In the ever-volatile world of cryptocurrency, holding onto key price levels can feel like walking a tightrope. With Bitcoin and other digital assets grabbing the headlines daily, it’s essential to zoom in on the altcoins that are quietly making waves amidst the noise. Today, we’re diving deep into the fascinating developments around XRP and HBAR—two altcoins that have recently survived significant profit-taking pressure and are now holding critical support levels. Alongside this, we’ll explore the explosive growth of spot Bitcoin ETFs, the ongoing drama around stablecoins like Tether, and the latest on crypto exchange security. Buckle up, because the crypto market is sizzling, and there’s plenty to unpack for investors and enthusiasts alike.

Why Holding Key Levels in Crypto Matters

Let’s start with the basics: what does it mean when we say a cryptocurrency is “holding a key level”? In trading terms, it means the asset’s price is maintaining support at a critical price point rather than falling below it. This is crucial because support levels often indicate where buyers are willing to step in, preventing the price from declining further.

For XRP and HBAR, holding these levels is a strong sign of resilience, especially after a period of profit-taking where many investors sell off to lock in gains. This behavior can often lead to price dips, but when a crypto asset holds its ground, it signals confidence among traders and sets the stage for potential upward momentum.

The Profit-Taking Phenomenon

It’s natural for investors to take profits after a rally. Nobody can expect the market to roar green candlesticks 24/7 without some pullbacks. What’s impressive here is that despite this selling pressure, XRP and HBAR have managed to stay above their crucial support zones. This holding pattern is setting them up nicely for what could be a strong week ahead, especially with some key regulatory developments on the horizon.

XRP and HBAR: The Details Behind the Hold

HBAR’s Climb Above 25 Cents

HBAR, the native token of the Hedera network, has been on a notable run. Less than a month ago, it was trading around 12 cents, but recent moves have pushed it north of the 25-cent mark—more than doubling in value. What’s particularly interesting is that even as trading volume begins to taper off, the price remains solidly above that key 25-cent support.

Resistance for HBAR is currently hovering near the 30-cent level, with recent candlesticks showing highs just shy of that. If HBAR can break through this ceiling, it could pave the way for further gains. Until then, holding above 25 cents is vital, providing a psychological and technical floor that traders are watching closely.

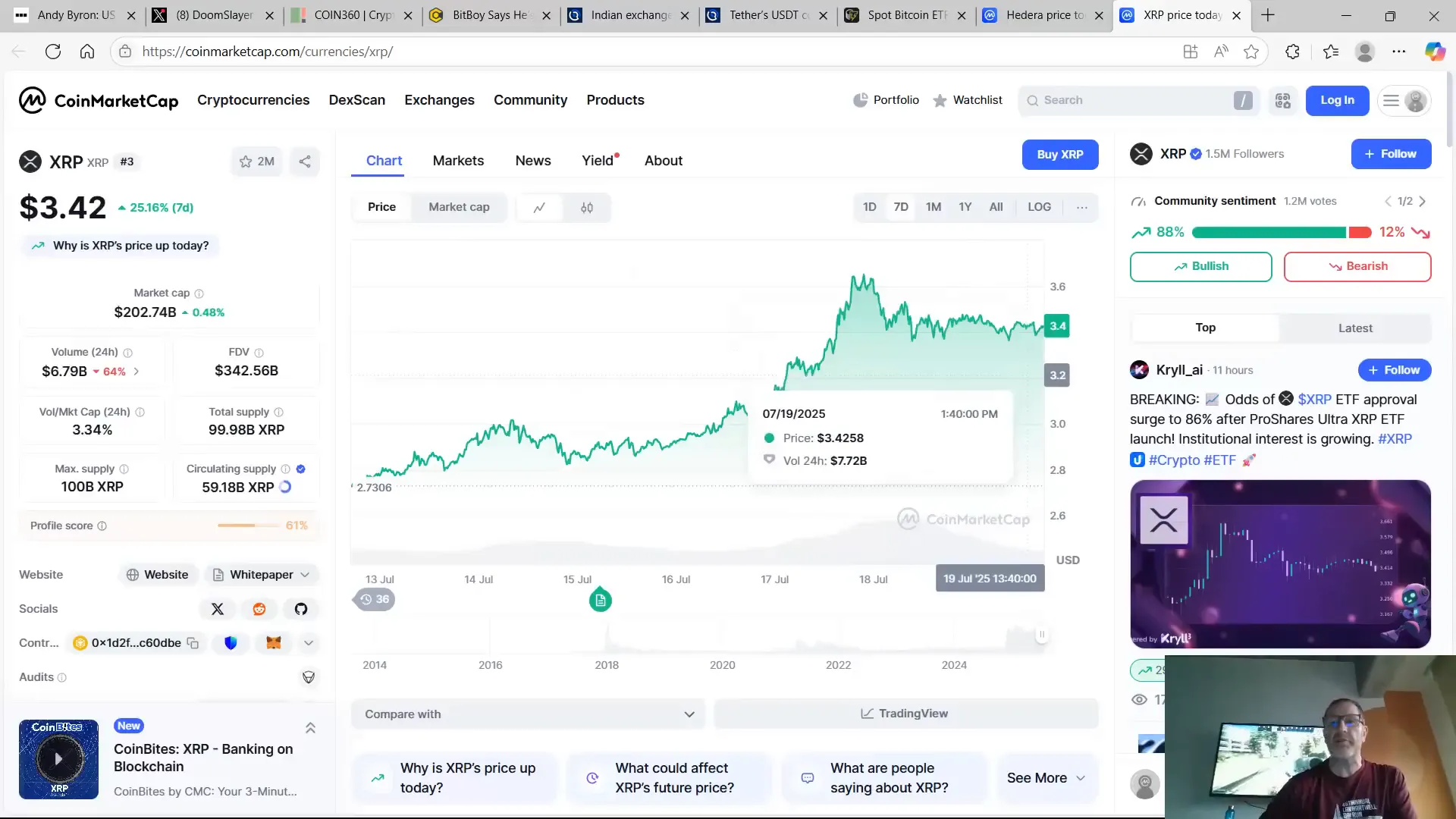

XRP: Steady Support Near $0.33

XRP’s price action this year has been a rollercoaster with plenty of anticipation, particularly because of its ongoing legal case and the promise of an XRP ETF on the horizon. Over the last few days, XRP has found support just above $0.33, holding steady despite a 64% drop in volume over the past 24 hours. This is significant because it shows that even as excitement cools, buyers remain ready to defend this level.

The near-term resistance sits around $0.364 to $0.365, with multiple candlesticks touching this ceiling before pulling back. However, the repeated bounce off the $0.33 area highlights a strong demand zone—a must-watch for any XRP fan.

Why This Matters for Investors

For those holding XRP and HBAR, this stability after profit-taking is a green light that the recent rallies were not just speculative pumps. Instead, these coins are demonstrating underlying strength. The ability to hold key levels also means these assets are positioning themselves well for upcoming catalysts, most notably regulatory clarity and ETF approvals.

The Regulatory Landscape: Clarity Act and Genius Act

One of the biggest factors influencing the crypto market right now is the progress of the so-called “Clarity Act” and “Genius Act.” While the Genius Act has already been signed into law, bringing much-needed regulation to stablecoins like USDC, the Clarity Act is what many investors are eagerly awaiting. This act promises to provide clear guidelines on how various crypto assets, particularly altcoins like XRP, will be treated under U.S. law.

This clarity is essential because it will encourage companies to hold strategic reserves of XRP and other altcoins without fearing regulatory repercussions. Right now, the market is navigating a grey area where judges and regulators interpret existing laws, but the passage of the Clarity Act would establish a firm legal foundation, reducing uncertainty and potentially unlocking massive institutional interest.

The legislative process is underway, with the Senate having voted on the Genius Act about a week ago and sending it over to the House. Now, all eyes are on the Senate again to see how quickly the Clarity Act will be introduced and debated. If passed cleanly, it could be a game-changer. If modified, it will go back to the House for approval, which might slow things down but still moves the market closer to regulatory certainty.

The Role of Stablecoins in Crypto Markets: Spotlight on Tether (USDT)

Stablecoins have become the backbone of crypto trading, providing liquidity and a safe harbor during market turbulence. Tether (USDT) commands a staggering 73% of all stablecoin activity, making it the dominant player in this space. Despite the criticism and skepticism it often faces, the reality is that if Tether were to collapse, it would likely drag the entire crypto market down with it.

Why is USDT so critical? Because many trading pairs, including XRP’s largest pairing, are against USDT. This means that a vast number of trades and investments flow through Tether, making it a vital cog in the crypto ecosystem.

Moreover, active stablecoin wallets have surged by over 50% in the last year—from 19.6 million to 30 million. This growth reflects increased adoption and reliance on stablecoins like USDT and USDC. With the Genius Act now signed, USDC is expected to grow even more, bringing additional stability and legitimacy to the space.

Exchange Security: The CoinDCX Hack Incident

Security remains a persistent concern in crypto, and recent events have once again highlighted this vulnerability. The Indian centralized exchange CoinDCX was reportedly drained of $44.2 million by hackers after a successful exploit. What’s worse is that the exchange did not inform its customers promptly. Instead, the news broke first on Telegram via crypto influencer Zach XBT, who exposed the breach.

This delay in transparency is unacceptable in any financial market, but especially in crypto, where trust is paramount. The CEO of CoinDCX, Sumit Gupta, only issued a statement after being called out publicly, claiming a commitment to transparency—something many are skeptical about given the circumstances.

The stolen funds were traced through complex transactions, including a transfer of one ETH from Tornado Cash and bridging to Solana and Ethereum networks, demonstrating the sophistication of modern crypto heists.

For traders and investors, this incident is a stark reminder to exercise caution, choose exchanges wisely, and consider security measures like hardware wallets for holding assets.

Spot Bitcoin ETFs: Institutional Appetite Heats Up

On the institutional front, spot Bitcoin ETFs are making waves. Over the last twelve days, spot BTC ETFs have attracted over $6.6 billion in inflows, extending a remarkable 12-day streak of positive investment. In just one day, these ETFs gained $363 million, pushing assets under management to $152 billion.

This inflow signals strong confidence from institutional investors and suggests growing acceptance of Bitcoin as a mainstream investment vehicle. The anticipation of the Clarity Act passing is expected to accelerate this trend, as regulatory clarity often begets institutional participation.

Community Voices and Crypto Culture

Crypto isn’t just about charts and regulations; it’s about community. On social media, the XRP army remains vocal, with some self-proclaimed leaders facing setbacks—like the notorious BitBoy currently behind bars. The crypto community is vibrant, with personalities like Doom Slayer engaging with fans and influencers actively sharing market insights.

Meanwhile, embracing local culture and enjoying life outside the markets is equally important. For example, spending time in Guatemala has been a refreshing experience for many crypto enthusiasts, providing balance amid the market’s highs and lows.

What This Means for Bitcoin, Crypto, BTC, Blockchain, CryptoNews, Investing

So, what’s the takeaway for those invested or interested in Bitcoin, Crypto, BTC, Blockchain, CryptoNews, and Investing?

- Altcoins like XRP and HBAR are showing resilience: Despite profit-taking, these assets are holding key levels, signaling strength and potential for further upside.

- Regulatory clarity is imminent: The passage of the Genius Act and the anticipated Clarity Act will bring much-needed legal certainty, especially benefiting altcoins.

- Stablecoin stability is critical: Tether’s dominance means its health directly impacts the broader crypto market, so keeping an eye on stablecoin regulations and adoption is vital.

- Institutional interest is booming: Massive inflows into spot Bitcoin ETFs show growing trust and acceptance among big players, which could drive prices higher.

- Security remains a priority: Recent exchange hacks remind us to prioritize safety in crypto trading and storage.

With all these factors converging, the crypto market is poised for exciting developments. Whether you’re a seasoned investor or just getting started, understanding these dynamics will help you navigate the market with confidence.

Keeping an Eye on the Horizon

The next few weeks could be pivotal. If XRP and HBAR maintain their support levels through the weekend and into next week, it sets a strong technical foundation. Coupled with the potential Senate debate on the Clarity Act, we could see significant market moves driven by both technical and fundamental catalysts.

Remember, crypto markets operate 24/7, unlike traditional stocks, giving traders unique opportunities to act on news and price movements anytime. This also means volatility can spike rapidly, so staying informed and vigilant is key.

And for those wondering about taking a break—sometimes, stepping away can be good for the soul. Interestingly, every time there’s been a vacation, the market seems to pump! So maybe it’s time for that well-deserved getaway—Guatemala, anyone?

Whether you’re holding Bitcoin, exploring altcoins like XRP and HBAR, or following the latest crypto news and investing trends, the landscape is rich with opportunities and challenges. Stay tuned, stay smart, and keep your eyes on those key levels!

Bitcoin, Crypto, BTC, Blockchain, CryptoNews, Investing: XRP and HBAR Hold Strong Amid Profit Taking – What’s Next?. There are any Bitcoin, Crypto, BTC, Blockchain, CryptoNews, Investing: XRP and HBAR Hold Strong Amid Profit Taking – What’s Next? in here.