If you’re deep into Bitcoin, Crypto, BTC, Blockchain, CryptoNews, and Investing, buckle up. There’s some mega breaking Ripple XRP news you absolutely need to hear. Ripple wants to become a federally regulated bank? Yep, you read that right. And Brad Garlinghouse, Ripple’s CEO, just dropped a sharp statement distancing Ripple from the Linqto mess. Meanwhile, Bitcoin is gearing up to touch all-time highs, sparking green lights across the altcoin market — including XRP. Let’s dive into everything you need to know right now.

Market Pulse: Bitcoin Leading the Charge, Altcoins Warming Up

First things first: Bitcoin (BTC) is making a serious move. Sitting comfortably in the green territory, BTC is inching closer to its all-time highs, and that momentum is contagious. Altcoins like XRP and ADA are starting to catch the wave, with some memecoins joining the party. The market volume is heating up with over $114 billion traded in the last 24 hours, signaling strong exchange activity and trader interest.

This uptick in volume and price action has traders buzzing about a potential altcoin season. Currently, altcoin season strength is measured at 24 out of 100 — not quite full throttle, but definitely warming up. The 4th of July holiday is on the horizon, and historically, holidays can bring volume surges and price pumps, so eyes are peeled for possible fireworks in the crypto space.

Ripple’s Big Move: Applying for a US National Bank License

Now for the juicy part. Ripple has officially applied for a US national banking license, marking a huge step in its regulatory ambitions. This move is significant because if Ripple gets approved, it would gain the authority to operate as a federally regulated bank. That’s huge because it means Ripple could bypass the hassle and complexity of having to get money transmitter licenses in every single state.

More importantly, this license would allow Ripple to custody its own assets. Imagine the power of vertical integration — Ripple would no longer have to pay third parties to hold or manage its assets. It would have full control, streamlining operations and potentially speeding up adoption of its stablecoin, RLUSD.

This isn’t just Ripple’s dream — other major crypto firms like Circle and Fidelity Digital are also pursuing similar federal charters. The race to integrate deeper into the regulated financial system is heating up, and Ripple wants to be at the forefront.

The application was submitted to the Office of the Comptroller of the Currency (OCC) on a Wednesday, making this breaking news hot off the press. The timing couldn’t be better as Congress moves closer to passing the Genius Act, which could further clarify crypto regulations and open doors for stablecoin innovation.

Why This Matters for XRP and RLUSD

Ripple’s push for a national bank license isn’t just regulatory posturing. It has real implications for XRP and RLUSD, Ripple’s stablecoin. If Ripple becomes a federally regulated bank, it can issue RLUSD at scale with more confidence from regulators and partners. This could turbocharge the adoption of RLUSD as a reliable digital dollar alternative, potentially driving demand for XRP as the network’s native token.

This vertical integration — controlling everything from issuance to custody — could set Ripple apart from competitors and smooth out regulatory bumps that have slowed crypto’s mainstream adoption. For investors and crypto enthusiasts, this is a signal that Ripple is serious about building a compliant, scalable financial infrastructure.

Breaking Down the Linqto Controversy: Garlinghouse Draws the Line

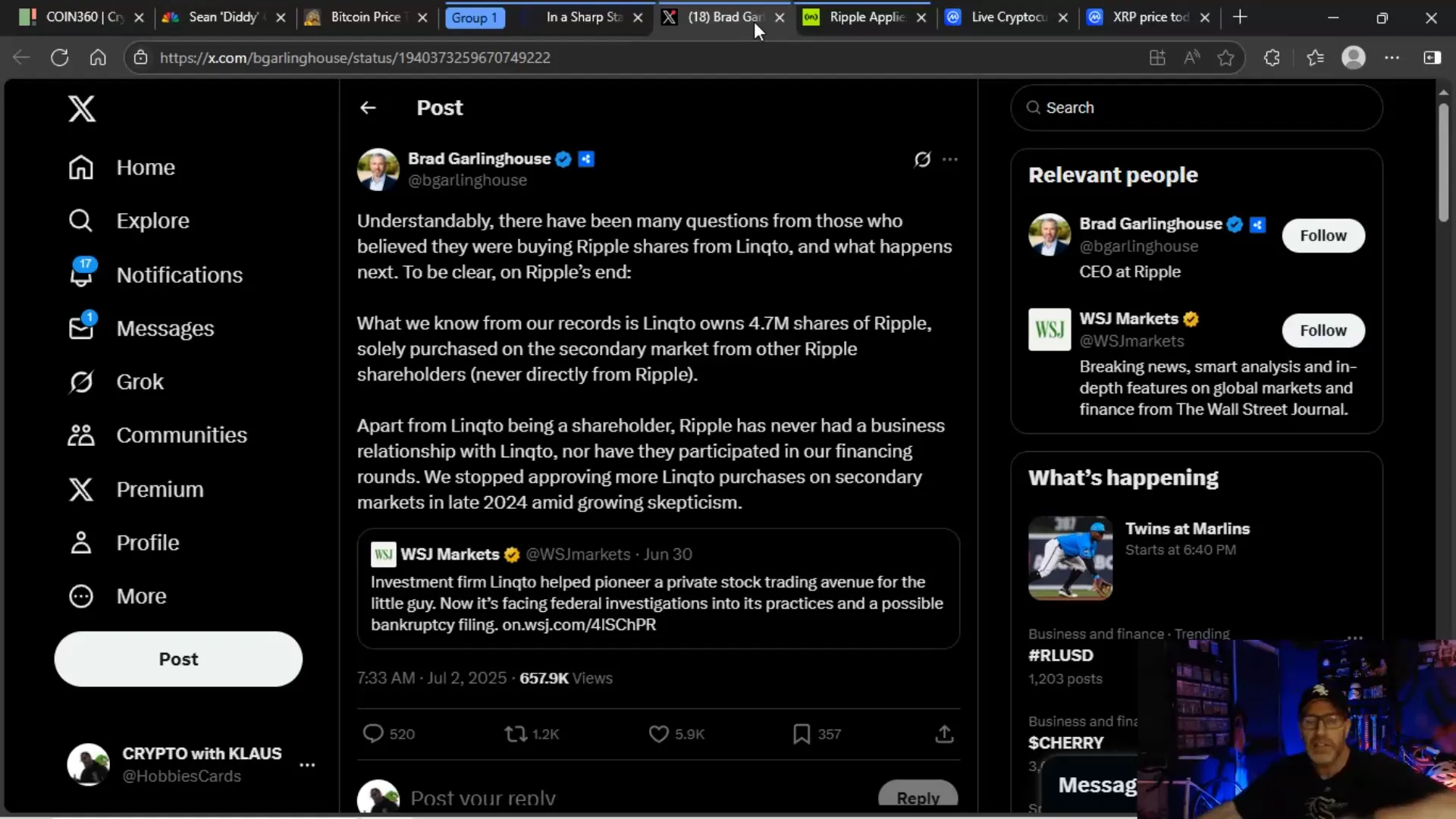

While Ripple is making headlines with its national bank application, it’s also distancing itself from a hot mess involving Linqto. Linqto marketed itself as a platform allowing retail investors to buy private startup and pre-IPO equity, including shares of Ripple. But here’s the kicker — Linqto is now under federal investigation for shady practices.

The problem? Linqto reportedly marked up Ripple shares by a whopping 60%, ignoring SEC rules that cap markups at 10%. Over 11,000 users bought Ripple shares through special purpose vehicles (SPVs) that may not have been properly structured, meaning many investors never legally owned those shares.

The SEC and Department of Justice are investigating Linqto, and the company is reportedly nearing bankruptcy, with users potentially locked out of their investments. This is a nightmare scenario for retail investors caught in the middle.

Brad Garlinghouse came out with a sharp statement to clarify Ripple’s position. He made it crystal clear that Linqto bought Ripple shares on the secondary market from existing Ripple shareholders — Ripple itself never sold shares to Linqto or had a business relationship with them. Ripple stopped approving Linqto purchases in late 2024 amid growing skepticism.

Garlinghouse said: “What we know from our records is Linqto owns 4.7 million shares of Ripple, solely purchased on the secondary market from other Ripple shareholders. Apart from Linqto being a shareholder, Ripple has never had a business relationship with Linqto nor did they participate in our financing rounds.”

In other words, if you got burned by Linqto, Ripple isn’t the culprit — Linqto’s shady dealings are the problem. Ripple is in the clear.

Diddy Verdict and Market Context: What Else Is Shaking?

On a side note, the video also touches on the recent Diddy verdict, where Sean Combs was convicted on lesser charges related to transportation of former girlfriends for prostitution but cleared of more serious accusations. While not directly related to crypto, this news adds to the general market sentiment and media attention.

Back in the crypto world, Bitcoin’s test of $110,000 led to $300 million in liquidations, indicating that shorts are getting absolutely rocked. The market’s volatility is high, and the recent pumps and dumps are keeping traders on their toes.

Price Action and Market Dynamics: The XRP Rollercoaster

Speaking of pumps and dumps, XRP has been on a wild ride. After hitting a high of $2.29, it quickly retraced, frustrating many investors. These 15-minute candlestick plays show quick spikes followed by sharp pullbacks, a pattern driven by market makers, bots, and “the bigs” controlling the flow.

Despite the frustration, XRP’s market cap has surged to $3.6 billion, showing strong interest leading up to the 4th of July holiday. Volume is robust, which is a positive sign, but the market’s control by whales and bots means these moves are often manipulated.

Here’s the key takeaway: the current pump was sparked just by Ripple’s application for the bank license. Imagine the potential when approval actually comes through. This could be a massive catalyst driving XRP and RLUSD adoption to new heights.

What’s Next for Bitcoin, Crypto, BTC, Blockchain, and Investors?

The overall crypto market is gearing up for a potentially explosive summer. Bitcoin’s resurgence is the main driver behind renewed investor optimism, and Ripple’s regulatory moves add fuel to the fire. The Genius Act’s progress in Congress could further clarify the regulatory landscape, paving the way for stablecoins and crypto firms to operate more seamlessly within the US financial system.

For crypto investors, this is a crucial time to stay informed and vigilant. Market volatility will remain high, and the interplay between regulatory news, market sentiment, and institutional moves will dictate price action.

As always, remember that the crypto market is influenced by larger forces — whales, bots, and market makers — so patience and a clear strategy are key to navigating the ups and downs.

Wrapping It Up: Ripple’s Path Forward and Market Outlook

Ripple’s application for a national bank license signals its commitment to becoming a fully regulated player in the financial ecosystem. If approved, it will be a game changer for the company and for XRP holders. Vertical integration, federal oversight, and the ability to custody their own assets set Ripple up for a more streamlined and scalable future.

Meanwhile, the Linqto debacle serves as a cautionary tale for retail investors. Always do your due diligence and be wary of platforms promising easy access to private equity without proper regulatory backing.

Bitcoin’s move toward all-time highs is the primary catalyst for the current market optimism. Altcoins, including XRP, are following suit, but the market remains volatile and susceptible to manipulation. The upcoming holiday season could bring additional volume and price action, so stay tuned.

Whether you’re a seasoned investor or just getting into Bitcoin, Crypto, BTC, Blockchain, CryptoNews, or Investing in general, the landscape is evolving rapidly. Staying informed, understanding regulatory developments, and managing risk are your best tools for success in this dynamic market.

Stay tuned for more updates as this story unfolds — the crypto world never sleeps, and neither do we.

Bitcoin, Crypto, BTC, Blockchain, CryptoNews, Investing: Mega Breaking Ripple XRP News and Market Moves. There are any Bitcoin, Crypto, BTC, Blockchain, CryptoNews, Investing: Mega Breaking Ripple XRP News and Market Moves in here.