Welcome to a deep dive into today's crypto scene where Bitcoin inches towards new all-time highs, altcoins like XRP and SOL remain stuck in a frustrating range, and big banks are throwing shade on stablecoins. If you want to understand how a hot jobs report can actually be bad news for crypto, why JPMorgan’s Jamie Dimon is downplaying stablecoins, and what this means for your crypto investments, you’re in the right place.

We’ll break down the key highlights, price action insights, and macroeconomic factors shaping the market right now. Buckle up as we unpack why Bitcoin, Crypto, BTC, Blockchain, CryptoNews, and Investing are all intertwined in a complex but fascinating story.

Why a Hot Jobs Report Is Bad News for Crypto

At first glance, it might seem counterintuitive—how can good jobs numbers hurt crypto? But here’s the deal: a strong jobs report signals a robust economy, which in turn means the Federal Reserve, led by Jerome Powell, is less likely to cut interest rates anytime soon.

Why does that matter? Higher interest rates make borrowing more expensive. For venture capital and big companies building on blockchain networks, this means less capital flowing into risky assets like altcoins. Bitcoin often holds up better because it is seen as a store of value, but altcoins take the brunt of the sell-offs.

In June, US employers added 147,000 non-farm jobs, and the unemployment rate ticked down to 4.2%. This stronger-than-expected labor market put a damper on hopes for a July rate cut. Traders slashed their expectations for a rate cut from 47% to 24% probability overnight. With rate cuts off the table for now, crypto prices, especially altcoins, are likely to stay suppressed.

The Bigger Picture: CPI and Inflation

Don’t forget, inflation data is also looming. If the Consumer Price Index (CPI) spikes, Jerome Powell has even more reason to keep rates high, further dampening hopes for easier monetary policy. This mix of strong jobs numbers and persistent inflation means crypto investors need to set realistic expectations for the near term.

Jamie Dimon and JPMorgan’s Take on Stablecoins: Why the Banks Are Nervous

Jamie Dimon, CEO of JPMorgan Chase, recently expressed skepticism about stablecoins becoming mainstream money. He forecasts stablecoin growth to reach only $500 billion by 2028, cutting previous trillion-dollar projections in half. JPMorgan argues there’s little evidence of mainstream adoption for dollar-pegged cryptocurrencies yet.

But I see it differently. Growing up, I remember when people still used carbon paper slips for credit card transactions, and cash and checks dominated. Now, debit cards and digital payments are everywhere. Crypto is just the next evolution.

What banks like JPMorgan fear is losing control of payment rails and profits. Decentralized finance (DeFi) is nibbling away at centralized finance (CeFi), and big banks hate it. But stablecoins are already massive, with a market cap north of $250 billion and growing fast.

Stablecoin Market by Blockchain

- Ethereum: $140 billion in stablecoins, the largest share.

- Tron: $80 billion.

- Solana: $10.5 billion, boosted by Circle’s recent $250 million USDC minting.

- Binance Smart Chain: $3 billion.

- Base: $4.2 billion, growing fast.

The volume numbers are staggering. USDC alone sees over $11.5 billion in 24-hour trading volume, while Tether’s volume hits $85 billion. This is trading volume, yes, but it’s undeniable that stablecoins are carving out a huge space in the financial ecosystem, taking volume away from traditional banks.

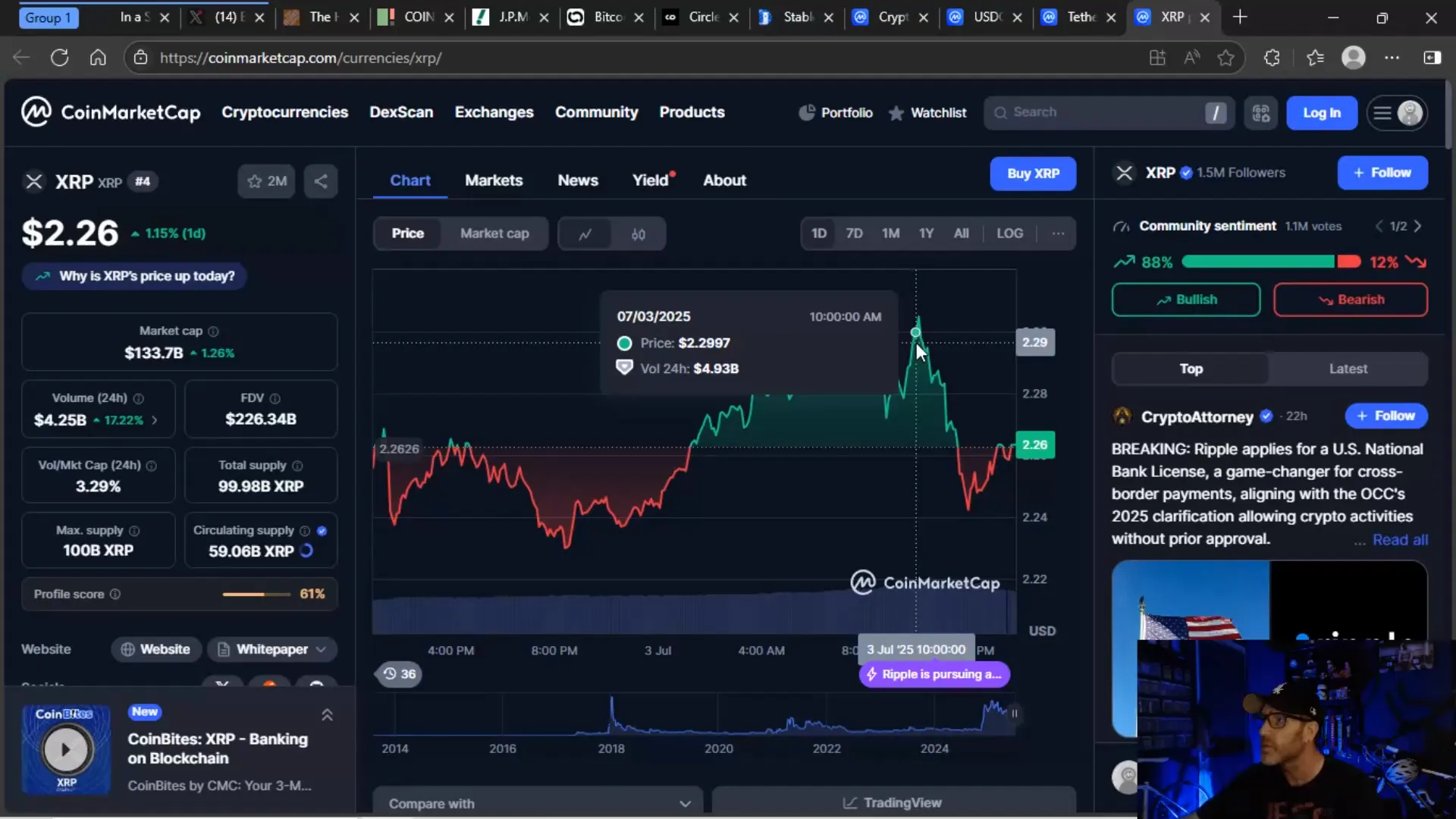

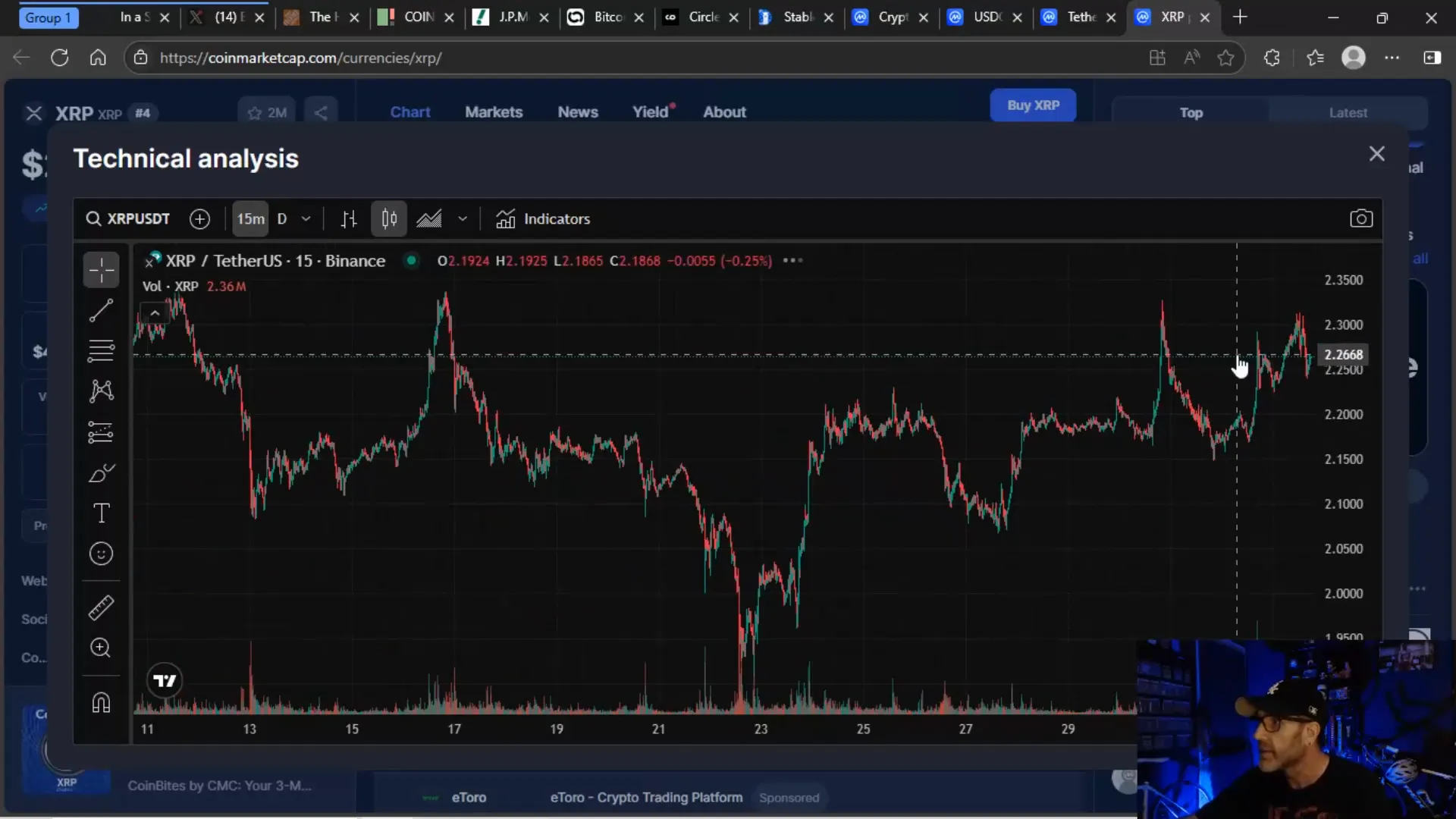

XRP Price Action: Stuck in the Friend Zone

Let’s talk XRP, a fan favorite that’s been frustrating many traders lately. The price has been range-bound between $2.10 and $2.30 for months now — what I call the “friend zone.” It’s like that crush who’s just not quite into you the way you want.

Every time XRP tries to push past $2.30, it gets slammed back down. This resistance level has been tested multiple times in recent weeks and months, and the price keeps bouncing off it. If you buy under $2.15 and sell near $2.30, you’re looking at about 5% gains — modest, but repeatable if you keep playing the pattern.

Why Is XRP Being Held Back?

There’s strong speculation that market makers or whales are controlling XRP’s price to keep it suppressed. For example, Ripple’s recent attempt to become a federally regulated bank caused a brief pump to $2.33 before the price dropped back below $2.30 again.

Until we get major regulatory clarity, rate cuts, or game-changing news like ETF approvals, XRP will likely stay stuck in this range. Bots and market makers thrive in these conditions, capitalizing on the predictable price action.

Bitcoin’s Resilience vs. Altcoin Struggles

Bitcoin (BTC) is doing something remarkable — it's just a couple of percentage points away from its all-time high. Meanwhile, many altcoins are languishing far below their peaks. For instance:

- Cardano (ADA) is around 60 cents, far from its previous highs.

- Solana (SOL) is hovering near $151, underperforming relative to Bitcoin.

This divergence highlights Bitcoin’s dominance and the challenges altcoins face in a high-rate, risk-averse environment.

What Could Change the Game?

September through November is shaping up to be a critical period for crypto. That’s when the SEC’s final decisions on several ETFs — including those involving XRP, ADA, and HBAR — are expected. Also, the much-anticipated “Clarity Act” and stablecoin legislation may finally move forward, although both face significant hurdles.

Until then, expect a lot of sideways price action and frustration for altcoin holders.

What You Need to Know About the Clarity Act and Stablecoin Legislation

The Clarity Act is a proposed regulatory framework aiming to provide clear rules for crypto businesses and assets in the US. While it promises to bring much-needed clarity, the path forward is uncertain, and the bill faces opposition.

Similarly, the stablecoin bill is under debate in the House, with various factions pushing different agendas. The outcome will have major implications for how stablecoins and crypto payments evolve.

Big banks like JPMorgan are watching these developments closely, likely lobbying behind the scenes to protect their turf. For crypto investors, these regulatory battles are critical to watch.

How to Navigate the Current Crypto Market

Given the current landscape, here are some practical tips for investors:

- Play the Range: For XRP, consider trading between $2.10 and $2.30 to capture repeatable gains.

- Monitor Bitcoin: BTC’s near all-time highs could eventually lift altcoins, but patience is key.

- Watch Regulatory News: ETF approvals, the Clarity Act, and stablecoin legislation will be major catalysts.

- Stay Informed on Macro Data: Jobs reports, CPI, and Fed announcements directly affect crypto prices.

- Be Wary of Scams: When crypto markets heat up, scammers ramp up their activity. Always use trusted platforms and double-check before investing.

The Importance of Taking Profits

Remember, no one ever went broke taking profits. If you see a pattern playing out, like XRP’s friend zone bounce, use it to your advantage. Stack those small gains over time — it adds up.

Final Thoughts on the Crypto Landscape

We’re living in an exciting but challenging time for Bitcoin, Crypto, BTC, Blockchain, CryptoNews, and Investing. The macroeconomic environment isn’t doing any favors for altcoins right now, and regulatory uncertainty looms large. Big banks are skeptical, and they’re not shy about expressing it.

But crypto is evolving. Stablecoins continue to grow rapidly, blockchain adoption is expanding, and Bitcoin’s resilience shows the strength of the space. The next few months will be critical as regulatory clarity and macroeconomic factors come into sharper focus.

Stay informed, stay cautious, and keep your eyes on the data and news. And remember, the crypto market is a marathon, not a sprint.

Bitcoin, Crypto, BTC, Blockchain, CryptoNews, Investing: What a Hot Jobs Report and Big Bank Skepticism Mean for XRP and SOL. There are any Bitcoin, Crypto, BTC, Blockchain, CryptoNews, Investing: What a Hot Jobs Report and Big Bank Skepticism Mean for XRP and SOL in here.