Welcome to an in-depth journey through the wild world of crypto trading, where every day brings fresh challenges, unexpected market shifts, and the need for sharp strategies. In this article, we dive into the latest updates from the $1K to $10K Crypto Trading Challenge, breaking down the latest trades, market signals, and how high-profile influencers like Elon Musk and Donald Trump are stirring the pot in the crypto and Bitcoin universe.

This guide is crafted to give you a clear, insightful look into the dynamics of Bitcoin, crypto, BTC, blockchain technology, and the volatile environment that traders face daily. Whether you’re a seasoned trader or just dipping your toes into crypto investing, you’ll find actionable insights, real trade setups, and lessons from both wins and losses. Let’s break down what’s happening behind the scenes and how you can navigate this complex landscape.

Setting the Stage: The $1K to $10K Challenge and a Risky Move

In the thick of the crypto market’s rollercoaster, I faced a critical moment that could have derailed the entire $1K to $10K trading challenge. It all started when Ethereum (ETH) began showing signs of breaking its structure. Spotting this, I decided to open a short position on ETH, which turned out to be a lucrative trade, netting me a $1,400 profit — an impressive 83% gain.

However, there was a catch. I broke one of my cardinal rules for this challenge: never use leverage above 20x. This time, I pushed the envelope with 25x leverage, which means I can’t officially count this win in the challenge. It’s a tough pill to swallow, but it underscores the importance of risk management in crypto trading.

Despite this hiccup, the market signals were clear. PhoneWords, a tool I rely on for market sentiment, was signaling a green light for long positions. The green side was stronger than the red, indicating bullish momentum. Additionally, Ethereum was flirting with a critical price of $2,449, a level where liquidity would dry up, forcing market makers to push prices upwards.

Understanding Market Signals: The Yellow Line and Liquidity Ranges

One of the most fascinating aspects of trading crypto is decoding the subtle signals that hint at future price movements. In this case, a major buy signal popped up on the chart — the yellow line. For those familiar with Bitcoin and Ethereum price charts, the yellow line acts like a beacon. The price behaves like a bug attracted to light, gravitating towards this line repeatedly.

Analyzing Ethereum’s liquidity ranges revealed that there were pockets of liquidity below the current price that ETH seemed eager to fill. But the key to predicting altcoin movements lies in Bitcoin’s behavior since altcoins often mirror Bitcoin’s trends.

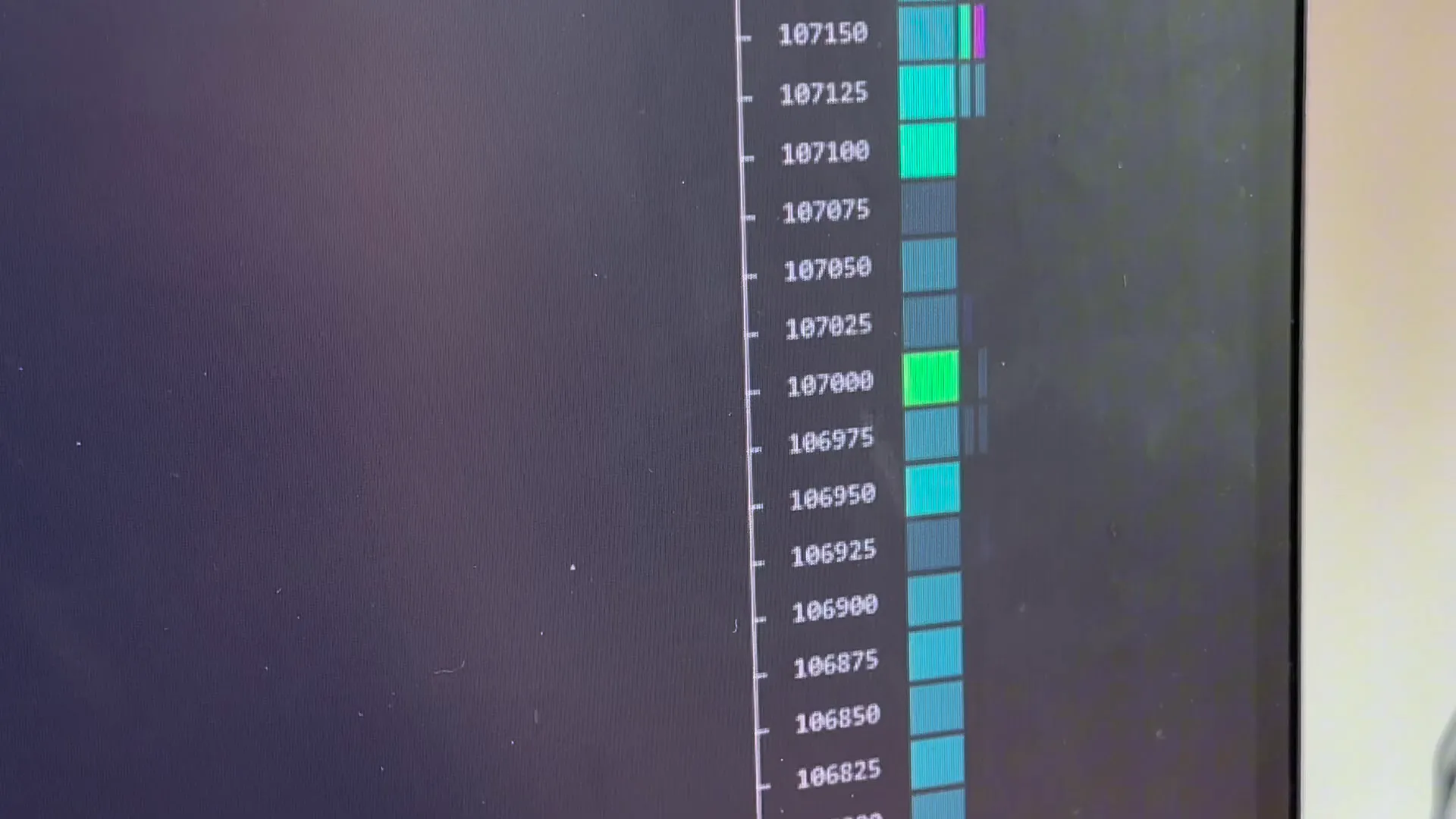

Checking Bitcoin’s charts showed it had room to drop further, with a target near $106,623. The order book revealed a massive sell block acting as resistance, making it tough for Bitcoin to break upwards in the short term. This suggested a likely pullback to the next support zone around $107,000.

For Ethereum, the implication was that despite its potential to pump, it would likely drop to the support zone near $2,455, aligning with Bitcoin’s expected dip. This analysis led me to set a limit order with 10x leverage and a stop block to protect against unexpected moves — a disciplined approach to risk.

Balancing Trading and Life: Celebrating America’s Birthday Amid Market Moves

Trading crypto isn’t just about staring at charts all day. It’s about balancing market action with real life. After setting up my trades and risk management tools, I took a moment to celebrate America’s birthday at the lake house. My daughter Kyla was ready for a swim, and the vibe was relaxed.

But even during downtime, the market never sleeps. I reminded myself and my trading group that stop losses are crucial — they’re the safety net protecting us from catastrophic losses. It’s a simple concept but often overlooked by traders driven by FOMO (fear of missing out).

Sunday Market Update: Ethereum’s Liquidity Grab and Celebrity Influence

Sunday brought some mixed signals. Ethereum made a small liquidity grab but remained stuck between two major ranges. Meanwhile, external influences shook the scene. Drake dropped a Bitcoin mention in a song, and Elon Musk, along with Andy Jassy, announced the “America Party” — a move I personally think is misguided and unlikely to benefit the market.

On the trading front, I entered a short position on Ethereum with light leverage (12-13x), aiming to catch a downward sweep. Unfortunately, a sudden liquidation spike wiped out about $150 from that trade, reminding me again how volatile crypto can be and how important it is to size positions carefully.

Monday’s Momentum: Bitcoin Long and Market Volatility from Political Tweets

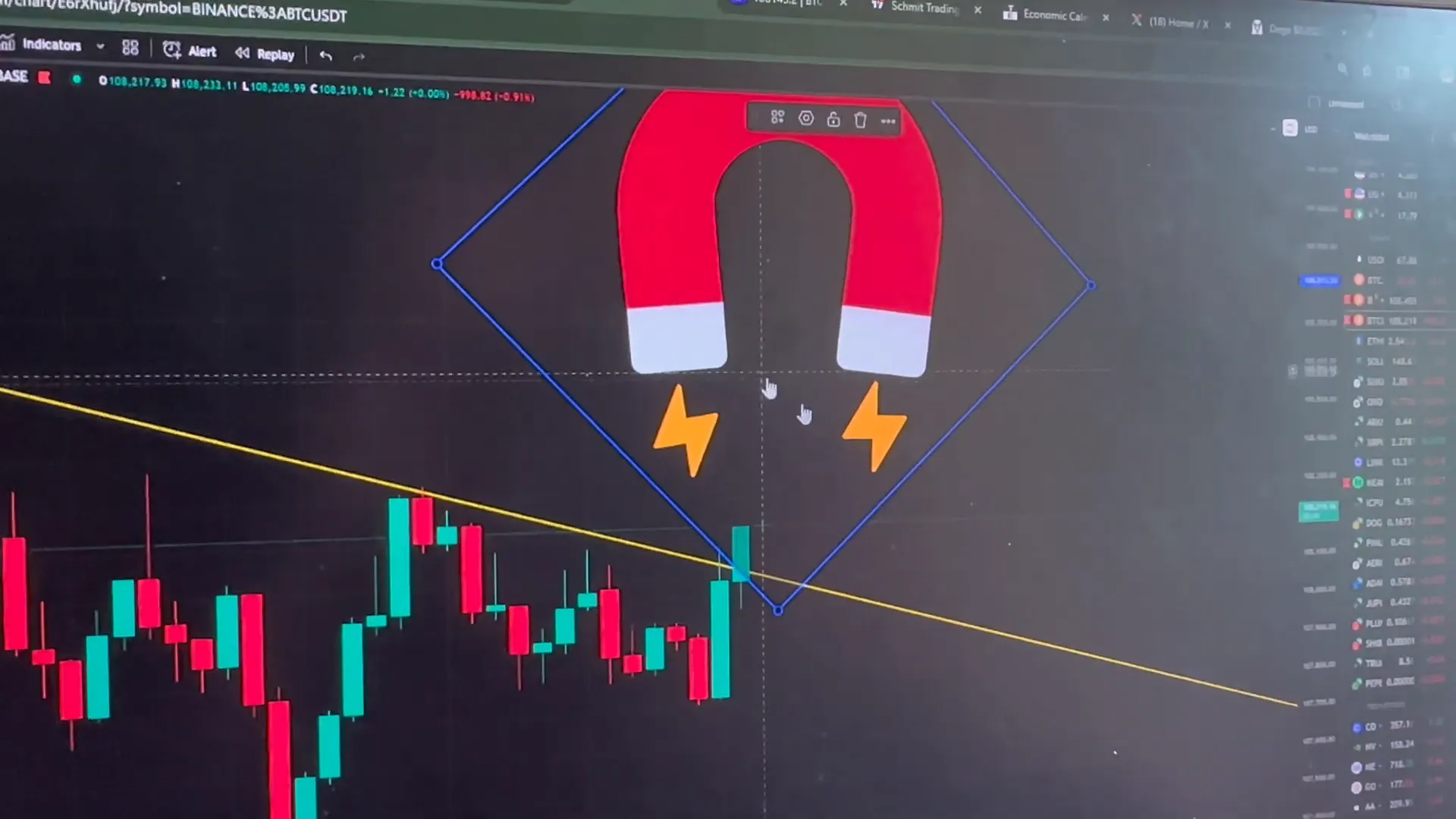

Monday kicked off with renewed energy. I locked into a Bitcoin long position at 15x leverage, entering near $108,200. The rationale came from the four-hour Bitcoin chart, where we filled a market imbalance — specifically, the CME gap on the futures market. This gap often acts like a magnet, pulling prices to fill it.

More importantly, the bottom liquidity range on Bitcoin was transforming into support, a bullish sign. I placed my stop loss just below this level to guard against downside risk. The upside target was set ambitiously at around $110,000.

Broader market optimism was fueled by new trade deals expected to be announced, which I predicted would cause the S&P 500 and Nasdaq to bounce by midday trading. But then the unpredictability of politics hit — Donald Trump’s relentless tweeting about tariffs and trade deals stirred volatility.

Trump’s statements were classic “Art of the Deal” tactics: promising trade deals, then threatening tariffs, then flip-flopping on actions. The result? Bitcoin started moving in 1% candlesticks non-stop throughout the morning, making it difficult to hold positions without getting stopped out.

Managing Losses and Embracing Discipline

Despite the chaos, I managed to limit losses to about $180 thanks to strict stop losses. This discipline is essential in crypto trading, especially when external news creates unpredictable swings. Rather than chasing every move, sometimes the best action is to step back and wait for clearer signals.

Trading can be exhausting — both mentally and emotionally — but using tools, strategies, and community support helps keep emotions in check. In fact, the Discord trading group has been invaluable for sharing insights and refining strategies.

The Power of Community: Trading Discord and the Magnet Strategy

One trade I took was prompted by the Discord community, using the so-called “magnet strategy.” The idea is simple: place a magnet sticker on the chart as a visual cue, then open a trade aligned with the magnet’s pull. According to chat, the bigger the magnet, the bigger the candlestick — a humorous but memorable way to remember market momentum.

At the time of writing, this trade was showing a small gain of $8, a modest but encouraging sign that community-driven strategies can add value.

XRP’s Comeback: EVM Capabilities and Smart Contract Deployment

One of the most exciting developments in the altcoin space is XRP’s resurgence. XRP has been outperforming many other altcoins recently, thanks in part to its new Ethereum Virtual Machine (EVM) capabilities. This upgrade allows XRP to support smart contracts, which has opened the door to more complex decentralized applications on the XRP Ledger (XRPL).

In fact, over 1,400 smart contracts have already been deployed on the XRPL, signaling strong developer interest and ecosystem growth. This technical innovation is a key reason why XRP is gaining traction while other altcoins lag.

Jack Dorsey’s New Bluetooth-Based Chat App and Market Implications

Adding to the market buzz, Jack Dorsey announced a new app called BitChat, which intriguingly works without WiFi or cellular service — relying solely on Bluetooth. This peer-to-peer communication tool could have interesting implications for decentralized communication, privacy, and resilience in connectivity.

While still early, such innovations from influential figures can influence market sentiment and investor interest, contributing to the overall crypto ecosystem’s dynamism.

Why Now Might Not Be the Best Time to Trade

Given all the tariff announcements, political uncertainty, and market volatility, my advice is to approach trading cautiously over the next few days. The major trade deals and tariff updates are expected to be finalized by Wednesday the 9th, which should bring some clarity and possibly smoother price action.

For traders wondering if they should jump in now, my answer is clear: hold off until the dust settles. Avoid chasing trades based on hype or noise. Instead, prepare, study your charts, and get ready for more stable opportunities post-announcements.

Join the Journey: How to Stay Informed and Trade Smarter

If you want to keep up with real-time trade setups, market insights, and community discussions, I invite you to join our free Discord group. It’s a place where traders share ideas, strategies, and support each other on the path from $1,000 to $10,000 and beyond.

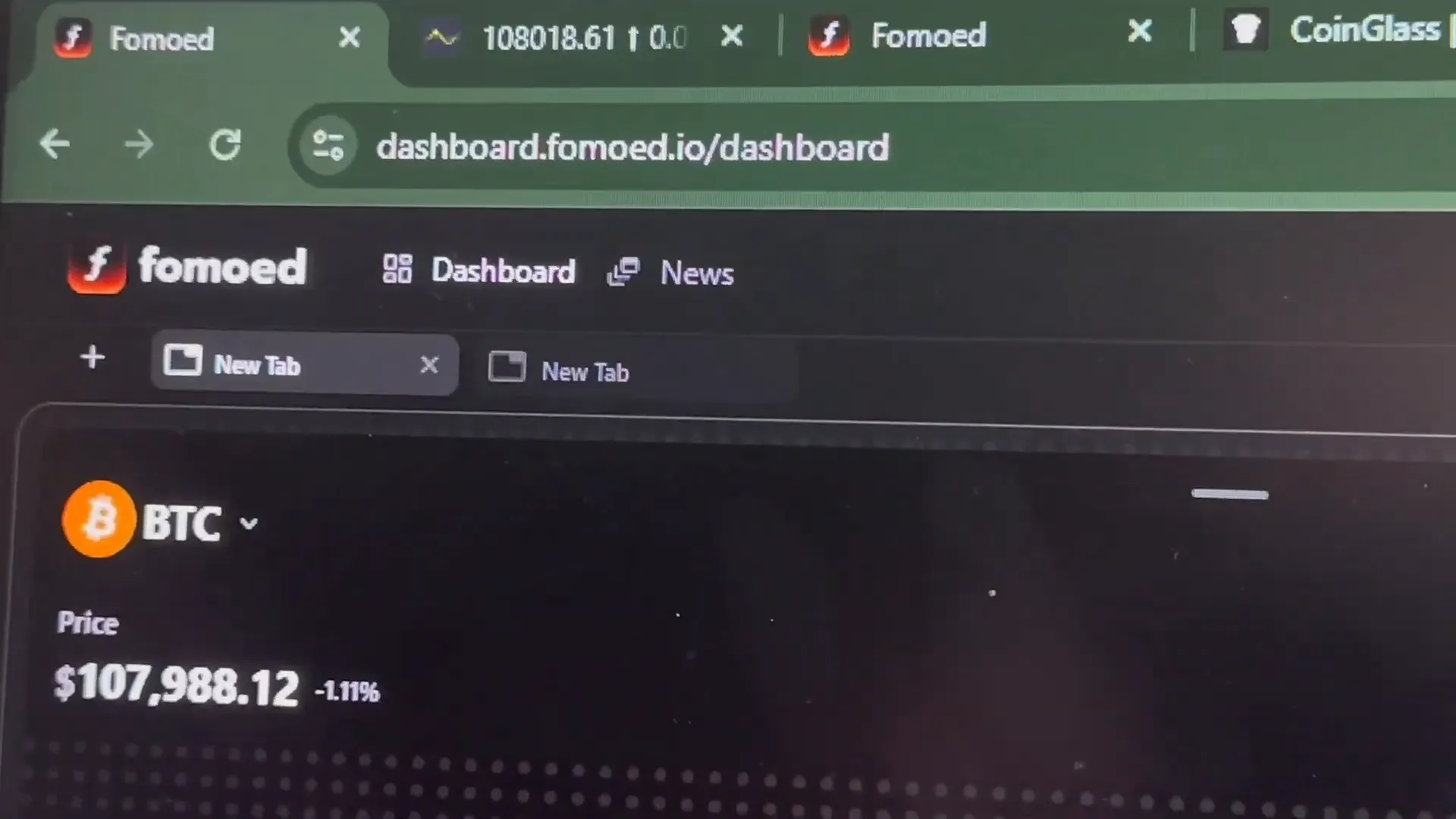

Alongside the Discord, I use tools like FOMO.io to monitor liquidation suites, which help me spot potential market moves before they happen. As of now, despite some recent losses, the challenge account remains up about 100% in just over a week — proof that disciplined trading and smart risk management pay off.

Don’t miss out on free trades, market updates, and a community that’s as passionate about Bitcoin, crypto, BTC, blockchain, and investing as you are. The link to join is in the description below.

Lessons Learned and Looking Ahead

Trading crypto is not for the faint of heart. It demands discipline, continuous learning, and a willingness to adapt to rapid changes. From breaking personal leverage rules to managing losses during unexpected news events, every experience is a lesson.

Here are some key takeaways from this phase of the challenge:

- Risk Management is Non-Negotiable: Leveraging above your comfort zone can lead to disqualified wins and bigger losses.

- Market Signals Matter: Tools like PhoneWords and chart indicators (like the yellow line) can guide entry and exit points.

- Altcoins Follow Bitcoin: Always watch Bitcoin’s movements before making decisions on altcoins.

- Political and Celebrity Influence: Tweets from figures like Donald Trump and Elon Musk can cause sudden volatility.

- Community Support Helps: Trading groups and Discord channels provide valuable insights and trading ideas.

- Patience is a Virtue: Sometimes the best trade is no trade, especially during uncertain news cycles.

As we move forward, staying informed, using proper tools, and maintaining emotional discipline will be the pillars of success in the crypto market.

Remember, Bitcoin, crypto, BTC, blockchain, and investing are all interconnected in this dynamic ecosystem. Your journey is just beginning, and with the right mindset, the $10,000 goal is within reach.

Bitcoin, Crypto, BTC, Blockchain, and Market Chaos: Navigating the $1K to $10K Trading Challenge Amid Elon & Trump’s Moves. There are any Bitcoin, Crypto, BTC, Blockchain, and Market Chaos: Navigating the $1K to $10K Trading Challenge Amid Elon & Trump’s Moves in here.