If you’ve been following the crypto space lately, you know the excitement is palpable. Bitcoin is just 2% away from its all-time high, and the markets are buzzing with potential. In this article, we’ll dive deep into the current crypto and stock market movements, dissect key trading strategies, and explore how institutional moves are shaping the future of Bitcoin and altcoins. Plus, I’ll share some personal trading insights and lessons that have helped me stay ahead in this volatile market.

Whether you’re a seasoned trader, a crypto enthusiast, or simply someone curious about the blockchain revolution, this in-depth guide will help you understand why now could be a pivotal moment for Bitcoin, crypto, and investing overall. Let’s get started!

The Bitcoin Surge: Just 2% from All-Time Highs

Bitcoin’s recent price action has been nothing short of thrilling. We are currently just 2% shy of Bitcoin’s all-time high, a milestone that many traders and investors eagerly anticipate. This proximity to the peak has traders buzzing, with some joking that we’re "just 100x away from buying a brand new Porsche GT3." It’s a funny way to look at it, but it perfectly captures the excitement and the potential profits on the table.

Bitcoin’s resilience and ability to flirt with new highs is a testament to its growing adoption and the influx of institutional capital. Unlike previous cycles, which were largely retail-driven, today’s Bitcoin market is increasingly influenced by major financial players, ETFs, and sovereign interest.

Breaking Down the Market Action

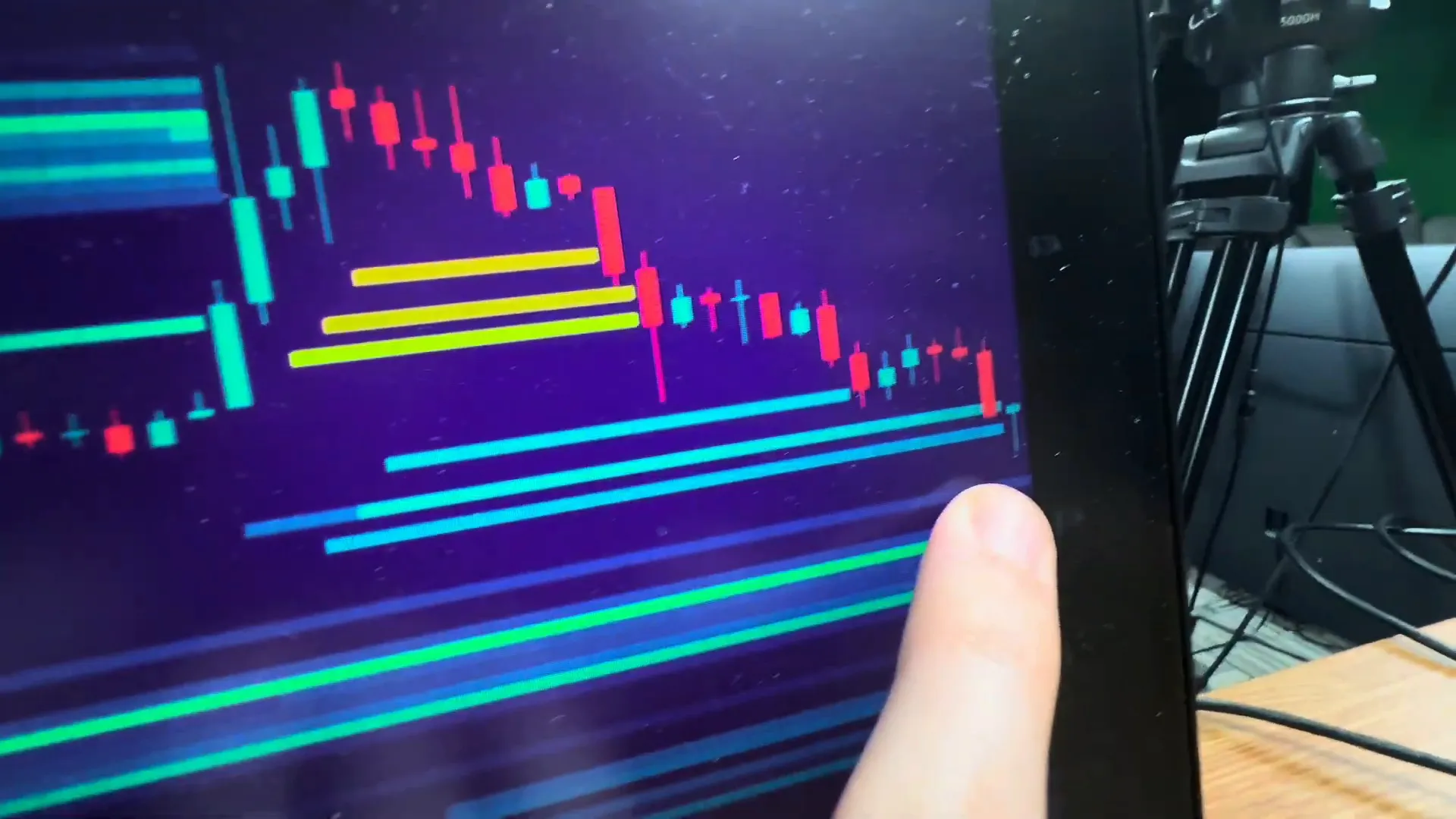

Trading today is a mix of patience, precision, and understanding market psychology. For instance, recently, I noticed a classic technical pattern on the Solana chart—a head and shoulders formation that played out beautifully. If you remember, this pattern was spotted a couple of days ago and has since confirmed its breakout target. By measuring from the neckline to the top of the head and projecting that from the breakout point, we can estimate a potential price target of $196 for Solana.

Patterns like these aren’t just theoretical—they help frame risk and reward, giving traders a roadmap for potential profits and stop losses. This approach is fundamental to successful crypto trading.

BlackRock’s Bitcoin ETF: A Game-Changer for Institutional Investing

One of the biggest stories shaking up the crypto and stock markets today is BlackRock’s Bitcoin ETF. This isn’t just another fund; it’s reportedly making BlackRock more money than their number one fund or even their S&P 500 fund, which historically has been a massive money-maker for them.

To put that into perspective, the Bitcoin ETF’s returns are outpacing their flagship funds by a factor of ten. This is huge because it signals where institutional capital is flowing and what the future of investing looks like—Bitcoin and blockchain assets are no longer fringe; they’re front and center.

This development aligns with the broader trend of mainstream finance integrating Bitcoin via ETFs, sovereign interest, and Wall Street allocations. The institutional adoption of Bitcoin is a key factor driving its price and volatility, making it a central asset in today’s investment landscape.

Trading in Real-Time: Lessons From the Morning Show

Trading is as much about strategy as it is about psychology. On a recent morning show, I entered a trade that initially went slightly against us—down by about $12. However, by analyzing FOMO.io, a platform that tracks liquidations and liquidity sweeps, it became clear that we had "eaten through" all the downside liquidations. This means the market had cleared out weak hands, and the price was poised to find support and move higher.

After refreshing the liquidation charts, the setup looked bullish with an upside target around $26,557 for Bitcoin. Crunching the numbers, if we capture the full move, we’re looking at a potential gain of 56.78%, while risking only about $88. This kind of asymmetrical risk-reward setup is what smart traders seek.

Why Patience Wins in Trading

One of the most important lessons I share with traders is patience. On the previous night’s show, I called a trade entry at $26,336. Despite a liquidity spike to $26,337 on Binance, the order didn’t fill on CoinW because exchanges have different prices and liquidity. Instead of FOMO-ing into a trade, I waited patiently for a better entry.

Why does this matter? Because 90% of traders lose money not due to bad strategies but because they overtrade. They switch leverage, listen to random calls, or chase altcoins unrelated to their core strategy. This dilutes their probability of success.

Missing one trade isn’t the end of the world. The market always offers new opportunities, and staying disciplined and patient is what separates winners from losers.

Altcoins and Ethereum: Signs of Life and Opportunity

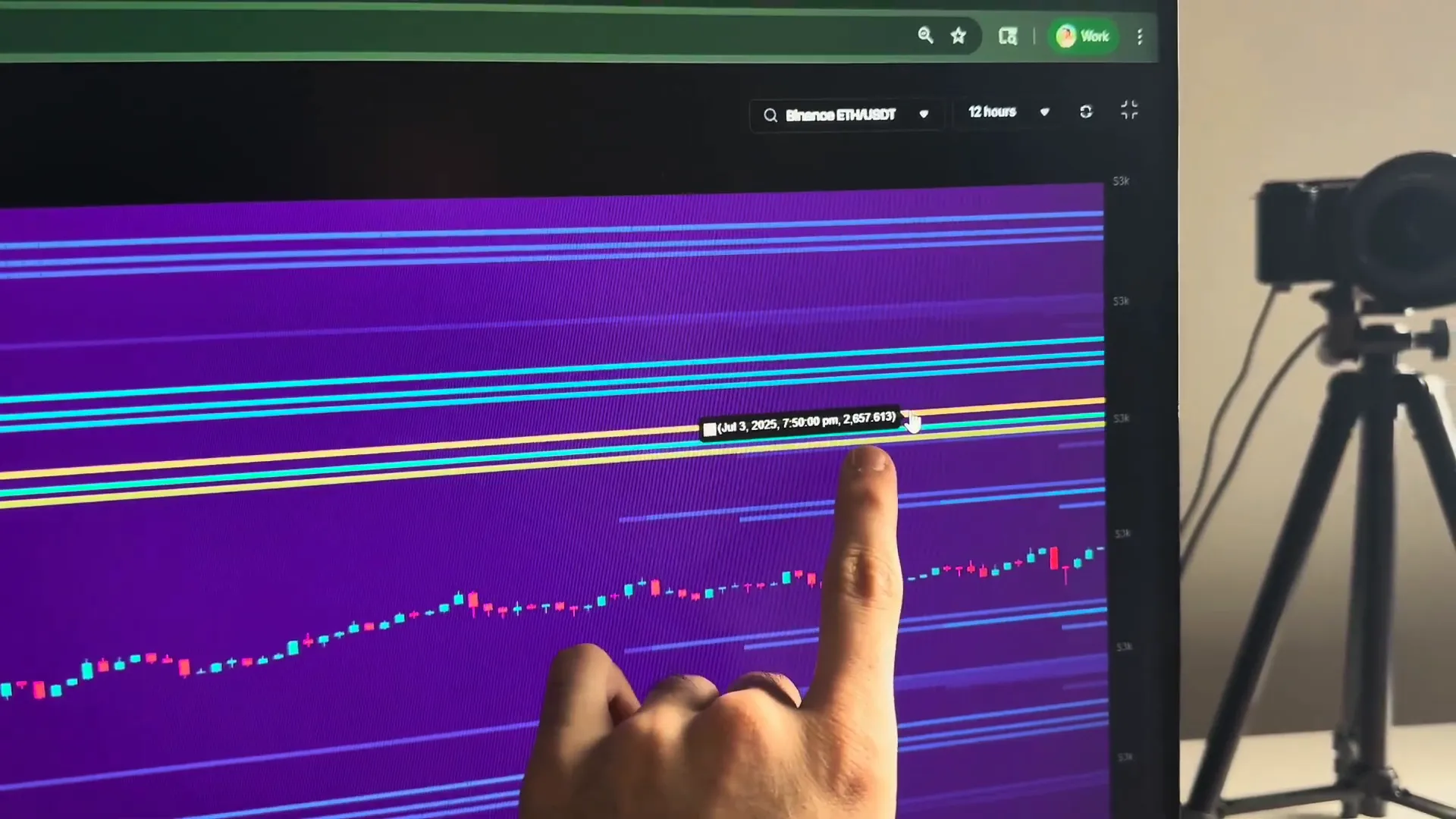

While Bitcoin often steals the spotlight, altcoins like Ethereum (ETH) are showing encouraging signs. ETH recently started bouncing, and on the 12-hour chart, it looks "insanely bold." Although liquidity strength fluctuates, the overall trend suggests upward momentum.

Ethereum’s price action is particularly sensitive to macroeconomic news and legislative developments. For example, when a significant tax cut and spending bill passed the House, ETH responded positively, rallying in anticipation of increased liquidity and market optimism.

This interplay between crypto and traditional political/economic events underscores the growing integration of blockchain assets into the broader financial ecosystem.

Trade Management and Protecting Profits

Our current trade is crushing it, having just hit the first take profit level. That means we locked in $120 in profits with a stop loss set at 6.8%, guaranteeing a total of around $200 for the day. Managing trades with clear take profit and stop loss levels is critical to protecting gains and limiting losses.

One of the reasons I’m able to manage trades on the go is thanks to technology. Having trading charts accessible while driving is exactly why I invested in a Tesla—combining lifestyle and trading efficiency.

Asymmetrical Trading: The Ultimate Crypto Strategy

Let me share one of the most valuable lessons I’ve learned as a crypto trader: asymmetrical trading. In simple terms, an asymmetrical trade means your potential reward is much greater than your risk. The likelihood of making money is higher than the chance of losing money.

How do you do this? By using stop losses effectively and waiting patiently for the perfect entry point where multiple indicators align.

For example, suppose you target a 20% gain on a trade but set a stop loss at just 5%. This is an asymmetrical trade because your upside potential is four times your downside risk.

Think of a stop loss like a speed limit on the road. It’s there to keep you safe and prevent catastrophic losses, just like speed limits prevent accidents. If you ignore it, you risk blowing your account or making emotional mistakes.

Being patient and disciplined with entry points and stop losses is critical for long-term success in the volatile crypto market.

Breaking News: Fed Liquidity Injection and Market Implications

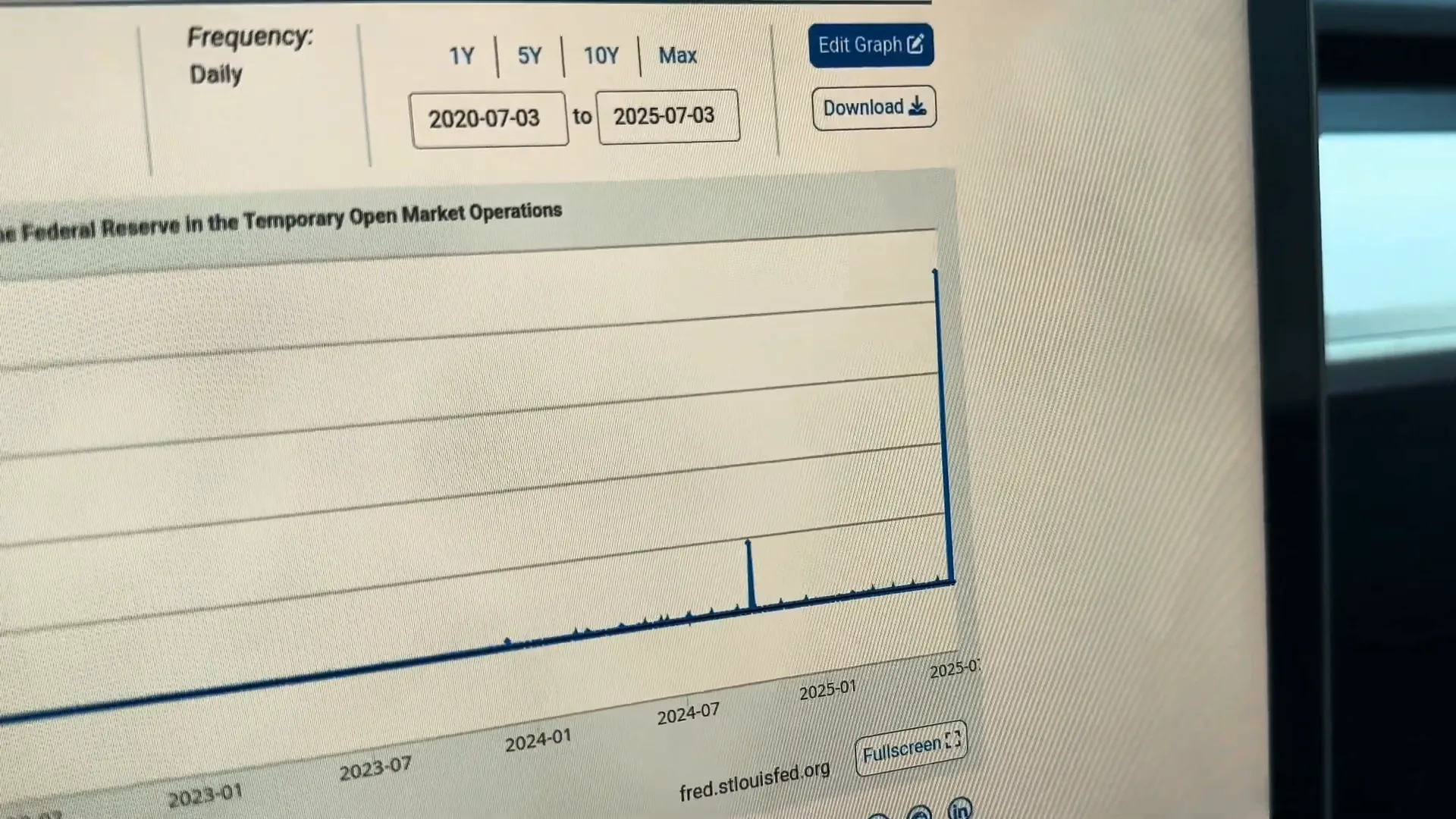

Recently, I spotted some breaking news that could shock the markets in the coming months. The Federal Reserve has injected over $11 billion into the overnight repurchase agreements (repo market), a facility where banks park excess cash to get instant liquidity.

This chart, which was flatlined for five years, suddenly skyrocketed, signaling the Fed’s direct intervention to inject liquidity back into markets. Why does this matter? Because if the Fed doesn’t act, markets could snap due to the dollar losing value and interest rates rising too high.

This isn’t the first time we’ve seen this. In 2019, during the repo crisis, the Fed injected massive liquidity to calm a short-term lending crunch, which eventually led to a 13% rally in the S&P 500 over five months. That time, Bitcoin crashed, but the market environment was very different.

Why 2025 is Different: Bitcoin’s Mainstream Integration

Back in 2019, Bitcoin was still a niche asset with no ETF access, mostly driven by retail investors. Fed liquidity primarily helped equities, not crypto.

Fast forward to 2025, and Bitcoin is deeply integrated into mainstream finance. BlackRock’s Bitcoin ETF, sovereign interest, Wall Street allocations, and institutional capital inflows dominate volume and volatility. Fed liquidity now flows into Bitcoin via ETF exposure and risk-on strategies.

This means that when the Fed injects liquidity today, Bitcoin is positioned to benefit significantly more than it did in the past. This could be the catalyst for another major Bitcoin pump.

Altcoins Outlook: Watch ETH/BTC and The Multi-Year Channel

Given the Fed’s liquidity moves and Bitcoin’s growing influence, altcoins, especially Ethereum, stand to gain in Q3 and Q4 of this year. The ETH/BTC chart is a critical indicator to watch.

When Ethereum breaks back into its multi-year channel, it has a strong chance of rallying to the top of its range, potentially delivering significant returns for traders and investors.

Our current trades have already yielded a 23% ROI, with locked-in profits and more gains unfolding as liquidity piles up at key levels around $26,557 for Bitcoin.

Join the Community and Stay Ahead

If you want to stop missing out on trades and stay updated with real-time calls, consider joining the free Discord community where I post all my trade alerts in the Joshua J chat. We are inching closer to that Porsche GT3, and it’s a thrilling journey filled with opportunity.

Trading and investing in Bitcoin, crypto, and blockchain assets require discipline, knowledge, and community support. Surround yourself with like-minded traders and keep learning every day.

Remember, the crypto market is volatile but full of potential. With the right strategies, patience, and understanding of the macro environment, you can position yourself for success in this exciting new financial era.

Stay sharp, trade smart, and enjoy the ride!

Bitcoin, Crypto, BTC, Blockchain, and Investing: Stocks & Crypto Going PARABOLIC (Day 4 Porsche Trading Challenge). There are any Bitcoin, Crypto, BTC, Blockchain, and Investing: Stocks & Crypto Going PARABOLIC (Day 4 Porsche Trading Challenge) in here.