Welcome to an in-depth look at the current state of the crypto market, brought to you by insights from Josh at Crypto World. If you’ve been watching the market lately, you’ve probably noticed Bitcoin’s recent bounce and the buzz around institutional buying, especially from big players like BlackRock. In this article, we’ll break down the latest Bitcoin news, analyze price action for Bitcoin and major altcoins like Ethereum, Solana, XRP, and Chainlink, and explore what these movements could mean for investors and traders alike.

Whether you’re a seasoned crypto investor or just diving into Bitcoin, Crypto, BTC, Blockchain, CryptoNews, and Investing, this comprehensive guide will provide you with valuable insights to help you stay ahead in the market.

Spotlight on Bitcoin: BlackRock’s Buying and What It Means

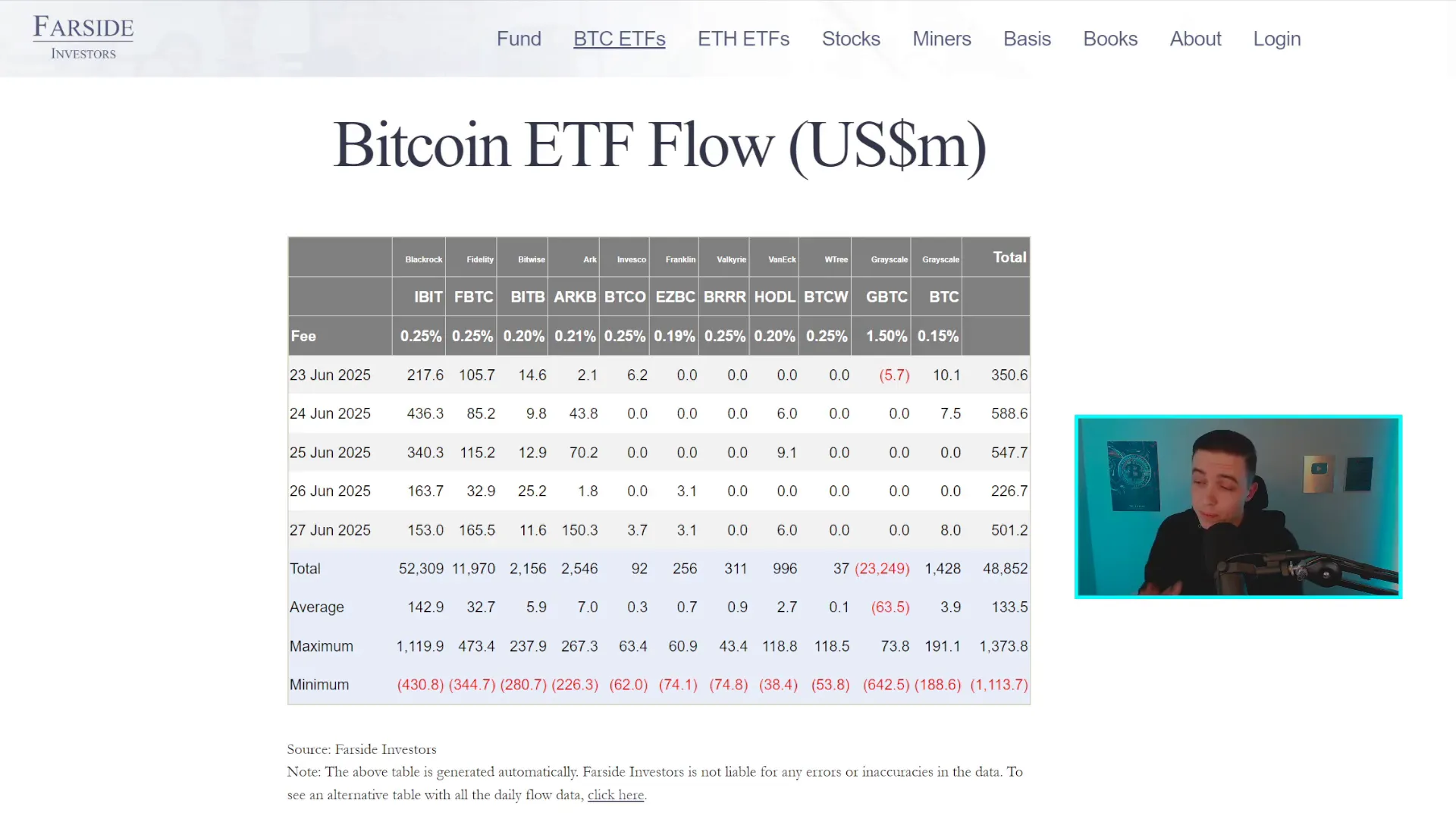

One of the most significant recent developments in the crypto space is the surge of inflows into spot Bitcoin ETFs, particularly on Friday, when over $500 million was added. This influx of capital is a strong signal that institutional investors, including giants like BlackRock, are actively buying Bitcoin. Let’s break down what this means and why it’s important.

Spot Bitcoin ETFs are investment funds that buy actual Bitcoin to back the shares they sell. Unlike futures-based ETFs, which track Bitcoin derivatives, spot ETFs hold the underlying asset. This means that every dollar flowing into these ETFs translates directly into Bitcoin purchases in the market, creating real buying pressure.

For example, when investors put money into BlackRock’s Bitcoin ETF, BlackRock itself must buy Bitcoin to back the shares. This fundamental mechanism is bullish for Bitcoin, especially in the short term, as it adds consistent demand.

This week has seen a steady stream of inflows into these ETFs, with notable daily inflow figures such as:

- Monday: $350 million

- Tuesday: $588 million (the best day this week)

- Wednesday: $547 million

- Thursday: $226 million (lowest but still above average)

- Friday: $501 million

These numbers highlight a strong buying appetite from Wall Street, which is crucial because institutional involvement often signals growing confidence in Bitcoin’s long-term prospects.

It’s also important to note that since ETFs trade on stock markets, they are closed on weekends, meaning no inflows or outflows occur during that time. This pause can sometimes lead to volatility once markets reopen.

Bitcoin Price Analysis: Neutral Momentum but Bullish Structure Emerging

Looking at Bitcoin’s price charts, the picture is mixed but slightly positive. On the weekly timeframe, the super trend indicator remains green, suggesting that the larger bull market is still intact. However, momentum is lacking, as shown by the weekly MACD indicator, which is neither showing strong bullish nor bearish momentum. This neutral stance means Bitcoin is currently consolidating rather than trending strongly.

There is a notable bearish divergence on the weekly chart, indicating that bullish momentum might be subdued for a while. This divergence is a technical signal that suggests caution, as it often precedes periods of sideways or downward price action.

Zooming into shorter timeframes like the three-day and six-hour charts, Bitcoin is trading sideways within a consolidation range. The price recently broke out above a key resistance level and has started to use that level as new support, which is a bullish price structure development. However, the lack of follow-through momentum means we may continue to see range-bound trading in the near term.

Key support and resistance levels to watch on the daily Bitcoin chart include:

- Support: $103,000 and strong support around $98,000

- Resistance: $110,000 to $112,000

There’s also a possible falling wedge pattern forming, which can be bullish if confirmed, but no breakout has been confirmed yet. The support line for this wedge sits between $100,000 and $101,000, while resistance is near $109,000.

On the six-hour chart, Bitcoin has retested the previous resistance zone, now flipped into support between $106,000 and $107,000. If Bitcoin breaks below this support, the next support zone lies between $103,500 and $104,000. Resistance remains strong between $108,500 and $109,000, and then again at $110,000 to $110,500.

Interestingly, a potential inverse head and shoulders pattern may form if Bitcoin pulls back below $106,000 and then bounces from around $104,000. This pattern is bullish and could lead to a breakout above the neckline near $108,000. However, if Bitcoin breaks above $108,000 without a pullback, this pattern won’t complete, though a breakout would still be bullish.

For traders interested in this pattern and its price targets, studying inverse head and shoulders patterns can provide a strategic edge. It’s worth keeping an eye on this setup over the next few days to weeks.

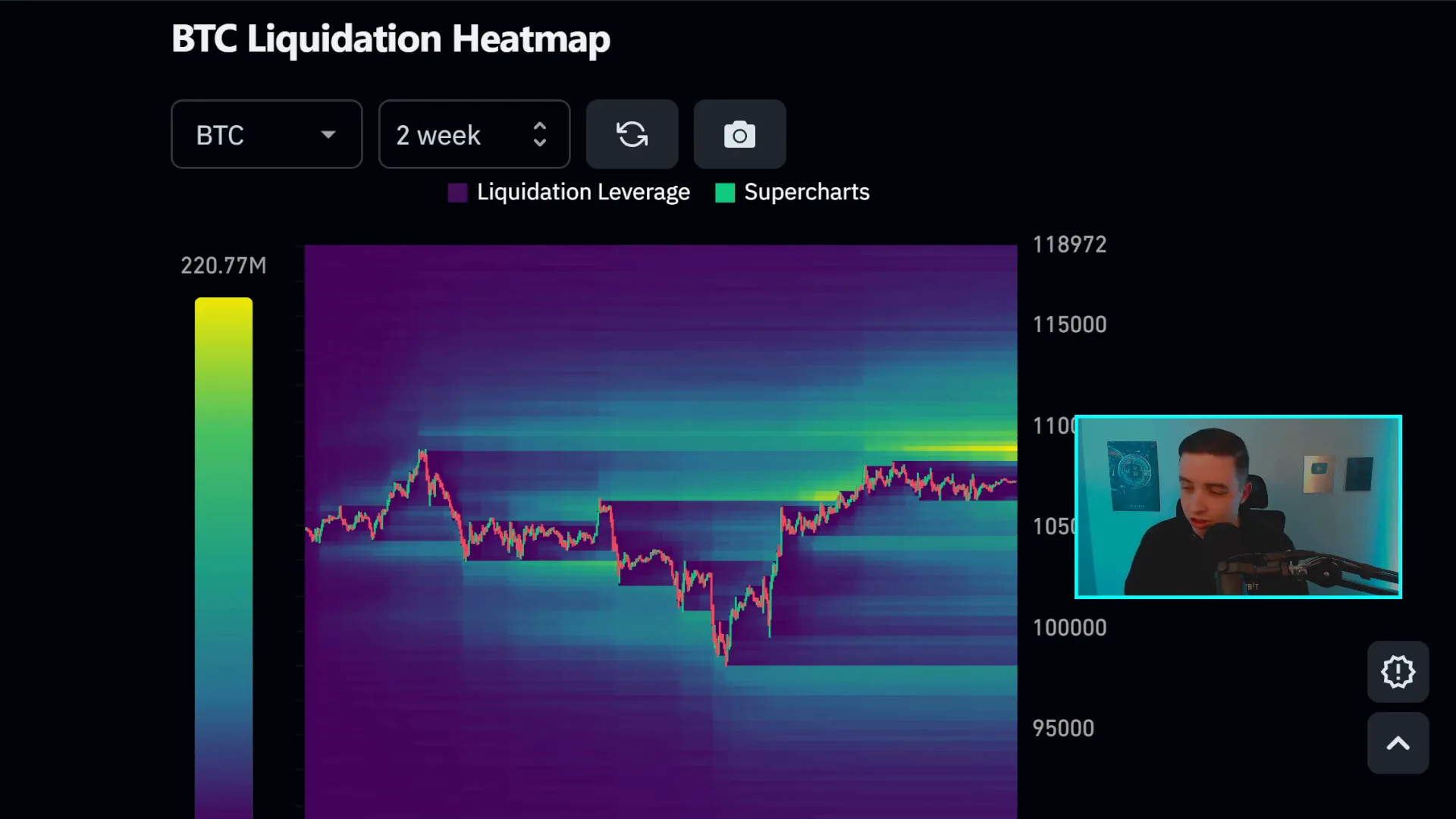

Liquidity and Price Targets: Why $109,000 Matters

Looking at the Bitcoin liquidation heat map, there is a significant cluster of liquidity around $109,000. In trading, liquidity zones are areas where many stop orders and limit orders are placed, attracting price action. Typically, Bitcoin moves toward liquidity pools, making $109,000 a critical short-term price target.

It’s important to remember that while price often gravitates toward liquidity, it’s not guaranteed. Occasionally, Bitcoin can move away from these zones, but most of the time, especially when liquidity is close to current prices, it acts as a magnet.

Despite these promising setups, the overall market remains neutral with a broader sideways trend likely to persist for weeks or even months. This means traders should expect a mix of short-term bullish and bearish moves within a range rather than a strong directional trend.

Getting Ready for Trading Opportunities

Given the current market conditions, it’s essential to be ready to act quickly when the next big trading opportunity arises. Setting up accounts on reliable crypto exchanges is a practical first step.

Personally, I use BTNEXT for many of my trades. It’s a no-KYC exchange, which means you can access it from most countries without lengthy verification processes. Plus, using my referral link, you can unlock bonuses of up to $45,000 just by trading crypto. Even smaller traders can benefit from deposit bonuses, like a $200 bonus on a $1,000 deposit.

If BTNEXT isn’t your preference, another excellent option is Toobit, also a no-KYC exchange. It offers up to $50,000 in trading bonuses. Smaller traders can enjoy a $30 sign-up bonus and a 20% deposit rebate, up to $200 USDT. Using my links below will ensure you get these bonuses.

Ethereum Price Analysis: Following Bitcoin’s Lead

Ethereum, the second-largest cryptocurrency, is showing similar price behavior to Bitcoin, which is typical given their correlated market movements.

Ethereum recently broke back above a key 50% Fibonacci retracement level around $2,380 to $2,390, which is now acting as support. However, like Bitcoin, Ethereum lacks strong bullish momentum and is mostly trading sideways.

Technically, a bearish divergence is still active on Ethereum’s daily chart, suggesting caution for bullish traders. The likely scenario is continued neutral price action with neither strong upward nor downward moves in the short term.

This neutral phase might feel boring, but it’s typical during periods of consolidation before the next significant trend develops. For investors and traders, patience is key while watching for momentum shifts.

Solana: Watching a Potential Breakout

Solana is currently testing a critical resistance zone between $143 and $146. This level has historically acted as both strong support and resistance, making it a crucial area to watch.

If Solana confirms a breakout with a daily candle close above $146-$147 and holds that level as new support, it could signal the start of a bullish trend. The next resistance targets would be:

- $153-$154

- $158

- $167

There’s also a possibility that Solana is forming a higher low, which would further support a bullish reversal if the breakout is confirmed. However, until the breakout is solidified, the current trend remains bearish with lower highs and lower lows.

For day traders and swing traders, this setup offers a potential opportunity for short-term gains if the breakout happens, but caution is warranted until confirmation.

XRP Price Action: Bouncing from Key Support

XRP is also in a critical phase, bouncing from a strong 50% retracement support level around $2.07. This level has held well over the past couple of days, providing a solid foundation for a potential rally.

Resistance lies in the $2.19 to $2.20 range, where XRP recently faced rejection. A daily candle close above $2.20 would be a bullish sign, potentially driving the price up to the next resistance levels at $2.24-$2.25 and then $2.30-$2.35.

Breaking above $2.35 would be especially bullish, likely leading to a move toward the highs near $2.60 or even higher.

However, given the broader market’s lack of momentum, XRP might continue to trade sideways with mild price fluctuations unless a strong breakout or breakdown occurs.

Chainlink: Consolidating but Eyeing a Possible Inverse Head and Shoulders

Chainlink is mirroring the sideways trend seen in many cryptos. It’s currently bouncing between support at $12.60-$12.80 and resistance at $13.60-$13.70 on the 12-hour chart.

There is a developing potential inverse head and shoulders pattern, a bullish reversal signal. To confirm this pattern, Chainlink needs to break and hold above $13.70 with strong candle closes on the 12-hour timeframe.

If confirmed, Chainlink could target resistance levels at $14.40-$14.50 and then $15.30-$15.50.

Despite this, Chainlink remains in a larger bearish trend characterized by lower highs and lower lows. The immediate outlook is neutral, with sideways movement expected in the short term until momentum shifts.

What This Means for Investors and Traders

The current crypto market environment is characterized by a lack of strong momentum and range-bound price action. While institutional buying, especially via spot Bitcoin ETFs, is a bullish fundamental factor, technical indicators suggest a period of consolidation across Bitcoin, Ethereum, and many altcoins.

For investors, this means the market might remain quiet and range-bound for weeks or months, requiring patience and careful risk management. For traders, this environment calls for strategies that profit from sideways movements and short-term breakouts rather than expecting sustained trends.

Being prepared with accounts on exchanges like BTNEXT and Toobit, which offer no-KYC access and generous bonuses, can position you well to capitalize on the next significant move in the market. Additionally, understanding technical patterns like inverse head and shoulders and liquidity zones can provide an edge in timing your trades.

Further Learning and Trading Strategies

To navigate this market effectively, it’s essential to understand how to trade in both trending and sideways markets. For those interested, there are valuable resources available that explain:

- How to profit from bullish or bearish price action using long and short positions.

- How to profit from choppy, sideways price action.

Mastering these strategies can help you adapt to the current market and maximize opportunities regardless of direction.

Stay informed, stay ready, and keep your trading toolkit sharp to make the most of Bitcoin, Crypto, BTC, Blockchain, CryptoNews, and Investing in this dynamic environment.

Bitcoin, Crypto, BTC, Blockchain, CryptoNews, Investing: What’s Happening Now?. There are any Bitcoin, Crypto, BTC, Blockchain, CryptoNews, Investing: What’s Happening Now? in here.