Welcome to an in-depth look at the latest developments in the crypto world, brought to you by CRYPTO with KLAUS. If you’re following Bitcoin, Crypto, BTC, Blockchain, CryptoNews, or Investing, you’re in the right place for a no-nonsense update on some of the most talked-about tokens out there — Ripple’s XRP, Cardano’s ADA, and the current state of the altcoin market. Spoiler alert: the market’s looking pretty soft right now, and some of the biggest players are making moves that might surprise you.

Let’s dive into the latest news, charts, and strategic insights, and break down what it all means for your crypto portfolio and investment decisions.

Ripple’s Big Move: Minting More RLUSD and What It Means for XRP

Good news for Ripple holders — Ripple has just minted 12 million new RLUSD tokens. You might be wondering, why does this matter? RLUSD is Ripple’s stablecoin, and this move signals Ripple’s strategic push into the stablecoin market, which is rapidly expanding and evolving into a lucrative business model.

Unlike XRP, which has faced some challenges lately, RLUSD is positioned to bring in steady revenue streams for Ripple. To put it into perspective, stablecoins like Tether (USDT), backed by US Treasuries, have generated nearly $593 million in revenue over the past 30 days alone. USDC has pulled in $191 million in the same period. Ripple is entering this arena with RLUSD, aiming to leverage similar yield strategies.

Here’s why this is important:

- RLUSD is mostly minted on the Ethereum blockchain, not on Ripple’s own XRPL chain, highlighting Ripple’s pragmatic approach to tapping into the largest DeFi ecosystem.

- Ripple’s stablecoin market cap for RLUSD is already around $440 million, with a 24-hour trading volume of $37 million, showing decent traction for a newcomer.

- Stablecoins today are not just about stability; they’re about generating yield and revenue, which means Ripple is diversifying its business model beyond just payments and custody solutions.

Ripple’s approach is smart and diversified. They’re not just sticking to XRP but are expanding into custody services and stablecoin issuance, positioning themselves as a multi-faceted player in the crypto space.

Why RLUSD on Ethereum?

Despite XRP’s roots in the XRPL, the reality is that the majority of stablecoin activity happens on Ethereum. Other blockchains like Tron, Solana, and Binance Smart Chain boast billions of dollars in stablecoins. XRPL lags behind with just around $70 million in stablecoins. Ripple is acknowledging this by focusing RLUSD minting on Ethereum to tap into the bigger market and liquidity pools.

This move also opens doors to Bitcoin DeFi integration and yield-generation strategies, which Ripple’s leadership sees as a gateway to unlocking trillions of dollars in liquidity from the Bitcoin ecosystem.

Cardano’s Charles Hoskinson: Dumping ADA to Buy Bitcoin and Stablecoins

Here’s a headline that’s bound to ruffle some feathers: Charles Hoskinson, the founder of Cardano, is reportedly looking to sell some of his ADA holdings to buy Bitcoin and stablecoins. Why? Because ADA’s price isn’t moving the way he hoped, and he wants to generate yield through other assets.

This is a significant signal for the Cardano community and the broader crypto market. When a project’s founder starts swapping their own native token for Bitcoin and stablecoins, it sends a message about the current market dynamics.

Cardano’s Treasury Strategy

Charles has proposed using Cardano’s treasury, which has a buying power of about $1 billion, to invest in assets like stablecoins and Bitcoin. This strategy aims to:

- Boost the Cardano ecosystem by generating yield on these investments.

- Showcase how Bitcoin DeFi can be integrated with Cardano to unlock liquidity.

- Address the reality that ADA’s price momentum isn’t where it needs to be for the ecosystem’s growth.

In short, Charles is adopting what he calls “the sailor approach” — diversifying Cardano’s holdings to include Bitcoin and stablecoins to create more financial yield opportunities.

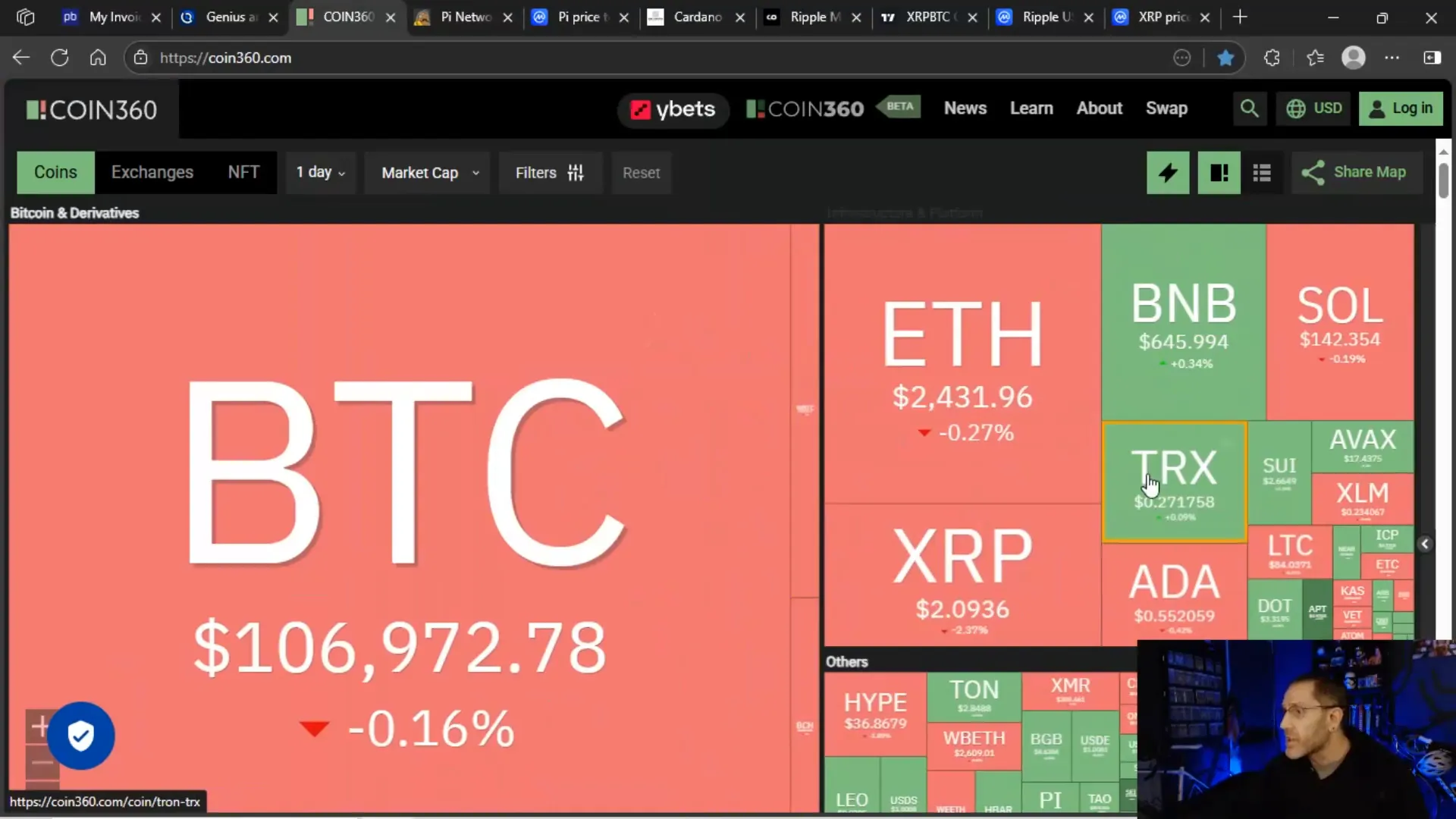

What This Means for ADA and Altcoins

This move is a clear indicator that altcoin season is far from underway. In fact, the popular altcoin season index currently reads 22 out of 100, signaling Bitcoin dominance. When top players like Charles are shifting from their native tokens to BTC, it underscores the current strength of Bitcoin relative to altcoins.

For investors, this means caution is warranted. The market is telling us that Bitcoin remains the dominant force, and altcoins, including ADA, might struggle to gain traction until macroeconomic conditions improve.

Pi Network’s Pi 2 Day: Another Hype or Real Deal?

Tomorrow marks Pi Network’s “Pi 2 Day,” a date that’s been hyped for years. The name references the number Pi (3.14), and June 28 (6/28) is being dubbed Pi squared day (Pi²). The community is anticipating a big announcement, but the reality might be less exciting.

Pi Network is a classic example of a crypto project that has been hyped for years with promises of revolutionary technology and massive networks. Unfortunately, it has become a “pump and dump” story with repeated overpromising and underdelivering.

Looking at the Pi coin’s chart, the price action is weak, and the hype has not translated into sustainable growth or adoption. This serves as a cautionary tale for investors chasing hype without fundamentals.

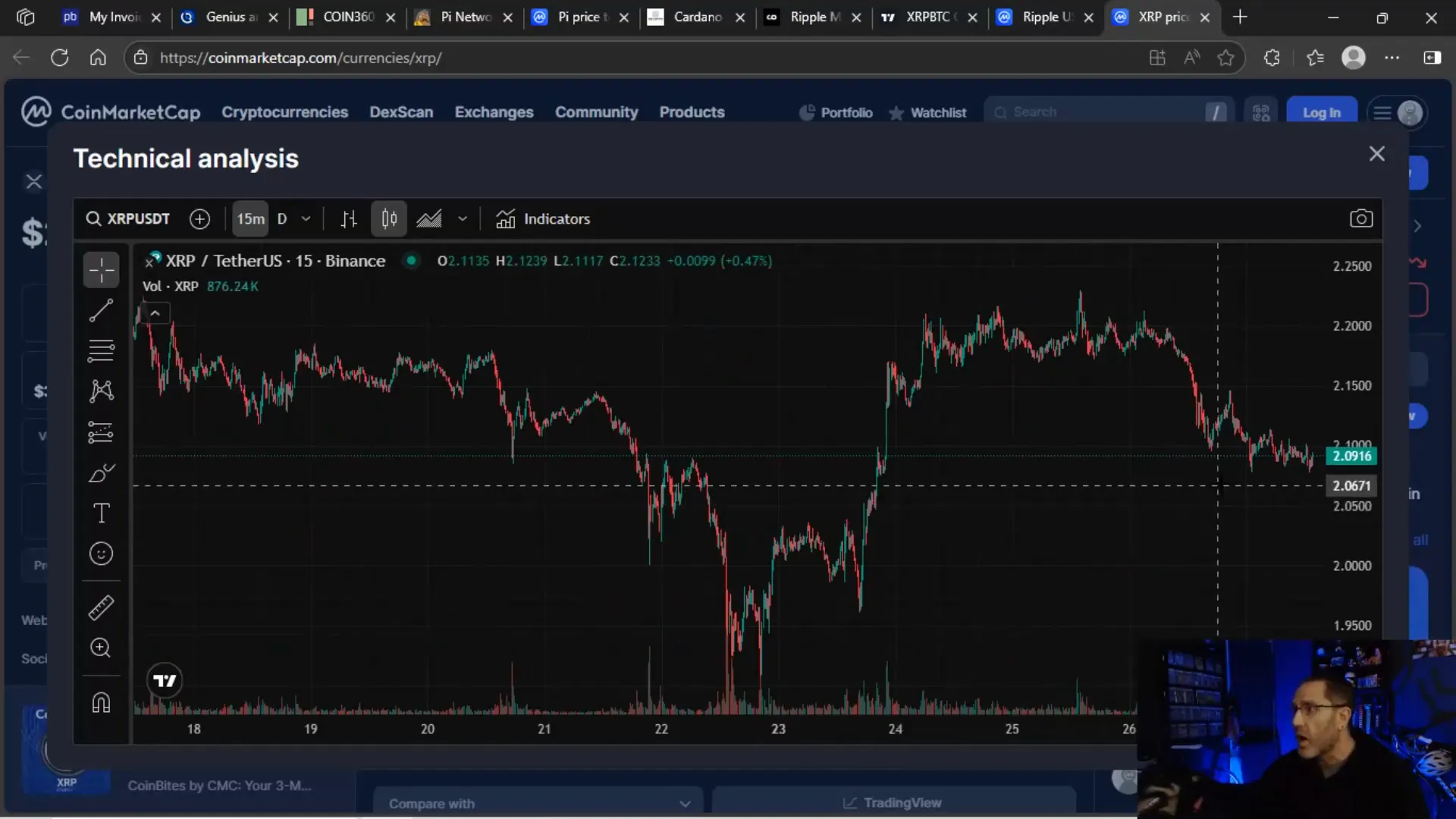

XRP Price and Chart Analysis: Why I’m Lowering My Buy Targets

Now, let’s get to the heart of the matter for XRP holders. The XRP price has been sliding, and I’ve adjusted my buy targets accordingly. Previously, I was looking to buy XRP under $2, but now I’m getting more aggressive and setting my buy zone around $1.90 to $1.92.

Why the change? The crypto market overall is showing signs of softness. It’s not just XRP — other altcoins like HBAR, ADA, and SOL are also showing more frequent dips and weaker price action.

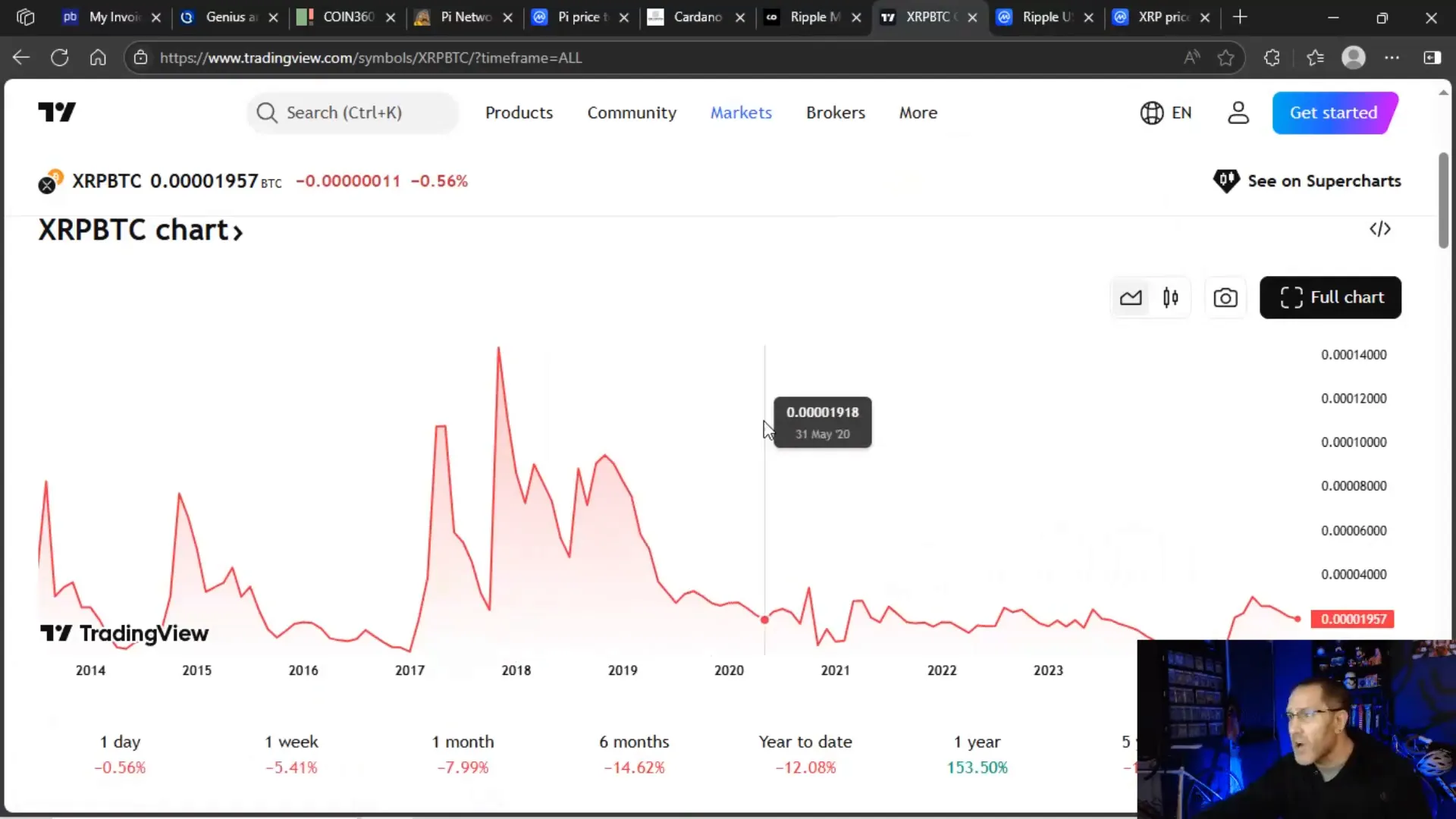

Examining the XRP-BTC Chart

The XRP-BTC chart is telling a grim story. After a brief rally in early 2025 when XRP was outperforming Bitcoin, we’ve now been sliding back down steadily. Bitcoin dominance is reasserting itself, and XRP’s strength relative to BTC is waning.

When you combine this with the fact that big players are selling their native tokens for BTC and stablecoins, it’s clear that the altcoin market is not in a bullish phase right now.

Market Factors Keeping XRP and Alts in Check

- Macroeconomic headwinds: Inflation concerns, geopolitical tensions in the Middle East, and Jerome Powell’s reluctance to cut interest rates are all weighing heavily on the market.

- Regulatory uncertainty: No clear regulatory guidance or relief is on the horizon, keeping investors cautious.

- Bitcoin dominance: Bitcoin continues to outperform altcoins, keeping money flowing into BTC rather than riskier assets.

- Market sentiment: The overall crypto market is softening, and dips are becoming more frequent across the board.

My XRP Strategy: Patience and Precision

I’m not chasing higher prices. If I have to wait weeks or even a month for XRP to dip below $2 and approach my new buy target around $1.90, I will. This strategy is about buying at the right price, not chasing the market.

This approach is about being aggressive with targets but patient with execution. The market will provide opportunities — you just have to be ready to strike when the time is right.

What’s Next for the Crypto Market? A Reality Check

With all these signals, it’s evident that the crypto market, especially altcoins, are on shaky ground. Here are some realities to keep in mind:

- Altcoin season is not here yet: Despite the chatter on social media, the data and behavior of market leaders show Bitcoin dominance continues.

- Stablecoins are gaining attention: With Ripple’s RLUSD and Circle’s IPO making waves, stablecoins are becoming a major focus for investors and projects alike.

- Market softness likely to last months: Interest rates remain elevated, and geopolitical risks persist. It could be several months before we see meaningful changes.

- Regulatory clarity is still pending: Without clear regulations, institutional and retail confidence remains muted.

There’s always something happening to shake the market — from political spats like Trump vs. Musk to conflicts in the Middle East. These events add volatility and keep the crypto markets cautious.

For now, the best approach is to stay informed, be selective with buy targets, and prepare for the next wave when the macro and regulatory environment improves.

Wrapping It Up: What This Means for Your Crypto Investing

Here’s the bottom line for Bitcoin, Crypto, BTC, Blockchain, CryptoNews, and Investing enthusiasts:

- Ripple’s diversification into RLUSD stablecoins is a strong strategic move that could pay off as stablecoins become more lucrative than ever.

- Cardano’s founder selling ADA for Bitcoin and stablecoins is a clear market signal — altcoins are not leading the charge right now.

- Pi Network’s hype has fizzled, reminding us to be wary of long-promised projects that fail to deliver.

- XRP price action and charts show weakness, so patience and lowered buy targets are prudent.

- Macro and regulatory factors dominate the market’s fate — until these improve, expect Bitcoin to remain king.

Ultimately, successful crypto investing today requires a blend of patience, strategic buying, and an eye on the bigger macro and regulatory picture. The market is soft, but that also means opportunities are on the horizon for those ready to act wisely.

Stay sharp, stay informed, and keep your strategies flexible. The crypto world never sleeps, and neither should your awareness.

Choo choo, biz nachos — let’s get ready for the next big move!

Bitcoin, Crypto, BTC, Blockchain, CryptoNews, Investing: What’s Really Happening with XRP, ADA, and the Crypto Market?. There are any Bitcoin, Crypto, BTC, Blockchain, CryptoNews, Investing: What’s Really Happening with XRP, ADA, and the Crypto Market? in here.