Happy Friday to all the crypto enthusiasts out there! As we slide into the weekend, it’s time to catch up on the latest and greatest in the world of Bitcoin, Crypto, BTC, Blockchain, CryptoNews, and Investing. Whether you’re an XRP fan, rooting for HBAR, or keeping an eye on XLM, this deep dive has got you covered. We’ll break down fresh price action, highlight some eye-opening developments across the crypto space, and share insights that keep your portfolio sharp and your mind sharpener.

So, kick back, grab your favorite beverage, and let’s navigate through the twists and turns of this vibrant market. From Aptos’ on-chain milestones to hacking woes, and strategic BTC buys to volume battles, here’s what you need to know.

Market Vibes: The Weekend Crypto Mood

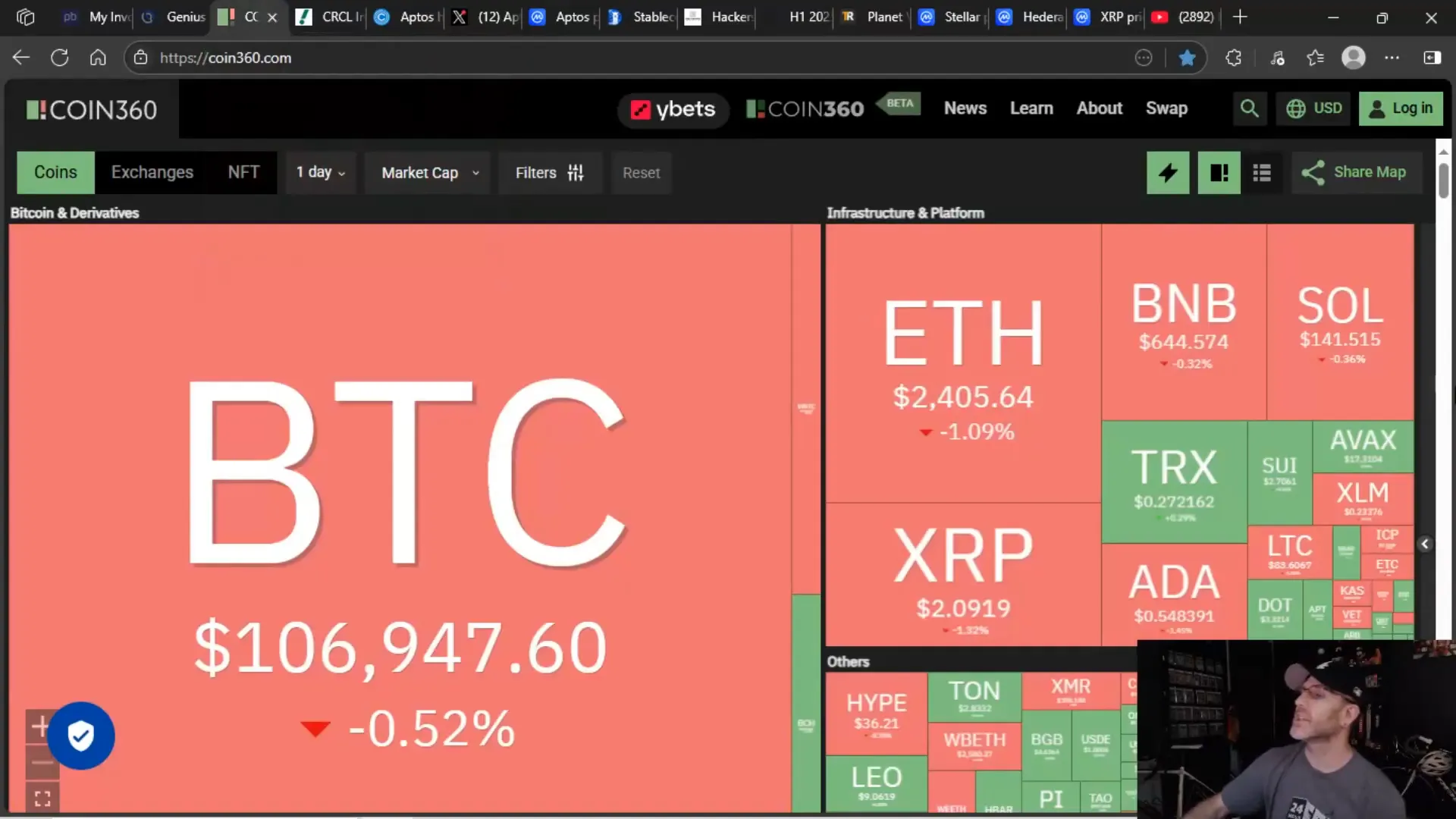

Right off the bat, the crypto market shows a mixed bag — a little red, a little green — as traders and investors gear up for the weekend. It’s the classic ebb and flow of crypto price action, where gains and losses battle it out in real-time.

Before we dive into specific coins, let’s acknowledge the community’s voice. Shoutout to Zibekian Savage for appreciating the info delivery and to Alan McMaster tuning in from Florida with some peaceful vibes. Even with bears spotted in the woods (literally!), the crypto hustle never sleeps.

Circle’s Price Rollercoaster: Profit Taking in Full Swing

Let’s talk Circle (USDC) — the stablecoin giant that’s been making waves. James Raider summed it up bluntly: Circle is “taking a dump right now” after a massive run-up. The numbers tell the story. The price peaked at nearly $29 on the 23rd, a jaw-dropping spike from its initial $24 underwriting price and $31 launch price.

But as we all know, what goes up often comes down — and fast. Circle’s price has now retraced to around $1.79, signaling profit-taking among traders. This kind of volatility is par for the course in crypto, where sudden surges invite quick sell-offs.

The big question: where will Circle settle? It’s a wild ride, but one thing’s for sure — the crypto market bros and gals are schooling traditional markets on how to pump and dump like pros.

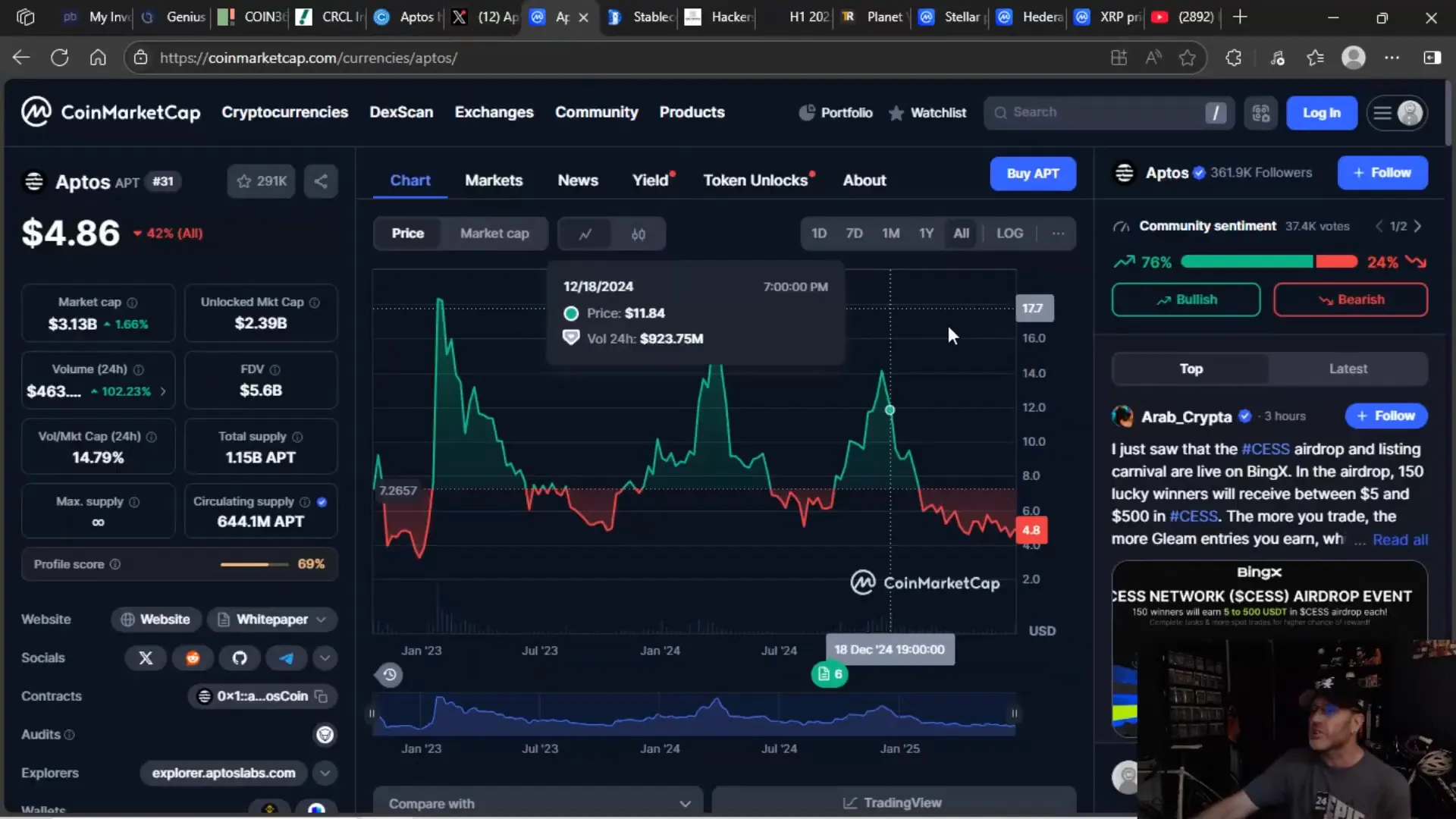

Aptos’ On-Chain Milestone: Half a Billion in Real World Assets

Now, onto Aptos, a layer one blockchain that just hit a major milestone — over $540 million in real world assets (RWA) now hosted on-chain. This achievement vaulted Aptos into the top three chains by RWA, marking a 57% spike in just 30 days.

Aptos’ official Twitter account celebrated this momentum, showcasing their growing ecosystem and the nonstop buzz around their tech.

But here’s the kicker: despite the on-chain success, Aptos’ token price is struggling. The charts tell a harsh truth: Aptos is flirting with some of its lowest price levels since its inception dump back in 2022. It’s a “pumperoni, dumperoni” saga — big hype, followed by sharp falls.

Even with $1.16 billion in stablecoins on-chain (69% of that is USDT), the token price isn’t reflecting the on-chain activity. It’s a reminder that real world asset integration and stablecoin presence don’t always translate to immediate price boosts.

Crypto Hacks: Over $2 Billion Stolen in H1 2025

On a darker note, the crypto space is battling a surge in hacks and exploits. In the first half of 2025 alone, over $2 billion was stolen — a figure that surpasses the totals from 2024, 2023, and even 2022.

This upward trend in security breaches is worrying. Starting the year with $1.6 billion lost in hacks sets a grim tone. It’s a stark reminder that while blockchain technology offers incredible possibilities, security remains a critical battleground.

For those who want to dive deeper, charts and detailed breakdowns of major hacks are available, highlighting lessons learned and areas needing attention.

Strategic BTC Acquisitions: Small Players Making Moves

Amidst the chaos, some positive signals emerge. Planet Ventures, for example, made its first strategic Bitcoin purchase, acquiring 3.4 BTC for half a million Canadian dollars. This is notable because it shows that even smaller players are embracing Bitcoin as a strategic asset.

The trend isn’t isolated. Across industries — from mining to healthcare — companies worldwide are entering the BTC space. Canadian, Norwegian, Japanese firms, and many more are diversifying their portfolios with Bitcoin.

For XRP, eight companies have pledged around a billion dollars in promised capital, poised to enter the market. While they haven’t started buying yet, the commitment signals growing institutional confidence and expansion.

Price Action Showdown: XRP, HBAR, and XLM

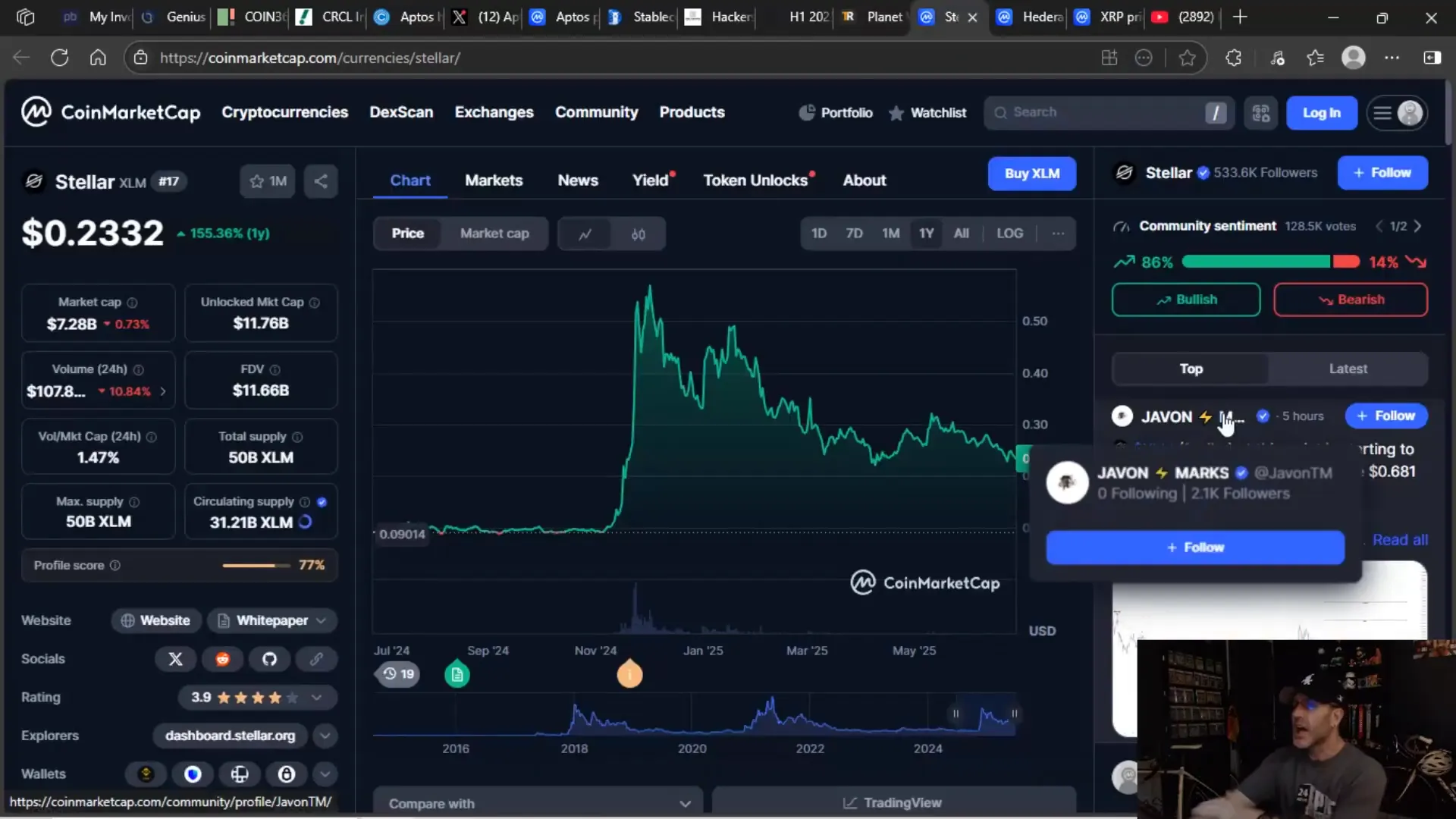

Let’s get to the heart of the matter — price action. The charts for Stellar (XLM), Hedera (HBAR), and Ripple (XRP) tell distinct stories over the past year.

Stellar (XLM)

XLM has had its moments, especially pre-November 2024 run-up. Long-term holders saw gains, but much of that momentum has faded. The chart reveals a pattern of “pamperoni, dumparoni” — spikes followed by declines — reminiscent of its laggard status in 2021 and 2022.

Interest in XLM seems to be waning, with volume drop-offs and less buzz in the community. It’s a classic case of a promising asset losing steam amid a crowded market.

Hedera (HBAR)

HBAR’s chart looks similar to XLM’s, showing a one-year trend of rising and falling peaks. Volume remains modest, hovering around $150 million in the last 24 hours. While there are still opportunities for savvy traders, downward pressure is evident.

HBAR is starting to slide into laggard territory, mirroring XLM's struggles. For holders, patience may be required as the market sorts itself out.

Ripple (XRP)

Now, XRP tells a different tale. The price action is much flatter, but that’s a sign of stability and strength. XRP has held its gains better than XLM and HBAR, benefiting from a strong retail following, ongoing litigation developments, and ETF excitement.

In the last 24 hours, XRP’s trading volume has been a staggering $2.8 billion — dwarfing XLM and HBAR. This liquidity and interest support the idea that XRP is carving out a new “$2” support level, which some traders now view as the new baseline, replacing the old $0.50 mark.

Volume Tells the Tale: XRP’s Dominance

Volume is often the heartbeat of crypto price action, and XRP’s numbers speak volumes. With $2.8 billion traded in the last day, XRP is clearly commanding the spotlight.

In contrast, XLM and HBAR volumes are much smaller — $107 million and $150 million respectively — signaling less market interest and liquidity.

This disparity reflects not just price but also community engagement, retail enthusiasm, and institutional interest. XRP’s ongoing legal battles and potential ETF approvals keep it relevant and in the news cycle — a critical factor in sustaining volume and price support.

Why On-Chain Activity Doesn’t Always Equal Price

The Aptos example is a cautionary tale. Despite boasting over half a billion in real world assets on-chain and a massive stablecoin presence, Aptos’ price languishes near historical lows.

This disconnect highlights a fundamental truth in crypto investing: tokenization and on-chain metrics don’t automatically translate into price appreciation. Market sentiment, liquidity, community support, and macro factors often play bigger roles.

Similarly, Stellar’s large stablecoin holdings haven’t prevented waning interest or price stagnation. Meanwhile, XRP’s strong social and retail presence, combined with news momentum, supports its more stable price action.

The Power of Social and News Momentum

Social media and news coverage matter — a lot. For every Aptos video or article, there are multiple XRP stories flooding the crypto news ecosystem. This coverage drives trader attention, volume, and ultimately price.

When Ripple’s CEO Brad Garlinghouse speaks, the community listens — and views spike. When Aptos’ leaders tweet, the response is more muted. This dynamic shows how narrative and engagement fuel crypto markets.

In short, price isn’t just about numbers on a chart. It’s about relevance, visibility, and community energy — all of which XRP currently commands in spades.

Looking Ahead: What to Watch This Weekend

- Circle’s next move: Will it find a new stable floor or continue its downward correction?

- Aptos’ price trajectory: Can on-chain growth eventually spark a price revival?

- Security risks: How will the crypto industry respond to the rising wave of hacks?

- BTC strategic buys: Will more companies follow Planet Ventures’ lead?

- XRP’s resilience: Can XRP maintain its new $2 support amid ongoing legal and ETF developments?

It’s an exciting time in Bitcoin, Crypto, BTC, Blockchain, CryptoNews, and Investing — with lessons to learn and opportunities to seize. Stay sharp, stay informed, and as always, keep your eyes on the charts and your ears to the ground.

Remember, the crypto market is as much about psychology as it is about technology. Understanding the interplay of price, volume, social buzz, and real-world adoption will give you the edge you need to navigate these volatile waters.

So, whether you’re holding XRP, watching HBAR, speculating on XLM, or keeping tabs on Aptos and Circle, the weekend’s crypto news keeps the game fresh and the stakes high.

Happy trading, investing, and blockchain exploring. See you on the next update!

Bitcoin, Crypto, BTC, Blockchain, CryptoNews, Investing: Friday’s Hot Takes on XRP, HBAR, XLM, and More. There are any Bitcoin, Crypto, BTC, Blockchain, CryptoNews, Investing: Friday’s Hot Takes on XRP, HBAR, XLM, and More in here.