Welcome to an in-depth analysis of the current cryptocurrency market, where we dive deep into Bitcoin’s price patterns, alongside updates on Ethereum, Solana, XRP, and Chainlink. If you're an active participant in the crypto space or an investor looking to understand emerging trends, this comprehensive breakdown will equip you with valuable insights to navigate the market effectively.

Throughout this article, we will explore the critical price levels, technical indicators, and potential trading setups shaping the near-term and mid-term outlooks for these major cryptocurrencies. Our analysis reflects a balanced approach, acknowledging both bullish and bearish signals, and emphasizes the importance of understanding multiple timeframes for a clearer market perspective.

Bitcoin Price Analysis: Navigating Key Patterns and Liquidity Zones

Bitcoin, the flagship cryptocurrency, remains the primary focus for traders and investors, as its price action often sets the tone for the broader market. Currently, Bitcoin is retesting a vital support area on its price chart, while a new price pattern is emerging that demands attention. Notably, liquidity is accumulating above Bitcoin’s current price, which often signals potential price movement as the market tends to move towards areas of high liquidity.

Weekly Timeframe: Bull Market Indications Amidst Bearish Divergence

On the weekly Bitcoin price chart, the SuperTrend indicator remains green, signaling the continuation of a larger bull market. However, a closer look at momentum indicators reveals a more nuanced picture.

- The Bitcoin MACD (Moving Average Convergence Divergence) on the weekly timeframe shows a lack of bullish momentum.

- There is a major bearish divergence present: Bitcoin’s price is forming higher highs, but the Relative Strength Index (RSI) is making lower highs.

This divergence suggests underlying weakness in upward momentum on the longer-term chart, cautioning traders not to expect a strong bullish surge in the weeks ahead. Such divergences often precede periods of consolidation or even pullbacks, so vigilance is key.

Three-Day Chart: Momentum in Neutral Territory

Zooming into the three-day timeframe, Bitcoin’s momentum remains virtually neutral. The MACD indicator on this timeframe shows almost no directional momentum, reinforcing the expectation of sideways consolidation over the next few weeks.

This neutral momentum means that short-term price swings may appear volatile on smaller timeframes but ultimately translate to choppy, range-bound action when viewed from a higher perspective.

Daily Chart: Formation of a Potential Falling Wedge

On the daily chart, Bitcoin is trading within a well-defined sideways range, bounded by support near 103,000 and resistance between 110,000 and 112,000 (values are in USD). Additionally, support near 98,000 is expected to provide a safety net if prices dip lower.

Importantly, Bitcoin is currently forming what looks like a falling wedge pattern, which is typically a bullish reversal pattern. Yet, confirmation is essential before drawing conclusions:

- A confirmed breakout would require a daily candle close above the resistance line, roughly around 109,000.

- A breakdown below support, near 100,000 to 101,000, would negate the bullish setup.

Until such confirmation, traders should remain cautious and watch for decisive candle closes that indicate the next major directional move.

Short-Term View: Six-Hour Chart and the Inverse Head and Shoulders Pattern

On a shorter six-hour timeframe, Bitcoin has recently retested a prior resistance area, which is now beginning to act as short-term support. This flip from resistance to support is a bullish price structure development.

Key resistance zones to monitor include:

- 108,500 to 109,000

- 110,000 to 110,500

Support is expected between 106,000 to 107,000. If Bitcoin’s price falls below 106,000 with confirmed candle closes, it could signal a retest of lower support around 103,500 to 104,000.

Interestingly, a pullback to the 103,000–104,000 zone could be constructive, as it may form the right shoulder of a larger bullish inverse head and shoulders pattern. This pattern is highly regarded in technical analysis as a potential reversal signal from bearish to bullish trends.

For this setup to play out, Bitcoin must:

- Hold above the 103,000–104,000 support zone

- Form the right shoulder with a bounce from this area

- Confirm a breakout above the neckline resistance near 108,000 with strong daily candle closes

If all conditions are met, Bitcoin’s next target could be around 117,000, representing roughly an 8% upside move from the breakout point. For leveraged traders, such as those using 10x leverage, this could translate to an 80% profit opportunity, underscoring the significance of this pattern.

However, it’s crucial to recognize that between the breakout and the target, Bitcoin is likely to face resistance near 110,000 and 112,000, where price action may stall or pull back. Traders should consider scaling out profits near these levels to mitigate risk.

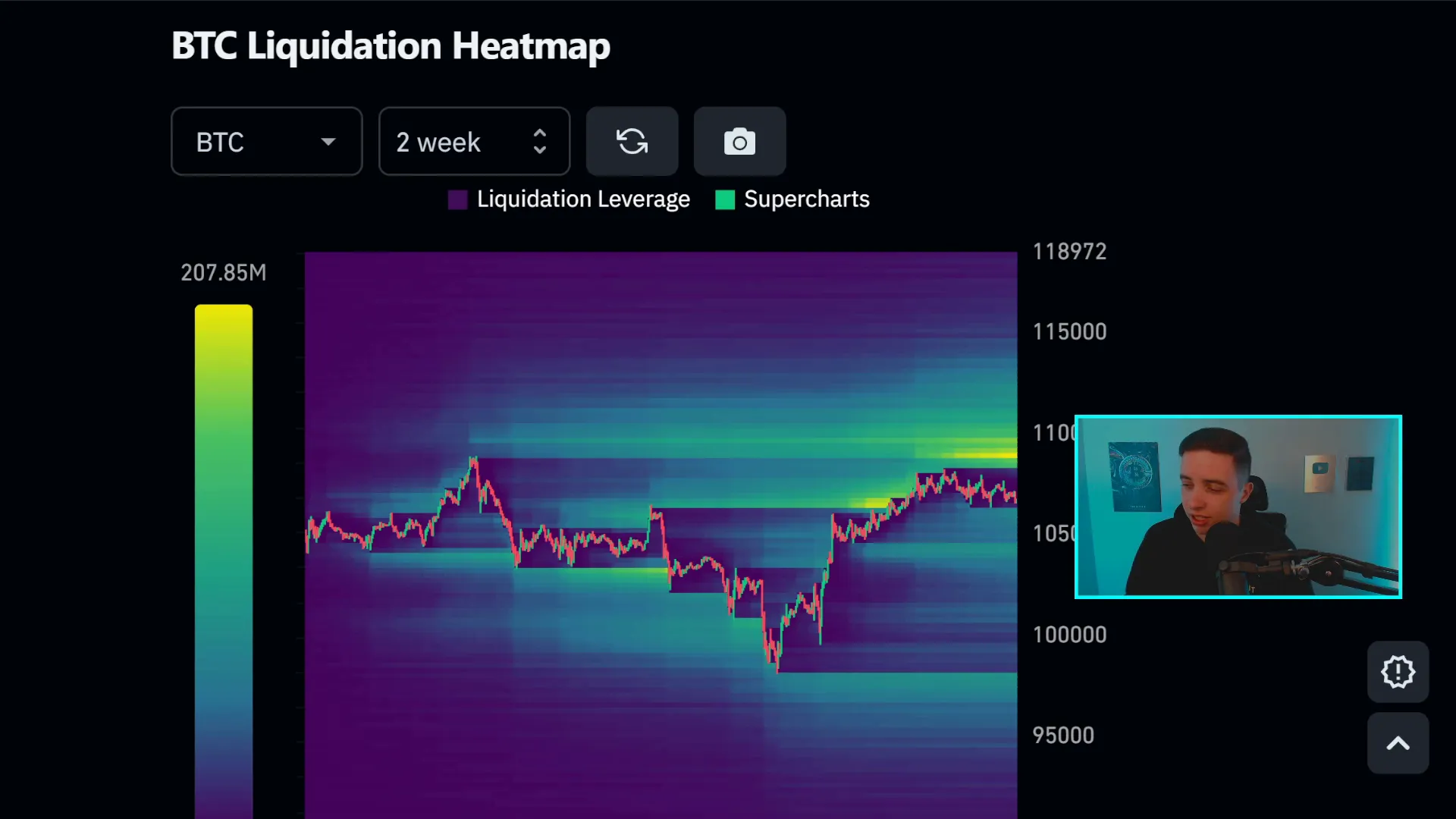

Liquidity Heat Map and Funding Rates: What Are They Telling Us?

The Bitcoin liquidation heat map shows a notable accumulation of liquidity above the current price, specifically between 109,000 and 110,000. This indicates that many stop orders and pending trades are clustered in this zone, making it a probable target area for price to move toward in the coming days.

While nothing is guaranteed in trading, markets often gravitate toward areas of high liquidity to trigger stop losses and position adjustments, which can fuel momentum.

Looking at crypto funding rates across exchanges, many remain below neutral, indicating that short positions dominate. However, over the past day, funding rates have inched slightly toward positive territory, reducing the likelihood of an imminent short squeeze.

Still, most funding rates remain just below zero, which is marginally bullish and suggests some underlying support for Bitcoin’s price in the near term.

Ethereum Price Update: Neutral Momentum Amidst Bearish Structure

Ethereum (ETH), the leading smart contract platform, is currently exhibiting neutral price action on the daily chart. Recently, ETH broke back into a sideways trading range, reclaiming a key support level near 2,400 USD, which had acted as resistance previously.

Despite this breakout, the broader price structure retains bearish characteristics, such as:

- Lower highs and lower lows on the daily timeframe, reflecting a downtrend

- A bearish divergence still influencing short-term momentum

These factors suggest that while short-term bullish moves may occur, the overall momentum remains subdued, and Ethereum is likely to continue consolidating or experiencing modest downward pressure in the near future.

Key support and resistance levels to watch include:

- Support: Around 2,400 and 2,100 USD

- Resistance: Between 2,700 and 2,800 USD, with additional resistance near 2,500 USD

With momentum currently lacking, sideways price action over the next few days is the most probable scenario.

Solana: Retesting Critical Resistance Zone

Solana (SOL) is retesting a crucial area on its price chart between approximately 143 and 146 USD. This zone has historically served as a pivotal support and resistance level, with multiple bounces and rejections observed over recent months.

Currently, Solana’s price is struggling to break above this resistance, and the larger daily trend remains bearish, characterized by lower highs and lower lows.

A confirmed breakout above 146 USD with a daily candle close and sustained support above this level would be a bullish signal, potentially paving the way for a rally toward next resistance levels around:

- 153 to 154 USD

- 158 USD

- 167 USD

On the downside, significant support lies between 124 and 126 USD, with additional support near 131 USD.

Until a breakout is confirmed, expect continued struggles in this range and monitor for the formation of a higher low, which would be an early sign of a potential trend reversal.

XRP: Continuing Bearish Trend with Key Levels to Watch

XRP remains entrenched in a bearish trend on the daily timeframe, marked by consistent lower highs and lower lows. Despite this, short-term bounces are visible, reflecting typical price behavior in downtrends where temporary rallies occur before further declines.

To confirm a bullish trend reversal, XRP needs to establish either:

- A higher low on the price chart

- A higher high or breakout above a critical resistance level

Currently, no such confirmation has occurred, and the bearish trend continues.

Key levels to monitor include:

- Support: Around 2.05 to 2.10 USD, a longstanding support zone

- If broken, major support near 1.92 to 1.95 USD

- Resistance: 2.19 to 2.20 USD, where recent rejections occurred

- Above that, short-term resistance near 2.25 USD and significant resistance between 2.30 to 2.35 USD

Given the current price structure, XRP traders should remain cautious and wait for clear signs of trend reversal before committing to bullish positions.

Chainlink: On the Cusp of a Potential Reversal

Chainlink (LINK) is currently battling key resistance on the 12-hour chart, still entrenched in a bearish trend with lower highs and lower lows.

However, there is a potential bullish setup on the horizon. If Chainlink manages to:

- Break above resistance between 1,360 and 1,380 USD

- Hold support above 1,260 to 1,280 USD

This could signal the formation of an inverse head and shoulders pattern, a classic bullish reversal formation. This pattern would mark a significant change in price structure, suggesting a shift from bearish to bullish momentum.

Should this breakout occur, expect further resistance around:

- 1,440 to 1,450 USD

- 1,530 to 1,550 USD

Until the breakout is confirmed, Chainlink remains in a bearish trend. Traders should keep a close eye on these levels and be ready to act when the pattern confirms.

Preparing for Trading Opportunities: Exchanges and Bonuses

With several cryptocurrencies showing signs of potential trend shifts or consolidation, the current market environment is ripe for trading opportunities. To capitalize on these moves, having an account on reliable crypto exchanges is essential.

Two recommended platforms for trading include:

- Bitfinex: No KYC required, accessible globally, with bonuses up to $45,000 and deposit bonuses (e.g., deposit $1,000 and get $200 bonus). Link to Bitfinex

- 2Bit: Also no KYC required, with bonuses up to $50,000, plus a $30 sign-up bonus and 20% deposit rebate up to 200 USDT. Link to 2Bit

Using these platforms and their exclusive bonuses can provide traders with additional capital and leverage to exploit market volatility effectively. Always ensure compliance with your local regulations before trading.

Summary of Key Levels and Patterns

- Bitcoin: Watching for confirmation of inverse head and shoulders pattern with breakout above 108,000 targeting 117,000 USD; support near 103,000 - 104,000 USD.

- Ethereum: Neutral to bearish momentum; support at 2,400 and 2,100 USD; resistance between 2,700 and 2,800 USD.

- Solana: Retesting resistance at 143-146 USD; breakout could lead to 167 USD; support at 124-126 USD.

- XRP: Still bearish; support at 2.05-2.10 USD and 1.92-1.95 USD; resistance at 2.19-2.20 USD and 2.30-2.35 USD.

- Chainlink: Potential inverse head and shoulders if breakout above 1,360-1,380 USD; support 1,260-1,280 USD; resistance at 1,440-1,450 and 1,530-1,550 USD.

Staying informed about these levels and patterns enables traders and investors to position themselves strategically for the next significant moves in the crypto markets.

Final Thoughts: Staying Ready and Informed in a Dynamic Market

The cryptocurrency market remains highly dynamic, with Bitcoin and major altcoins showing mixed signals across different timeframes. While larger timeframes hint at some weakness and sideways consolidation, shorter timeframes reveal emerging bullish patterns that could trigger meaningful moves.

Understanding the interplay between different timeframes, monitoring critical support and resistance zones, and recognizing price patterns like falling wedges and inverse head and shoulders can offer an edge in trading and investing decisions.

Liquidity zones and funding rates provide further context, suggesting where price action might gravitate in the near term. Combining these technical insights with sound risk management and access to reliable trading platforms positions traders well to navigate the evolving crypto landscape.

As always, remain patient, disciplined, and ready to act when confirmation signals emerge. The next big trading opportunity could be just around the corner.

For those eager to deepen their trading skills and learn how to profit from both bullish and bearish markets, educational resources and tutorials are invaluable. Leveraging long and short positions and strategies for sideways markets can help maximize profits regardless of market direction.

Keep watching the charts, stay informed, and trade smart!

Bitcoin, Crypto, BTC, Blockchain, CryptoNews, Investing: Decoding the Latest Market Moves and Key Price Patterns. There are any Bitcoin, Crypto, BTC, Blockchain, CryptoNews, Investing: Decoding the Latest Market Moves and Key Price Patterns in here.