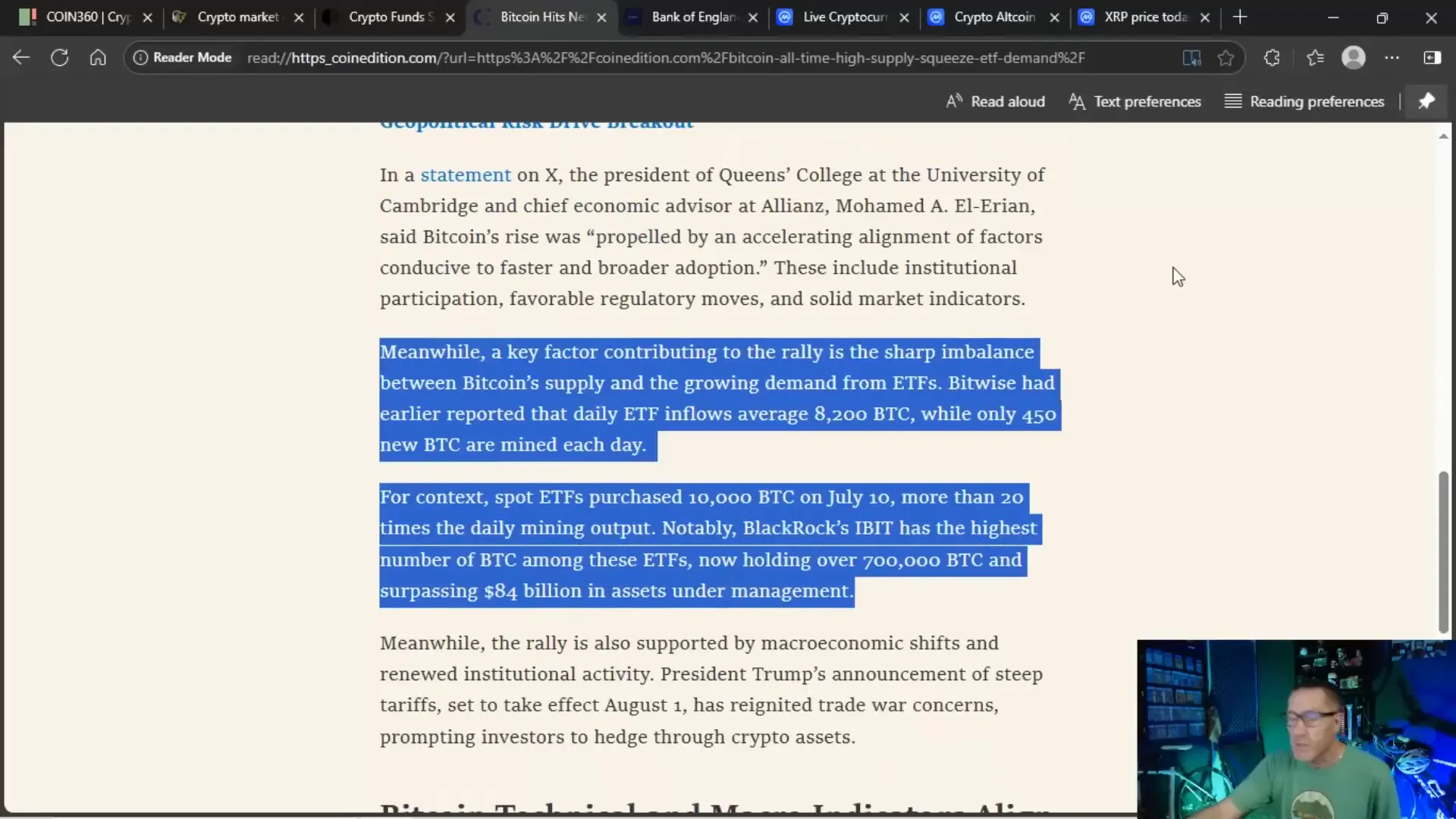

Bitcoin is no stranger to headlines these days, smashing past previous all-time highs and reaching $122,000 in some reports. What’s driving this rally? Institutional demand, particularly from Bitcoin ETFs (Exchange-Traded Funds), is off the charts.

Here’s the kicker: ETFs are buying Bitcoin at a rate 20 times higher than the daily mined supply. On July 10th alone, spot ETFs purchased about 10,000 BTC, while miners are only producing around 450 BTC daily. This supply-demand imbalance is creating a scarcity effect that’s pushing prices higher.

This dynamic raises questions about the future of Bitcoin mining and how the ecosystem will adapt. Will rising demand from ETFs increase the profitability for miners, driving more investment in mining infrastructure? Or will scarcity lead to a price squeeze that benefits holders? Only time will tell, but the current data points to a bullish scenario.

Bitcoin Fund Inflows Break Records

Crypto funds have experienced their biggest weekly inflow of the year, with $3.7 billion pouring in, marking the 13th consecutive week of net inflows. Year-to-date, total inflows have reached $22.7 billion, pushing assets under management past the $200 billion mark for the first time.

Weekly trading volume in ETFs hit $29 billion, double the average for this year. This influx of capital from institutional investors signals growing confidence in Bitcoin as a store of value and investment vehicle.

Regulatory Spotlight: Bank of England’s Warning on Stablecoins

While the market surges forward, regulators are watching closely. The Bank of England’s governor, Andrew Bailey, recently issued a stern warning against banks issuing their own stablecoins. His concern centers on the potential threat to financial stability and the weakening of government control over currency issuance.

This stance highlights the ongoing tension between innovation and regulation. Stablecoins pegged to fiat currencies like the pound, dollar, euro, or yen theoretically maintain value parity with their underlying assets. But the real risk lies in the companies behind these coins. Trust in their ability to redeem tokens for cash at face value is crucial.

The recent Chapter 11 filing by LinkTo, a company involved in some questionable dealings with Ripple’s pre-IPO shares, underscores these risks. Stablecoins like USDC require trust that the issuing company can fulfill redemption requests without slippage or losses, an area regulators want to scrutinize.

Government Control vs. Innovation

The resistance to stablecoins also reveals a deeper struggle over financial sovereignty. Governments and central banks want to maintain control over money supply and monetary policy. The rise of decentralized digital currencies and private stablecoins challenges this status quo.

As we see with figures like Elizabeth Warren and regulators like Gary Gensler in the U.S., and now Andrew Bailey in the U.K., the pushback against stablecoins is part of a broader effort to regulate and contain the crypto space within traditional financial frameworks.

Crypto Market Cap and Volume Surge

The overall crypto market capitalization has hit a staggering $3.8 trillion, a milestone signaling the growing maturity and acceptance of digital assets. This figure dwarfs many national economies and reflects the massive inflows of capital from both retail and institutional investors.

Trading volume is also on fire, nearing $300 billion, which is up 156% compared to previous averages. This surge in volume is a key indicator of market vitality and liquidity, making it easier for investors to enter and exit positions without significant slippage.

Altcoin Season: What to Watch

With more than a third of altcoins showing gains, altcoin season is heating up. This period is often characterized by smaller-cap cryptocurrencies outperforming Bitcoin, driven by innovation, hype cycles, and speculative interest.

Investors should keep an eye on mental price barriers—key round numbers where price action tends to stall or reverse. Coins battling these levels often experience volatile swings, and breaking through these barriers can signal further momentum.

Investor Sentiment: Balancing Retail and Institutional Players

One of the most fascinating aspects of the current market is the blend of retail enthusiasm and institutional muscle. Retail investors have kept the momentum alive through weekends and quieter periods, while institutions are driving large inflows during the week.

This dual dynamic creates a more stable and sustained market rally compared to previous cycles dominated by one group or the other. It also suggests that crypto is increasingly viewed as a legitimate asset class by traditional investors, which bodes well for long-term growth.

Mining Dynamics: The Supply Side of Bitcoin

The Bitcoin mining landscape is in flux due to the growing demand from ETFs and investors. With daily mining output relatively fixed and demand surging, miners might find themselves in a lucrative position, potentially driving more investment into mining infrastructure.

However, this dynamic also raises questions about sustainability and whether the supply squeeze could lead to extreme price volatility. While billions are flowing into crypto, it’s important to recognize the complex interplay between mining supply, investor demand, and price action.

Final Thoughts: The Crypto Week Momentum

As we move deeper into crypto week, the energy in the market is palpable. Green Mondays and weekends packed with volume and price gains are a refreshing change from the usual slow starts. This momentum is fueled by a mix of retail passion and institutional seriousness, making the current market environment exciting and full of potential.

Whether you are holding onto Bitcoin, accumulating XRP, or exploring altcoins, the key takeaway is to stay informed, watch key price levels, and understand the broader market forces at play. The crypto world is evolving fast, and being part of this wave requires both patience and savvy.

So, keep your eyes on the charts, stay tuned to the news, and remember: in the world of Bitcoin, Crypto, BTC, Blockchain, CryptoNews, and Investing, knowledge is your best asset.

Chew chew what? Chew chew biz nachos! The crypto train is rolling, and it’s time to hop on if you haven’t already.

Bitcoin, Crypto, BTC, Blockchain, CryptoNews, Investing: XRP Retail and Institutions Buying Amid 20x Shortage. There are any Bitcoin, Crypto, BTC, Blockchain, CryptoNews, Investing: XRP Retail and Institutions Buying Amid 20x Shortage in here.