If you’ve been following the crypto space, you’ve probably heard the chatter: “XRP is dead, $3 is never happening.” But here’s the thing — I don’t buy that narrative. I believe XRP still has a shot at breaking that $3 mark, but it’s going to take a perfect storm of factors aligning. Let’s dive into the latest crypto news, dissect the price action, and explore what’s really moving the needle on XRP, Bitcoin, and the broader market right now.

We’ll also talk about some heavy hitters like Michael Saylor and Japan’s Meta Planet ramping up Bitcoin buys, the roaring gold ETFs signaling market caution, and what it all means for crypto investors looking for the next big breakout. This isn’t your typical dry market update — expect some colorful language, sharp insights, and a few surprises along the way. So buckle up, pimps, players, and hustlers, because this ride is about to get interesting.

XRP $3: Dead or Alive? The Price Action Breakdown

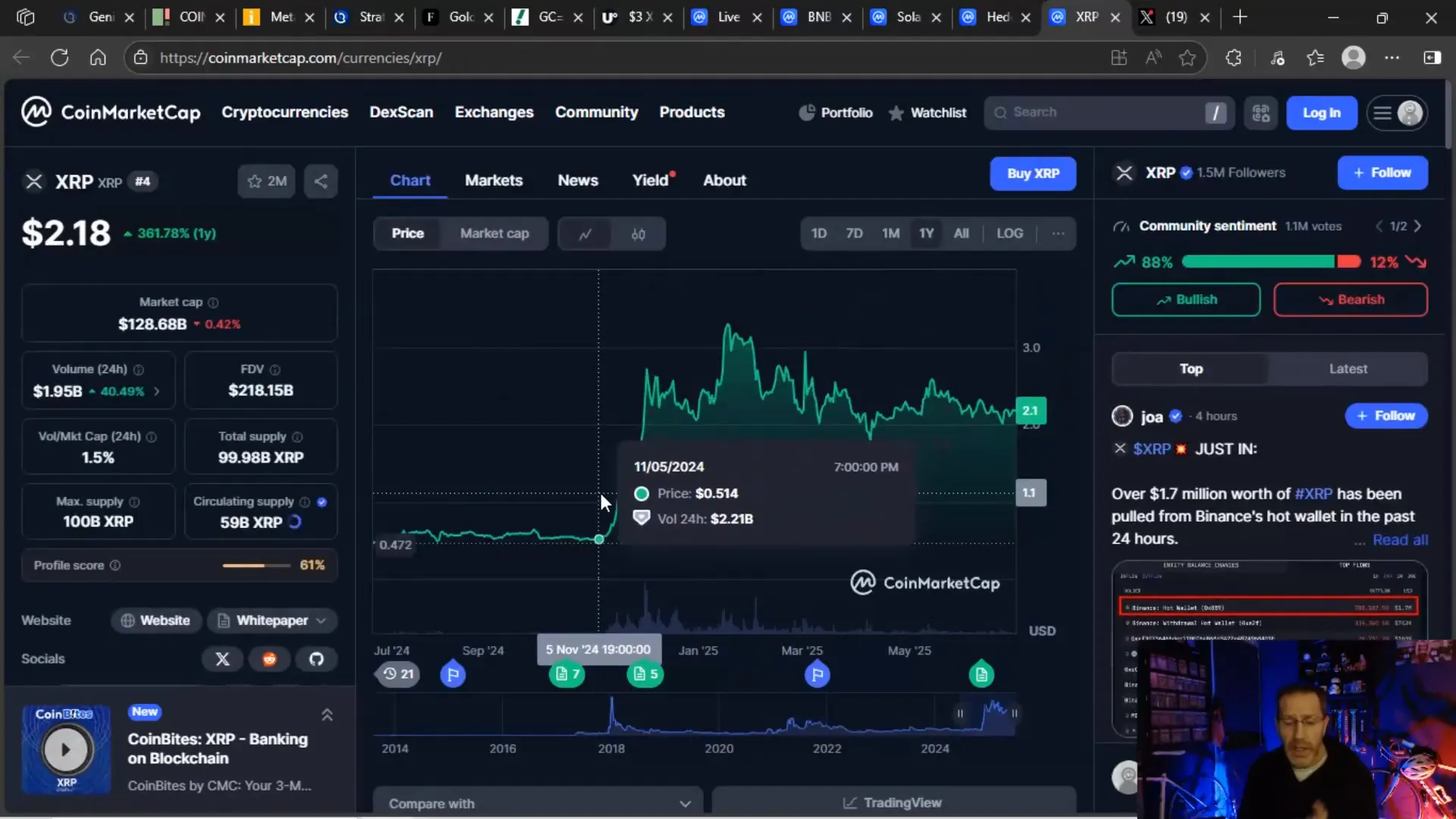

Let’s cut right to it — some big players in the crypto space are calling XRP’s $3 target dead. But I’m here to tell you, it’s not dead yet. In fact, XRP has already proven it can hit that number. Remember late last year around the presidential election? XRP was hovering around 50 cents, then suddenly shot up to over $3. That wasn’t luck, it was a clear market response to political and regulatory signals. So, what’s stopping it from happening again?

The answer lies in a few key catalysts that need to fall into place:

- Regulatory clarity: XRP’s biggest hurdle right now is the lack of clear regulations protecting it.

- Interest rate cuts: Lower rates mean less risk and more money flowing into risky assets like crypto.

- Reduced geopolitical tensions: The market hates uncertainty, and right now, there’s plenty of it.

- Gold’s market dominance easing: Gold ETFs are booming, sucking up capital that might otherwise flow into crypto.

Until these factors shift, XRP’s price action will struggle to break through resistance levels, regardless of what the charts say.

Why Charts Can’t Tell the Whole Story

Here’s a truth bomb — charts don’t predict political events, regulatory changes, or macroeconomic shifts. They’re mathematical averages based on historical data, not crystal balls. The charts didn’t see the election-driven XRP pump coming, nor did they anticipate the legal interpretations that gave XRP a boost in 2023.

So, when you hear “charts say XRP can’t hit $3,” remember that charts are only part of the puzzle. The real game changers are the external factors that charts can’t capture:

- Passing of the Clarity Act or other crypto-specific regulations

- Companies starting to buy XRP as a strategic reserve asset

- Jerome Powell cutting interest rates to reduce market risk

- Geopolitical stability, especially in volatile regions like the Middle East

When these move in XRP’s favor, the price could soar, and the charts will follow.

Big Players Are Stacking Bitcoin — What It Means for Crypto Markets

While we wait for XRP’s moment, Bitcoin continues to be the heavyweight champion of the crypto world. Michael Saylor and his company Strategy have been on a relentless buying spree, snapping up nearly 5,000 BTC in recent purchases. That brings Strategy’s total Bitcoin holdings to a staggering 597,000 BTC, with an average cost basis around $70,000 per coin.

But Saylor isn’t the only one. Japan’s Meta Planet just bought another 1,000 BTC, shelling out over $100 million at an average price of about $107,000 per BTC. This is Japan’s version of the Saylor strategy — buying Bitcoin as a long-term store of value despite the high price tag.

Here’s the kicker — these companies are buying Bitcoin at prices that many retail investors would consider expensive. This shows they have conviction in BTC as a digital gold and inflation hedge. But it also means these companies are vulnerable to market shocks. If a big negative event hits and these companies don’t have enough cash on hand or are heavily indebted, they could be forced to liquidate their Bitcoin holdings, potentially triggering price dips.

So, as an investor, it’s crucial to watch the financial health of these big Bitcoin holders. Their buying patterns help set the market floor, but their forced selling could also amplify volatility.

Bitcoin Ownership is Becoming Highly Centralized

With Strategy holding nearly 600,000 BTC, Bitcoin ownership is consolidating among a few major players. This centralization has pros and cons:

- Pro: Large holders provide stability by absorbing market dips and supporting price floors.

- Con: Centralization makes the market more susceptible to large sell-offs if these holders face liquidity crises.

We’re in a new era where institutional players have outsized influence on BTC’s price action, and by extension, the entire crypto market.

Gold ETFs Roaring as Crypto Struggles: What’s Going On?

Now, let’s talk about gold. While Bitcoin and altcoins battle for investor attention, gold ETFs are seeing record inflows — the highest in two years and breaking a four-year streak of outflows.

This surge in gold ETF holdings is a major signal that the markets are nervous about risk right now. Investors are flocking to this “boring” safe haven to hedge against inflation, geopolitical tensions, and economic uncertainty.

Here’s what this means for crypto investors:

- Gold is absorbing capital that might otherwise flow into crypto, especially riskier altcoins.

- Bitcoin, often dubbed “digital gold,” remains relatively resilient but is still about 3% shy of its all-time high.

- The broader altcoin market, including utility and meme coins, is struggling to hold gains amid this risk-off sentiment.

In other words, as long as gold ETFs keep roaring, crypto’s roar will be muted. The market sees gold as a safer bet right now, and until that changes, expect crypto to face headwinds.

What Needs to Change for Crypto to Roar Again?

For crypto — especially XRP — to break out, we need risk to come down. That means:

- Interest rates must fall: Lower rates make borrowing cheaper and reduce the appeal of safe havens like gold.

- Geopolitical tensions need to ease: Less uncertainty means investors are more willing to take risks.

- Regulatory clarity must improve: Clear rules encourage institutional adoption and corporate buying.

Until these factors align, expect gold to keep gobbling up capital while crypto waits in the wings.

The Regulatory Landscape: Why XRP Needs More Than Just Court Decisions

One of the biggest roadblocks for XRP right now is regulatory uncertainty. Despite some optimistic rulings — like Judge Torres’ interpretation that gave XRP a boost — these are just interpretations, not binding law. Other judges, especially in California, have ruled differently, calling XRP a security.

This patchwork of conflicting opinions leaves companies hesitant to buy XRP as a strategic asset. Without clear, federal-level regulations, businesses don’t want to risk buying something that could later be deemed illegal or heavily restricted.

So, what would unlock XRP’s potential?

- The Clarity Act or similar legislation: A law that explicitly defines the status of XRP and other cryptocurrencies.

- Regulatory protections for buyers: Rules that give companies confidence to hold XRP without legal risk.

- Classification as a commodity: Similar to BTC, which would open the door for institutional and corporate buying.

Once these regulations are in place, we might see companies piling into XRP just like they do with Bitcoin today.

Why Executive Orders Aren’t Enough

Right now, the crypto space is operating mostly under executive orders and piecemeal court decisions. That’s a shaky foundation when you’re trying to build multi-billion-dollar corporate strategies around digital assets.

Clear, comprehensive regulations would allow XRP to move from a speculative altcoin to a strategic reserve asset, potentially driving its price well beyond $3.

What Else Needs to Happen for XRP to Hit $3?

Besides regulation, here’s a quick checklist of what needs to swing our way for XRP to reclaim that $3 price point:

- Jerome Powell cuts interest rates: Reducing rates lowers market risk and encourages investment in riskier assets like crypto.

- Gold ETFs cool off: Less appetite for gold means more money can flow into crypto markets.

- Geopolitical tensions ease: Stability in regions like the Middle East would reduce market uncertainty.

- Corporate adoption picks up: Firms start buying XRP as a reserve asset once regulations are clear.

- Market sentiment turns bullish: Investors regain confidence in crypto’s long-term value.

Anything less than this lineup means XRP’s price will likely remain under pressure.

Is It Likely? That’s Up To You

Look, I’m not going to sugarcoat it — this isn’t a guaranteed rocket ride. The market is complex, and many moving parts need to align. Do you think the government will get regulations finalized by late 2025? Will Jerome Powell ease monetary policy this year? Will geopolitical tensions calm down? If your answer is “yes,” then XRP at $3 is definitely on the table.

But if you think these conditions won’t happen soon, then patience is your best friend. The crypto market rewards those who understand the bigger picture, not just the charts.

What This Means for Crypto Investors and Traders

Whether you’re holding Bitcoin, XRP, or other altcoins, the current market environment demands a nuanced approach:

- Watch the big players: Keep an eye on companies like Strategy and Meta Planet. Their buying and selling patterns can signal market shifts.

- Monitor gold ETF flows: Gold’s performance is a leading indicator of risk appetite in the market.

- Stay updated on regulations: Regulatory news can cause rapid price movements, especially for XRP.

- Manage risk carefully: High interest rates and geopolitical tensions mean volatility will persist.

Remember, Bitcoin is still the “digital gold” of the crypto world, offering a relatively safer bet compared to other cryptos. XRP’s future depends heavily on regulatory clarity and risk sentiment shifting in its favor.

The Case of Stellar’s XLM: A Cautionary Tale

Before I sign off, a quick heads-up on XLM — Stellar’s native token. I recently did a deep dive on XLM that revealed some eye-opening stats and concerns. Like many altcoins, XLM has struggled recently, eroding value for reasons different than the typical market forces hitting other altcoins.

This is a reminder that not all cryptos are created equal. Some suffer due to fundamentals, others due to market sentiment or regulatory issues. Always do your homework before diving in.

Final Thoughts: XRP’s $3 Is Real — But It’s Not a Sure Thing

Let’s wrap this up with some real talk. XRP hitting $3 again is absolutely possible — I believe it can happen within this year or the next — but it won’t be easy. We need a cocktail of positive regulatory developments, rate cuts by Jerome Powell, easing geopolitical tensions, and a cooling off of gold’s dominance in the market.

Until then, big players like Strategy and Meta Planet will keep stacking Bitcoin, reinforcing BTC’s position as the market’s digital gold. Gold ETFs soaring is a sign that the market is still cautious, and risk appetite hasn’t fully returned.

In the meantime, keep your eyes on the regulatory landscape and macroeconomic signals. Those are the true drivers behind the scenes, not just the charts.

So, to all the pimps, players, and hustlers out there: stay sharp, stay informed, and don’t let the naysayers fool you. XRP’s $3 is real, but it’s a prize for those who understand the bigger game.

Remember, investing in Bitcoin, crypto, BTC, blockchain, and related assets is about playing the long game and knowing when to move. Stay tuned, stay savvy, and let’s see where this wild ride takes us.

Choo choo, bitches. I got you.

Bitcoin, Crypto, BTC, Blockchain, CryptoNews, Investing: Why XRP $3 Is Still Real and What It Takes to Get There. There are any Bitcoin, Crypto, BTC, Blockchain, CryptoNews, Investing: Why XRP $3 Is Still Real and What It Takes to Get There in here.