Hey crypto fam, buckle up! We’re diving deep into some of the most exciting developments in the world of Bitcoin, crypto, and blockchain investing right now. This isn’t your usual run-of-the-mill hype — we’re talking real, concrete changes that could shape the future of the crypto landscape. From major regulatory moves in Congress, fresh crypto tax bill proposals, to price action insights on XRP, HBAR, and BTC pushing toward new highs, this update is packed with everything you need to know to stay ahead.

So grab your coffee, maybe a snack (I’ll share some Chicago food love later), and let’s break down the latest crypto news, investing insights, and blockchain updates that are buzzing right now.

Welcome to Crypto Week: Congress Gets Serious About Regulations

First off, mark your calendars for the week of July 14th — it’s officially Crypto Week in the House of Representatives. Move over Shark Week, because this is where the real action’s happening for Bitcoin, crypto, and blockchain regulations.

House Republicans, led by French Hill, are rolling out three major pieces of legislation aimed at clearing the fog around digital assets. Here’s the lineup:

- The Clarity Act – Aiming to bring much-needed clarity to crypto regulations.

- The Anti-CBDC Surveillance State Act – Targeting concerns around central bank digital currencies and privacy.

- The Genius Act – Focused on stablecoin regulations.

This is huge because it’s not just talk — these bills are set to be pushed through the House Financial Services subcommittee, which is Republican-dominated, meaning the chances of them getting voted on and moving to the House floor are strong.

Why should you care? Because if these bills pass cleanly, they’ll head straight to the president’s desk. If there are tweaks or modifications, they’ll bounce back to the Senate for approval. This process will give us a clear picture of the regulatory landscape ahead for all crypto players, from Bitcoin to altcoins like XRP and HBAR.

What’s at Stake with These Bills?

The Genius Act already passed the Senate, so it’s on track. Stablecoins, while easier to regulate compared to the broader crypto market, still face challenges — think Tether controversies and issues with various “Trump meme coins” and other altcoins. The Clarity Act’s fate is less certain. It’s expected to be packaged carefully, possibly including tax provisions that didn’t make it into the “Big Beautiful Bill” (BBB) earlier.

It’s important to remember that the SEC remains cautious, denying ETF applications for most altcoins except Bitcoin and Ethereum-based products. This regulatory hesitation highlights the ongoing struggle between traditional finance and crypto innovation.

Stand-Alone Crypto Tax Bill: A Ray of Hope or Just Another Pipe Dream?

Now, let’s talk taxes — the bane of every investor’s existence. Senator Cynthia Lummis has drafted a stand-alone crypto tax bill that proposes some very interesting exemptions:

- An exemption for capital gains taxes on crypto trades under $300.

- An annual cap of $5,000 on tax-exempt crypto trading gains.

This means if you’re trading or using less than $5,000 worth of crypto annually, you could potentially avoid paying taxes on those gains. For casual traders or those just dipping their toes into the crypto waters, this is a breath of fresh air.

However, there’s a catch. Stand-alone bills rarely get passed on their own. They usually need to hitch a ride on larger legislative packages — which can be thousands of pages long and packed with unrelated provisions. Plus, Senator Lummis is a Bitcoin maximalist, which might limit bipartisan support, especially since some Republicans opposed the BBB.

Still, it’s a step in the right direction. The bill promises to cut through bureaucratic red tape and establish “common sense rules” that reflect how digital technologies actually function, rather than sticking to outdated tax policies that could stifle American innovation. Fingers crossed it gains traction!

Grayscale’s GDLC Fund and XRP: The Unexpected Shake-Up

Grayscale’s Digital Large Cap Fund (GDLC) has been a hot topic lately, especially since about 4.6% of the fund is XRP. The SEC initially approved this first-of-its-kind spot fund but then suddenly pulled back, creating a lot of uncertainty.

This back-and-forth highlights how dynamic and evolving the regulatory environment is — and why investors need to stay sharp. Grayscale’s attempt to push forward despite the SEC’s hesitation signals a potential game changer in how digital assets like XRP are treated in the US.

For XRP holders, this is juicy news. The fund’s status impacts liquidity, price action, and the broader legitimacy of XRP as an asset class. Stay tuned, because the regulatory tide could turn fast with the bills on the table during Crypto Week.

Price Action: Bitcoin Nears All-Time Highs and Altcoins Show Strength

Let’s get to the numbers — because at the end of the day, investing is about the price action and market movements.

Bitcoin (BTC) is creeping closer to its all-time highs, bringing optimism back to the market. This bullish momentum is supported by strong inflows into BTC, signaling continued investor confidence.

HBAR: From Dips to Gains

HBAR has been quietly making moves, bouncing from the 12-cent range up to 16 cents recently. If you managed to snag some HBAR at those lower levels, congrats — you’re sitting on some juicy profits.

This price action suggests that HBAR is developing a solid floor, much like XRP’s story. While dips below 14 or 13 cents still happen, the token tends to bounce back quickly, creating a potential target zone for traders and investors alike.

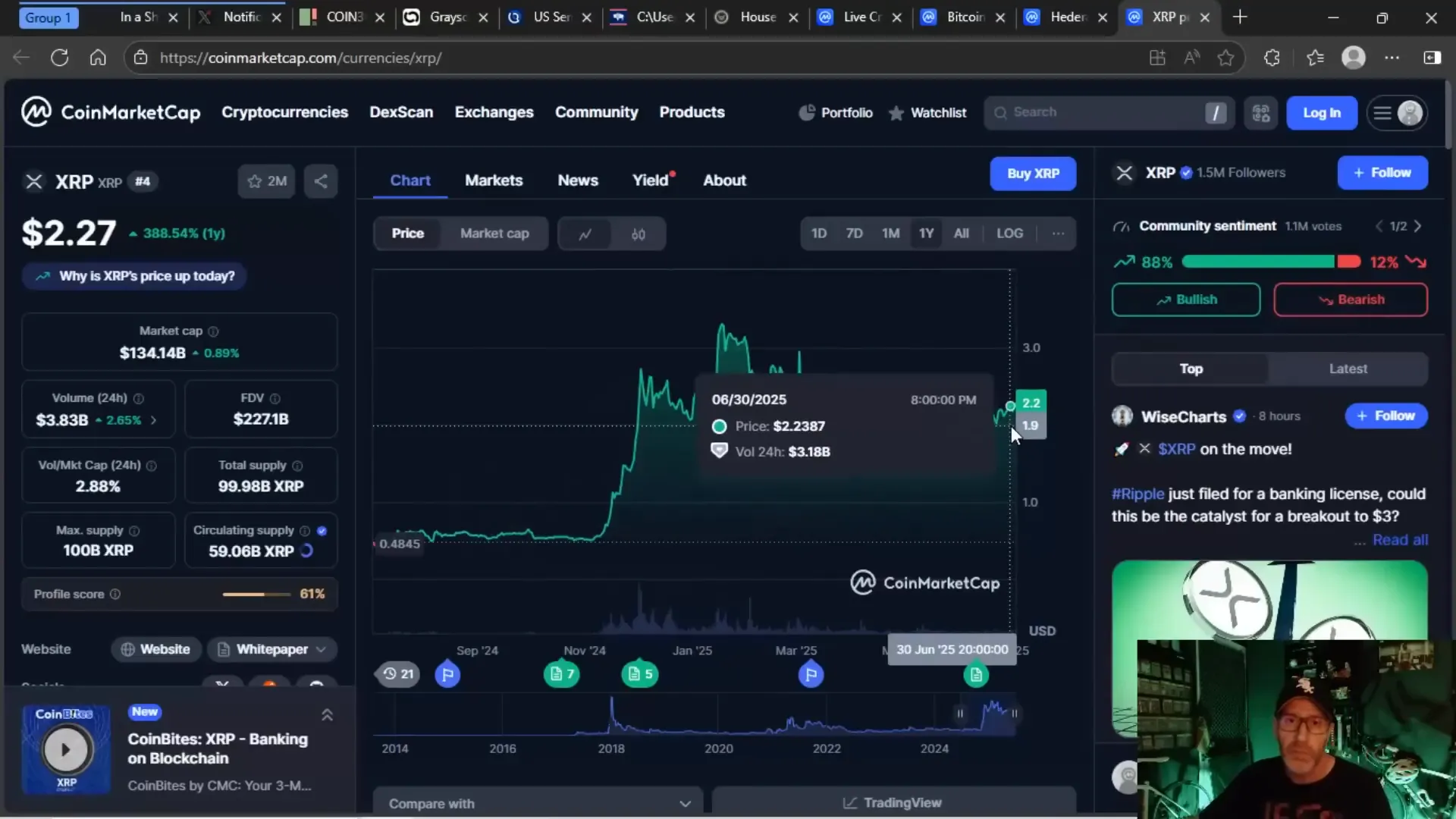

XRP: Holding the Line Despite Challenges

XRP has been struggling to break the $2.30 resistance level, but it’s still showing strength compared to where it was in the 30 to 50 cent range pre-election. The current “friend zone” for XRP is between $2.10 and $2.30 — a huge improvement from before.

Volume remains solid, with around $3.8 billion in trading activity. While the upcoming July 4th holiday might cool down the market volume temporarily, holding steady through low volume periods is a positive sign.

Despite the lack of regulatory clarity, ETF approvals, and promised strategic reserve asset status, XRP is maintaining critical support levels, which is bullish for the token’s long-term outlook.

What to Expect From Crypto Week and the Road Ahead

Crypto Week will provide us with a much clearer picture of what Congress thinks about digital assets. We’ll get insight into pain points, regulatory timeframes, and whether the government is serious about making the US a leader in blockchain innovation.

Here’s what to watch for:

- Regulatory clarity: Will the Clarity Act and related bills pass as-is or get bogged down in amendments?

- Tax policy changes: Will Senator Lummis’s crypto tax bill find a home in a larger legislative package?

- Market reaction: How will BTC, XRP, HBAR, and other alts respond to regulatory news and potential ETF approvals?

- Macro environment: Jerome Powell’s anticipated rate cuts around September and how that will influence crypto investing and venture capital flows.

End-of-year budget considerations and tightening venture capital purse strings might affect development funding, so keep an eye on how these external factors interplay with crypto regulations and market dynamics.

On a Lighter Note: Chicago’s Portillo’s and Crypto Culture

Before we wrap up, a quick shoutout to the Chicago area — home to the legendary Portillo’s. If you’ve never been, do yourself a favor and try their combo with peppers, fries dipped in cheese sauce, and a beef sandwich dipped in au jus. It’s an experience that makes any crypto trader’s day better.

Big thanks to my buddy Frankie D for reminding me of the magic that is Portillo’s. It’s a taste of home that keeps me grounded, even while navigating the wild world of Bitcoin, crypto, and blockchain investing.

Why This Matters for Bitcoin, Crypto, and Blockchain Investors

We’re at a pivotal moment. The regulatory landscape is shifting, and the market is responding. Whether you’re a Bitcoin maximalist, an XRP advocate, or an HBAR fan, the decisions made during Crypto Week will affect your investing strategy and portfolio.

Stay informed, stay patient, and watch how these legislative moves unfold. Remember, the crypto space thrives on innovation and resilience — and with support from lawmakers who get it, we could be on the cusp of a new era for digital assets.

Keep your eyes peeled, and as always, I’ll keep bringing you the latest updates, real talk, and a little bit of humor to go with your Bitcoin, crypto, BTC, blockchain, and investing journey.

Choo choo! Let’s ride this train to the moon — and maybe grab some nachos on the way.

Bitcoin, Crypto, BTC, Blockchain, CryptoNews, Investing: The Mega Crypto Week Update You Can’t Miss. There are any Bitcoin, Crypto, BTC, Blockchain, CryptoNews, Investing: The Mega Crypto Week Update You Can’t Miss in here.