If you’ve been watching the crypto markets lately, you’ve probably noticed something: the buzz from Crypto Week seems to be fading. Prices are softening, and traders are wondering if this was a classic "buy the rumor, sell the news" situation. In this deep dive, we’ll unpack everything from XRP’s recent price action to Ripple’s bold moves in the European Union, a chaotic token launch, and even some spicy political drama involving the Epstein files and crypto legislation. Buckle up—this week has been anything but boring.

Market Moves: Is Crypto Week a “Buy the Rumor, Sell the News” Event?

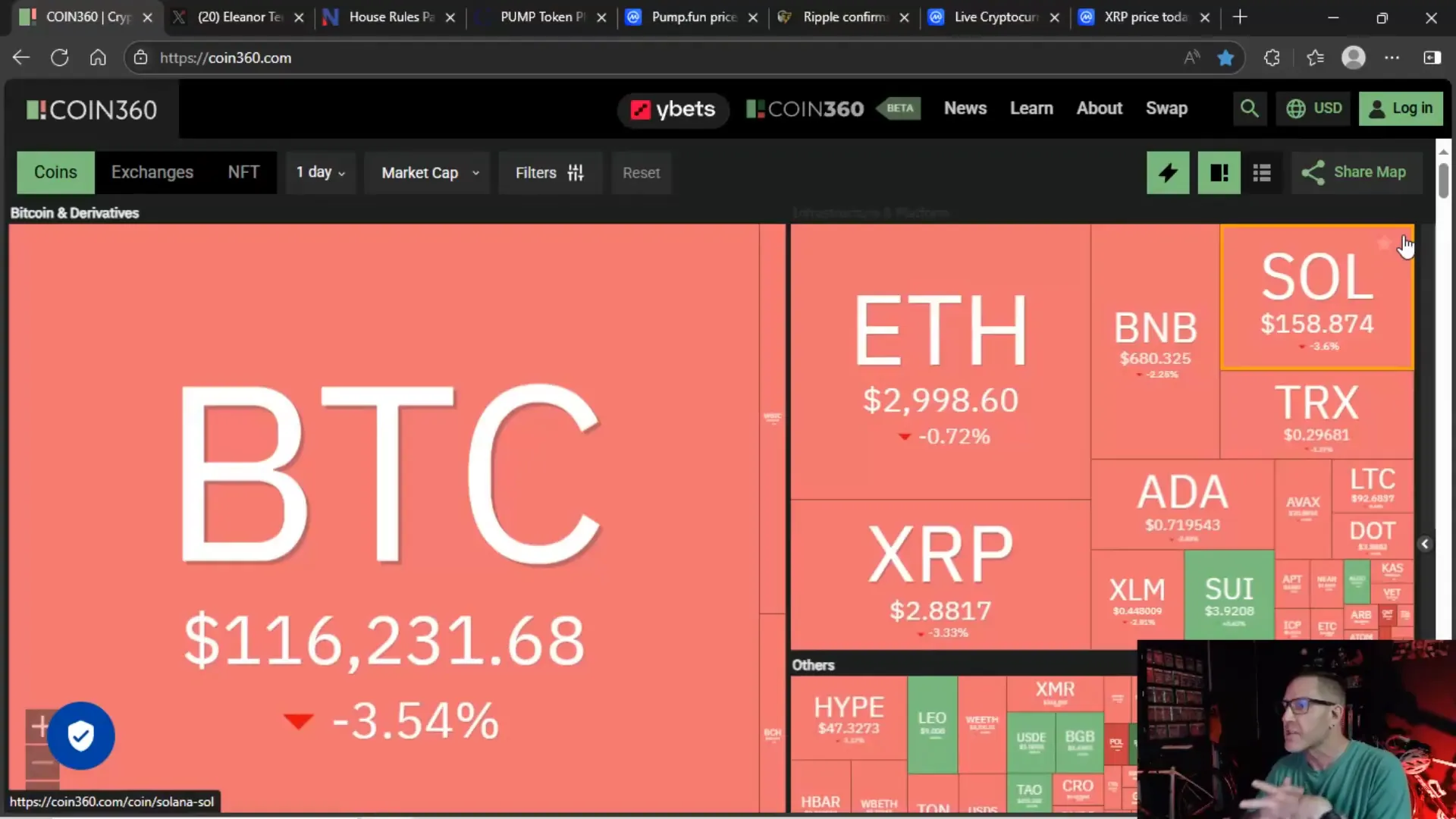

Let’s start with the big question on everyone’s mind: was Crypto Week a classic "buy the rumor, sell the news" event? The market showed a strong pump as the rumor of regulatory clarity and positive crypto legislation circulated. Bitcoin hit all-time highs, altcoins rallied, and excitement was tangible. But as the news started to roll in and the legislative votes approached, the market began to soften.

Bitcoin (BTC) hovered around $60,000 to $62,000 during the hype but has since pulled back to about $60,000, and Ethereum (ETH) slipped below $3,000 to around $2,880. XRP, one of the key altcoins we’re watching, hit highs near $3 but couldn’t hold that level and is now struggling to maintain support near $2.80.

Volume has declined by roughly 31%, dropping from highs near $250 billion to about $194 billion—a sign that traders are taking profits and stepping back to see how the legislative dust settles.

Many viewers and crypto enthusiasts predicted this pullback. Dillon Crypto, for example, expected a "massive sell-off" after the initial pump, with hopes to catch XRP again near $2.20. Others shared skepticism about government intervention and the potential for disappointment, reminding us that regulatory outcomes can often fall short of expectations.

Political Drama: The Epstein Files and Crypto Legislation Collide

Here’s where things get really interesting—and a little wild. During the crypto regulatory debates, the House Rules Committee was faced with an unexpected amendment: a push to make the Epstein files public as part of the crypto bill. This amendment was introduced by Democrats who wanted transparency about the victims and the powerful figures allegedly involved in Epstein’s trafficking network.

The vote was razor-thin—six Republicans voted against the amendment, effectively blocking it, while four Democrats and one Republican (Ralph Norman of South Carolina) supported it. The rationale from the opposition was straightforward: this amendment had nothing to do with crypto, so it shouldn’t be part of the bill.

Roe Conn, a Democrat from California, was vocal about the need for transparency, framing the vote as a choice between standing with the "rich and powerful" or with the people. The debate exposed the intersection of politics, social justice, and crypto legislation, adding a layer of complexity to an already tense regulatory environment.

Pump Token Chaos: Sold Out in 12 Minutes, Then a Crash

On the token launch front, the Pump token presale was an event that caught many eyes. It sold out in just 12 minutes, showing the hunger for new projects and tokens in the market. But the rollout was far from smooth. Technical glitches on major exchanges—most notably Kraken—prevented some users from completing their presale orders or accessing their airdropped tokens.

Kraken’s co-CEO publicly acknowledged these issues and promised to airdrop tokens to affected users, even purchasing tokens at a secondary market premium to compensate them. Despite these efforts, the token’s price has since slid, dropping over 24% in the past 24 hours after a chaotic launch weekend.

This is a textbook example of the risks and volatility in new token launches—fast sellouts can create hype, but technical failures and user frustration can quickly turn that excitement sour.

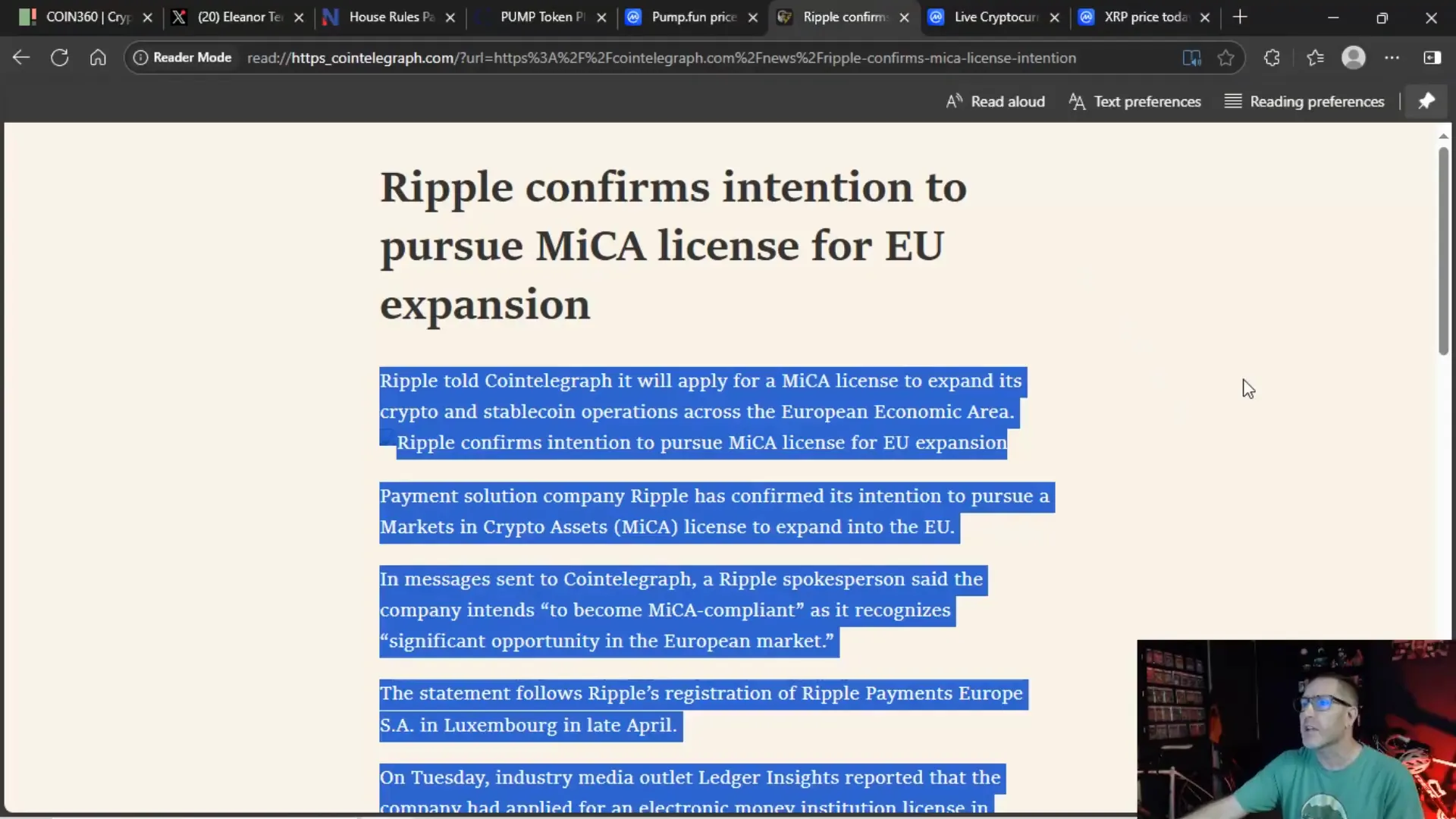

Ripple’s Ambitious EU Expansion: Pursuing MICA Compliance

Meanwhile, Ripple isn’t sitting still. The company has confirmed its intention to pursue a MICA (Markets in Crypto-Assets) license as part of its strategy to expand crypto and stablecoin operations across the European Union. This move is significant because MICA compliance is becoming the gold standard for crypto regulation in the EU.

Ripple’s plans include applying for an electronic money institution license in Luxembourg, a financial hub in Europe. This will enable Ripple to operate RLUSD (Ripple’s stablecoin) and other payment solutions within the EU’s massive market.

The EU market is a huge opportunity, and Ripple’s proactive approach to compliance shows its commitment to long-term growth rather than short-term hype. While the U.S. remains the largest market, the EU’s regulatory clarity and economic size make it an essential arena for crypto companies looking to scale globally.

Current Crypto Market Landscape: Softness and Volatility

The broader market is showing signs of softness, not just in price but also in trading volume. After the mega gains and euphoric rallies, a healthy pullback is underway. This is a natural part of market cycles, especially in the crypto space, which is known for its volatility.

Looking at the last 90 days, most major cryptocurrencies have been deep in the green, but recent days are showing more red than green. This pullback is especially noticeable in XRP, which has been a rollercoaster—going from below $2 just weeks ago to nearly $3, and now hovering around $2.80.

The catalyst for this recent dip appears to be a mix of hotter-than-expected CPI data and uncertainty around the crypto bills expected to be voted on in the House of Representatives. If the bills pass, the market could stabilize or even rally again. If not, or if they get delayed, we could see a deeper correction.

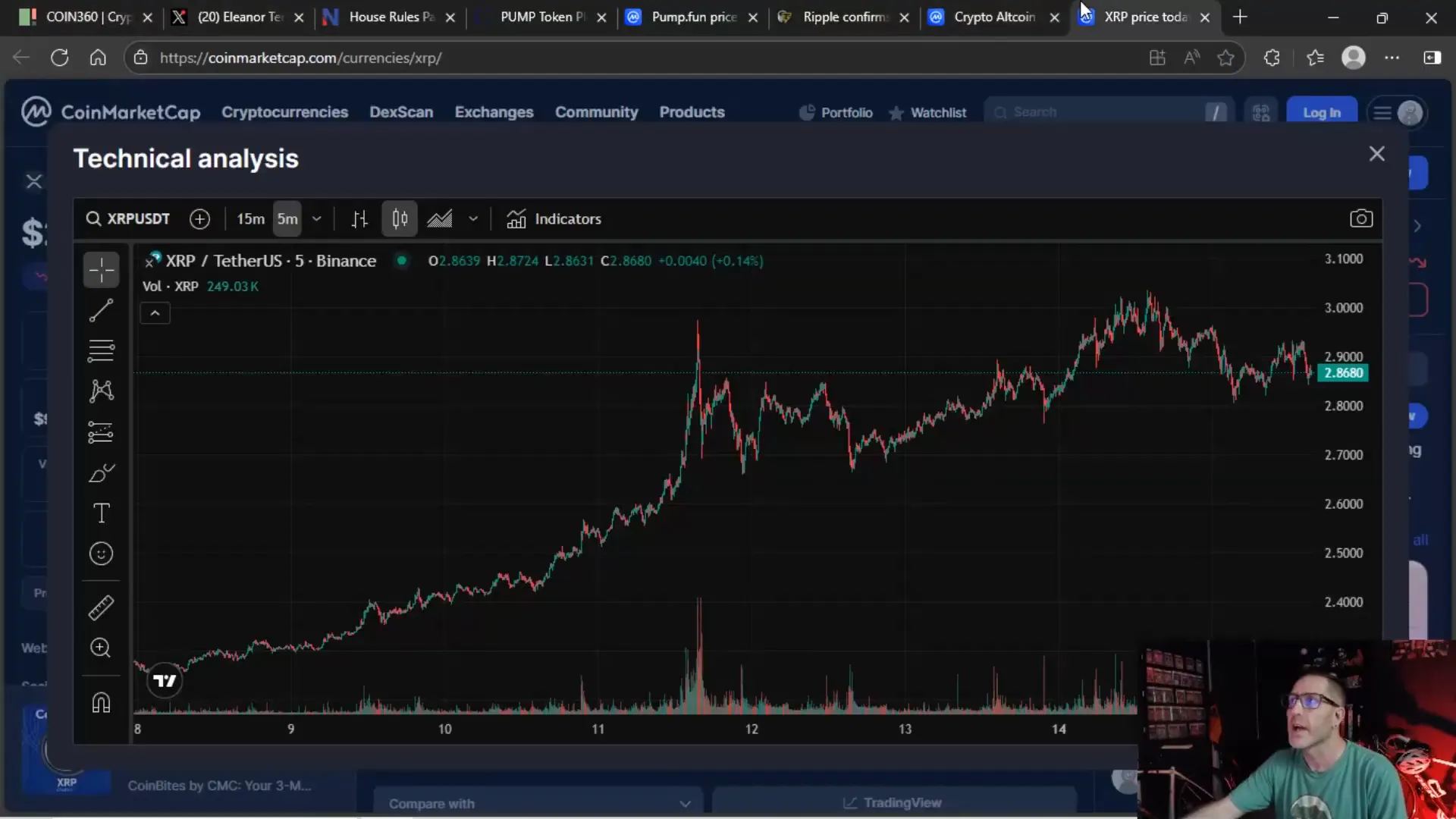

XRP Price Action: Support at $2.80, Resistance at $3

XRP’s price action exemplifies the current market mood. It hit highs near $3 but failed to hold, retreating to the $2.80 support zone. This level has proven to be a critical buy zone for traders, with candlesticks showing strong buying interest at the lows around $2.80.

Given XRP’s volatility, swings of nearly 50% within weeks are not unusual. What traders are watching closely now is whether XRP can regain momentum above $2.90 and push back toward $3, or if it will slide further toward $2.20, which was a strong support level during its previous run.

This volatility is a double-edged sword—while it offers tremendous trading opportunities, it also brings risk for those holding positions during sharp pullbacks.

What’s Ahead? Expectations and Potential Catalysts

The market is currently pricing in the potential passage of the Genius Bill, a key piece of legislation expected to provide clarity and momentum for crypto regulations. However, there are still hurdles, such as the Clarity Bill and the anti-CBDC (Central Bank Digital Currency) proposals, which have some unresolved issues.

If the bills pass as expected, we could see a return to green for the market and renewed investor confidence. This would likely lead to increased inflows of capital, setting the stage for a strong finish to the year.

On the flip side, if the legislation is delayed or rejected, it could trigger further sell-offs and a period of uncertainty.

Macroeconomic Headwinds: Rising Rates and CPI Data

Adding to the pressure is the recent CPI data showing inflation running hotter than expected, with interest rates rising for the second month in a row. This macroeconomic environment is tough for risk assets like crypto, which often suffer during periods of tightening monetary policy.

However, savvy investors know that these cycles are temporary. Rate cuts, the approval of Bitcoin ETFs, and the resolution of ongoing legal cases could all act as significant tailwinds in the near future.

Why This Matters: The Market’s Appetite for Regulation and Clarity

Despite the volatility and setbacks, the market’s interest in regulatory clarity is a positive sign. Crypto investors and traders want to understand the rules of the game—they want to know what the tax structure will look like, how crypto assets will be treated legally, and what protections will be in place.

Getting these questions answered will unlock significant new capital inflows and could usher in a new era of growth and adoption. The crypto space has been waiting for this moment, and while it might be bumpy, the long-term outlook remains bright.

So, while we might be seeing some "sell the news" action now, the bigger picture points to a juicy and exciting rest of the year for Bitcoin, crypto, BTC, blockchain, and investing in digital assets.

Final Thoughts: Hold On, It’s Going to Be a Wild Ride

Crypto markets are never dull, and this week has been a perfect example. From political drama involving the Epstein files to a chaotic token launch, Ripple’s EU expansion, and shifting price action across the board, there’s a lot to keep an eye on.

For investors and traders, the key takeaway is to stay informed, watch the legislative developments closely, and be prepared for volatility. The market’s appetite for crypto regulation and clarity is a sign of maturity, and once the dust settles, more money could flow in to fuel the next big run.

As always, remember that crypto investing carries risk, and staying educated and cautious is crucial. But if you can ride the waves, the potential rewards are immense.

So buckle up, keep your eyes on DC and the global markets, and get ready for whatever comes next. Choo choo—this train is just getting started.

Bitcoin, Crypto, BTC, Blockchain, CryptoNews, Investing: What’s Next After Crypto Week?. There are any Bitcoin, Crypto, BTC, Blockchain, CryptoNews, Investing: What’s Next After Crypto Week? in here.