Hey there, crypto enthusiasts! It’s your friendly neighborhood analyst here to break down the latest buzz in the world of Bitcoin, Crypto, BTC, Blockchain, CryptoNews, and Investing. This weekend, the market is showing some sideways action with a mix of red and green, but what really stands out is the painfully low trading volume across many coins, especially XRP. We’re staring down a big deadline next week that could shake up the entire crypto landscape. Plus, there’s some fresh news about a strategic reserve purchase—but it’s not your usual suspects like BTC or XRP. Intrigued? Let’s dive deep into what’s happening, what to watch for, and how to make sense of the noise.

The Calm Before the Storm: Low Volume and Sideways Price Action

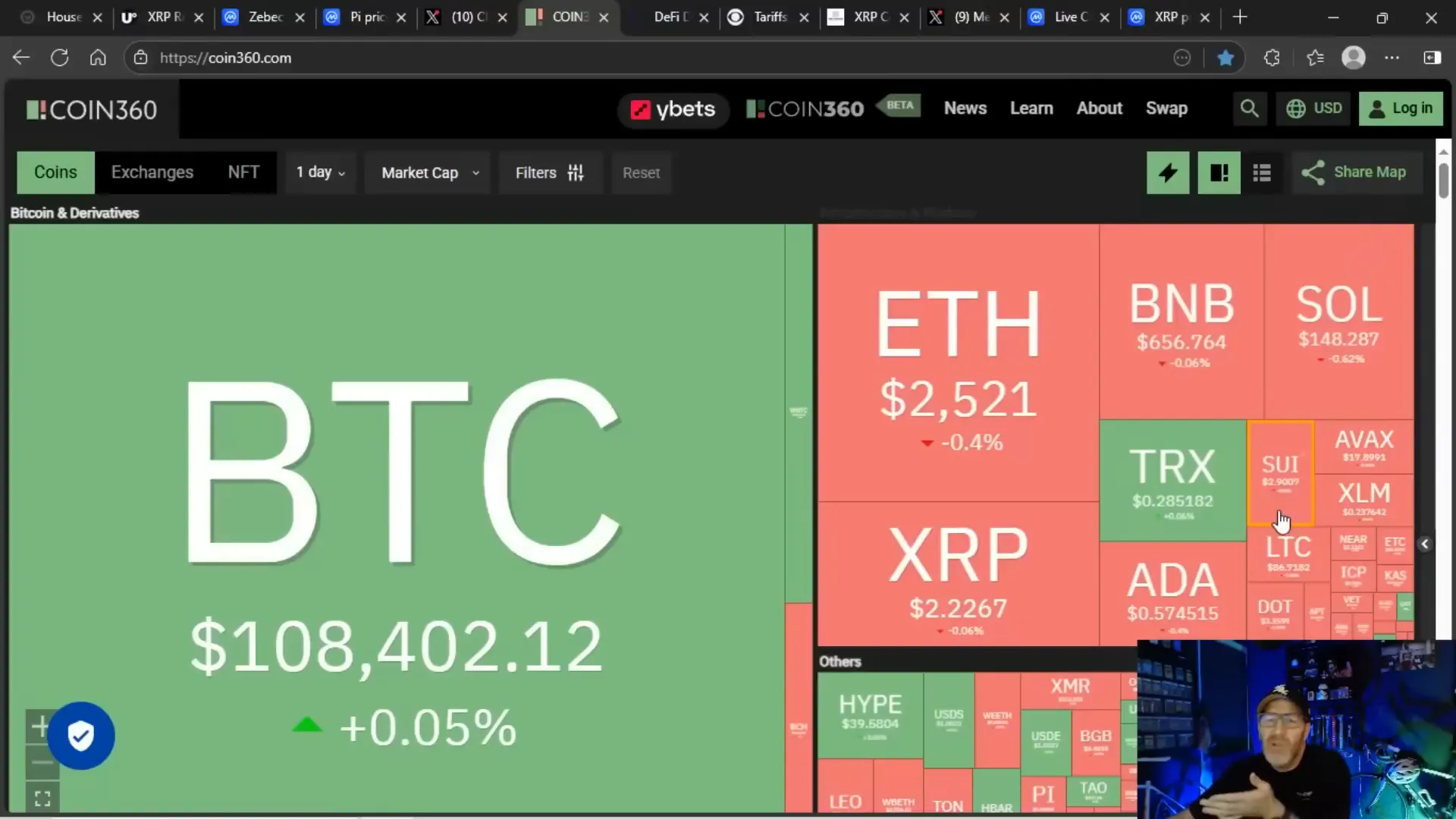

It’s Saturday, and if you’re checking your portfolio or watching the charts, you’ll notice the market is mostly sideways. That’s actually a good thing given the volume absolutely sucks right now. We’re talking about volume levels so low they remind me of pre-election days. To put it in perspective, XRP’s volume has dropped to around $1.5 billion, which is historically low.

Why does this matter? Because low volume often means fewer traders are active, and price movements can be sluggish or erratic. But if the market can hold key price levels through this quiet weekend, we could be setting up for something bigger once volume picks back up.

The big question is: can XRP and other cryptos maintain their footing in this friend-zone range? For XRP, that’s roughly between $2.10 and $2.30. Holding this range through the weekend is crucial because next week brings a deadline that could trigger volatility.

Why Low Volume Happens and What It Means

- Holiday weekends often see reduced trading activity as many traders step back.

- Uncertainty around upcoming economic data and regulatory decisions makes investors cautious.

- Low volume can lead to exaggerated price swings but also sets the stage for potential breakouts when activity resumes.

So, while the current quiet might feel frustrating, it’s a natural phase before markets start reacting to bigger catalysts.

Community Vibes and Motivation: Keeping the Crypto Spirit Alive

Before we get into the hardcore news, shoutout to the amazing community showing love and support. From Alaska to all corners of the globe, your comments and encouragement keep this channel alive. Whether it’s motivation to get back in shape or sharing holiday vibes, it’s clear this is a great time to be alive—even if celebrations feel a bit muted this year.

Speaking of muted celebrations, did you notice fewer fireworks this Fourth of July? It’s a question worth pondering: is inflation biting into discretionary spending? I sure felt it on my street, where the usual cacophony of fireworks was replaced by a more subdued atmosphere. Let me know your thoughts below!

Strategic Reserve Purchases: DeFi Development Corp’s Big Move Into Solana (SOL)

Now, onto some exciting news that’s flying a bit under the radar. We’ve talked about XRP, PTC, and ETH reserves before, but here’s a fresh player stepping into the spotlight: DeFi Development Corp (Nasdaq: DFTV), a publicly traded real estate tech company, has been quietly accumulating Solana (SOL) tokens.

Just recently, they acquired an additional 17,760 SOL tokens valued at around $2.7 million. This latest purchase pushes their total SOL holdings to approximately 640,000 tokens, bringing the total value of their crypto treasury to a whopping $98 million.

That’s right—nearly $100 million worth of SOL in the treasury of a real estate tech company. This is a significant strategic move that’s worth paying attention to, especially since it’s outside the usual BTC and ETH headlines.

Why This Matters for Crypto Investors

- It’s a sign that institutional players are diversifying their crypto reserves beyond Bitcoin and Ethereum.

- Solana’s growing ecosystem and fast transaction speeds continue to attract serious investment.

- Such large corporate purchases can signal confidence in the long-term potential of SOL and DeFi projects in general.

While it’s not XRP or BTC, this move adds a fresh angle to the crypto investing landscape, showing that strategic reserve building is alive and well with new players.

Market Alert: The Fall of Zebec (ZBCN) – A Classic Pump and Dump

On the flip side, not all crypto news is good news. Zebec (ZBCN) is currently falling apart after what looks like a textbook pump and dump scam. Their social media channels have been eerily quiet for the past couple of days, and the price is eroding fast.

Back on May 28th, I warned on Twitter that Zebec was likely headed for a nasty pump-and-dump. The red flags were obvious:

- Most followers were bots.

- The company’s partnership announcements were hollow at best.

- Promotion came from the same pump-and-dump YouTubers we've seen time and again.

Since May 28th, Zebec’s price plummeted from $0.64 to a mere $0.27—less than half of its previous value. This is a prime example of why due diligence is critical in crypto investing. Spotting these scams early can save you from major losses.

Lessons from Zebec’s Collapse

- Always verify the legitimacy of partnerships and project announcements.

- Be wary of sudden price pumps without solid fundamentals.

- Follow credible sources and avoid hype-driven influencers.

Remember: in crypto, if something looks too good to be true, it probably is.

Upcoming Economic and Regulatory Deadlines: What to Watch Next Week

One of the biggest market-moving events on the horizon is the expiration of the Trump-era tariff extensions on June 9th. This deadline carries significant weight for millions of US consumers and businesses, as economists warn of a barrage of import duties that could reignite inflation fears.

To recap, the Trump administration imposed a 90-day reprieve on certain tariffs announced on April 2nd, often referred to as the "Liberation Day tariffs." This reprieve ends on July 9th, and the market is anxiously awaiting whether these tariffs will be reinstated or extended further.

The stakes are high because these tariffs impact supply chains, consumer prices, and ultimately inflation—a key factor that influences Federal Reserve policies and, by extension, the crypto market.

Trade Agreements and Tariff Updates

- New trade agreements have been initiated with China, the UK, and Vietnam.

- Vietnam is particularly important as it was a top five country with trade discrepancies.

- Many other tariffs remain under wraps, but the administration has indicated that notifications to affected countries could come soon.

Jerome Powell and other Fed officials have already warned that tariffs can cause short-term inflation bumps, which could delay rate cuts or influence monetary policy decisions.

XRP Price Action: Friend-Zoned but Holding Strong

Alright, let’s talk XRP. The hype train has been chugging along with claims that XRP is “coiling like a spring” ready to explode. But here’s the real talk: it’s not coiling; it’s range-bound. Think of it as stuck in the friend zone, hanging out between $2.10 and $2.30, waiting for some economic thaw.

Players pushing the narrative of an imminent breakout are using classic FOMO tactics—words like “melting faces” and “grown men will cry” are thrown around to stir excitement and fear of missing out. But, let’s be honest, this is the same playbook used by big names like Michael Saylor to create urgency where none really exists.

Why the Range-Bound Pattern?

- We’re waiting on economic and regulatory clarity, especially with crypto week coming up mid-July.

- Rate cuts aren’t expected until September, so any major bullish catalyst is still months away.

- ETFs and other institutional products are also delayed until September or October.

So, while the FOMO crowd is yelling “get in now or miss out,” the reality is there’s plenty of time to position yourself wisely. The crypto market moves slow because Congress, the SEC, and Jerome Powell all move slow. Plus, global economic conditions remain challenging with persistent inflation and high costs.

The Crypto Market’s Current Pulse: Volume, Seasonality, and Inflows

Volume across the crypto market is sluggish. Total crypto volume hovers around $85 billion, which is low for this space. Altcoin season is measured at 25 out of 100, signaling that Bitcoin still dominates inflows.

For XRP specifically, the key for this weekend is survival within the friend zone range. If we can close the weekend between $2.15 and $2.20 with volume steady, that’s a green light for the upcoming weeks.

Why This Weekend Matters

- Holiday weekends typically mean quiet markets, so low volume is expected.

- Holding key support levels means traders are confident and not panicking.

- It sets the stage for more significant moves during Crypto Week and economic data releases.

Don’t fall for hype tweets claiming “supply shocks” or “you’ll never be able to buy XRP again.” These are scare tactics to manipulate emotions. There will always be buyers and sellers in the market, and opportunities to enter or exit positions.

Patience is a Virtue: Why Time is on Crypto’s Side

Let’s be real: crypto investing isn’t about rushing in to catch every wave. It’s about pacing yourself and understanding the bigger picture. Congress moves slow. Regulators move slow. The Fed moves slow. And economic conditions globally remain rough with inflation and high prices. All these factors put a natural drag on the crypto market’s ability to shoot the moon overnight.

Crypto Week, scheduled for mid-July, promises to shed light on regulatory developments and economic data that could set new market directions. This event is arguably more important than Shark Week for crypto investors, as it will clarify timelines, potential pain points, and opportunities.

Final Thoughts: Staying Grounded and Prepared

So, what’s the takeaway from all this? Here’s the bottom line:

- Volume is low, but that’s normal for a holiday weekend.

- XRP and other cryptos are range-bound but holding crucial levels.

- Watch next week for tariff deadline updates and the week after for CPI data and Crypto Week.

- Beware of pump and dump scams like Zebec. Do your research.

- Institutional interest in cryptos like Solana shows diversification beyond BTC and ETH.

- Don’t get caught up in FOMO hype; there’s always time to make smart moves.

As always, stay tuned, stay informed, and keep your fingers safe if you’re celebrating with fireworks like I did (my street’s a mess!). Let me know down below if you noticed a more muted holiday this year and what you think about the upcoming crypto catalysts.

Remember, Bitcoin, Crypto, BTC, Blockchain, CryptoNews, and Investing are all parts of a dynamic ecosystem. Keeping your cool and staying educated is your best bet to navigate the waves ahead.

Until next time, keep stacking those sats and making smart crypto moves!

Bitcoin, Crypto, BTC, Blockchain, CryptoNews, Investing: XRP Getting Ready to Explode or Crash?. There are any Bitcoin, Crypto, BTC, Blockchain, CryptoNews, Investing: XRP Getting Ready to Explode or Crash? in here.