If you’re a fan of Bitcoin, Crypto, BTC, Blockchain, CryptoNews, and investing, buckle up because the week ahead is shaping up to be one of the wildest and most exciting in recent memory. The crypto market is already buzzing with green candles and high volume, even before the official business week kicks off. From major price moves in HBAR and XRP to significant institutional buying, crucial regulatory developments, and key economic data releases, there’s a lot to unpack. Let’s dive deep into what’s driving this surge, what to expect in the coming days, and why the big players are getting ready to make their moves.

The Calm Before the Storm: Crypto Market Heating Up on a Sunday

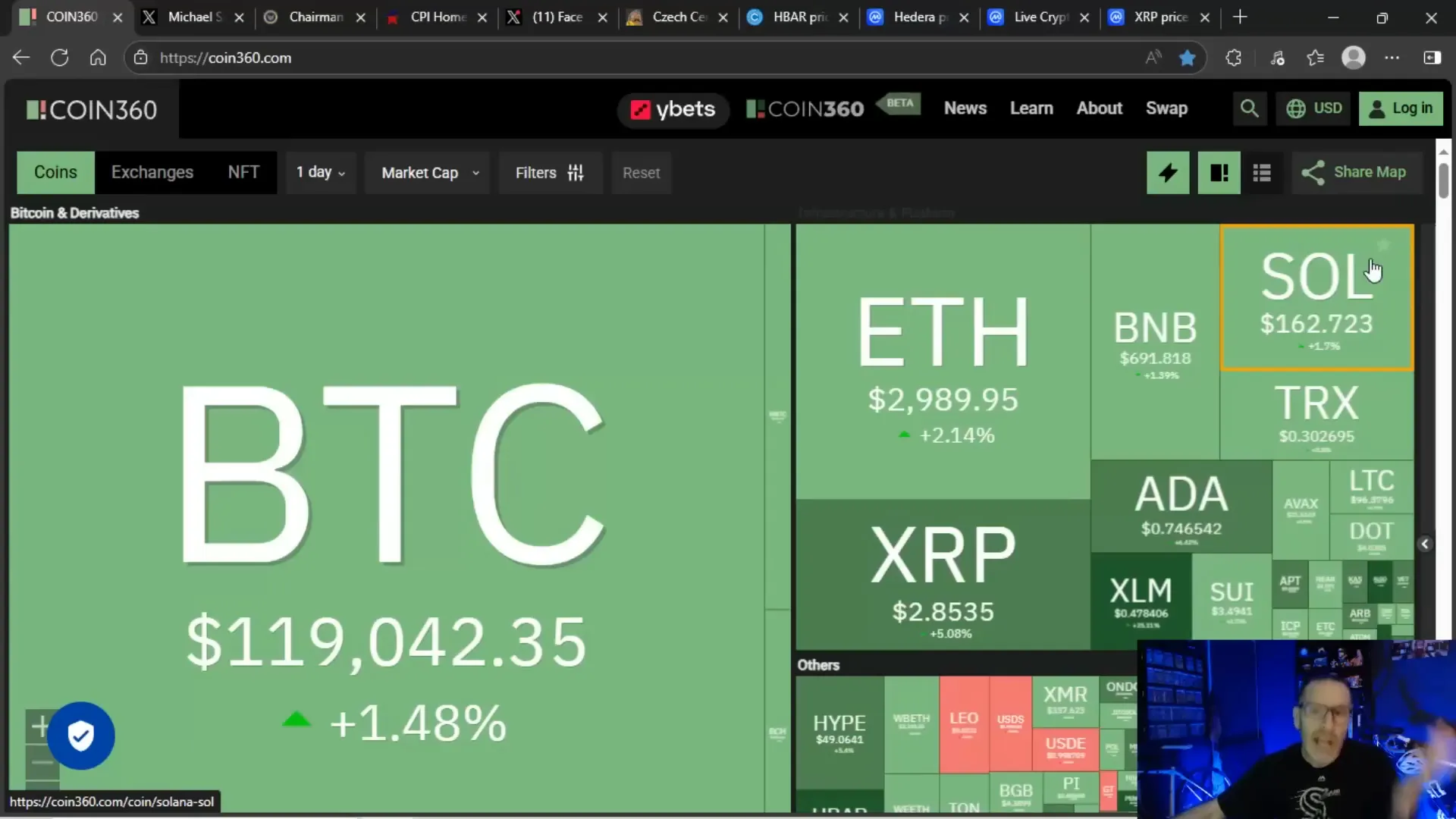

It’s Sunday, and while most people are preparing for the week ahead, the crypto market is already showing signs of strength. Bitcoin (BTC) is flirting with $119,000, Ethereum (ETH) is hovering close to $2,989, and XRP is pushing upward near $2.85. This early momentum is a strong signal that investors are positioning themselves for what’s expected to be a mega week in crypto trading and news.

What’s fascinating is that this surge is happening on a weekend, typically a quieter time for markets. Historically, weekend volumes can be subdued or even bearish, but this time around, retail money is flowing in aggressively, setting the stage for a potential explosion in volume and price action once the business week kicks off.

Big Players Are Back: Saylor Buys the Dip, Institutional Interest Grows

Michael Saylor, a name synonymous with Bitcoin investing, recently broke his own pattern and started buying again after a pause. He famously said some weeks you don’t huddle, and some weeks you just gotta huddle. After a brief break, he’s back in the game, signaling strong confidence in the market’s upward trajectory.

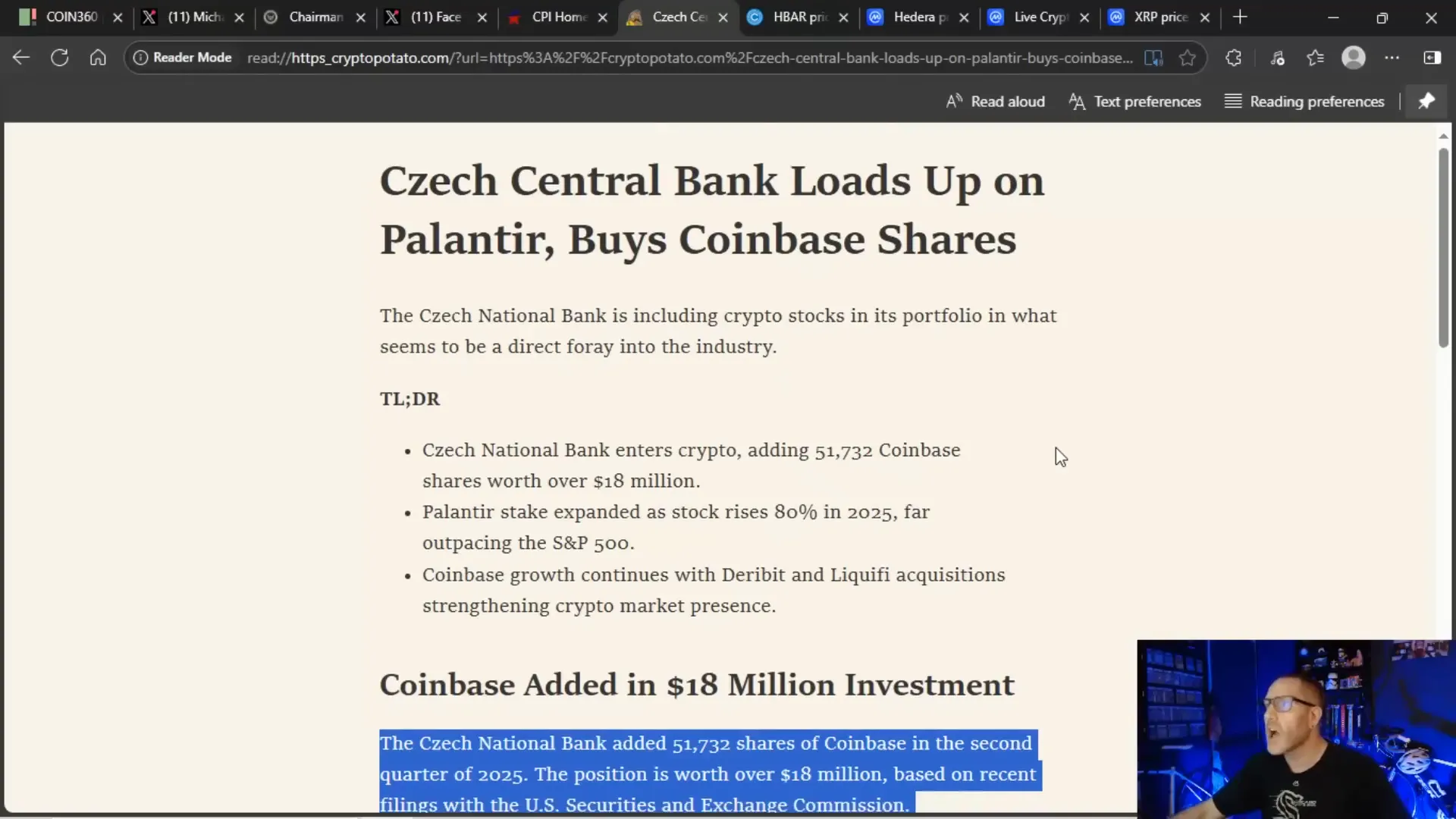

But it’s not just private investors. The Czech National Bank recently disclosed a significant position in Coinbase shares, accumulating over 51,000 shares worth more than $18 million in Q2 2025. This move marks the first time the bank has publicly disclosed an investment in a US cryptocurrency exchange, highlighting how central banks are warming up to the crypto space.

This kind of institutional and central bank involvement is precisely what the crypto market needs to gain more legitimacy and attract even more capital. When regulators and big financial entities start to embrace crypto, it creates a safer environment for investors, which in turn fuels further growth.

Regulatory Clarity is the Secret Sauce

One of the biggest catalysts for this current surge is the ongoing work around crypto regulation, particularly the proposed Clarity Act. This legislation aims to set clear rules of the road, defining what constitutes a commodity versus a security, how digital assets should be used, stored, and custodied. The clarity this act promises is a game changer because it removes a significant amount of uncertainty that has historically scared away institutional investors.

Chairman Hill recently emphasized on "Face the Nation" that once these regulations are in place, we can expect a massive inflow of money into the crypto space. Investors want to feel safe, and regulated markets provide that security. The Clarity Act, building on two years of prior work, is poised to provide that foundation.

Keep an eye on this legislation because its progress could be the spark that ignites a new wave of investment and price appreciation across the board.

CPI Data Release: The Economic Wild Card

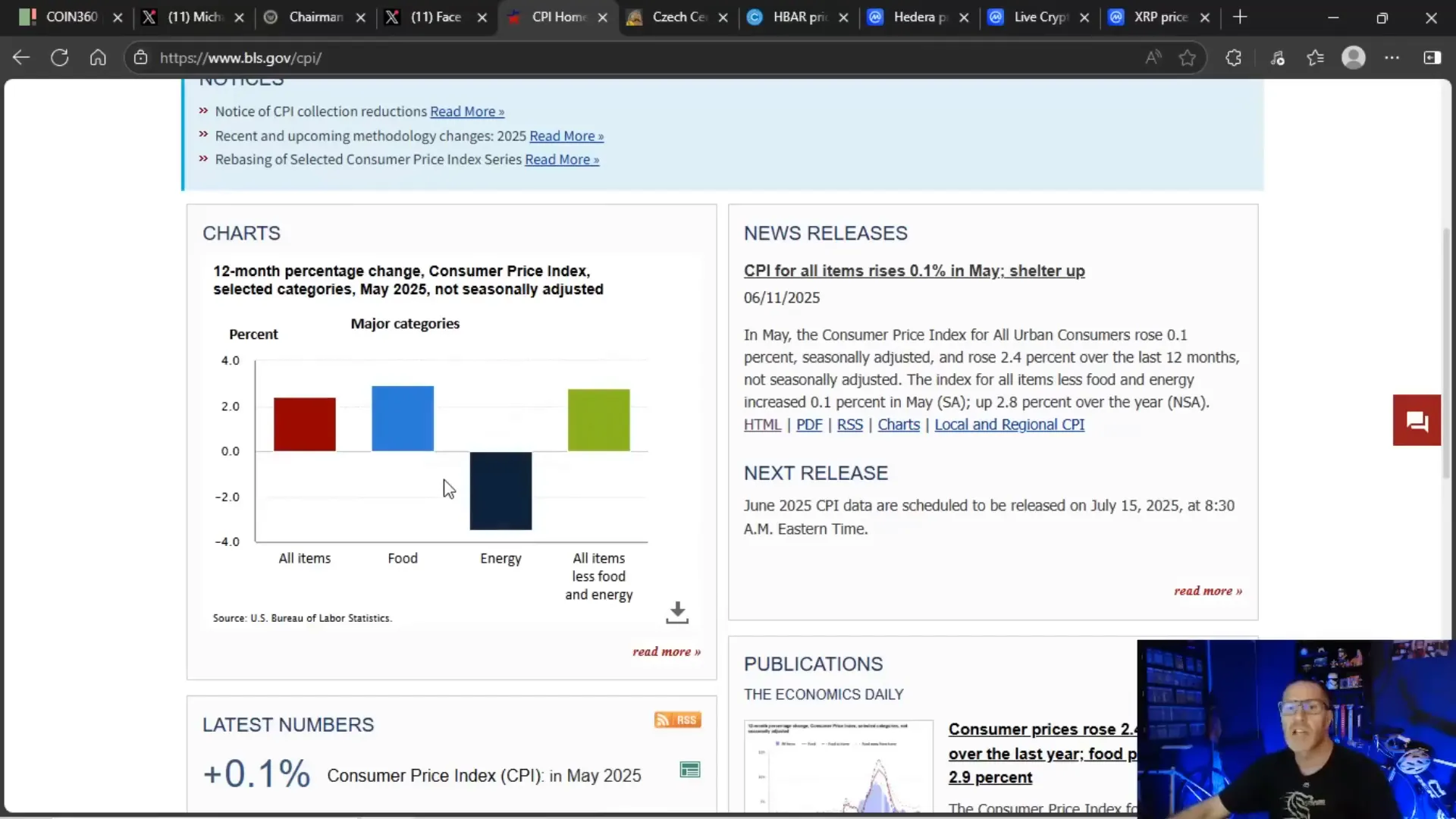

Another major event on the horizon is the Consumer Price Index (CPI) data release scheduled for Tuesday morning. This data is crucial because it influences expectations around interest rate hikes by the Federal Reserve, led by Jerome Powell. A softer-than-expected CPI reading could increase pressure on Powell to pause rate hikes sooner rather than later, which historically has been bullish for risk assets like crypto.

While a pause in rate hikes might not happen this month, the market is watching closely for any signs of a slowdown in inflation. If the CPI data comes in "nice and juicy low," it could trigger a strong rally in Bitcoin and altcoins alike, setting the stage for a sustained bull run.

HBAR: The Underdog Making a Major Comeback

HBAR has been one of the most beaten-down cryptocurrencies in recent months, but now it’s clawing its way back with a vengeance. Over the past 24 hours, HBAR’s volume surged to a staggering $10.1 billion, and the price jumped 23%. Over the last week, it’s rallied 50%, and in the last month, it’s up 52%. These are healthy gains that indicate strong buying interest.

This surge is largely fueled by optimism around regulatory clarity and taxation rules being figured out, which is bringing fresh money into the market. HBAR is now approaching the price levels it held back in March, signaling a robust recovery.

Investors who snagged HBAR a few weeks ago are currently sitting pretty, and if this momentum continues, the next few days could see even higher gains.

XRP: Steady Gains and Ready for a Breakout

While HBAR is making a dramatic comeback, XRP is showing steady, healthy gains. Over the past seven days, XRP is up 25%, which is impressive given it didn’t fall as much as HBAR in the first place. XRP is currently testing the $2.85 level, close to the $3 mark that has acted as a psychological resistance point.

Looking back, XRP’s recent rally was partly fueled by the announcement from the Trump administration regarding strategic reserve assets, which gave the token a significant boost. The market is now watching for a breakout above $3.00, which could trigger a test of all-time highs.

Technical analysis shows XRP recently faced a double rejection on the 15-minute candlestick chart but has since found solid floors and is moving upwards. This bullish technical setup combined with the positive macro environment could pave the way for a major breakout.

Market Overview: Altcoin Season is Heating Up

The overall crypto market cap is sitting around $117 billion on a Sunday, which is remarkable. This level of market activity on a weekend suggests strong bullish momentum going into the week.

Altcoin season is also gaining traction, with a current score of 31 out of 100. This means that while Bitcoin is making waves, altcoins are also moving strongly, creating multiple opportunities for investors to capitalize on market gains.

XRP and HBAR are prime examples of this altcoin strength, but the momentum is broad-based and could spread to other tokens as well, especially if the upcoming regulatory and economic news is positive.

Why This Week Could Be a Gamechanger for Crypto Investors

There are several converging factors that make this week particularly exciting for Bitcoin, Crypto, BTC, Blockchain, and investors:

- Regulatory clarity with the Clarity Act potentially advancing, offering a safer investment environment.

- Economic data like CPI influencing Federal Reserve policy and risk appetite.

- Institutional buying from figures like Michael Saylor and central banks entering the space.

- Strong retail volume pushing prices higher even on weekends, signaling sustained interest.

- Altcoin rallies like those in HBAR and XRP that could lead the next phase of the bull market.

All of these elements combined suggest a high probability of significant price appreciation and volume surges in the days ahead.

What To Watch For: Key Events and Potential Market Movers

To make the most of this mega week, here are some key events and indicators to monitor closely:

- Tuesday CPI Data Release: Tune into the live stream and watch how the market reacts to inflation numbers. A lower-than-expected CPI could ignite a rally.

- Senate Crypto Hearing: This could provide insights into regulatory direction and investor protections, impacting market sentiment.

- House Crypto Week: Progress on legislation like the Clarity Act can open the floodgates for institutional money.

- Volume and Price Action: Watch for sustained volume spikes and price breaks above key resistance levels, especially for XRP and HBAR.

- ETF Developments: Any news about crypto ETFs entering the market could provide additional liquidity and price support.

Final Thoughts: The Momentum Is Real, and It’s Just Getting Started

The crypto market is showing undeniable signs of life heading into this mega week. Whether you’re a seasoned investor or a newcomer, this period offers a unique blend of opportunity and excitement. The combination of regulatory clarity on the horizon, strong institutional interest, and positive economic signals creates a fertile ground for significant gains in Bitcoin, XRP, HBAR, and the broader market.

Remember, the market doesn’t move in isolation. The interplay between macroeconomic factors like CPI data, legislative progress, and investor sentiment will dictate the pace and sustainability of this rally. Stay informed, watch the key events, and position yourself wisely.

As always, investing in crypto carries risks, but with great risks come great rewards. This week could very well be a defining moment for many portfolios.

Get ready, because crypto is about to enter a new phase of growth, and you won’t want to miss the ride.

Bitcoin, Crypto, BTC, Blockchain, CryptoNews, Investing: Mega Week Ahead for XRP and HBAR. There are any Bitcoin, Crypto, BTC, Blockchain, CryptoNews, Investing: Mega Week Ahead for XRP and HBAR in here.