Hey crypto fam, buckle up because we’ve got some massive breaking news that could shape the future of Bitcoin, Crypto, BTC, Blockchain, and the entire crypto market this week! If you’re following the crypto space closely, you know how volatile and fast-moving it can be. But this week, it’s not just about watching charts or waiting for Jerome Powell’s next move on interest rates. No, this week, we might actually see voting happen on major crypto legislation that could redefine the market’s trajectory.

In this deep dive, we’ll cover everything you need to know about the latest Consumer Price Index (CPI) data, what Jerome Powell and the Fed’s stance means for interest rates, and most importantly, the highly anticipated congressional voting on key crypto bills. We’ll also analyze XRP price movements and what they tell us about market sentiment heading into this pivotal week. So get ready, because this article is packed with insights, stats, and some spicy commentary to keep you informed and ahead of the game.

The Hot CPI Data: What It Means for Crypto and Interest Rates

First things first — let’s talk about the latest CPI data because it’s a huge factor in how the Federal Reserve will handle interest rates, which in turn impacts Bitcoin, crypto, and the broader financial markets.

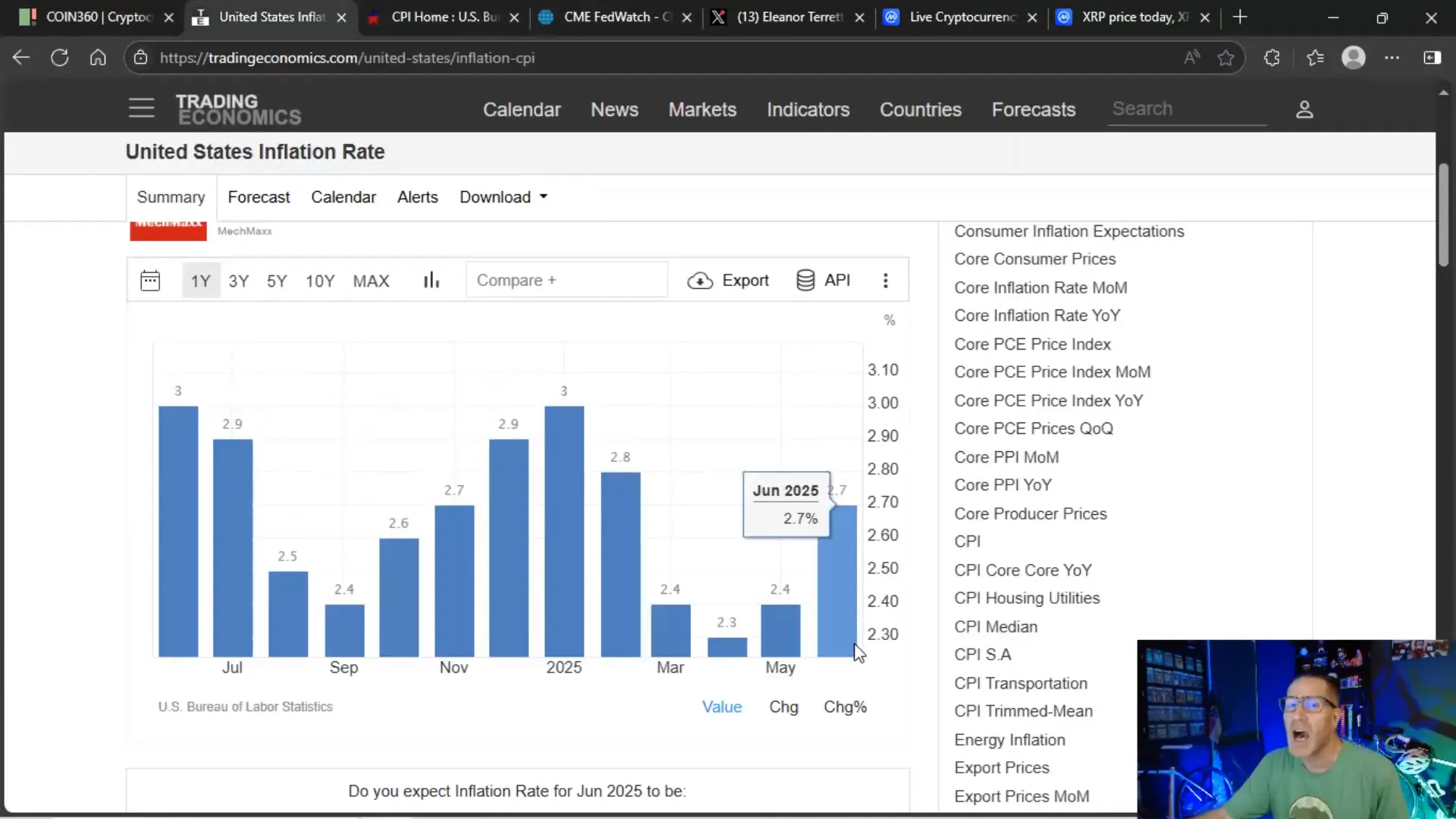

According to the recent report, the Consumer Price Index (CPI) came in hotter than expected at 2.7% year-over-year. Analysts were predicting around 2.5% to 2.6%, so this uptick signals inflation is still creeping upward. If you look at the trend starting from April, inflation has been on the rise through May and June, confirming that the economy isn’t cooling off as much as some hoped.

Why does this matter? Jerome Powell, the Fed Chair, has been very clear: he wants to see the data before deciding on any rate cuts. He also warned that tariffs might cause a short-term bump in inflation. Well, that bump is here, and it’s not the kind you want — it’s a “bad pumperoni,” as I like to say.

What this means practically is that the Fed is very likely to pause on rate cuts at the upcoming July 30th FOMC meeting. The probability of a pause is a whopping 97.4%. That pause opens the door for the first potential rate cut to happen in September, with a 62% chance of that occurring.

Breaking down the CPI components, we see some troubling signs:

- Shelter costs rose by 0.2%

- Energy index increased by 0.9%

- Food prices increased by 0.3%, with food from home rising 1.4%

These increases hit consumers hard, and that’s a concern because it can stifle retail spending, which is a major driver for crypto adoption and trading volume. We saw this effect over the weekend when retail activity slowed down noticeably.

Bottom line: Jerome Powell won’t be cutting rates this month, and there will be no emergency meetings to change that. So if you’re hearing rumors of rate cuts in July, ignore them. The Fed is playing the long game, and inflation data is the key.

Crypto Week Voting: The Moment We’ve Been Waiting For

Now, let’s get to the juicy part — the crypto legislation voting happening this week. This is a game changer.

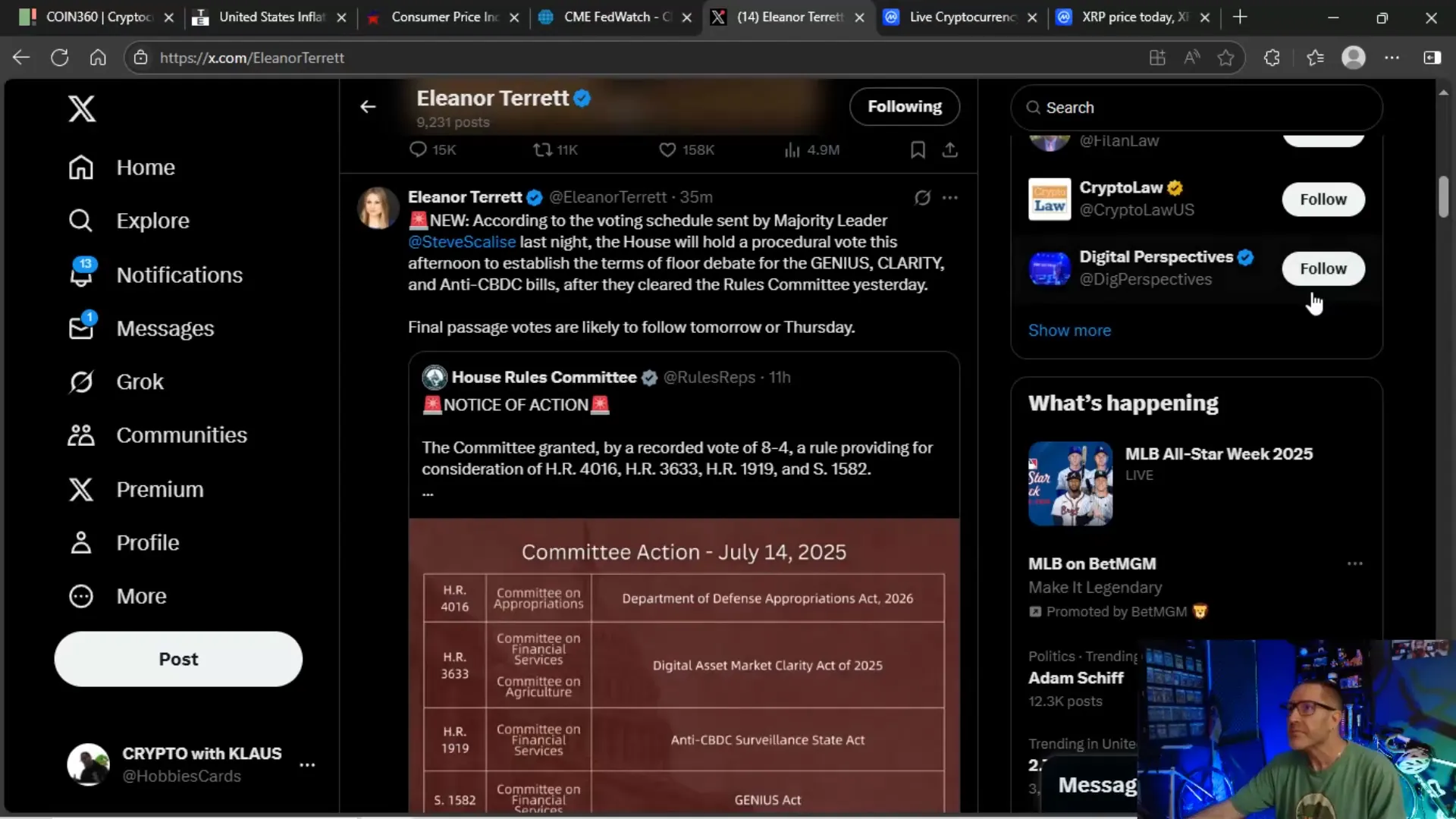

According to insider Eleanor Tourette, the House Majority Leader Steven Sleece sent out a voting schedule that includes a procedural vote this afternoon to establish the terms for floor debate on three major bills:

- The Genius Stablecoin Act — focused on stablecoin regulation

- The Clarity Act — designed to provide regulatory clarity for the entire crypto market

- The Anti-CBDC Surveillance Act — aimed at curbing central bank digital currency (CBDC) surveillance concerns

These bills cleared the rules committee yesterday, and the final passage votes are expected as early as Wednesday or Thursday this week. This isn’t just talk anymore — it’s real action on the floor of Congress.

What’s the market expecting? The Genius Act, which regulates stablecoins, is widely seen as the most likely to pass. It’s the “meh” bill that everyone expects to clear without much resistance.

The Clarity Act and the Anti-CBDC Surveillance Act, however, face a tougher road. These bills are more comprehensive and controversial, and they will see heavy debate. But they’re also the ones that could unlock massive growth for the crypto space by providing the regulatory certainty companies and investors desperately need.

Why is this so important? Because without clear regulations, companies are hesitant to buy altcoins or hold crypto assets as strategic reserves. Right now, we mostly have executive orders protecting crypto, and those can be undone by any new administration. Regulations, on the other hand, are law — they provide long-term security and predictability.

The Role of Crypto Super PACs and Funding in the Midterms

Eleanor also dropped some spicy news about crypto’s biggest super PAC, Fair Shake, which played a crucial role in getting crypto-friendly votes in the past. As midterms approach, Fair Shake and its affiliates are gearing up with a massive war chest of $141 million in cash on hand.

Here’s the breakdown:

- $25 million received from Coinbase

- $52 million raised in the first half of 2025

- $109 million raised since the last election day

This kind of funding is critical because it influences both Democrats and Republicans to support crypto legislation. Politicians see the money and the votes, and that can sway their decisions in favor of pro-crypto bills.

So, the voting this week is not just about the bills themselves — it’s about the future of crypto investing, regulations, and how much capital will flow into Bitcoin, Crypto, BTC, and altcoins in the coming months.

Crypto Market Overview: Volume, Altcoins, and ETF Inflows

Despite the inflation data being hotter than expected, the crypto market is holding up well. Trading volume remains robust at around $246 billion — that’s nearly a quarter of a trillion dollars moving through exchanges daily.

Exchanges are cashing in, and volume like this shows strong market participation. The altcoin season index reads 32 out of 100, meaning BTC is moving, but altcoins are gaining momentum too. This is a healthy sign for diversification and market depth.

ETF inflows continue as well, signaling that institutional investors are still bullish on crypto’s long-term prospects. This is crucial because ETFs bring more mainstream capital, which can stabilize and grow the market.

XRP Price Action: Eyes on the $3 Mark

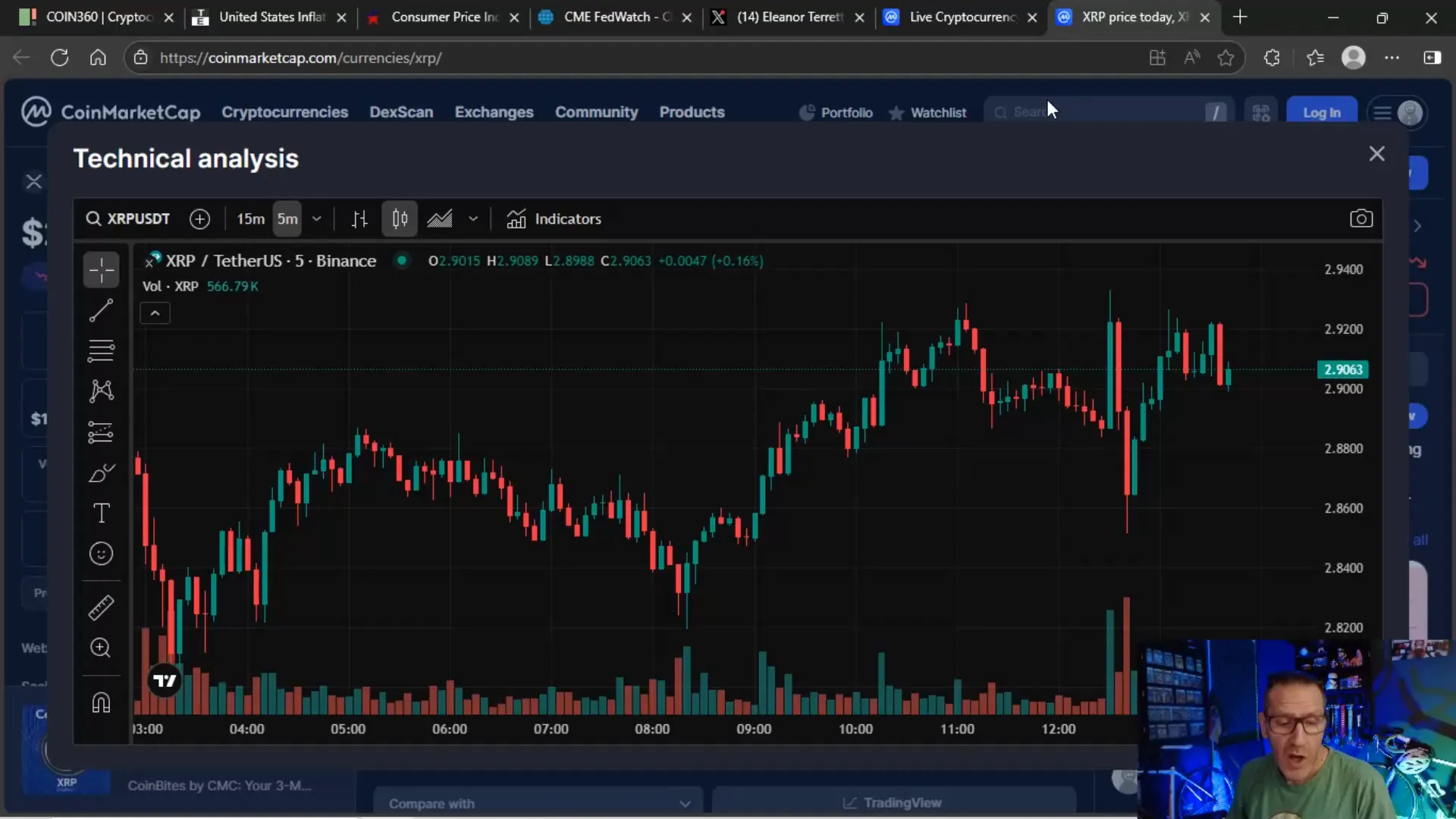

Now, let’s talk XRP. This week’s voting could be make-or-break for XRP price.

If the bills pass cleanly — especially the Genius Act and Clarity Act — we could see XRP break through the $3 mark and hold it as a new floor. That would be a huge bullish signal and could ignite a fresh rally not just for XRP but for the entire crypto market.

But if the votes stumble or the bills don’t pass, expect downward pressure. The recent price move has been largely driven by optimism around regulation. Without that, the market could sell off hard, and XRP might slip below current levels, maybe back to $2.20 or lower.

Why is regulation so pivotal for XRP? Because it’s about clarity. Clear regulations allow more money to flow into crypto, including from companies that want to hold XRP and other altcoins as part of their strategic reserves. It also sets a framework for tax treatment and compliance, removing uncertainty for investors and institutions.

Plus, with rate cuts possibly coming later this year and continued ETF inflows, the regulatory environment could be the catalyst that turns this market from sideways to a full-blown bull run.

Why This Week Is a Turning Point for Crypto Investors

Here’s the bottom line: The market has already priced in a Fed pause due to the hot CPI data. Jerome Powell’s stance is widely expected, so it’s not moving the needle much anymore.

What’s really moving the needle is the potential for crypto legislation voting this week. The market’s green lights are flashing because if the Genius Act and Clarity Act pass, it means:

- More regulatory clarity

- Increased institutional investment

- Stronger market confidence

- Potential for rate cuts and ETF growth later this year

All of this sets up a juicy environment for Bitcoin, Crypto, BTC, Blockchain projects, and altcoins like XRP.

But, let’s keep it real — if the bills don’t pass, or if the debates drag on without resolution, expect some red on your screens. The market hates uncertainty, and without regulatory clarity, crypto investing remains risky.

Stay Alert and Follow the Votes

This is a fluid and fast-moving situation. The votes could happen as soon as Wednesday or Thursday, and the debates are happening right now. If you want to stay ahead, keep your eyes on the news, follow credible sources, and stay subscribed to channels that deliver real-time updates.

The key takeaway? Follow the regulations, because they’re the best indicator of where XRP and the broader crypto market are headed.

Keeping the Momentum Alive

So here’s what you should do next:

- Keep an eye on the House proceedings this week and watch for voting updates.

- Monitor XRP price action around the $3 mark — this is a critical threshold.

- Watch the Fed and Jerome Powell’s announcements, but remember the market is already pricing in a pause.

- Stay informed about ETF inflows and institutional interest, as they will sustain momentum beyond this week.

- Be ready for volatility — either way, the next few days will be wild.

If you’re a crypto investor, trader, or enthusiast, this week could be one of the most important in 2025. It’s about more than just price moves — it’s about whether the US government finally gives crypto the regulatory framework it deserves, which could unlock trillions in value and adoption.

Remember, Bitcoin, Crypto, BTC, Blockchain, CryptoNews, and Investing are all intertwined. The regulatory environment shapes the future of all these elements. So stay sharp, stay green, and let’s ride this wave together.

Choo choo, baby. The crypto train is rolling, and you don’t want to miss it.

Bitcoin, Crypto, BTC, Blockchain, CryptoNews, Investing: What to Expect From Crypto Week Voting, CPI Data, and XRP Price Action. There are any Bitcoin, Crypto, BTC, Blockchain, CryptoNews, Investing: What to Expect From Crypto Week Voting, CPI Data, and XRP Price Action in here.